- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: What Is There To Be Bullish About?

Posted on 8/15/22 at 9:14 am to SouthMSReb

Posted on 8/15/22 at 9:14 am to SouthMSReb

Sad how some of y’all have been so brainwashed by the boomers. They only invented the stock market to get out of paying millenials pensions

Also they sent all the fun, fulfilling jobs like working at the factory or the coal mine to Mexico when they voted for nafta

Also they sent all the fun, fulfilling jobs like working at the factory or the coal mine to Mexico when they voted for nafta

Posted on 8/15/22 at 9:18 am to Decisions

I think the real downturn starts sometime early next year.

This post was edited on 8/15/22 at 9:19 am

Posted on 8/15/22 at 9:29 am to I Love Bama

Analysts of major funds trying the support the various companies' long positions...

Posted on 8/15/22 at 9:46 am to I Love Bama

quote:

This is the most obvious time in my life to be bearish but I want to know why the bulls are bulls.

Buy signal

Posted on 8/15/22 at 9:51 am to JohnnyKilroy

quote:

Buy signal

Go all-in my guy.

Posted on 8/15/22 at 9:55 am to I Love Bama

quote:

Go all-in my guy.

I am.

Posted on 8/15/22 at 10:40 am to boomtown143

quote:

I think the real downturn starts sometime early next year.

I don't know if that's a pessimistic attitude or an optimistic one.

I think we're starting to see glimmers of the real downturn.

Homebuilders say U.S. is in a ‘housing recession’ as sentiment turns negative

quote:

The National Association of Home Builders/Wells Fargo Housing Market Index dropped 6 points to 49 this month, its eighth straight monthly decline. Anything above 50 is considered positive. The index has not been in negative territory since a very brief plunge at the start of the Covid pandemic. Before that, it hadn’t been negative since June 2014.

“Tighter monetary policy from the Federal Reserve and persistently elevated construction costs have brought on a housing recession,” said NAHB Chief Economist Robert Dietz.

Of the index’s three components, current sales conditions dropped 7 points to 57, sales expectations in the next six months fell 2 points to 47 and buyer traffic fell 5 points to 32.

quote:

The biggest hurdle for buyers right now is affordability. Home prices have been climbing since the start of the pandemic, and the average rate on the 30-year fixed mortgage, which had hit historic lows in the first part of the pandemic, is nearly twice what it was at the start of this year. Home price growth has cooled somewhat in recent weeks, while mortgage rates have come down from highs.

“The total volume of single-family starts will post a decline in 2022, the first such decrease since 2011. However, as signs grow that the rate of inflation is near peaking, long-term interest rates have stabilized, which will provide some stability for the demand-side of the market in the coming months,” Dietz said.

To add to this a little: New Home Starts

quote:

Housing starts in the US dropped 2% month-over-month to an annualized rate of 1.559 million units in June of 2022, the lowest since September last year. Figures were also lower than forecasts of 1.58 million but follow an upwardly revised 1.591 million rate in May. The housing sector has been cooling amid soaring prices and mortgage rates. Single-family housing starts sank 8.1% to 982,000 while starts for units in buildings with five units or more was 568,000. Starts were lower in the South (-4.8% to 825,000) and the Midwest (-7.7% to 215,000) but rose in the Northeast (10.6% to 156,000) and the West (3.7% to 363,000)

New home starts have been plummeting since April, expect July to be even lower.

