- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 9/20/25 at 7:45 am to RealDawg

quote:

2-You will see “rental financing”. Financing of rent over a period of time which guarantees investors but is essentially the used car model for consumers. Don’t pay, they repo you and put you for collection then rent it again and collect another deposit.

I don’t see this being viable or a financial product that would be packaged and sold. Would work great for landlords, getting rental term up front. The lender is giving a loan beyond the term of the rent. The financial institution has no collateral. They’re basically giving a signature loan to someone who can’t even afford to pay rent. And what if that person is required to move?. Then the renter is owing double rent, lowering the chance that the rent finance contract will be paid. And if the house burns down or is destroyed? The renter is locked into the rental financining contract- the lender already paid the Landlord the money? Way too much risk for the lender.

Posted on 9/20/25 at 7:50 am to RealDawg

quote:That's how my dad put my sister and me through college. Bought an old pea field with some guys from work, paved a road down the middle, subdivided it, then offered the lots for trailers, owner financed: 1% down, 1% a month.

Don’t pay, they repo you and put you for collection then rent it again and collect another deposit.

People would pay for a few years, then default. The county would give them so many days to move the trailer or it would be sold to pay what they owed. Then you start all over again with the next one.

Didn't have to be shady. It was a good deal for the purchasers, they just were irresponsible. Took about 25 yrs for them all to cycle through with people willing to pay off the notes. Put us and the kids of five or six of my dad's work buddies through college.

They also did a custom home neighborhood but it wasn't anywhere near as profitable as the trailerhood.

Eta: I take it you're in the Atlanta area? If so, wasn't that a bubble begging to be popped anyway?

This post was edited on 9/20/25 at 7:53 am

Posted on 9/20/25 at 7:51 am to baldona

quote:

people can just not buy as big of homes?.

This. I grew up in a 3 bedroom, 1,400 SQ ft home with a family of 5. I shared a room with my brother until he moved out.

Currently in a 1,600 SQ ft home with 3 kids. My girls will share a room until they're off to college.

It's not that difficult.

Posted on 9/20/25 at 7:51 am to Big Jim Slade

It may have to be some type of deal where the bank is a sublessor.

Posted on 9/20/25 at 7:56 am to BamaCoaster

quote:

I’m as free market as they come, but the govt needs to step in here.

So not so much free market.

quote:

Some state needs to lead the way.

What, exactly, do you think they need to do? How many of the issues we see right now are the result of poorly thought-out government involvement?

quote:

Home ownership is the keystone of the American dream, and it’s under attack.

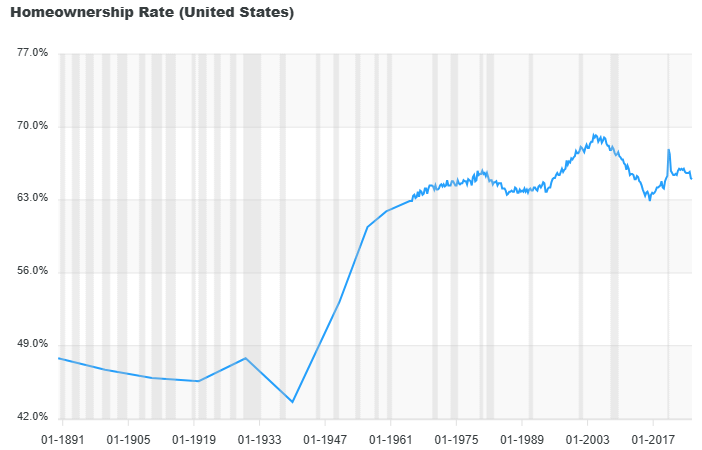

The rate of home ownership now is higher than it has been for most of the history of the US.

Posted on 9/20/25 at 8:10 am to Grnbud

quote:

Pretty sharp way to handle a rental. You get your year’s worth of money up front from the bank or whoever is financing it. You lock your renters in for a fixed term, no surprises. Is it easier to evict them if they don’t pay?

I always tried to pay my rent for the entire year/lease term up front and they never would let me. Apparently it's tough to evict someone if they've fully paid in advance. That's what they told me anyway. Doesn't make much sense why they wouldn't want the year's worth of working capital up front.

Posted on 9/20/25 at 8:10 am to RealDawg

quote:

We don’t see housing recovering until 2027

Because of a bunch of scumbag Democrats and their RINO comrades have politicized the Federal Reserve. They can’t allow Trump to look too good with a strong economy with the obscene inflation they and the Democrats caused over the last four years with their insane, demented, and deranged policies. But hey, at least they got a couple trillion in "green" graft out to their donors to launder back to themselves.

