- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

TorchtheFlyingTiger

| Favorite team: | North Carolina St. |

| Location: | 1st coast |

| Biography: | |

| Interests: | LSU & NC St sports, travel, finance |

| Occupation: | FIRE'd |

| Number of Posts: | 3037 |

| Registered on: | 1/14/2008 |

| Online Status: | Not Online |

Recent Posts

Message

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/6/26 at 9:48 am to GeauxBurrow312

quote:

If Qatar is worried about shutting down oil production, they can always join the war effort to expedite getting rid of the regime. Otherwise they can sit back and keep paying Cucker

Qatar isnt just sitting idly on sidelines. They already provide basing/access and air defense assets. We probably dont want to cope with integrating more nations into offensive packages at this point. It unnecessarily adds complexity and risks expansion of conflict.

I've been there done that and integrating partners/allies into strike ops can be tactically detrimental even if it serves strategic purpose of demonstrating broader coalition resolve.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/6/26 at 8:23 am to YNWA

Another made up accusation of breaking norms. Stop making shite up!

We have never had a standing policy of lowering flags to half mast for casualties during ongoing conflicts. State/local more often do so to honor their local fallen.

We have never had a standing policy of lowering flags to half mast for casualties during ongoing conflicts. State/local more often do so to honor their local fallen.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/6/26 at 7:50 am to BOHICAMAN