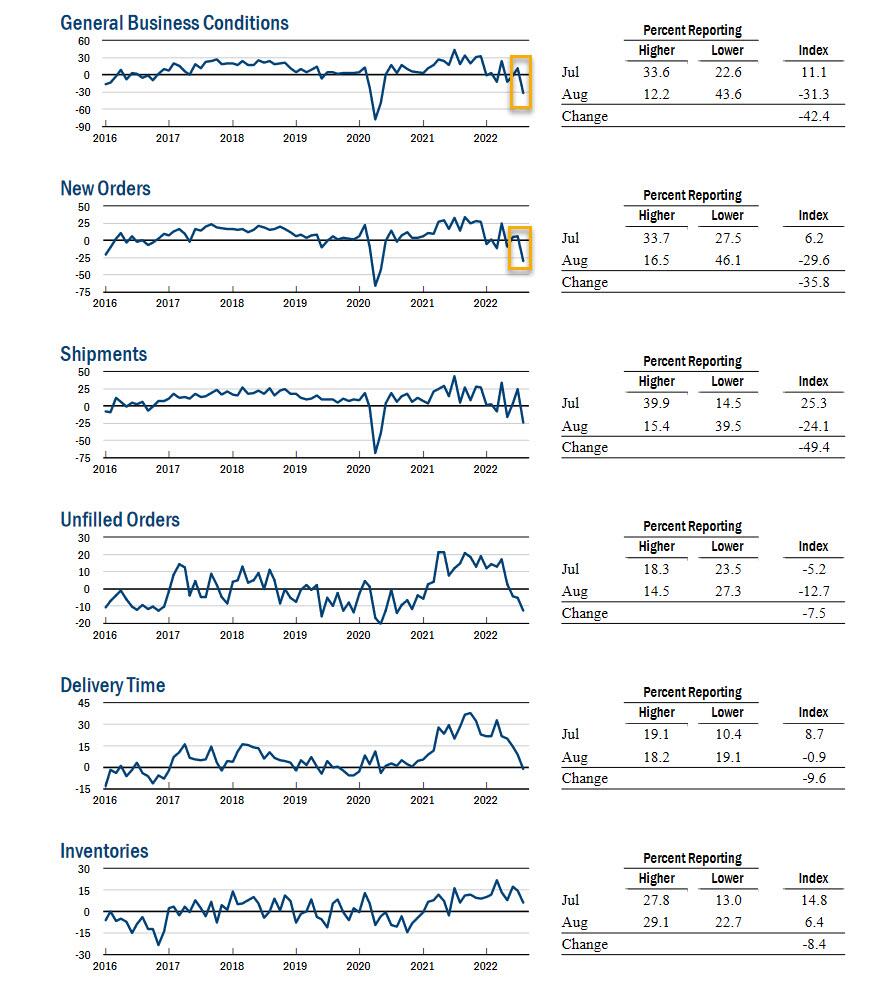

Recession Back On: NY Fed Manufacturing Unexpectedly Craters In 2nd Biggest Drop On Record

quote:

The big miss of the month's first regional manufacturing survey was driven by a decline across all indicators, but especially by a sharp drop in the forward looking New Orders which tanked to -29.6 from +6.2, while the shipments index plummeted nearly fifty points to -24.1, indicating a sharp decline in both orders and shipments, and strongly hinting that a hard-landing recession is inevitable and that, for all the posturing, a Fed rate cut is imminent after all.

We'll likely see a similar trend across most of the country as more numbers come out.

Let's sum this all up:

-High (and increasing) levels of consumer debt

-Sustained high inflation

-Sustained high fuel prices

-Wage growth being constantly far outpaced by inflation

-High (and likely increasing) energy prices (especially with the extra energy costs in the Inflation Reduction Act)

-Declining home sales and new home starts

-Declining manufacturing across the board

-Rising vehicle repossessions

-Rising foreclosure rates

You simply can't have these sorts of numbers if you believe you're moving into a period of economic upswing or even flat economic activity. Our economic winter is coming.

Posted on 8/15/22 at 12:34 pm to I Love Bama

quote:

What Is There To Be Bullish About?

I know this is a Money Board topic but my knowledge there is limited. I do however have something to be very bullish about, virtual reality porn. I don't know where the investment opportunities are as I'm not super stoked about Meta but it's whole new world out there once you get a VR headset.

This post was edited on 8/15/22 at 12:50 pm

Posted on 8/15/22 at 2:11 pm to I Love Bama

Eventually the economy will deteriorate enough that the fed will have to pivot from raising rates.

That’s all I got…

That’s all I got…

Posted on 8/15/22 at 2:14 pm to I Love Bama

One big thing is the 10 year at 2.79%. If that is anchored correctly, the S&P should be at 20-25x earnings. If the S&P is at 20x earnings that is right at S&P 5000, which is very bullish from current S&P 4300. The 10-year has to move to 4-5% for support that this market will go bearish.

Inflation is weakening and expansion is softening (look at Europe and China), so this makes the Feds job easier and they can stop raising by Jan 2023. That also helps with liquidity. The market is going vertical when the fed pivots from raising rates to not moving up more, which appears to be setting up sooner than most expected.

Things you mentioned are already priced in and Investors were positioned for far worse data. See the recent big outflows from TIPS and inflows to tech as an example. Markets bottom in bad news, so when markets are rallying on bad news, which has happened for the last six weeks, you have to think the market has bottomed.

