- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: There are some major issues lurking in the US financial markets

Posted on 2/15/19 at 7:13 am to LSUtoOmaha

Posted on 2/15/19 at 7:13 am to LSUtoOmaha

Also... and this might be slightly inappropriate for this board, but... GAMEDAY BITCHES!!

Posted on 2/15/19 at 10:11 am to LSUtoOmaha

so Omaha, im trying to understand the opinions in the last few replies with you, Doc, Vol.

Are you guys saying we are going the right direction again or that the signs are pointing the rough times in the near future?

Are you guys saying we are going the right direction again or that the signs are pointing the rough times in the near future?

Posted on 2/15/19 at 10:30 am to Mr.Perfect

My opinion is that assets are overpriced and returns over the next several years will be quite poor.

Many players have a vested interest in propping up markets in the shorter term.

Many players have a vested interest in propping up markets in the shorter term.

This post was edited on 2/15/19 at 10:31 am

Posted on 2/15/19 at 10:34 am to LSUtoOmaha

quote:Which assets?

My opinion is that assets are overpriced

Real estate? Stocks? Gold? Silver? Oil? Government securities?

All of the above?

Posted on 2/15/19 at 10:46 am to LSURussian

Stocks- mainly big tech. I think that companies with priced in earnings growth of 25% will set up for a pretty large failure once that growth stalls.

For example:

Salesforce

Service Now

Netflix

Amazon

NVDA

For example:

Salesforce

Service Now

Netflix

Amazon

NVDA

Posted on 2/15/19 at 10:48 am to LSUtoOmaha

quote:That's the case ALL THE TIME.

I think that companies with priced in earnings growth of 25% will set up for a pretty large failure once that growth stalls.

Nothing new to see here....

Posted on 2/15/19 at 10:54 am to LSURussian

The are soooo many of these companies though.

What are your thoughts on stock prices?

What are your thoughts on stock prices?

Posted on 2/15/19 at 1:03 pm to LSUtoOmaha

quote:I doubt there is statistically more of them now than in the past.

The are soooo many of these companies though.

quote:The next 25,000 point move on the Dow Jones will be up.

What are your thoughts on stock prices?

Posted on 2/15/19 at 1:11 pm to LSURussian

quote:

The next 25,000 point move on the Dow Jones will be up.

Posted on 2/15/19 at 1:25 pm to LSUtoOmaha

quote:

My opinion is that assets are overpriced and returns over the next several years will be quite poor.

Many players have a vested interest in propping up markets in the shorter term.

I agree with this. I cant look at equities and believe that they are fairly priced.

The S&P 500 is nearly 50% higher than this time 3 years ago and i keep asking myself how that could be possible when the cost of capital has increased. It cant be all buybacks.

And then i look at the p/e ratio and get even more confused.

The p/e of the s&p was 22.18 on 1/1/2016

Earnings are not fully reported but projections have the 1/1/2019 figure at 19.96

I know i am a simpleton but how can we be paying so much more for less

LINK

Posted on 2/15/19 at 5:19 pm to Mr.Perfect

quote:

The p/e of the s&p was 22.18 on 1/1/2016

Earnings are not fully reported but projections have the 1/1/2019 figure at 19.96

I know i am a simpleton but how can we be paying so much more for less

If I understand your question, then the answer is tax cuts increased earnings.

Posted on 2/15/19 at 11:55 pm to Omada

Lord and Taylor is liquidated and sold off historic store front.

Sears is dying but has been slowed so a guy can siphon the rest of the valuable assets to himself until it's totally bankrupt.

Payless shoes is liquidating 2100 stores.

7 million americans are 90 days behind on car payments(record high).

earning forecasts are being reduced or missed on some major stocks. although some are still performing. I think it runs out of gas before end of year and we see a bear market. may not be anything catastrophic but I think there is some unrealistic growth priced in everywhere.

Sears is dying but has been slowed so a guy can siphon the rest of the valuable assets to himself until it's totally bankrupt.

Payless shoes is liquidating 2100 stores.

7 million americans are 90 days behind on car payments(record high).

earning forecasts are being reduced or missed on some major stocks. although some are still performing. I think it runs out of gas before end of year and we see a bear market. may not be anything catastrophic but I think there is some unrealistic growth priced in everywhere.

Posted on 2/16/19 at 8:58 am to LSURussian

quote:

That's the case ALL THE TIME.

