- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Everyone has been WishCasting the housing market for almost 4 years now...

Posted on 7/29/24 at 12:04 pm to theunknownknight

Posted on 7/29/24 at 12:04 pm to theunknownknight

quote:

Retarded

Pretty similar to my situation.

34 years old

$300k home

1750 sqft

~17% down

Note is about $2200

We purchased a year ago, and as of this morning owe about $215k. Throwing money at this fricker like there’s no tomorrow.

Absolutely retarded.

Posted on 7/29/24 at 12:12 pm to sidewalkside

We've just resigned to the fact we aren't moving for a very long time and we're going to fix up our house in strategic ways (added sq ft and bathrooms/kitchen) so when we do move in 10 years it'll be worth more and we enjoy living there more.

I'm at 3%. For a $700,000 loan at 3% that is $2,900 a month. At 7%, that is $4,700.

INSANE. I refuse.

I'm at 3%. For a $700,000 loan at 3% that is $2,900 a month. At 7%, that is $4,700.

INSANE. I refuse.

This post was edited on 7/29/24 at 12:16 pm

Posted on 7/29/24 at 1:05 pm to CatfishJohn

quote:

We've just resigned to the fact we aren't moving for a very long time and we're going to fix up our house in strategic ways (added sq ft and bathrooms/kitchen) so when we do move in 10 years it'll be worth more and we enjoy living there more.

I'm at 3%. For a $700,000 loan at 3% that is $2,900 a month. At 7%, that is $4,700.

INSANE. I refuse.

You are in good shape. Id never leave that rate haha.

Posted on 7/29/24 at 1:17 pm to jizzle6609

quote:I told my wife the other day we are married to our rate

You are in good shape. Id never leave that rate haha.

In our 20’s currently:

Bought house in January 2022 for $315k. 4 bed 3 bath 2200 sqft

Locked in 3.2% rate for a $1,505 payment(not including tax and insurance)

Have done upgrades ourselves over the past couple years. House estimate now is about 375k with appreciation and upgrades we’ve made

No way we could do what we did now. Our payment would be about $1k more a month

Posted on 7/29/24 at 1:24 pm to Mahootney

quote:

Who wants to buy a home at 7% interest?

Ummm LOTS of people... In the 80's and 90's the average was 7-10%. That certainly did not deter anyone.

Posted on 7/29/24 at 1:45 pm to theunknownknight

quote:

Imagine being 25 years old

$80,000 down payment

$12,000 closing costs

$2,600 monthly

+ 1,400 in taxes/insurance monthly

For a 1700-square-foot house

Retarded

Imagine where it's ever been much of a thing for a 25 year old to scrape together 20% for a $400k/1700 sq. ft. home. That usually requires outside help.

Assuming they went to college and graduated on time, even pulling together 20% on a $250k home ($50k) in 3 years is difficult to do. If they have a good job and avoid student dead and were very disciplined in saving, yeah, maybe. That's hardly the norm.

And previous generations didn't start out buying the homes their kids were raised in. The rented, saved, bought small, then gradually moved up by rolling equity from house to house over the years.

Posted on 7/29/24 at 1:47 pm to sidewalkside

Who the heck is selling right now? I think we have only had 2 houses for sale in my neighborhood in Covington since Covid. Everyone locked in at 3-4%, they ain’t going anywhere.

Posted on 7/29/24 at 1:49 pm to Dragula

quote:

Who wants to buy a home at 7% interest?

Ummm LOTS of people... In the 80's and 90's the average was 7-10%. That certainly did not deter anyone

7% isn't the affordability problem

7% with high valuations is the problem.

15 year loans used to also be feasible

Posted on 7/29/24 at 1:49 pm to DakIsNoLB

quote:

And previous generations didn't start out buying the homes their kids were raised in. The rented, saved, bought small, then gradually moved up by rolling equity from house to house over the years.

That’s great and all. But a starter home in north Texas is like 450k at this point. Unless you have a high income it’s very hard. I feel for these kids.

Posted on 7/29/24 at 1:52 pm to DakIsNoLB

quote:

And previous generations didn't start out buying the homes their kids were raised in. The rented, saved, bought small, then gradually moved up by rolling equity from house to house over the years.

This talking point made a lot more sense 10-15 years ago.

Most millennials have school aged children and older millennials have kids in high school. They are at the age their parents were when their parents had a nice house with room for 4 or 5 in a safe neighborhood.

Posted on 7/29/24 at 1:58 pm to JohnnyKilroy

quote:

Most millennials have school aged children and older millennials have kids in high school. They are at the age their parents were when their parents had a nice house with room for 4 or 5 in a safe neighborhood.

We have "geriatric millennials" and a millennial as a VP candidate on the GOP side but the OT still thinks we are all 24 old fresh college grads.

Posted on 7/29/24 at 2:13 pm to Mahootney

quote:

but until rates return to what they were

They won’t. I don’t think people realize that historically going back 45 years or so, that 7% is roughly what the average rate was. I think thee is a chance with the right conditions that we maybe see a skitter drop down to somewhere between 5.5 and 6.5 % in the next couple years but really wouldn’t be holding my breath for sub 5 anytime soon.

Posted on 7/29/24 at 2:16 pm to GeauxTigers123

quote:

That’s great and all. But a starter home in north Texas is like 450k at this point. Unless you have a high income it’s very hard. I feel for these kids.

Waiting for the classic old guy comeback where we're told to just buy a home in a violent part of town where bullets fly and cars are stolen.