Economy is going to weaken, but that will not impact the market. The economy was going gangbusters from November-May and the market had massive retracement. Weakening economy continues to mean lower energy prices due to demand, which will also offset inflation.

Inflation is weakening and expansion is softening (look at Europe and China), so this makes the Feds job easier and they can stop raising by Jan 2023. That also helps with liquidity. The market is going vertical when the fed pivots from raising rates to not moving up more, which appears to be setting up sooner than most expected.

Things you mentioned are already priced in and Investors were positioned for far worse data. See the recent big outflows from TIPS and inflows to tech as an example. Markets bottom in bad news, so when markets are rallying on bad news, which has happened for the last six weeks, you have to think the market has bottomed.

Economy is going to weaken, but that will not impact the market. The economy was going gangbusters from November-May and the market had massive retracement. Weakening economy continues to mean lower energy prices due to demand, which will also offset inflation.

This post was edited on 8/15/22 at 10:59 pm

Posted on 8/15/22 at 2:32 pm to I Love Bama

quote:

I see a lot of guys here continuing to dump into the market right now and I am curious what your reasoning is?

ASTS, DKNG, OWLT

Over the last two weeks. WOW

ASTS has a launch in sept. If successful this stock will explode.

DKNG has scaled back a major expense, Advertising and it is recession proof.

OWLT IDK but It is moving up in spite of poor earnings.

This post was edited on 8/15/22 at 2:37 pm

Posted on 8/15/22 at 2:51 pm to I Love Bama

Fake rally. Don't believe it.

Posted on 8/15/22 at 4:24 pm to I Love Bama

If you’re feeling this negative, you should be buying because better days must be ahead.

We have about the best capital structure in the planet

Posted on 8/15/22 at 5:52 pm to I Love Bama

quote:

This is the most obvious time in my life to be bearish

Wow, the most obvious in your life? What time period does that cover? Purely and seriously curious. Just asking.

Whether trading or investing, what strategies are you utilizing to take advantage of your bear thesis? Buying puts, shorting SPY, at least selling calls, etc.? Again, serious question. Not baiting. You seem to have real conviction.

Posted on 8/15/22 at 6:26 pm to Decisions

Did you know that every bull market started with a bear market rally?

Posted on 8/15/22 at 8:48 pm to wutangfinancial

quote:

You're actually not an investor. You're a systematic momentum trader given what your chart implies. "Stocks go up" so buy is not an investment. Hopefully you insure yourself with that much long exposure.

Every time I post on this board I am reminded why I don't post more often. I mean, I don't even know where to start with this kind of response.

Maybe with...how do you define "investor"?

You know far less about my situation than you think you do.

Posted on 8/15/22 at 8:49 pm to slackster

And every bear market has vicious rallies.

Posted on 8/15/22 at 9:16 pm to skewbs

quote:

The media (and I mean that by literally anything you watch or read, regardless of the source) wants you to believe things are MUCH worse than they actually are. Once you understand that you can then invest accordingly.

I agree with this. Back in the day there'd be recessions and the average man on the street wouldn't even be aware of it. 24-7 news cycle at some point figured out that "recession" and "inflation" and interviewing people at the gas pumps who swear they'll be in the poor house if gas goes up another 50 cents draws eye balls and get ratings.

This post was edited on 8/15/22 at 9:16 pm

Posted on 8/15/22 at 9:19 pm to I Love Bama

quote:

I see a lot of guys here continuing to dump into the market right now and I am curious what your reasoning is?

Is it just "can't time the market" "it goes up over time"?

The bear case seems much more logical.

1. Euro energy crisis (this will go off the rails in the winter)

2. China is having their 2008 real estate crash.

3. Record leverage in the lower and middle class of USA

4. Taiwan/Ukraine

5. Inflation

This is the most obvious time in my life to be bearish but I want to know why the bulls are bulls.

It's pretty obvious what sort of echo chamber you choose to be in. If you took your political leanings and political sentiments out of the equation, would you still feel the same?

Posted on 8/15/22 at 9:51 pm to Bard

quote:

Bard

I’ve seen you make some great points in several threads recently, with adequate detail and support for those points. Your fatal flaw is that the market DOES NOT equal the economy. You’ve got to learn that my dude.

Popular

Back to top

0

0