- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: How can folks afford to live their lives today?

Posted on 9/12/23 at 10:42 am to sosaysmorvant

Posted on 9/12/23 at 10:42 am to sosaysmorvant

quote:

And you are barely making it with that income now a days (especially if you have kids). Not to mention private school. Savings outside of retirement has to be almost non-existent for the majority of Americans.

The people that say they are barely making it with that income have wives that either work part time or stay at home. Tell your wife to get off her arse and get to work

This post was edited on 9/12/23 at 10:43 am

Posted on 9/12/23 at 10:48 am to dewster

quote:

New vehicle pricing is insane.

The manufacturers seem to also be canceling the affordable models and replacing them with more expensive vehicles with turbochargers and CVTs.

The Camry has been a great affordable choice. It’s still around for now.

My wife and I make what I consider to be a solid upper middle-class income. I'd consider myself priced out of the full-sized truck or SUV market if I was shopping for one right now.

Posted on 9/12/23 at 10:48 am to RB5

quote:

With rampant inflation, including fuel, how are people making it?

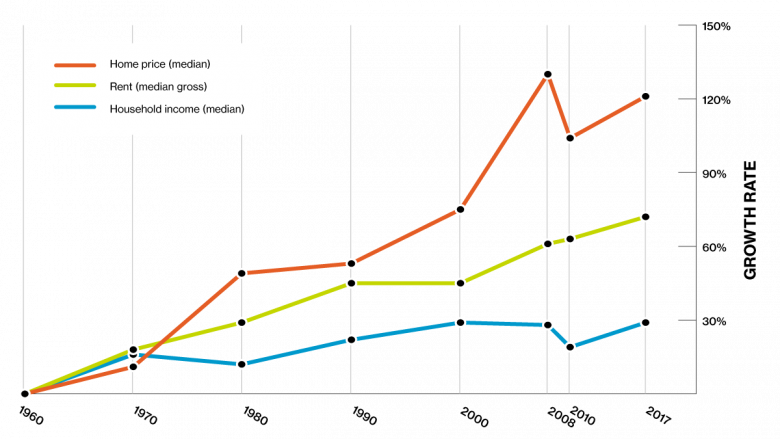

People like to point the finger on this issue, but it's been going on for a long time. Sure recent inflations made it worse, but it's been bad for a while.

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19743248/Screen_Shot_2020_02_24_at_2.28.49_PM.png)

This is the problem in my opinion.

Posted on 9/12/23 at 10:50 am to Fletch1985

quote:

shop all insurance every year. Insurance companies use algorithms to determine who isn’t like to shop every year and then raise those people’s rates the most. Use an independent brokerage like Goosehead or a good local broker

Seems like a good chance to ask a dumb question, what is the expectation for an independent broker? Should they be doing this proactively and telling me they have better rates? Do I initiate it? How often? We are coming up on 6 years with our broker, and I don’t think I’ve ever seen them present different / better / cheaper options.

Posted on 9/12/23 at 10:50 am to WigSplitta22

quote:

The people that say they are barely making it with that income have wives that either work part time or stay at home. Tell your wife to get off her arse and get to work

Meh, we'd rather her raise our kid than a daycare than cost $1,700 a month.

She'll go back 3-4 days a week 4-5 years.

Posted on 9/12/23 at 10:58 am to WaydownSouth

I wonder if woking at ochsner counts to see student loans go poof since it is non-profit.

Posted on 9/12/23 at 11:04 am to glorymanutdtiger

quote:They aren't making that much money. But if they have a job and a steady, easily verifiable income stream, they qualify to borrow that much money.

I wonder the same thing. Everyone in BR cannot be making that much money.

Credit card companies give tens of thousands of dollars to people with decent credit for months/years at zero interest. Some people choose to take out credit card loans (interest free) to buy the things they want and often times they're able to pay back the loan before interest starts..... which leads the credit card company offering even more interest free $$ to that consumer.

The majority of people don't fall in the category above, but when you see folks that appear to live well above their means, that's just one way they float the debt to live that luxurious lifestyle.

This post was edited on 9/12/23 at 11:04 am

Posted on 9/12/23 at 11:08 am to RB5

I helps, for my family, living in the country on 6 acres. We do a lot of things outside, cook all our meals, so no eating out, go fishing a good bit to keep our son entertained. Basically just held up in our little compound waiting it out. I don't see how anyone can survive in an expensive city right now.

Posted on 9/12/23 at 11:09 am to Dawgfanman

quote:

If I could get one of these poor souls to roll down the window to their $50,000 SUV, I would ask them how they afford to live. But it seems they are too busy following the directions their $1000 cell phone is giving them to tonight’s restaurant of choice.

