- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: There are some major issues lurking in the US financial markets

Posted on 2/17/19 at 2:04 pm to Doc Fenton

Posted on 2/17/19 at 2:04 pm to Doc Fenton

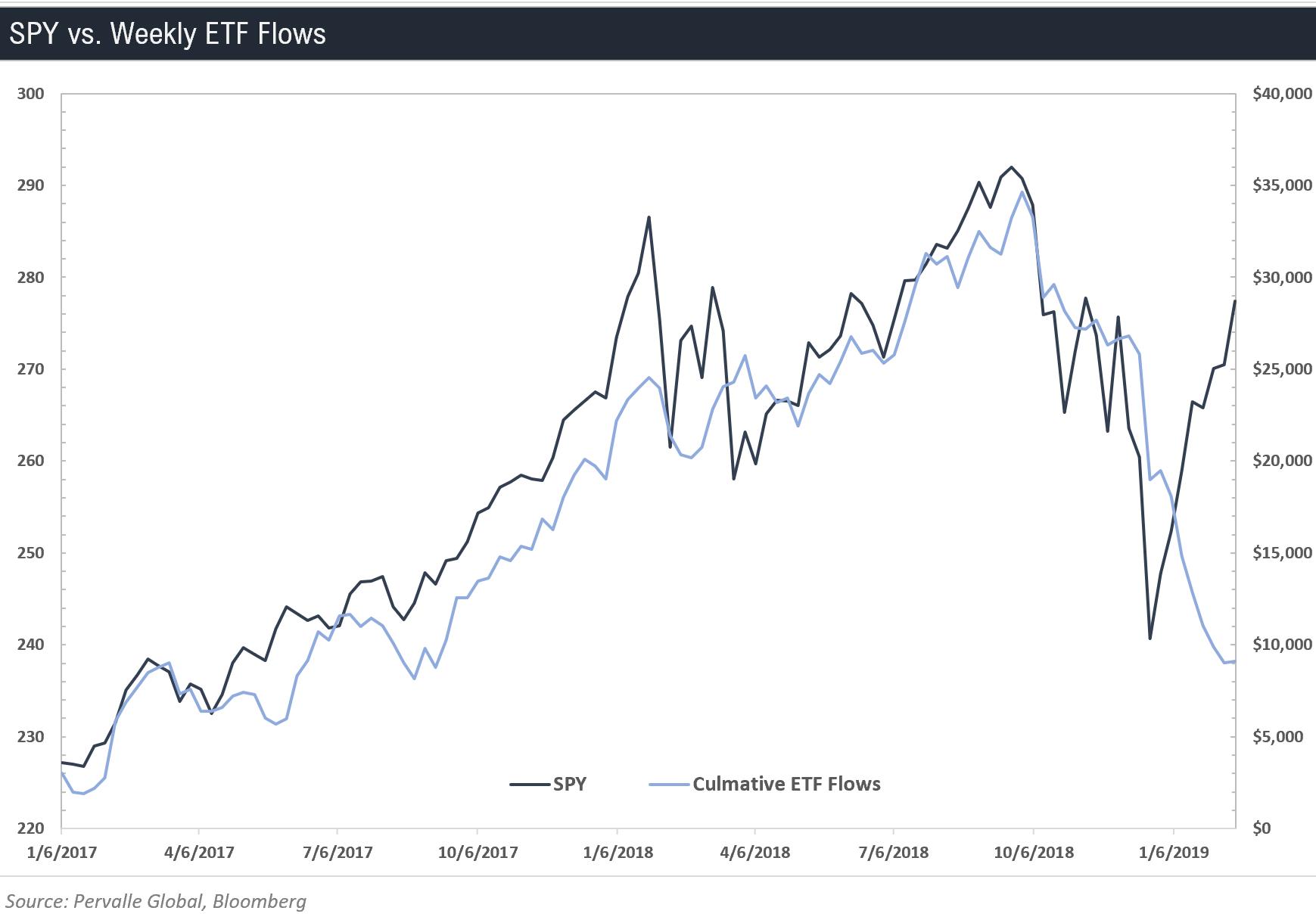

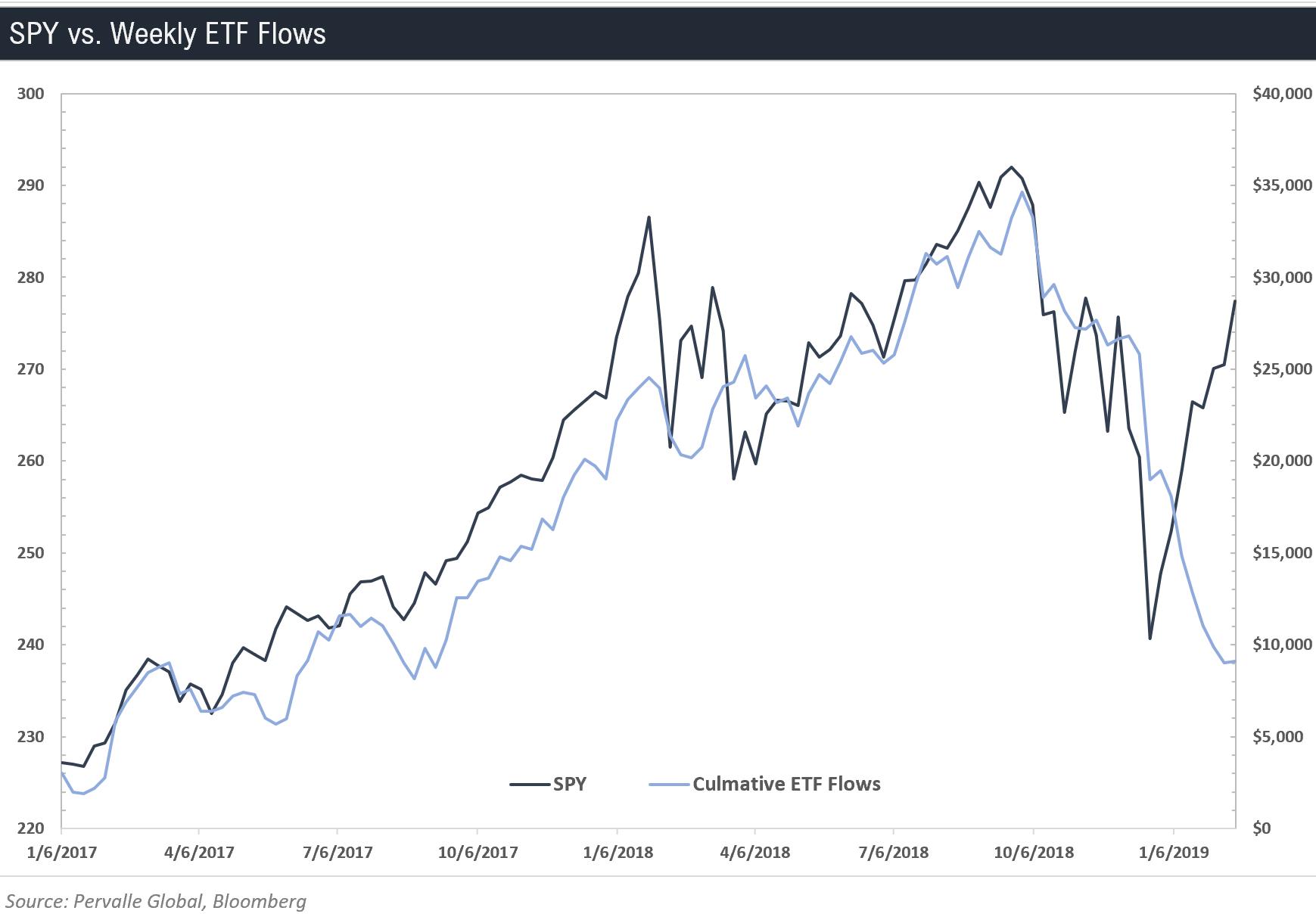

ETF’s still don’t represent even close to majority of the market. Can you find data on equity mutual fund flows?