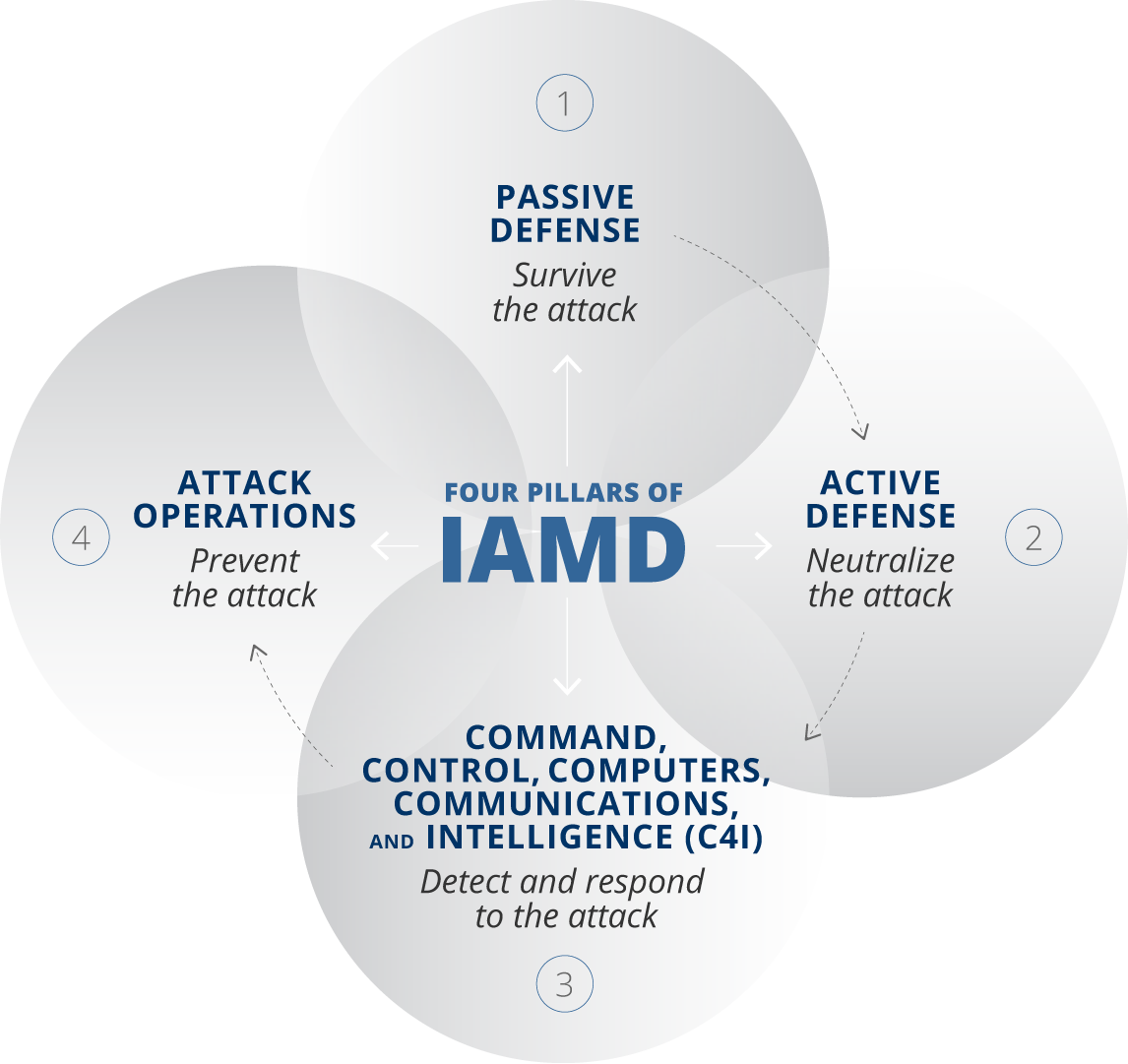

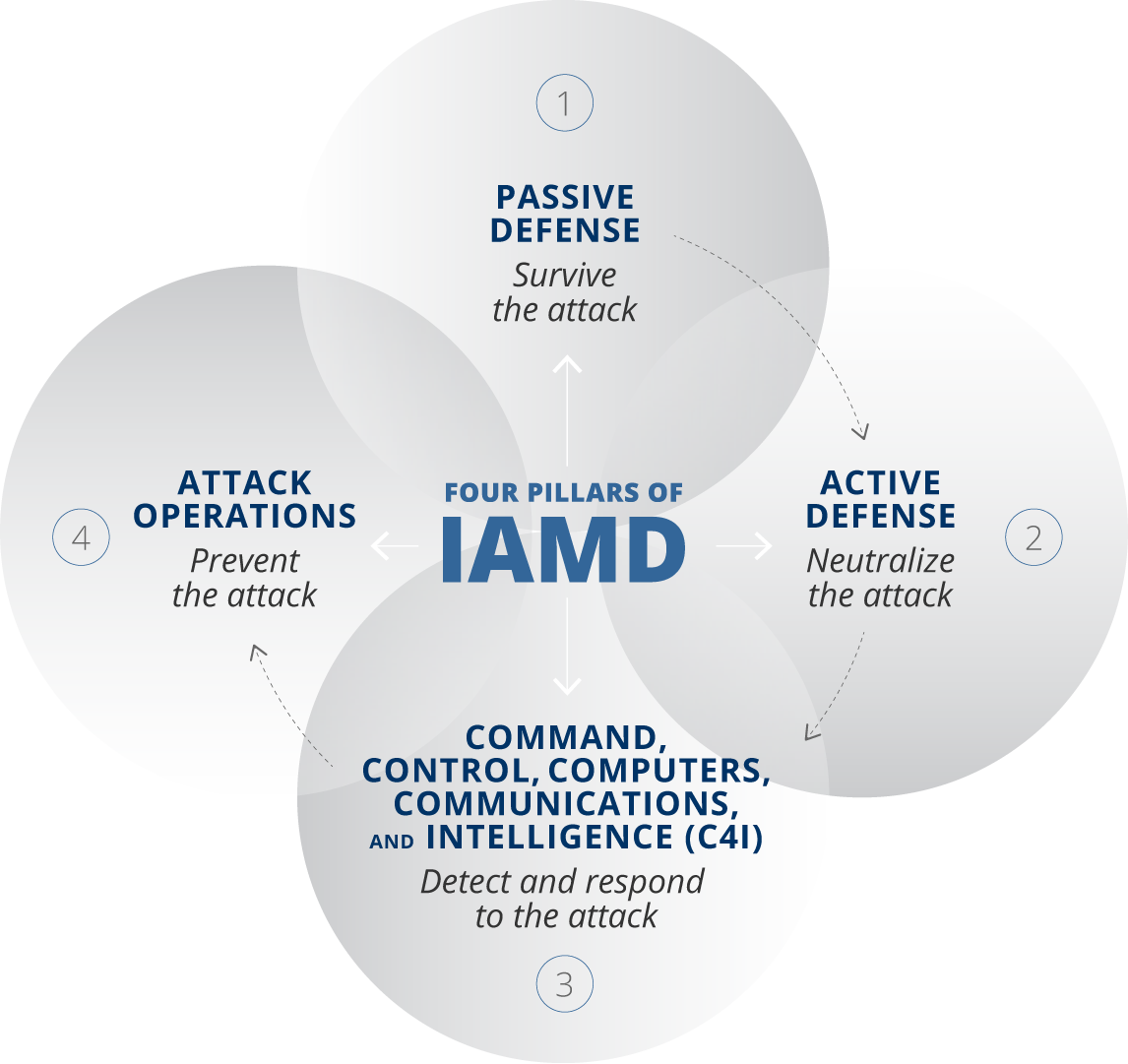

If the report of AN/TPY-2 struck are accurate this is a perfect example of why we were wise to seize the initiative and strike Iran preemptively. Had they managed to orchestrate the first volleys of the conflict on their own timing our ability to defend may have been drastically compromised.

That's why Attack Operations is the 4th pillar of IAMD. Ignore it at your peril. We can't sit back and rely on playing catch against more threat systems than we have interceptors.

That's why Attack Operations is the 4th pillar of IAMD. Ignore it at your peril. We can't sit back and rely on playing catch against more threat systems than we have interceptors.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/6/26 at 7:38 am to BayouBengal51

quote:

Last night was the first night since the war started without any launches from Iran

CNN reporting Saudi intercepted 3x ballistic missiles overnight. And 9 versus UAE. Perhaps zero launches against Israel although that's also contradicted.in the comments. We have dramatically reduced their capacity but it isnt quite annihilated yet.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/6/26 at 7:29 am to BayouBengal51

[

Loading Twitter/X Embed...

If tweet fails to load, click here. quote:

The Lanchester square law explains why it’s collapsing so fast, even if Iran planned to “save the good stuff.” Quick version: In modern ranged combat (missiles, drones, precision strikes), a force’s real power isn’t just its numbers — it’s roughly proportional to the square of its numbers. Why? Because every launcher can potentially target any enemy asset. So when the coalition knocks out even a modest percentage of Iran’s mobile launchers (TELs), command nodes, and air defenses, the remaining launch capacity drops exponentially — not linearly. That’s why the chart shows 350 ? 175 ? 