You need a better cardboard sign or better intersection.

Posted on 9/12/23 at 11:33 am to BabyTac

quote:

People have zero reason to be in debt.

Ya frick going to college amiright

Posted on 9/12/23 at 11:35 am to RB5

We have always tried to live without debt and paid off our mortgage a few years back. I really don't know how people do it with kids in daycare, car payments, and rent/mortgage. I have a few coworkers with small children who are paying $1500+ a month for daycare for one child. It's crazy expensive!

Posted on 9/12/23 at 11:43 am to thegreatboudini

quote:

Meh, we'd rather her raise our kid than a daycare than cost $1,700 a month.

She'll go back 3-4 days a week 4-5 years.

Good, then you should never bitch and moan about not having money. Your wife should be able to make more than 1700 a month and how the frick do you pay 1700/month for 1 kid?

Posted on 9/12/23 at 11:51 am to justaniceguy

quote:

Ya frick going to college amiright

Yes, a college education is a good thing if the desired job requires one, but many go about it the wrong way. Kids are taking out MASSIVE loans to go to 4-year universities that they have no business attending.

They want to go see the country and live their best lives! YOLO! But the reality is that some kid from a family without much financial sense is going to go take out a loan to pay out of state tuition for a nonspecific bachelor's degree.

Can you imagine graduating from a basic state school with a basic business degree and starting your professional life $160,000 or more in debt? INSANITY.