Except in the pass those companies didn't carry some of the largest market caps

Posted on 2/16/19 at 9:28 am to GenesChin

quote:Why is that significant to the economy?

Except in the pass those companies didn't carry some of the largest market caps

Posted on 2/16/19 at 1:44 pm to Doc Fenton

Before or after 2050?

Market is on record start for the year - best since 1991.

So the FEAR PORN Cra-p hits in December then boom again

Market is on record start for the year - best since 1991.

So the FEAR PORN Cra-p hits in December then boom again

Posted on 2/16/19 at 7:16 pm to LSUtoOmaha

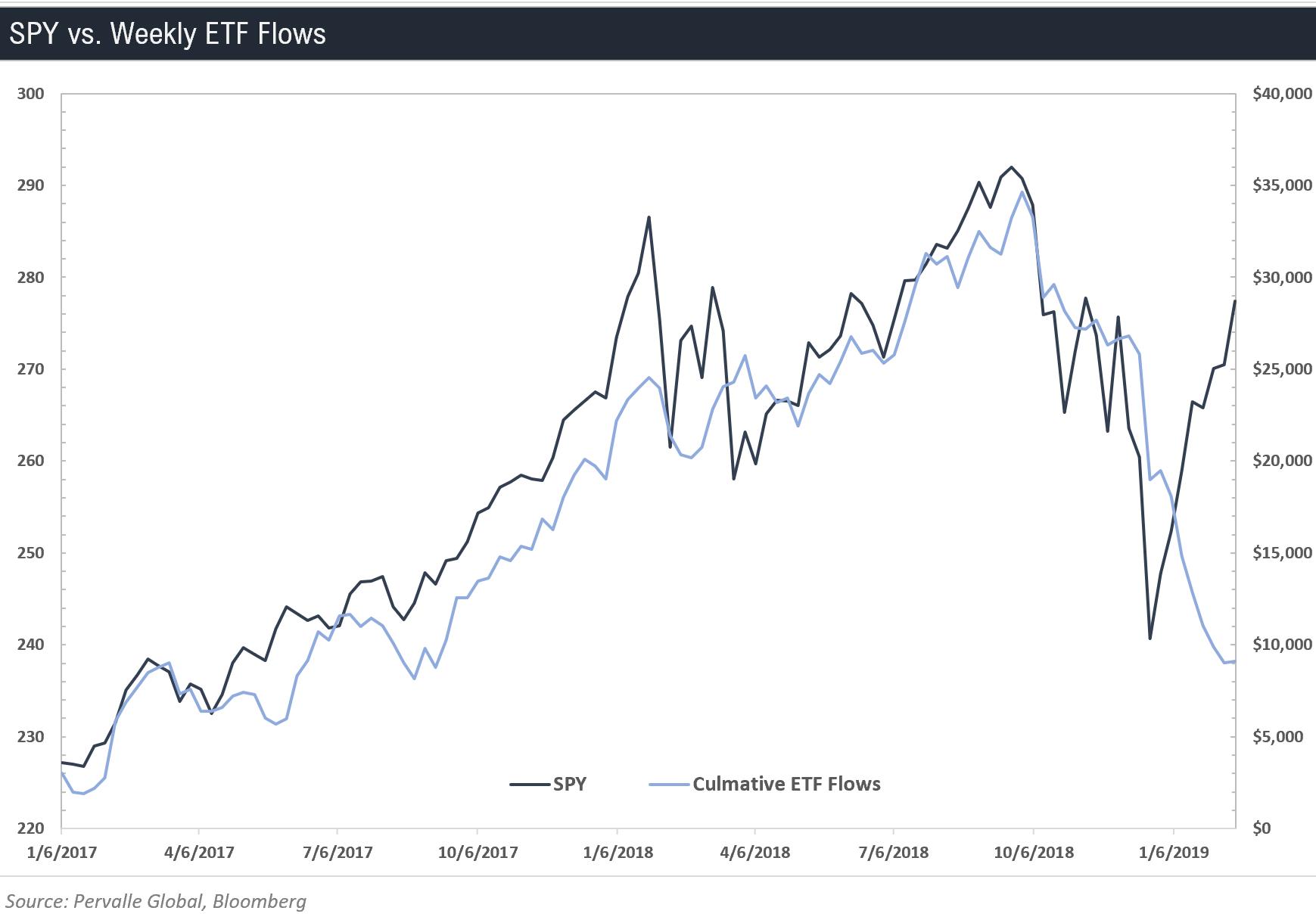

When I started this thread four months ago the SPY closed at 273.6.