120 ? ~50 in days, not a slow grind. Destroying one TEL doesn’t just remove one missile; it kills every future missile that truck could have fired, plus the coordination around it. The Economist article was written before the coalition went straight for the “launcher hunt” strategy. Iran never got the chance to cycle through cheap stuff and then unleash the hypersonics — the infrastructure to do it is being dismantled faster than they can adapt. The exponential decay we’re seeing (half-life ~1 day) is textbook square-law attrition. Classic case of quality + precision beating quantity in real time.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/6/26 at 7:25 am to TigersSEC2010

quote:There have been quite a few unintentional friendly fire air defense shootdowns over the years. This happened at offset of conflict as ROE and shot doctrine shifts from peace to war, tensions at their highest, and confusion reigns. An engagement error, defense design planning/coordination error, or even procedural/routing mistake by aircrew egressing the combat area is much more likely than deliberate fratricide.

There is some suspicious shite surrounding the Kuwaiti shootdown of 3 US planes. Either they’re fricking retarded or it was intentional.

Have any details come out that actualy indicate "some suspicious shite"? Maybe I missed it.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/5/26 at 6:29 pm to hawgfaninc

I'm mildly shocked that NASA hasnt masked the FIRMS data over the war zone. Seems like it could assist adversary conducting post attack BDA and/or lend legitimacy to hoax claims of targeting success for their propaganda purposes.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/5/26 at 12:29 pm to WeeWee

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/5/26 at 8:25 am to BayouBengal51

quote:

Video of US strikes on an Iranian airbase destroying airforce assets in hangers and transports planes on the runway.

