- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

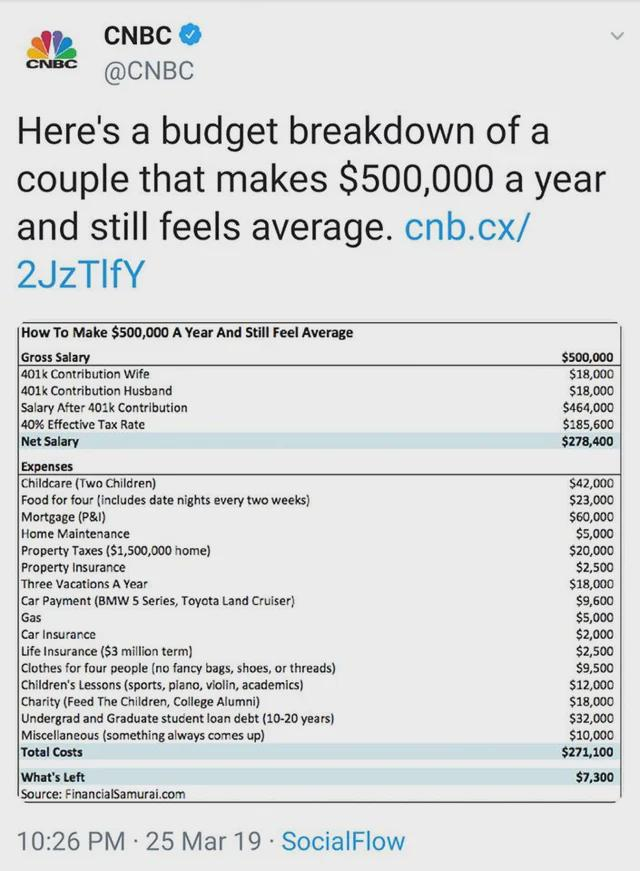

re: Here's the budget breakdown of a couple that make $500K and still feel average

Posted on 1/26/24 at 11:39 am to FinleyStreet

Posted on 1/26/24 at 11:39 am to FinleyStreet

quote:

Well they need to quantify what makes up that number because it's clearly more than just federal which would be closer to ~22% (standard deduction) on that salary. Another 3.5% for FICA and assuming they live in CA it's roughly another ~4% bump. It's not good but it's still not 40%.

I think it's weird that they don't have any medical deductions.

Your effective tax rate estimate may be a little on the low side. Would have to assume person lives in a high state/local tax area as well to get to 40% though.

LINK

quote:

But a Tax Foundation study reveals how much the average person pays overall in taxes after income taxes, FICA, business taxes, excise taxes, and deductions and credits have all been accounted for. These were the average total tax rates for various income levels:

Less than $10,000: 10.6%

$10,000 to $20,000: 0.4%

$20,000 to $30,000: 4.1%

$30,000 to $40,000: 8.5%

$40,000 to $50,000: 11.7%

$50,000 to $75,000: 15.2%

$75,000 to $100,000: 17.7%

$100,000 to $200,000: 21.6%

$200,000 to $500,000: 26.8%

$500,000 to $1 million: 31.5%

Above $1 million: 33.1%

Posted on 1/26/24 at 11:51 am to Street Hawk

They’re not including electricity/gas, cable/internet/subscriptions, lawn and pool care, repairs, clothing etc. or maybe that’s in miscellaneous.

Posted on 1/26/24 at 11:51 am to Lightning

quote:

No explanation given for $2,500 insurance on a $1.5M home though.

They don’t need full homeowners; they probably have a HO6 policy that covers from the walls in.. don’t need roof/wind coverage as that is handled by the condo association policy.

Posted on 1/26/24 at 12:25 pm to Street Hawk

quote:

That sort of behavior is why Dave Ramsey has made so much money.

Posted on 1/26/24 at 12:52 pm to thunderbird1100

quote:For 3 and 5 year olds, yes. Not for older kids.

A grand a month for "children lessons" is hilarious

This post was edited on 1/26/24 at 12:54 pm

Posted on 1/26/24 at 12:56 pm to Lightning

Their numbers have to be completely fabricated.

They don't include utilities, phone plans, discretionary spending.

The entire list is BS

They don't include utilities, phone plans, discretionary spending.

The entire list is BS

Posted on 1/26/24 at 1:15 pm to Street Hawk

Where the hell are they getting homeowners insurance at $2500 for a $1.5 million house?

And $5,000/year in maintenance on a $1.5M house?

And $10,000/year in clothes?

They will always be broke being idiots.

And $5,000/year in maintenance on a $1.5M house?

And $10,000/year in clothes?

They will always be broke being idiots.