Posted on 7/29/24 at 2:29 pm to sidewalkside

We’re in a housing bubble right now. If you look at prior history for any decent house for sale they’ve gone up 50% in a very short timeframe. Desirable properties are up 2 or 3x. I saw a lake house for sell that I liked and they’re asking twice what they paid for it 7 years ago.

I don’t know what will cause the correction…but something will. Either a recession or a credit squeeze.

Also I do believe there will be a shift as the Boomers age out. They’ll leave real estate to their kids who will all need to sell or sell themselves to finance end of life expense. I think I read somewhere that Boomers own 40% or RE? That’s a lot….and baristas and Uber drivers can’t afford current prices.

I don’t know what will cause the correction…but something will. Either a recession or a credit squeeze.

Also I do believe there will be a shift as the Boomers age out. They’ll leave real estate to their kids who will all need to sell or sell themselves to finance end of life expense. I think I read somewhere that Boomers own 40% or RE? That’s a lot….and baristas and Uber drivers can’t afford current prices.

Posted on 7/29/24 at 2:34 pm to llfshoals

quote:

Offer an agent bonus, and they’ll beat down your door with all the clients they have sitting on the fence.

I don’t think people realize the value of this.

Posted on 7/29/24 at 3:00 pm to kywildcatfanone

quote:

The problem is 2020-22 made everything think rates should be in the 2-4% range, and it has never been there ever before then.

You are wrong. I bought my house in 2013 and got 3% on 30 years.

Posted on 7/29/24 at 3:05 pm to GetCocky11

quote:

Waiting for the classic old guy comeback where we're told to just buy a home in a violent part of town where bullets fly and cars are stolen.

Yeah. 450k to be on a remotely decent street like 30 minutes from downtown without traffic. If you work in the city that’s your best bet. And it will probably take over an hour on a weekday morning.

If you go super far out you can find 1400 square foot new construction for like high 200s but then you will probably be driving 1.5 hours in the AM.

This post was edited on 7/29/24 at 3:06 pm

Posted on 7/29/24 at 3:55 pm to Dragula

quote:

Who wants to buy a home at 7% interest?

Ummm LOTS of people... In the 80's and 90's the average was 7-10%. That certainly did not deter anyone.

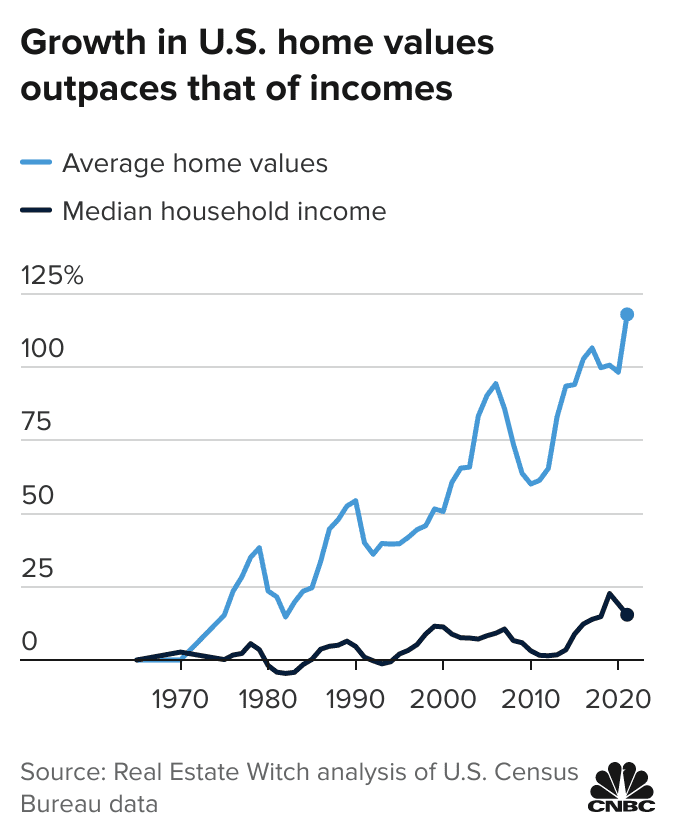

Housing was not close to as expensive relative to median household income, etc.

This is just California, but another chart:

Another:

This post was edited on 7/29/24 at 3:57 pm

Posted on 7/29/24 at 4:02 pm to el Gaucho

quote:

Yep. A lot of people don’t realize that boomers voted for this so that millenials will never be able to own houses

That’s why I did it, but I wouldn’t say every boomer felt the same. I friggin HATE it when millennials own their own homes, and I’ll do ANYTHING to stop it!

This post was edited on 7/29/24 at 4:05 pm

Posted on 7/29/24 at 4:04 pm to sidewalkside

It's way more complicated than is being talked about here.

10-15M illegals needing housing.

19M unoccupied homes nationwide, 1.9M in FL many bought as investments due to low return on CDs, MM, etc....

9.3M homes subsidized through Section 8 or other taxpayer funded initiatives.

Mass migration from high tax states to more desirable locations driving up prices.

Building starts slowed during COVID due to material shortage/cost.

Boomers have very little to do with it other than having large equity when selling to reinvest.

10-15M illegals needing housing.

19M unoccupied homes nationwide, 1.9M in FL many bought as investments due to low return on CDs, MM, etc....

9.3M homes subsidized through Section 8 or other taxpayer funded initiatives.

Mass migration from high tax states to more desirable locations driving up prices.

Building starts slowed during COVID due to material shortage/cost.

Boomers have very little to do with it other than having large equity when selling to reinvest.

Popular

Back to top

0

0