- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Predicting a 30 year mortgage rate around October 2022?

Posted on 12/10/21 at 12:50 pm

Posted on 12/10/21 at 12:50 pm

I am about to build a house and obviously have been tinkering with a mortgage calculator. Trying to prepare for worst case situation, have been putting in 4.5% interest rate in hopes it will be less than that (I believe it will end up being about 3.85 to 4%). Where does the board see the 30 year rate for a good ole baw with good credick and down payment. My lender suggested prepping for 4.25 to 4.5 but that’s to be conservative. Anyone else doing this same exercise?

Posted on 12/10/21 at 1:02 pm to JumpingTheShark

Got quoted 3.2 yesterday for immediate buy. We really think it’s gonna go up a whole point? Don’t think the stomachs are there for that.

Posted on 12/10/21 at 1:07 pm to jimbeam

Crazy how times have changed. Was lucky to get 6-1/8% on my first home in 2005.

Posted on 12/10/21 at 1:13 pm to jimbeam

I don’t think we will get a whole point up either but my guy was just trying to prep me for the worst because it’s so unpredictable. I’m curious which of the forecasting entities have been most accurate in the past…Fannie Mae, MBA, etc

Posted on 12/10/21 at 1:31 pm to bayoudude

Exactly. I got a 5.9% in 2004 and thought I was a god.

Posted on 12/10/21 at 1:46 pm to soccerfüt

I was the head of the loan department at a small commercial bank during the Carter years. We didn’t have adjustable rates, so we amortized everything for 15 years with a 36 - 60 month balloon depending on the mood of our directors. My husband and I had property to build on, but couldn’t afford the mortgage rates so sat tight with our 8.5% mortgage on our first little 2 bedroom house that we bought in 77.

Posted on 12/10/21 at 2:45 pm to JumpingTheShark

I'd be more concerned on the increase of likely purchase price depending on your market than I would be the interest rate.

Posted on 12/10/21 at 3:35 pm to Billy Blanks

The interest rate is of key importance for me because I lock in all my prices at the time construction begins, big variable for me is interest

Posted on 12/10/21 at 4:10 pm to soccerfüt

This post was edited on 12/10/21 at 4:12 pm

Posted on 12/10/21 at 4:20 pm to JumpingTheShark

Get a construction loan that converts to permanent at a fixed rate. You can always refi later if the rates are better.

Posted on 12/10/21 at 5:34 pm to JumpingTheShark

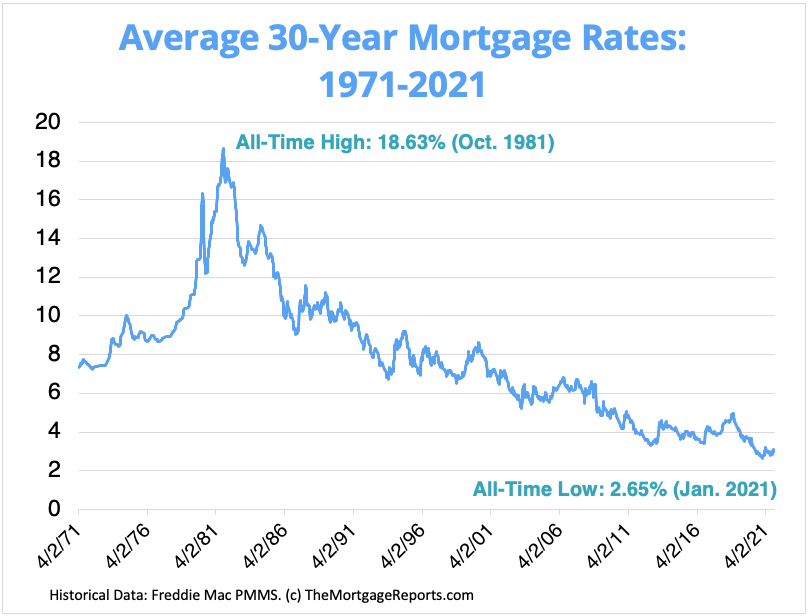

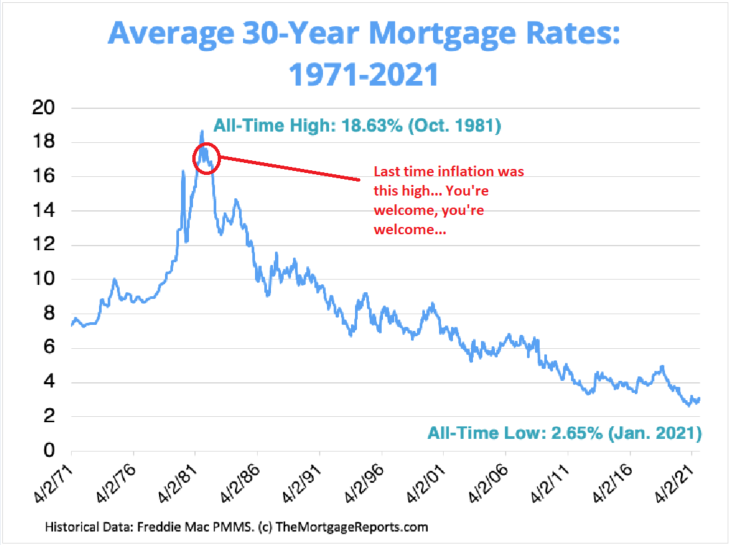

Our first home in 1981 was 15.5% on a 30 year FHA mortgage. This is what you have to look forward to in the future.

Posted on 12/10/21 at 6:32 pm to FlyingTiger1955

quote:

Our first home in 1981 was 15.5% on a 30 year FHA mortgage. This is what you have to look forward to in the future.

So home values will plummet to 80k?

Posted on 12/10/21 at 6:54 pm to SDVTiger

Home values will definitely go down if interest rates get that high again. The 15.5% was due to Carter. Inflation was also double digit. Fun time to enter the workforce.

Posted on 12/10/21 at 6:56 pm to FlyingTiger1955

quote:

Home values will definitely go down if interest rates get that high again.

Interest rates will never get that high

If they do values will be 80k like when you bought your home during the Carter days

Posted on 12/10/21 at 7:51 pm to SDVTiger

Nobody thought they would go that high in the late 70’s either. They were raised to deal with inflation which was 13.5% in 1980 and 10% in 1981. If inflation gets up to those rates again, you might see very high interest rates again. CD rates were high too.

Posted on 12/11/21 at 6:03 am to FlyingTiger1955

quote:

They were raised to deal with inflation which was 13.5% in 1980 and 10% in 1981. If inflation gets up to those rates again, you might see very high interest rates again.

If we measured inflation like we did back then, todays inflation would exceed those numbers.

Posted on 12/11/21 at 7:13 am to BamaCoaster

My prediction would be 3.75.

Popular

Back to top

9

9