- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 5/21/25 at 3:30 pm to Jax-Tiger

All these fricking cheaters are manipulating the markets as usual.

You know. Buy low, sell high. Or sell high then buy low. It works both ways.

Timing is everything.

First: Here's some bad news.

Next: Here's some good news

Rinse, repeat.

You know. Buy low, sell high. Or sell high then buy low. It works both ways.

Timing is everything.

First: Here's some bad news.

Next: Here's some good news

Rinse, repeat.

Posted on 5/21/25 at 3:41 pm to Robcrzy

quote:

He cut rates to help democrats in the election he can cut rates now

He cut rates again in December of last year after trump was elected.

Posted on 5/21/25 at 3:54 pm to tarzana

It's about the BBB. Here's a snippet from Reuters:

quote:

By Chibuike Oguh

NEW YORK, May 21 (Reuters) - U.S. stocks closed sharply lower on Wednesday as Treasury yields spiked on worries that U.S. government debt would swell by trillions of dollars if Congress passes President Donald Trump's proposed tax-cut bill.

All three major Wall Street indexes closed with their biggest daily losses in a month. Small cap stocks also fell sharply, with the Russell 2000 index posting its biggest daily loss since April 10.

Longer-dated Treasury yields rose after the Treasury Department's $16 billion sale of 20-year bonds met soft demand from investors. The yield on benchmark U.S. 10-year notes rose 10.8 basis points to 4.589%. During the session, the 10-year yield hit its highest since mid-February.

A Congressional committee set an unusual hearing as House Republicans sought to overcome internal divisions about proposed budget cuts, including to the Medicaid health program.

Nonpartisan analysts said the Republican bill could add between $3 trillion and $5 trillion to the federal government's $36.2 trillion debt.

"There are any number of headlines, all of which have consequences if indeed they come to pass," said Michael Farr, chief executive officer at investment advisory firm Farr, Miller & Washington in Washington. "Many of these things are threats that fade rather quickly and markets are trying to digest what's important or what's material or what's perhaps negotiating bluster on behalf of the administration."

Posted on 5/21/25 at 3:57 pm to Robcrzy

quote:

Back to my other point he can try and manipulate an election but he can’t lower them now which is the right thing to do

Would you please articulate exactly why it would be “the right thing to do”?

Posted on 5/21/25 at 4:10 pm to Jax-Tiger

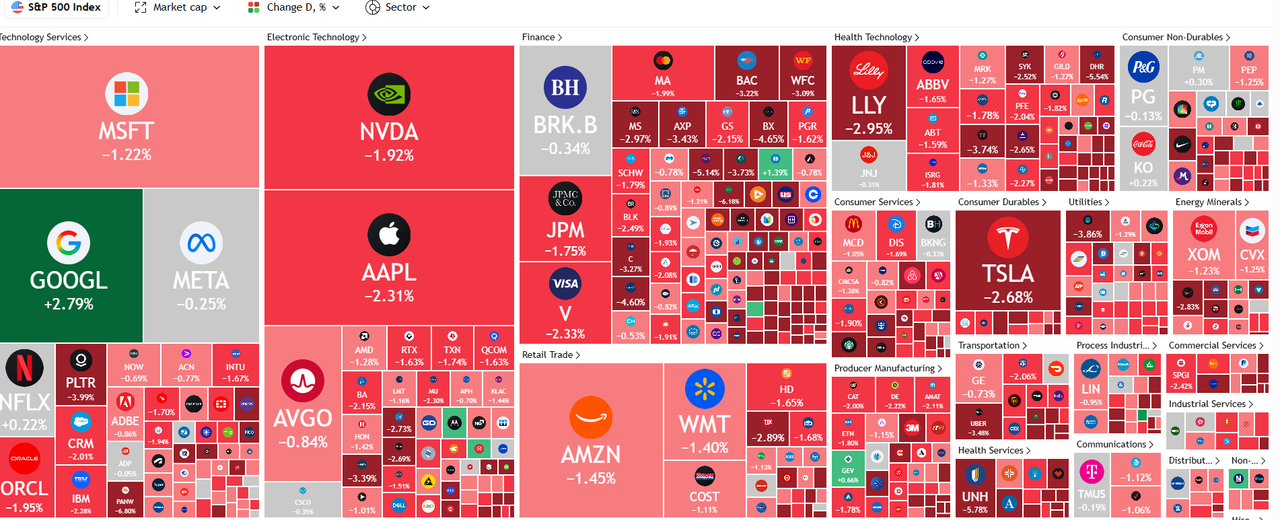

Saw this and thought today must have been a slaughter maybe I should check. S&P500 is only down 1.6%. Why the drama?