These WarMonitor tweets are pretty flawed. The footage clearly shows targeting of fighter aircraft not the cargo planes. Seems like an.odd tactic to park them in so closely instead.of dispersing assets. Did they actually think we wouldn't recognize the fighters between the larger cargo aircraft?

Notably, looks like we are making an effort to preserve their non combat aircraft or they arent yet a targeting priority.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 3/4/26 at 8:14 pm to hawgfaninc

fun fact: Qatar flew combat missions in the US led Coalition for Operation Odyssey (Libya) Dawn. Perhaps they meant first for their F-15s.

re: Iranian missile targeting Turkey shot down by NATO, 1st NATO member targeted

Posted by TorchtheFlyingTiger on 3/4/26 at 4:05 pm to BOHICAMAN

Yes although technically both can be true. If Aegis were conducting NATO ops under NATO C2, ROE, and defending the NATO Defended Asset List while TOA'd (Transfer of Authority) to NATO then it was a NATO shot. Or, it could have been US conducting US national ops autonomous of NATO command.

re: Iranian missile targeting Turkey shot down by NATO, 1st NATO member targeted

Posted by TorchtheFlyingTiger on 3/4/26 at 8:25 am to BOHICAMAN

NATO.int NATO IAMD

The shooters may have been US or other capable allied BMD shooters that regularly deploy forward ISO allied defense such as German or Netherlands PATRIOT. Allied nations also provide sensor elements, C2 facilities and personnel.

NATO's IAMD mission is a long standing alliance defensive effort. The BMD portion is made up of rotational forces from the NATO member states. These national contributions are under NATO command and control and authorities when conducting these missions. Nations always retain their inherent right to self defense of their own forces and collective self defense. They can also pull assets back for national priorities by transfer of authorities back to national C2.

NATO Air Command is always led by a US 4 Star (dual hatted as USAF-Europe Commander) The Allied Air Command staff that plans and C2s these missions is made up of military staff from all NATO members. and of course NATO's Supreme Allied Commander Europe is always a US 4 Star who also leads the US European Command.

E-3s are an integral part of the air portion of IAMD and integrated C2 but not specifically BMD.

The shooters may have been US or other capable allied BMD shooters that regularly deploy forward ISO allied defense such as German or Netherlands PATRIOT. Allied nations also provide sensor elements, C2 facilities and personnel.

NATO's IAMD mission is a long standing alliance defensive effort. The BMD portion is made up of rotational forces from the NATO member states. These national contributions are under NATO command and control and authorities when conducting these missions. Nations always retain their inherent right to self defense of their own forces and collective self defense. They can also pull assets back for national priorities by transfer of authorities back to national C2.

NATO Air Command is always led by a US 4 Star (dual hatted as USAF-Europe Commander) The Allied Air Command staff that plans and C2s these missions is made up of military staff from all NATO members. and of course NATO's Supreme Allied Commander Europe is always a US 4 Star who also leads the US European Command.

E-3s are an integral part of the air portion of IAMD and integrated C2 but not specifically BMD.

re: Be careful everybody out on the highway quick story that happened to me earlier

Posted by TorchtheFlyingTiger on 2/28/26 at 6:20 pm to R11

Just a day ago nearby, a woman was killed and man critically injured while pulled over in emergency lane exchanging insurance info after a fender bender. Florida has a move over law that's rarely followed.

re: Official US/Israel vs Iran war thread

Posted by TorchtheFlyingTiger on 2/28/26 at 9:25 am to WeeWee

quote:

Arabs choosing to fight with Israel against the Islamic Republic. That is something I didn’t expect.

