- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Artificially inflated credit scores are starting to drop nationwide

Posted on 5/26/25 at 9:21 pm to white perch

Posted on 5/26/25 at 9:21 pm to white perch

Mine was 830 and then dropped to 790 last month.

I only have one credit card I pay off monthly and no debt. I haven't owed a loan in several years so my credit score balance swings wildly based on how much I spend that month and what I order because it's the only open account I've had in years. It's reallstrange how volatile it can be. We did spend a lot last month on booking vacation plans and I bought some more woodworking tools.

I never had student loans, didn't go to college but I pay my debts and I believe others should as well.

I only have one credit card I pay off monthly and no debt. I haven't owed a loan in several years so my credit score balance swings wildly based on how much I spend that month and what I order because it's the only open account I've had in years. It's reallstrange how volatile it can be. We did spend a lot last month on booking vacation plans and I bought some more woodworking tools.

I never had student loans, didn't go to college but I pay my debts and I believe others should as well.

This post was edited on 5/26/25 at 9:23 pm

Posted on 5/26/25 at 9:37 pm to El Segundo Guy

Cause your credit score is not how good you are about paying your debts , it’s about how well you play Kissyface with the banks. Remember your credit score is managed by companies who are owned by the banks therefore, the banks wanna know how much interest they can safely make off of you.

I’m in Your boat as well. 790. Why? No debt . I own my car. I own my own home. Banks don’t like me all that much.

Eta: I will say it’s crazy to borrow money and think you don’t have to pay it back.

I’m in Your boat as well. 790. Why? No debt . I own my car. I own my own home. Banks don’t like me all that much.

Eta: I will say it’s crazy to borrow money and think you don’t have to pay it back.

This post was edited on 5/26/25 at 9:38 pm

Posted on 5/26/25 at 9:43 pm to FCP

quote:

My 825 scoffs at your pedestrian score.

I have a 824. It's sort of a BS system though. My dad has a lower score than me and could pay cash for my house and just rent it out. He just hasn't used credit and has had no reason to take on debt for a long time. He's in a stronger financial position than me.

Posted on 5/26/25 at 9:46 pm to Smeg

This has to be a parody. If this is really where the left is at, then they are way more lost than I thought they were.

Posted on 5/26/25 at 9:50 pm to deeprig9

Mine fluctuates between 828 and 842 depending on my credit card spending. It actually drops when I have a $0 balance.

Posted on 5/26/25 at 9:51 pm to Smeg

I demand we deport her and everyone who thinks like her. Treasonous scum forfeit citizenship.

Posted on 5/26/25 at 10:04 pm to HailHailtoMichigan!

A good part of the problem was the successful framing of the language as "student loan forgiveness".

That's a lie. It isn't forgiven. The debt is transferred to everyone else. Which is ultimately evil.

Because you are transferring debts from people who chose to assume debt so they could get an education. It is evil when the debt is being shouldered by other people who didn't have the choice and often did not have the opportunity to go to college.

Editing for clarity

That's a lie. It isn't forgiven. The debt is transferred to everyone else. Which is ultimately evil.

Because you are transferring debts from people who chose to assume debt so they could get an education. It is evil when the debt is being shouldered by other people who didn't have the choice and often did not have the opportunity to go to college.

Editing for clarity

This post was edited on 5/26/25 at 10:39 pm

Posted on 5/27/25 at 5:27 am to HailHailtoMichigan!

I don’t see this as a bad thing.

I’m not in the market for financing any big purchases but I shouldn’t have an issue if I needed to. I do put my monthly expenses on a points earning card and pay it to 0 every month. My credit score is well over 840 but also slightly lower when that card is paid to 0 if you can believe it.

People that default on loans should not have as easy access to financing. They are higher risk. Banks should be compensated for that risk rather than spreading that cost across everyone.

I’m not in the market for financing any big purchases but I shouldn’t have an issue if I needed to. I do put my monthly expenses on a points earning card and pay it to 0 every month. My credit score is well over 840 but also slightly lower when that card is paid to 0 if you can believe it.

People that default on loans should not have as easy access to financing. They are higher risk. Banks should be compensated for that risk rather than spreading that cost across everyone.

