- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

As US Permian crude turns lighter, it risks losing favor with refiners

Posted on 10/22/24 at 10:42 am

Posted on 10/22/24 at 10:42 am

quote:

HOUSTON, Oct 22 (Reuters) - Companies drilling for the crude that turned the U.S. into the world's top oil producer face an unexpected dilemma: their West Texas Midland crude is getting lighter, which could make it less appealing to some refiners.

Super-light crudes would have to be blended with heavier grades for processing into gasoline, diesel and jet fuel. Less supply of heavy crude and high prices for it could cut demand for WTI Midland. This could result in lower prices for the globally used dated Brent benchmark of which WTI has become an integral part.

The volume and quality of the flagship U.S. crude has made it popular with refineries in Asia and Europe, thanks to its similarity to other benchmark grades and a low sulfur content that makes it relatively easy to remove during processing.

quote:

But shale producers in the Permian basin of west Texas and New Mexico have been pumping lighter crude. Recent testing shows the oil's gravity, or measure of density, is between 41 and 44 degrees, said sources who declined to be identified as the data is confidential.

WTI Midland crude historically has a gravity of about 38 degrees to 42 degrees. The higher the number, the lighter the oil.

Shale producers are pumping lighter oil as they exhaust first-tier production areas and move into second-tier acreage. These wells yield more natural gas, with crude pushing into super-light territory.

Generally, lighter crude is more valued than heavier crude, but refineries are set up for specific densities, usually not super-light crude. Refiners look for crude that can deliver the best margins from existing gear. Converting units to run lighter crudes economically would require investing in new equipment.

quote:

"One would need to reconfigure the refinery, build completely different units, bigger units for light distillates (like naphtha), smaller units for middle distillates (like diesel) and no one has the money for that," Katona added.

With gasoline demand likely to peak as more people work from home and many adopt electric vehicles, refiners are reluctant to make large investments into plants, sources and analysts said.

quote:

Refiners, pipeline operators and others have begun discussing the need for a lighter gravity benchmark, which would help buyers differentiate WTI Midland from super-light streams of oil, sources said.

LINK

Any insight from our downstream baws? I know it’s been said on here we have to continue to import oil because of the way our refineries were constructed years ago.

Posted on 10/22/24 at 10:46 am to ragincajun03

Pussification of America continues. Even our crude oil is becoming light and worthless. Lol

This post was edited on 10/22/24 at 10:47 am

Posted on 10/22/24 at 10:48 am to ragincajun03

Ya this doesn't change much...other than more and more WTL will be sent to Houston. Better economics to export WTI out of Corpus Christi, so that port will continue to receive it. They can try and blend the remaining WTL to get it WTI specs or just export it as WTL.

None of this changes anything about the way the US processes crude for domestic use. We have complex refiners that need heavy crude...the bigger problem for us is if PEMEX ever gets the Dos Bocas refinery together...cause that will use a lot of heavy Mexican crude that we buy. But Mexico is such a garage run domestic country/refiner that no one thinks it'll ever reach full capacity. This is also why we keep our Venezuela connection open no matter what happens down there. We need heavy from somewhere and preferably not the ME.

WTL won't go anywhere really though...it'll still have some demand as more and more of the petchem complex moves to lighter ends. Naptha margins in Asia are bad, thats why the US LPG market has gotten so big. Petchem companies make more money making plastic out of Ethane/Propane/Butane. WTL can be cracked into lighter ends easier in non-complex refineries.

None of this changes anything about the way the US processes crude for domestic use. We have complex refiners that need heavy crude...the bigger problem for us is if PEMEX ever gets the Dos Bocas refinery together...cause that will use a lot of heavy Mexican crude that we buy. But Mexico is such a garage run domestic country/refiner that no one thinks it'll ever reach full capacity. This is also why we keep our Venezuela connection open no matter what happens down there. We need heavy from somewhere and preferably not the ME.

WTL won't go anywhere really though...it'll still have some demand as more and more of the petchem complex moves to lighter ends. Naptha margins in Asia are bad, thats why the US LPG market has gotten so big. Petchem companies make more money making plastic out of Ethane/Propane/Butane. WTL can be cracked into lighter ends easier in non-complex refineries.