We are currently at 277.4.

We are currently at 277.4.

Posted on 2/17/19 at 1:06 pm to LSUtoOmaha

I honestly can't figure out what's happening in China right now. We have both the Shanghai and Hong Kong markets bottoming just before Powell's remarks on 1/4, and then taking a steady climb up to last Wednesday, 2/13, before taking a small dip into the current weekend.

I had been expecting a move down after the week-long holiday for the Lunar New Year (2/4 - 2/8), but the markets rose through it. As I mentioned in a recent post, the China story has been a big deal so far in 2019. On the one hand, we are seeing markets become bullish on reports of massive monetary stimulus from the PBoC. On the other hand, we are not yet seeing that stimulus fully reflected in the underlying economy, with Chinese inflation for Jan 2019 coming in less than expected on Friday ( LINK), and Chinese M1 money supply for Jan 2019 was up just 0.4% y-o-y ( LINK), although there are some funky things going on with monthly dropoffs around the new year in recent years.

This would be ordinary enough for China, I suppose, except that there are also some crazy imbalances being reported in the real estate sector there, such as:

Nikkei Asian Review (2/13/2019): " China's housing glut casts pall over the economy" (A building binge leaves cities with 65 million empty apartments)

So these downgrades on 1/23 and 2/4 were occurring right in the middle of the stock market run-up. Weird.

I'm not ready to say that the Chinese government's stimulus operation has been a failure. They've seemingly had their backs to the wall several times before over the past 20 years, and they always seem to boost the economy back into growth. However, I also know that pattern can't last forever, and they are now dealing with small-player, local shadow banking leverage on a huge aggregated scale that they've never dealt with before. So can the Chinese government bailout the industrial and real estate sectors once again? Maybe, we'll have to see some positive inflation and money growth numbers before we'll know if that's happening.

I had been expecting a move down after the week-long holiday for the Lunar New Year (2/4 - 2/8), but the markets rose through it. As I mentioned in a recent post, the China story has been a big deal so far in 2019. On the one hand, we are seeing markets become bullish on reports of massive monetary stimulus from the PBoC. On the other hand, we are not yet seeing that stimulus fully reflected in the underlying economy, with Chinese inflation for Jan 2019 coming in less than expected on Friday ( LINK), and Chinese M1 money supply for Jan 2019 was up just 0.4% y-o-y ( LINK), although there are some funky things going on with monthly dropoffs around the new year in recent years.

This would be ordinary enough for China, I suppose, except that there are also some crazy imbalances being reported in the real estate sector there, such as:

Nikkei Asian Review (2/13/2019): " China's housing glut casts pall over the economy" (A building binge leaves cities with 65 million empty apartments)

quote:

Funding problems for some developers

Investors are also growing jittery about the property sector. While the outlook for top developers like Country Garden and China Vanke remains stable, the bond market is flashing warning signs about debt held by many smaller Chinese property groups.

Four of them now carry a "CCC" rating from S&P Global Ratings -- deep into junk territory. Such ratings signal that companies are "vulnerable" and may not survive a slide in business conditions. The credit agency only rates 13 companies in the Asia-Pacific region this low out of the roughly 1,120 companies that it evaluates.

Hong Kong-headquartered Guorui Properties is one of them. The company was downgraded two notches to "CCC" by S&P on Feb. 4, a move reflecting "uncertainty over the company's refinancing plan for its imminent debt maturities" -- a warning that the midsized developer could default on its debts. Another developer, Yida China Holdings, was downgraded at the end of January to "CCC+," with analysts raising concerns that the company's "capital structure, with limited cash balance and weak liquidity, is unsustainable in the longer run and is vulnerable to adverse market conditions." The Shanghai-based business park operator has not paid the annual dividends it declared last March.

Similarly, Moody's on Jan. 23 took action on Jiayuan International Group, dragging its rating down two notches to "Caa1" with a negative outlook. The ratings agency is concerned that a recent sharp fall in share price coupled with an unstable ownership structure could "undermine investor confidence [and] increase refinancing risks."

So these downgrades on 1/23 and 2/4 were occurring right in the middle of the stock market run-up. Weird.