Posted on 1/26/24 at 2:00 pm to Pintail

South Louisiana edition 2024

Income $300K (two at $150 because its LA not NY)

2 401k at $23K (-$46k)

Tax rate of 35% on remainder leaves you with 165K a year or $13.7K a month

$13.7K

($2K) tuition for two kids

(1.2) two car notes at $600

(1K) nola property taxes

(1K) NOLA insurance house

($1K) groceries

(4K) mortgage

Ya'll can pick your poison from there (Disney trip, skiing?, boat note?, car and house maintenance

Income $300K (two at $150 because its LA not NY)

2 401k at $23K (-$46k)

Tax rate of 35% on remainder leaves you with 165K a year or $13.7K a month

$13.7K

($2K) tuition for two kids

(1.2) two car notes at $600

(1K) nola property taxes

(1K) NOLA insurance house

($1K) groceries

(4K) mortgage

Ya'll can pick your poison from there (Disney trip, skiing?, boat note?, car and house maintenance

Posted on 1/26/24 at 5:02 pm to Street Hawk

They are getting raped by taxes.

Posted on 1/26/24 at 5:45 pm to Street Hawk

A sad sight to see someone with that income with no invesment properites. W2 earners spend their full income usually. Business owners making/netting the same...do not...usually.

Posted on 1/26/24 at 5:47 pm to frequent flyer

quote:Nah. Their tax quote is clearly inaccurate.

They are getting raped by taxes.

Posted on 1/26/24 at 7:12 pm to Street Hawk

This is what you get living and working in NYC. Even at $500K, you get killed with the COL and taxes. Plus the weather is lousy. They can keep NYC.

Posted on 1/27/24 at 12:29 am to Street Hawk

Cut out charity

500 a week for food for family of 4? That’s pretty high. Meal prep, cut that in half

Cut out one vacation.

Over 2k a year in clothes per person? I never buy clothes except a couple pairs of 40 dollar jeans every 6 months. 1 pair of boots a year. My shirts I get enough in gifts every Christmas and bday to last the year.

500 a week for food for family of 4? That’s pretty high. Meal prep, cut that in half

Cut out one vacation.

Over 2k a year in clothes per person? I never buy clothes except a couple pairs of 40 dollar jeans every 6 months. 1 pair of boots a year. My shirts I get enough in gifts every Christmas and bday to last the year.

Posted on 1/27/24 at 12:34 am to castorinho

quote:

2- on the budget itself, mortgage and childcare are two things they can probably trim a lot out of.

I don’t even understand making 500k and having a car payment/mortgage/student loans. I’d live sparsely a few years and buy it all outright then save. Rent a house for 5 years and save up over a million, buy a nice 5-600k home cash, 2 cars, pay off student loans. Then you have only living expenses and put the rest in investments so it grows

Posted on 1/27/24 at 9:30 am to deltaland

quote:

I don’t even understand making 500k and having a car payment/mortgage/student loans. I’d live sparsely a few years and buy it all outright then save

Inefficient.

Now you can certainly make the argument that they don’t need cars at all, but trading liquidity and opportunity to save a relatively small amount of interest expense is dumb.

Posted on 1/27/24 at 9:44 am to Street Hawk

Note to self: never use financialsamurai.com

Posted on 1/27/24 at 10:48 am to Street Hawk

Taxes are wrong, and statistically impossible. I'm not sure what state they're in, but there is no reality that gets a tax bill that high. 40% effective tax rates don't exist for families making $500k. It could be the author is confusing an effective rate with a top bracket. Social Security has a cap, deductions exist, and you are only taxed on the dollars that land in those brackets. Once you do that right, it likely frees up another $80k or so unaccounted for to save. There just is no reality where someone has that much student loan debt, property tax, interest, etc. and doesn't deduct any of it. It's worst than high school math.

If the moral of the story is taxes are too high, and government spending needs to be checked back, ok. I'm aligned. But this should be about real numbers if it's coming from CNBC. It should.

If the moral of the story is taxes are too high, and government spending needs to be checked back, ok. I'm aligned. But this should be about real numbers if it's coming from CNBC. It should.

Posted on 1/27/24 at 10:56 am to rocksteady

quote:

Note to self: never use financialsamurai.com

I’m not sure if these numbers are from the blogger or from a commenter/case study, but financial samurai is a FIRE blogger who retired from tech in their 30s with children, while continuing to live in the Bay Area. They subsequently shared that their early retirement became more tenuous than expected because of (at the time) depressed bond and treasury yields compared to their projection. I can’t recall if this was pre or post pandemic, but I think they were considering returning to the workforce.

Posted on 1/27/24 at 5:42 pm to Street Hawk

I suspect if I did mine it wouldn’t be much different. Tuition will be ending soon so that will help.

Posted on 1/27/24 at 5:47 pm to Street Hawk

I see lots of potential cutbacks in that list.

Popular

Back to top

0

0