This post was edited on 10/22/24 at 10:51 am

Posted on 10/22/24 at 10:51 am to ragincajun03

quote:

West Texas Midland crude is getting lighter, which could make it less appealing to some refiners.

Racist refiners.

Posted on 10/22/24 at 10:57 am to MadtownTiger

quote:

This is also why we keep our Venezuela connection open no matter what happens down there. We need heavy from somewhere and preferably not the ME.

What about Canada / oil sands? I thought that’s where most heavy crude comes from for US refining.

Posted on 10/22/24 at 10:57 am to MadtownTiger

MadTown.. you seem educated on the subject.

Is there known locations in the US that have heavier oil wells that we could expand production on, or would we have to invest tons in exploration of this?

Was Keystone and Alaskan oil heavy or lighter crudes?

Sorry if stupid question, genuinely curious.

Is there known locations in the US that have heavier oil wells that we could expand production on, or would we have to invest tons in exploration of this?

Was Keystone and Alaskan oil heavy or lighter crudes?

Sorry if stupid question, genuinely curious.

Posted on 10/22/24 at 11:00 am to Samso

It is...the company I work for ships a lot of diluent up Colonial Pipeline to help in the transportation of the Canadian tar sands oil.

Posted on 10/22/24 at 11:14 am to ragincajun03

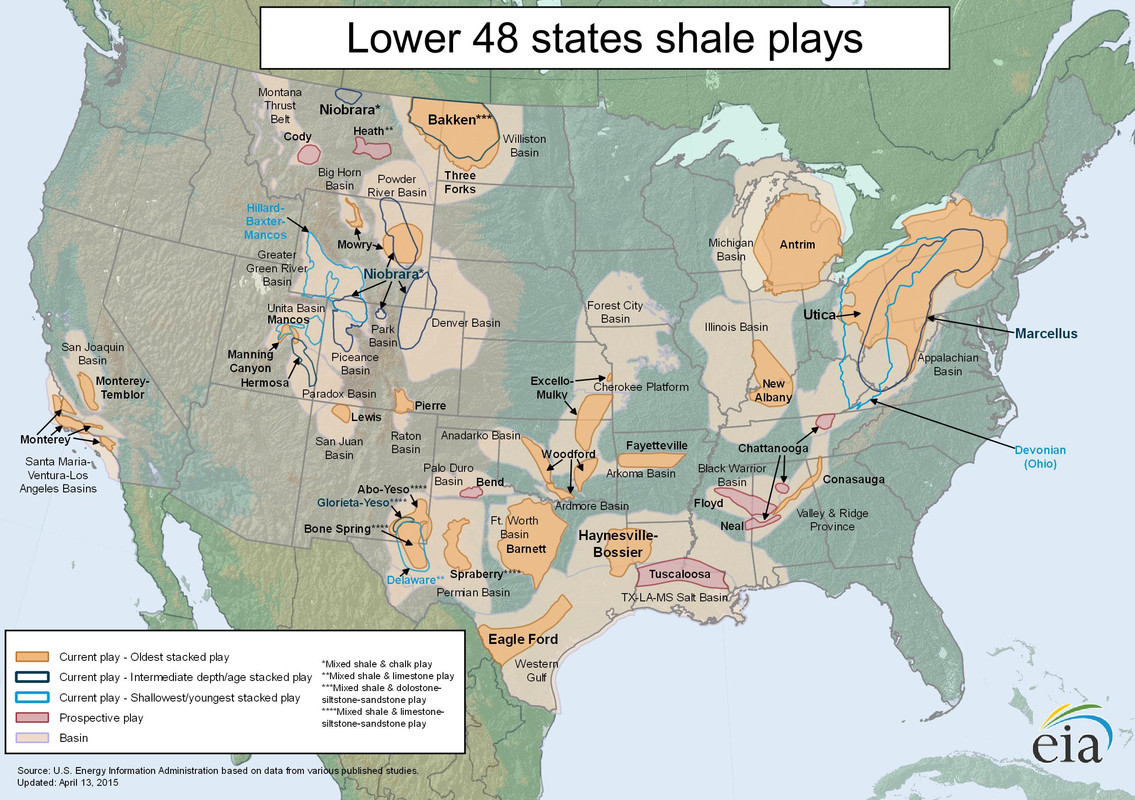

the article talks about the oil getting lighter in the Permian Basin but most of the new action out there is in the Delaware Basin

there are numerous heavy oil production areas in the US, the LaBrea Tar Pits in Los Angeles is a prime example of heavy oil bubbling up to the surface. All of the production in Bakersfield, the LA Basin and offshore in CA is heavy oil