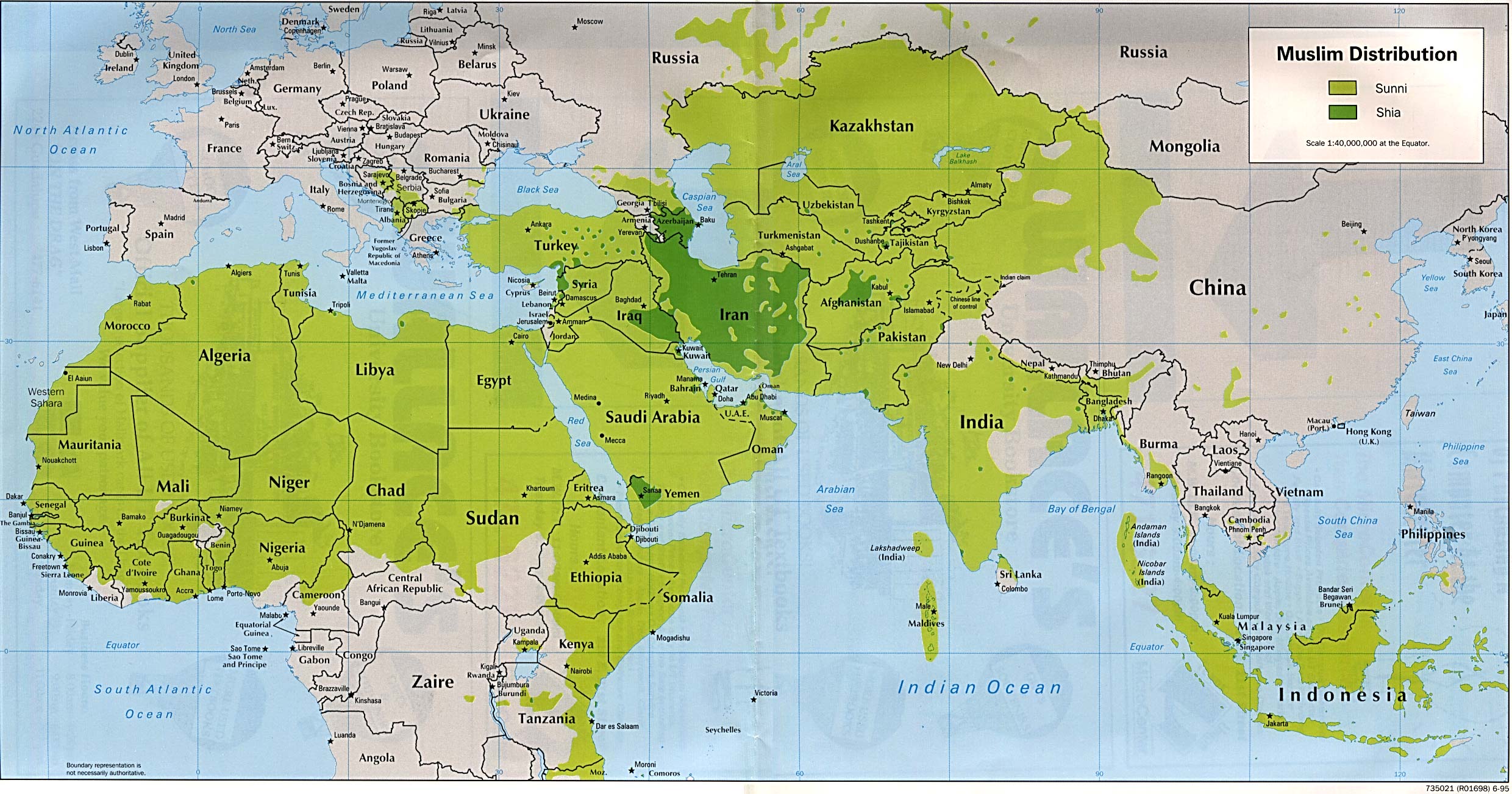

After decades of prolonged US conflict in ME it's remarkable how few otherwise informed citizens have no clue about Shia v Sunni or Arab v Persian animosity.

They may remain defensive only but due more so to lack of capability and desire to cooperate w Israel rather than will to strike Persian rivals.

re: How can I invest in OpenAI and/or xAI?