Posted on 2/17/19 at 8:05 pm to Doc Fenton

What does “culmative” mean? Is that a word?

Posted on 2/19/19 at 7:03 pm to LSUtoOmaha

quote:And since you made this post on 11/20 (about 3 months ago):

When I started this thread four months ago the SPY closed at 273.6.

We are currently at 277.4.

quote:

I am. Also put some money in FNGU (3x inverse fang).

B-rab honestly has the best idea. Facebook is a disaster of a company and will implode even without market headwinds.

The 3X inverse FANG (assume you actually meant FNGD) is down 34.4% while Facebook is up 22.4%.

I just

Posted on 2/19/19 at 8:14 pm to LSUtoOmaha

He just can’t lmao these people are acting like nothings changed it’s hilarious.

Posted on 2/19/19 at 8:25 pm to wutangfinancial

I’m about to sell my soul, take out a HELOC, and buy Herbalife. It has the risk of a T-bill

Posted on 2/22/19 at 10:29 am to LSUtoOmaha

We back across 26k in the Dow baws

Closing in on 2800 s&p

I hope the folks who took Husss’s advice have warm weather for sleeping under their bridges

Closing in on 2800 s&p

I hope the folks who took Husss’s advice have warm weather for sleeping under their bridges

Posted on 2/22/19 at 12:12 pm to Thib-a-doe Tiger

quote:"But I said we'd see a crash sometime in the 'next 20 years'!!!"

I hope the folks who took Husss’s advice have warm weather for sleeping under their bridges

Posted on 2/22/19 at 8:27 pm to Thib-a-doe Tiger

quote:

Husss’s

Where is this guy? It was just about time for some quality roasting.

On a serious note; let’s talk Europe...

EZ big banks seem to be signaling serious weakness across the pond. Hopefully growth can pick up and these are idiosyncratic events... but seeing DB, BCS, SAN continually shedding market cap is noteworthy.

Also... UK stocks (EWU, etc.) are breaking away from EZ so far this year. Interesting.

Posted on 2/22/19 at 8:55 pm to LSUcam7

Db is just a mess. I think there are more shoes going to drop with how much smoke there is regarding their mismanagement and fraud.

Also I believe others have said huss was banned.

Also I believe others have said huss was banned.

Posted on 2/25/19 at 11:49 am to leoj

You guys are entertaining. Again, acting as if nothing has changed. Have fun holding bags for the next 5 years  BUY EVERYTHING MARKETS ONLY GO UP

BUY EVERYTHING MARKETS ONLY GO UP

Posted on 2/25/19 at 5:54 pm to notiger1997

Trump tweeting about the markets going up

Posted on 2/25/19 at 8:24 pm to wutangfinancial

quote:

acting as if nothing has changed

Nothing changed in Q4 2018. That’s your first problem.

Posted on 2/25/19 at 9:01 pm to wutangfinancial

quote:

You guys are entertaining. Again, acting as if nothing has changed. Have fun holding bags for the next 5 years BUY EVERYTHING MARKETS ONLY GO UP

I would like to know how many times it has been said "this time is different" over the 45 years that I have been investing, or how many times someone has said "a crash is imminent, better be moving to cash" and been wrong. Better financial advise can usually be had from actual astrologers than the majority of those that engage in financial fortune telling under the guise of economics.

Posted on 2/25/19 at 9:15 pm to EA6B

quote:

I would like to know how many times it has been said "this time is different" over the 45 years that I have been investing, or how many times someone has said "a crash is imminent, better be moving to cash" and been wrong.

EA i completely agree with you however i am not sure why the market is testing all time highs right now. I just dont understand.

Posted on 2/25/19 at 9:31 pm to LSUtoOmaha

We have certainly approached an interesting inflection point.