Posted on 5/27/25 at 5:40 am to Smeg

We used to say “” they never paid attention much less a bill” , now that would somehow be racist even though it refers to applications not applicants.

Posted on 5/27/25 at 5:56 am to FCP

Your parents score is lower because everything is paid off in full. No revolving credit. Something as simple as monthly gas on a credit card will raise it those 10 points usually.

Posted on 5/27/25 at 6:13 am to Skeeterzx190

quote:

Your parents score is lower because everything is paid off in full. No revolving credit. Something as simple as monthly gas on a credit card will raise it those 10 points usually.

I know Dave Ramsey gets a lot of flack, but him calling credit scores “I Love Debt” scores was on the money.

Posted on 5/27/25 at 6:25 am to Bard

quote:

It's a necessary thing, whether good or bad is in the eye of the beholder.

As a former lender the standard for the entire debt industry has been 3-3.5% delinquency rate or you are not maxing out your profit by cutting opportunities. Over 3.5% and you are spending more to collect cutting profits.

Posted on 5/27/25 at 6:37 am to Lake Vegas Tiger

This is gonna be a thread

Posted on 5/27/25 at 6:40 am to HailHailtoMichigan!

quote:

It’s concerning to me that more than 2 million people with student loans were expecting the pause to permanent

Federally backed, non-dischargeable student loans were the west thing to happen to higher education.

Posted on 5/27/25 at 6:47 am to frequent flyer

quote:

put my monthly expenses on a points earning card and pay it to 0 every month. My credit score is well over 840 but also slightly lower when that card is paid to 0 if you can believe it.

Increase your available revolving to above 100k. You'll stop seeing a score dip when you hit zero.

Posted on 5/27/25 at 6:50 am to Smeg

This white lib retard makes me sick

Posted on 5/27/25 at 6:50 am to Froman

quote:

quote:

Article presents it as a bad thing

It’s not a good thing.

Short term (6-12 months) its not good. It's another indication of the structural (and, yes, painful) change this country needs.

Posted on 5/27/25 at 6:51 am to Smeg

The internet and social media has rotted people's brains. These people are so desperate to go viral they will make complete asses of themselves in hopes that a sizable portion of people will like and comment on their nonsense.

I guess it's better than shooting up elementary schools for attention though, so theres a plus.

I guess it's better than shooting up elementary schools for attention though, so theres a plus.

Posted on 5/27/25 at 6:51 am to fallguy_1978

quote:

I have a 824. It's sort of a BS system though. My dad has a lower score than me and could pay cash for my house and just rent it out. He just hasn't used credit and has had no reason to take on debt for a long time. He's in a stronger financial position than me.

Dave calls it an “I love debt score” — and in many ways, I think he’s right. I know his approach isn’t for everyone, but I can say that my credit score was built by taking on debt and demonstrating my ability to repay it.

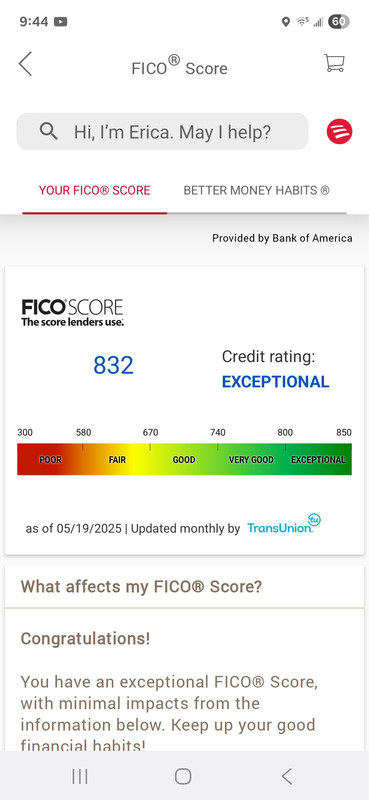

This score is mine. I haven’t changed anything in my financial habits between hitting 850 and dropping to 810 — it just fluctuates. From what I understand, anything above 750 (or maybe it’s 780?) doesn’t really offer any additional benefits when it comes to borrowing.

Popular

Back to top

3

3