I'm not ready to say that the Chinese government's stimulus operation has been a failure. They've seemingly had their backs to the wall several times before over the past 20 years, and they always seem to boost the economy back into growth. However, I also know that pattern can't last forever, and they are now dealing with small-player, local shadow banking leverage on a huge aggregated scale that they've never dealt with before. So can the Chinese government bailout the industrial and real estate sectors once again? Maybe, we'll have to see some positive inflation and money growth numbers before we'll know if that's happening.

Posted on 2/17/19 at 1:07 pm to Doc Fenton

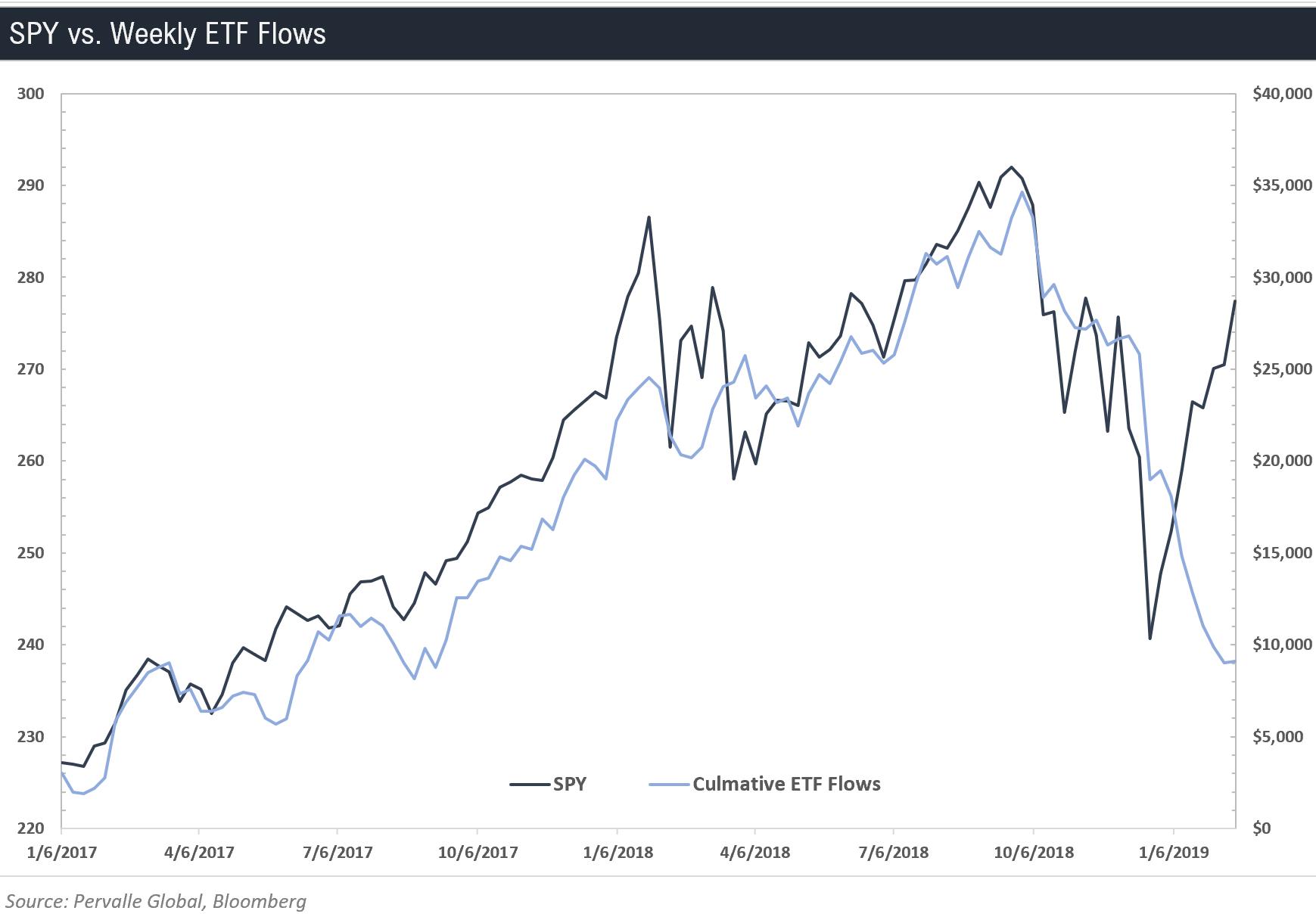

Meanwhile in the U.S. markets...

Popular

Back to top

2

2