Posted by TorchtheFlyingTiger on 2/26/26 at 7:16 pm to Gauge

Neither OpenAI nor xAI is publicly traded as of February 2026. This means you cannot buy their shares on a regular stock exchange like the NYSE or NASDAQ through a standard brokerage account (e.g., no ticker symbols for direct purchase).Investing in OpenAIOpenAI remains a private company, with recent valuations in the hundreds of billions (reports mention figures around $500B–$830B in late 2025/early 2026 fundraising and secondary sales). It has no confirmed IPO date yet, though discussions point to a possible Q4 2026 or later public offering, potentially at a $1T+ valuation, contingent on factors like achieving AGI milestones or restructuring.Direct investment options (for accredited investors only):Accredited investors (generally those with $200K+ annual income, $300K+ joint, or $1M+ net worth excluding primary residence) can access shares via secondary/pre-IPO marketplaces. These include platforms like:Forge Global

Hiive

EquityZen

Others like Nasdaq Private Market or specialized brokers (e.g., TSG Invest affiliates).

These involve buying from existing shareholders (e.g., employees or early investors) often through special-purpose vehicles (SPVs) due to OpenAI's share transfer rules. Availability fluctuates, and minimums can be high.

Indirect exposure (available to all investors):Invest in Microsoft (MSFT) — OpenAI's largest partner and shareholder, with a major stake, profit-sharing agreement, and deep integration (e.g., Azure powers much of OpenAI's compute).

Other public companies benefiting from AI growth or OpenAI ties: Nvidia (NVDA), Amazon (AMZN), or Google (Alphabet/GOOGL), as hyperscalers provide infrastructure.

AI-focused funds or ETFs: Examples include ARK Venture Fund (offers some private exposure including OpenAI), Fundrise Innovation Fund (accessible to non-accredited investors with low minimums), or others like Destiny Tech100 (DXYZ) that hold pre-IPO stakes.

These provide partial or proxy exposure but not direct ownership.

OpenAI is actively raising massive private rounds (e.g., talks of $100B+ at high valuations), often led by SoftBank, Thrive Capital, and others, but these are typically closed to retail investors.Investing in xAIxAI (the company behind Grok) was acquired by SpaceX in early February 2026 (around February 2–3). It is no longer an independent entity, so direct xAI shares are no longer tradable separately on pre-IPO markets.Current status:xAI is now part of SpaceX, which remains a private company (no public trading).

SpaceX has been gearing up for a potential IPO later in 2026 (some reports suggest mid-year, like July, at enormous valuations potentially $1T+ for the combined entity).

If/when SpaceX goes public, that would effectively bring xAI (along with elements of X/Twitter from prior mergers) into the public markets indirectly.

Direct investment options (limited/accredited only):Pre-acquisition, platforms like Hiive, EquityZen, Forge, or Nasdaq Private Market offered xAI shares to accredited investors — but post-acquisition, these are no longer available for standalone xAI.

Exposure now ties to SpaceX private shares (if available via secondary markets for accredited investors) or waiting for a potential SpaceX IPO.

Indirect exposure (available to all investors):Invest in public AI-related companies that compete or align with xAI's goals (e.g., Tesla (TSLA) for Elon Musk ecosystem ties, or broader AI plays like Nvidia).

Some publicly traded funds or ETFs hold pre-IPO/private AI stakes (e.g., ARK Venture Fund or similar vehicles that may include SpaceX/xAI exposure indirectly).

No straightforward public proxy exists specifically for xAI yet, beyond waiting for SpaceX developments.

Key notes for both:Private investments carry high risk (illiquidity, valuation volatility, no guaranteed returns) and are restricted for non-accredited investors.

Always verify your accreditation status and consult a financial advisor or platform directly, as opportunities change rapidly.

For broader AI exposure without direct access, public stocks like Microsoft, Nvidia, or AI-themed ETFs remain the most accessible route.

The AI sector is moving fast, with massive fundraising and IPO speculation — monitor official announcements from the companies for updates.

-Grok

re: I have worked 41 years for the same company and calling it quits today!

Posted by TorchtheFlyingTiger on 2/26/26 at 6:55 pm to BK Lounge

Congrats! Enjoy your retirement, you've earned it.

@BKLounge retirement even early retirement has been more achievable for Gen X than generations before us. No other generation had such easy access to low cost investments and knowledge at our fingertips not to mention expanded access to educational opportunities. I mostly retired at 45 and only work a little by choice. Living below means and investing early is they key. Lack of opportunities isnt what holds most Americans back it it their rampant over consumption and poor life choices.