Posted on 5/21/25 at 4:13 pm to TorchtheFlyingTiger

quote:

Why the drama?

That is the norm around here it seems now

Posted on 5/21/25 at 4:19 pm to Jax-Tiger

quote:

Today was brutal in the old brokerage account

Learn to diversify.

Posted on 5/21/25 at 4:25 pm to DarthRebel

quote:

Learn to diversify.

My retirement funds are managed by a professional.

I have a fund that I play with.

Posted on 5/21/25 at 4:26 pm to DaBeerz

quote:

my brokerage is for 20 years from now and laughing at any down days or overreactions. I don’t need that money now so it doesn’t affect me if it goes down

Then why do you celebrate when the market rallies ?

I mean if it's all about 20 years from now then the rallies are as meaningless as the pull backs

Market Rallies: I'm up 20 percent YTD, let's roll !

Market Drops 20 percent: I don't care, my brokerage is for 20 years from now so it doesn't affect me

This post was edited on 5/21/25 at 4:31 pm

Posted on 5/21/25 at 4:28 pm to Jax-Tiger

quote:

Was looking okay until it wasn't and everything went south.

I only look at my accounts on days that I know the market is up!

Posted on 5/21/25 at 4:29 pm to bigjoe1

The BBB is a rounding error for our debt problems. We could go back to 90s era tax rates on everyone and debt would still be exploding at an unsustainable rate.

I have no patience for people blaming our debt problems on revenue shortfalls.

Medicaid, Medicare, and ss are causing our debt crisis. Period.

Also, something like 90% of all bbb “spending” is just the TCJA extension.

Letting the TCJA expire without cutting out of control programs like Medicaid would be terrible

I have no patience for people blaming our debt problems on revenue shortfalls.

Medicaid, Medicare, and ss are causing our debt crisis. Period.

Also, something like 90% of all bbb “spending” is just the TCJA extension.

Letting the TCJA expire without cutting out of control programs like Medicaid would be terrible

Posted on 5/21/25 at 4:31 pm to Shredded

quote:

Then why do you celebrate when the market rallies ?

I mean if it's all about 20 years from now then the rallies are as meaningless as the pull backs

lol

Posted on 5/21/25 at 4:33 pm to TorchtheFlyingTiger

quote:

Saw this and thought today must have been a slaughter maybe I should check. S&P500 is only down 1.6%. Why the drama?

I wasn't talking about anyone's account but mine...

Posted on 5/21/25 at 5:04 pm to HailHailtoMichigan!

quote:

Medicaid, Medicare, and ss are causing our debt crisis. Period.

Disagree.

2019 total federal spend ($4.5T) plus increases since in these programs (@$800B) puts us at $5.3T. Total receipts in 2024 will be about $5T.

What’s killing us us all of the increases in other programs PLUS a $400B increase in debt service.

We could cut spending to 2019 levels and still fund these programs at a much smaller deficit. Then cut rates to offset the impact and refinance debt. Viola… we’re in the path.

Posted on 5/21/25 at 5:21 pm to bigjoe1

It is the BBB. But there's hope on the horizon as that lethal package is starting to flounder as spending hawks in the far right of the party actually are showing backbone and real fiscal responsibility, but using the wrong approach.

The death knell of America's economy will ring out the Dies Irae if the bill passes in its current configuration, with the renewed Trump tax cuts plus today's level of spending (or even increases in spending per provisions in the bill).

The death knell of America's economy will ring out the Dies Irae if the bill passes in its current configuration, with the renewed Trump tax cuts plus today's level of spending (or even increases in spending per provisions in the bill).

Posted on 5/21/25 at 5:39 pm to Jax-Tiger

I’m down 1.2% on the day.

This post was edited on 5/21/25 at 5:40 pm

Posted on 5/21/25 at 5:40 pm to tarzana

quote:

tarzana

quote:

Trump'

Like stink on shite

Back to top

0

0