Posted on 9/20/25 at 8:16 am to RealDawg

Another part to this issue which is HUGE is the migrant labor which occupies a chunk of total supply. Their presence keeps the occupancy level high. However, their presence keeps wages low, and also the American Dream out of reach for far too many. The only hope is that 'they all go home'. It will result in a rapid vacancy rate increase. In the mid to long term the system and the economy will be much better served.

This post was edited on 9/20/25 at 8:19 am

Posted on 9/20/25 at 8:18 am to rowbear1922

What’s it matter how much you are there? That’s not a good thought process…unless it’s significantly cheaper

You are still paying rent no longer if you are there 10 days a mth or 30.

You aren’t building any equity. You can’t sell and make money.

You are still paying rent no longer if you are there 10 days a mth or 30.

You aren’t building any equity. You can’t sell and make money.

Posted on 9/20/25 at 8:19 am to TheosDeddy

quote:Florida (and Texas and California and the ATL metro area) are each famous for booms & busts.

I think the Florida bubble will burst eventually

So it’s a question of when not if.

And sometimes the timing of their cycles are somewhat synchronized and other times completely independent.

Posted on 9/20/25 at 8:22 am to RealDawg

Why not just do an ARM now (making a comeback I believe) and bet on Trump to get his new FOMC Chair in by May when Too Late Powell's term ends and benefit from what will probably be a 100 basis point rate reduction.

With Too Late's expected two 25 basis pts reductions by 12/31, a buyer will be sitting pretty by summer 2026 to refinance IMO.

With Too Late's expected two 25 basis pts reductions by 12/31, a buyer will be sitting pretty by summer 2026 to refinance IMO.

Posted on 9/20/25 at 8:23 am to RealDawg

quote:

1-At least a 20% further swing toward more rental versus ownership. People simply can’t afford to buy and salaries aren’t going to match the huge price swing up Covid and Fed caused any time soon. 2-You will see “rental financing”. Financing of rent over a period of time which guarantees investors but is essentially the used car model for consumers. Don’t pay, they repo you and put you for collection then rent it again and collect another deposit. There will have to be a reshaping of the entire mortage industry and the way equity firms invest in housing.

THIS IS BY DESIGN

Posted on 9/20/25 at 8:25 am to el Gaucho

quote:isn’t that what queers do

take some tips from our greatest ally israel and get them a house in the ghetto and fix it up.

Posted on 9/20/25 at 8:27 am to BamaCoaster

quote:

I’m as free market as they come, but the govt needs to step in here.

Then you are NOT as free market as they come. And government “stepped in” a long time ago. The OP mentions how government helped create the problem. If government steps in now how would that look? Guarantee more sub-prime mortgages so we can get another giant bubble?

Posted on 9/20/25 at 8:29 am to meeple

quote:

True that trusses and walls are prefabbed offsite, then shipped in and installed in sections?

I saw two big truckloads of them yesterday on Main Street in Heber City, Utah. There’s a big building boom going on there, too. Construction everywhere.

Posted on 9/20/25 at 8:34 am to Longhorn Actual

quote:Did your Mom have to sleep with your Elementary School principal to keep you in a “normal” class?

I always tried to pay my rent for the entire year/lease term up front and they never would let me. Apparently it's tough to evict someone if they've fully paid in advance.

These two above-quoted sentences would lead a rational person to believe that was the scenario.

This post was edited on 9/20/25 at 8:35 am

Posted on 9/20/25 at 8:35 am to Shexter

quote:

This. I grew up in a 3 bedroom, 1,400 SQ ft home with a family of 5. I shared a room with my brother until he moved out.

Yep. Until I was in middle school all three of us boys slept in one room. House was 2br and 1 bath, maybe 1100 sq feet max.

It was a fairly normal experience then.

Posted on 9/20/25 at 8:38 am to mdomingue

quote:Simple answer to a dumb question: Make it illegal for investment firms to buy up housing. Period. End of story. They can make their trillions some other way. It gets to a point where it's no longer a free market, but a monopoly, and we have a handful of investment firms that are just that. Break em up.

What, exactly, do you think they need to do?

quote:Is this a joke? Pretty much the majority of the problems we are dealing with can be contributed to government action, and some times, inaction (like in this case).

How many of the issues we see right now are the result of poorly thought-out government involvement?

quote:What a clown arse argument to make with that graph. Yeah, over 134 years, of course home ownership would go up - for various reasons - but it's now at about the late 50s/early 60s and has been dropping rapidly since 2017. So much for your, "most of US history" claim if you take out the dust bowl and WW2 time periods.

The rate of home ownership now is higher than it has been for most of the history of the US.

Stop acting like it's not a major problem. You look dumb, and you sound like a try hard.

Posted on 9/20/25 at 8:38 am to RealDawg

quote:

You will see “rental financing”. F

You know what's scarier? People being allowed to finance their door dash orders over 3 months... THAT is terrifying

Popular

Back to top

1

1