Deepwater Offshore production in the GOM is usually heavier oil, the Bakken in ND, MT, CO, Tuscaloosa Trend, MS, AL and some areas of east texas are also heavy black oil

Posted on 10/22/24 at 11:26 am to supatigah

According to that map, Tuscaloosa does in fact, own Tiger Stadium.

Posted on 10/22/24 at 12:13 pm to supatigah

quote:

supatigah

Great map to add to the OP. Thanks for sharing

Posted on 10/22/24 at 12:32 pm to Samso

quote:

What about Canada / oil sands? I thought that’s where most heavy crude comes from for US refining.

A lot is, but if we needed to increase imports we’d most likely need more pipelines to economically get it to the gulf coast and Great Lakes area.

California is seeing another refinery shutting down and the Rodeo refinery is all sustainable feed stocks now.

Posted on 10/22/24 at 1:35 pm to Samso

quote:

What about Canada / oil sands? I thought that’s where most heavy crude comes from for US refining.

most of the imported tar sands crude goes to the Koch Refinery in ST Paul Minnesota, the bp Whiting refinery in Indiana and to the Capline Convent Terminal in St James LA

Posted on 10/22/24 at 2:03 pm to ragincajun03

This should lower feed costs for the Chem Industries and make all products cheaper.

This post was edited on 10/22/24 at 2:08 pm

Posted on 10/22/24 at 2:07 pm to Bamafig

quote:

According to that map

We are more South of that ribbon.

Posted on 10/22/24 at 2:54 pm to Samso

quote:

What about Canada / oil sands?

Gee, if only we were building more pipelines to bring heavy crude from Canada, eh? Like Keystone XL.

API post: fact vs ficton on the Biden-cancelled pipeline

Posted on 10/22/24 at 3:16 pm to ragincajun03

I'm not a petroleum guy, but could we blend the heavy oils with the light shale to run it through our current refineries? Also, if light, sweet shale oil is what we're going to have the bulk of going forward, the companies are probably just going to have to transition their equipment to handle it.

Posted on 10/22/24 at 3:41 pm to supatigah

quote:

there are numerous heavy oil production areas in the US, the LaBrea Tar Pits in Los Angeles is a prime example of heavy oil bubbling up to the surface. All of the production in Bakersfield, the LA Basin and offshore in CA is heavy oil

I love that map. Brings back memories. By the time I retired, I had worked on the Haynesville, Eagle Ford and Woodford shales. And we had other smaller plays such as the Goddard in Oklahoma. My last push was Mississippian Merrimac Lime in Oklahoma which was also unconventional.

I never considered the Monterey in California was prospective because it is heavy, immature oil that is steam flooded to produce with very low gravity like 11 or 12. I'm not sure it is a commercial horizontal target. Not sure Michigan worked either. But that was ten years ago.

This post was edited on 10/22/24 at 3:43 pm

Posted on 10/22/24 at 4:43 pm to Tantal

quote:

I'm not a petroleum guy, but could we blend the heavy oils with the light shale to run it through our current refineries?

We do. Very few, if any, refineries run a single crude at a time. Most, especially all of the larger ones, blend crude in storage tanks before pumping it to the crude unit.

quote:

Also, if light, sweet shale oil is what we're going to have the bulk of going forward, the companies are probably just going to have to transition their equipment to handle it.

That’s billions of dollars of capital at a time where it’s still very easy and cheap (relatively speaking) to import the heavy stuff needed to make the desired blends

Posted on 10/22/24 at 5:14 pm to Oilfieldbiology

quote:

That’s billions of dollars of capital at a time where it’s still very easy and cheap (relatively speaking) to import the heavy stuff needed to make the desired blends

I fear that maintaining that supply of "cheap" heavy crude is going to have a high non-monetary price in the coming decades.

This post was edited on 10/22/24 at 5:15 pm

Back to top

11

11