@BKLounge retirement even early retirement has been more achievable for Gen X than generations before us. No other generation had such easy access to low cost investments and knowledge at our fingertips not to mention expanded access to educational opportunities. I mostly retired at 45 and only work a little by choice. Living below means and investing early is they key. Lack of opportunities isnt what holds most Americans back it it their rampant over consumption and poor life choices.

re: Rule of 55

Posted by TorchtheFlyingTiger on 2/26/26 at 8:59 am to JL

quote:

simulations determined it was better to just convert everything to roth up front and take the hit.

I've seen recommendations to convert all at once but can't see how it could be optimal if more than couple hundred thousand traditional balance. If I convert all at once it would bump my marginal bracket from 12% to 37%, LTCG from zero to 20% and trigger 3.8% NIIT.

I'm struggling to justify voluntarily paying 20-22% rate and 15% LTCG. I cant imagine a case for full conversion up to 37% making any sense.

re: Rule of 55

Posted by TorchtheFlyingTiger on 2/26/26 at 8:37 am to Sho Nuff

Most those dividends (if qualified) will likely fall in the zero LTCG rate (under $98900 married/joint). I'm facing similar dilemma but with a pension and part time job very little space to convert in 12% bracket. I'm mulling whether to go ahead and convert to top of 22% but that also pushes my LTCG rate to 15% on $20k+ and makes it costly to sell shares from taxable to pay tax on Roth conversion.

Recently.stumbled upon idea to reduce income in a large conversion year by utilizing 100%/bonus depreciation on an investment property. I'm not eager to get into real estate and it requires cost segregation study to determine what components can be depreciated immediately (not land or.primary structure). So, I probably wont pursue it but might be a promising strategy.

Recently.stumbled upon idea to reduce income in a large conversion year by utilizing 100%/bonus depreciation on an investment property. I'm not eager to get into real estate and it requires cost segregation study to determine what components can be depreciated immediately (not land or.primary structure). So, I probably wont pursue it but might be a promising strategy.

re: Convince me: Why not RH?

Posted by TorchtheFlyingTiger on 2/25/26 at 7:37 am to oneg8rh8r

I looked at TSP timing strategies a few years back was unconvinced there was a good thesis behind it other than past performance. I've done quite well without timing the market.

The main reason to move from TSP is successor beneficiaries cannot keep TSP accounts and they cant rollover to inherited IRA resulting in an immediate distribution. Afraid wife wont remember this when I pass (or we pass in quick succession) and kids eventually get screwed by immediate distribution and massive excess tax burden.

Expenses (once lowest) are now higher than buying index funds w a brokerage not to mention the poor user interface and customer service issues.

The main reason to move from TSP is successor beneficiaries cannot keep TSP accounts and they cant rollover to inherited IRA resulting in an immediate distribution. Afraid wife wont remember this when I pass (or we pass in quick succession) and kids eventually get screwed by immediate distribution and massive excess tax burden.

Expenses (once lowest) are now higher than buying index funds w a brokerage not to mention the poor user interface and customer service issues.

re: Rule of 55

Posted by TorchtheFlyingTiger on 2/24/26 at 4:44 pm to Pockets

You could adjust wife's withholding and.pension withholding to offset the excess witholding (20%) on 401(k) withdrawals.

On other hand, consider the $150k (net $114k in 24% bracket) could fund your first 3 years of retirement with no additional tax (other than on interest). That would take you nearly to 59.5 without taping into 401k or past.it.if.you tighten finances and/or have other income or capital sources.

On other hand, consider the $150k (net $114k in 24% bracket) could fund your first 3 years of retirement with no additional tax (other than on interest). That would take you nearly to 59.5 without taping into 401k or past.it.if.you tighten finances and/or have other income or capital sources.

re: Rule of 55

Posted by TorchtheFlyingTiger on 2/24/26 at 12:54 pm to Weekend Warrior79

quote:

would it make sense to roll it over into an IRA away from your current company?

Not if intending to use Rule of 55. That only applies to plan w employer you leave during or after year you turn 55. It doesn't apply to an IRA.

Popular

1

1