Posted on 9/12/23 at 12:08 pm to RB5

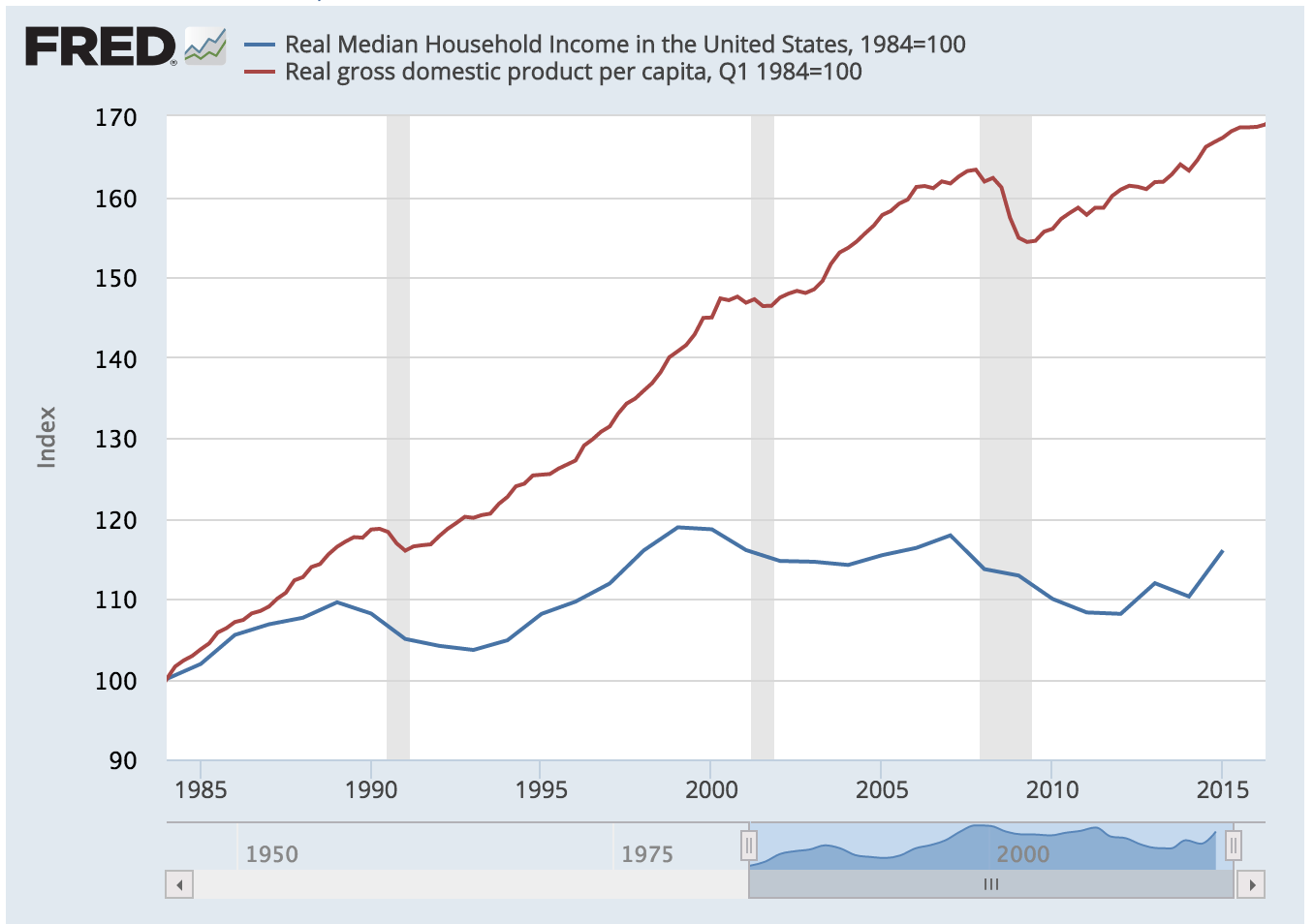

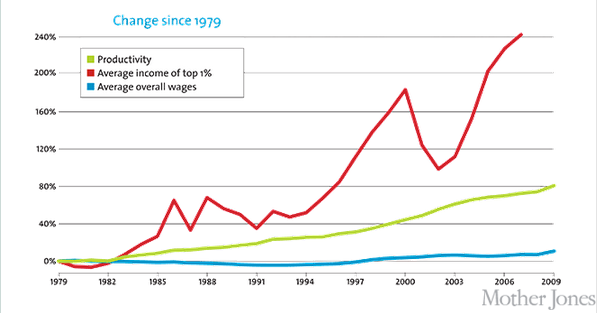

Thought I’d leave this here to add into the massive inflation, rising debt, and general overall difficulty in living lives today, NOT TO MENTION saving for retirement through all of this.

Ever feel like you’re an ant in an ant farm, and there’s some kid that comes around every now and then to shake it up to get his kicks? There’s a very good reason people feel disheartened, and I get it. This isn’t about you. It’s about a select few living life high on the hog on your backs and the sweat from your brow.

Posted on 9/12/23 at 12:12 pm to RB5

quote:

How can folks afford to live their lives today?

It's really not that hard, you don't need an apple watch, a brand-new leased truck or Yukon. Your kids don't need to play on every travel ball team imaginable, you don't need a gym membership, you don't need to be going out to eat more than once a week at most, you don't need to go to 30A for clout when there are cheaper alternatives. You don't need a price out of your range, don't need brand new appliances. It amazes me the money that people will spend on pointless shite because they want to feel like they belong to some crowd.

Posted on 9/12/23 at 12:33 pm to BhamBlazeDog

quote:

It amazes me the money that people will spend on pointless shite because they want to feel like they belong to some crowd.

It amazes me when i see parents pay for private schools when they live in a good school district but then complain about

not having money

Posted on 9/12/23 at 12:40 pm to WigSplitta22

The transition to debit cards vs cash and checks also changed people’s spending habits for the worse. Doesn’t feel like you are spending as much money when you just slide or tap a card vs have to write out a check for that amount or better yet dole out physical cash.

Posted on 9/12/23 at 12:45 pm to WigSplitta22

quote:public schools are trash

It amazes me when i see parents pay for private schools when they live in a good school district but then complain about

not having money

Posted on 9/12/23 at 12:46 pm to BhamBlazeDog

quote:

It's really not that hard

Here’s some quick math. Let’s say early 30’s couple both working, with 2 kids, bring in combined $140k/yr which is a number seen a lot in this thread. They have been saving for a house and now have 20% down and want to buy a solid $350k home - 2.5x gross income - a common standard for affordability.

This couple has good family insurance and saves well for retirement and in an HSA, so after that and taxes they bring home 50% of their $140k. So about $5800/month.

Including property taxes and insurance, and todays 7% interest rate with no PMI because of the $70k down payment, they are looking at about a $2500/month note.

Utilities: $400/month

Two modest cars and car notes: $600/month total

Car ins for two: $250/month total

Gas: $100/month total

Monthly groceries: $500

Daycare for 2: $1600

Total budget: $5950

Total take home: $5800

Situation: fricked

That’s before any of the stuff you mentioned. Not even a single vacation or many of the other common life expenses. They make double the median income for a family in this country and are barely getting by and can’t have more than 2 kids.

Posted on 9/12/23 at 12:53 pm to HouseMom

quote:

Kids are taking out MASSIVE loans to go to 4-year universities that they have no business attending.

It costs almost $13,000/year in just tuition for an in-state student to attend the University of South Carolina. That is as basic as you can get for a 4-year college.

Popular

Back to top

1

1