On the one hand, we are now near the very top of the range of what most quantitative analysts have been telling us that a bear market rally could achieve. If the markets go another 5% or so higher and exceed the Fall 2018 peak, then that will certainly be egg on my face, along with a lot of other pundits out there. (I'm still waiting on that mythical "Point G" to occur, right?)

On the other hand, the bears have taken cannonball broadsides from the two factors feared the most (Fed policy and U.S.-China trade news), and the bulls no longer have much dry powder left. The Fed has been trotting out members to calm the markets on an almost daily basis, the bond markets aren't seeing any rate hikes in the future, QT might be over sooner rather than later, and yet we're still not as high as we were in September when rate hikes and QT were still expected. The unlikely tariff hikes scheduled for March 1 will not occur, and U.S.-China trade developments seem to be as much of a classic "buy the rumor, sell the news" type of event as you can get. (And I don't think any type of pending trade deal can rescue us from the effects of a deep upcoming Chinese recession at this point.)

All the while, we have been inundated with bad economic news nearly throughout the whole year-to-date so far for 2019. When the selloff of Jan/Feb 2018 occurred, I noted that it might be the beginning of the end, but I also knew that the bear market was yet to actually commence in earnest, because that particular selloff was based almost entirely on good underlying economic data (which sent bond yields too high). By the same type of logic, we can look at the underlying economic data for the recent rally--as well as the story being told by the bond markets--and understand that this time it looks very bad for the bulls.

Today we had the markets open at 2804 and quickly rise to 2813 as the worst-case scenario on Trump-Xi that the markets feared most was officially avoided. Yet near the end of trading, the market had nearly returned to its previous close of 2792, before rebounding a few points up. It's impossible to tell when exactly we'll be out of the woods for this late rally, but from a bear's perspective, it looks like it can't possibly have much steam left.

On the one hand, we are now near the very top of the range of what most quantitative analysts have been telling us that a bear market rally could achieve. If the markets go another 5% or so higher and exceed the Fall 2018 peak, then that will certainly be egg on my face, along with a lot of other pundits out there. (I'm still waiting on that mythical "Point G" to occur, right?)

On the other hand, the bears have taken cannonball broadsides from the two factors feared the most (Fed policy and U.S.-China trade news), and the bulls no longer have much dry powder left. The Fed has been trotting out members to calm the markets on an almost daily basis, the bond markets aren't seeing any rate hikes in the future, QT might be over sooner rather than later, and yet we're still not as high as we were in September when rate hikes and QT were still expected. The unlikely tariff hikes scheduled for March 1 will not occur, and U.S.-China trade developments seem to be as much of a classic "buy the rumor, sell the news" type of event as you can get. (And I don't think any type of pending trade deal can rescue us from the effects of a deep upcoming Chinese recession at this point.)

All the while, we have been inundated with bad economic news nearly throughout the whole year-to-date so far for 2019. When the selloff of Jan/Feb 2018 occurred, I noted that it might be the beginning of the end, but I also knew that the bear market was yet to actually commence in earnest, because that particular selloff was based almost entirely on good underlying economic data (which sent bond yields too high). By the same type of logic, we can look at the underlying economic data for the recent rally--as well as the story being told by the bond markets--and understand that this time it looks very bad for the bulls.

Today we had the markets open at 2804 and quickly rise to 2813 as the worst-case scenario on Trump-Xi that the markets feared most was officially avoided. Yet near the end of trading, the market had nearly returned to its previous close of 2792, before rebounding a few points up. It's impossible to tell when exactly we'll be out of the woods for this late rally, but from a bear's perspective, it looks like it can't possibly have much steam left.

This post was edited on 2/25/19 at 9:34 pm

Posted on 2/25/19 at 11:00 pm to Doc Fenton

Yea. I don't understand where the optimism comes from. We are overvalued

Posted on 2/26/19 at 9:30 pm to Doc Fenton

quote:

it looks like it can't possibly have much steam left.

But what if it does?

Popular

Back to top

0

0