- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

What Is There To Be Bullish About?

Posted on 8/15/22 at 5:34 am

Posted on 8/15/22 at 5:34 am

I see a lot of guys here continuing to dump into the market right now and I am curious what your reasoning is?

Is it just "can't time the market" "it goes up over time"?

The bear case seems much more logical.

1. Euro energy crisis (this will go off the rails in the winter)

2. China is having their 2008 real estate crash.

3. Record leverage in the lower and middle class of USA

4. Taiwan/Ukraine

5. Inflation

This is the most obvious time in my life to be bearish but I want to know why the bulls are bulls.

Is it just "can't time the market" "it goes up over time"?

The bear case seems much more logical.

1. Euro energy crisis (this will go off the rails in the winter)

2. China is having their 2008 real estate crash.

3. Record leverage in the lower and middle class of USA

4. Taiwan/Ukraine

5. Inflation

This is the most obvious time in my life to be bearish but I want to know why the bulls are bulls.

Posted on 8/15/22 at 5:36 am to I Love Bama

not much really. Think the theory of this "bull" run is inflation has already "peaked".

This post was edited on 8/15/22 at 5:37 am

Posted on 8/15/22 at 5:56 am to I Love Bama

I'm just buying large cap dividend payers with a solid balance sheet and reinvesting it. If/when they go down I'll average down. I think most of them will be higher in 5-10 years. I don't really care where they are in 6 months.

Posted on 8/15/22 at 6:38 am to fallguy_1978

quote:

I'm just buying large cap dividend payers with a solid balance sheet and reinvesting it. If/when they go down I'll average down. I think most of them will be higher in 5-10 years. I don't really care where they are in 6 months.

This is a statement that you bears have missed ever since the Covid drop in 2020 and what that drop brought with it.Thousands and thousands of new investors with billions of new money invested into the market with this same concept stated above and the Apps to apply it. These aren't just college students they are professionals with 401ks and great paying jobs. I have been in since 2018 and have seen the spike after Covid.

These folks are buying the dip with their new fidelity/brokerage accounts and hoping that 5 to 10 years from now they made the right choice with history providing the evidence it will. This is why the John Deer's , Microsoft's, Dividend payers aren't crashing people are buying these expecting them to be stable for 5 or 10 years from now not a year or two or however long this recession last. Not saying the market can't crash but it would take a catastrophic event like USA/Russia/China War to do it. The game has changed after covid and pointing to a chart from 1929 to 2008 is not going to change that.

Posted on 8/15/22 at 7:00 am to FLObserver

What if all the bad news you cited is already priced in?

Posted on 8/15/22 at 7:00 am to I Love Bama

quote:

Is it just "can't time the market" "it goes up over time"?

Yep.

quote:

The bear case seems much more logical.

Good luck.

Posted on 8/15/22 at 7:35 am to FLObserver

I'm definitely buying fewer speculative stocks in this market than during times when everything is running but I'm still putting money to work. Cash is a dog.

Posted on 8/15/22 at 7:54 am to I Love Bama

The media (and I mean that by literally anything you watch or read, regardless of the source) wants you to believe things are MUCH worse than they actually are. Once you understand that you can then invest accordingly.

Posted on 8/15/22 at 7:57 am to I Love Bama

quote:

This is the most obvious time in my life to be bearish

quote:

why the bulls are bulls.

You pretty much figured it out.

Posted on 8/15/22 at 7:59 am to FLObserver

quote:

Thousands and thousands of new investors with billions of new money invested into the market

And what about the Boomers exiting stage left? They have all the money, not the “new” investors.

quote:

Spike after Covid

Created by Fed and US gov. stimulus not “new investors.”

“Post Covid” has looked like one huge pump and dump scheme so far. Volume tells us as much.

Posted on 8/15/22 at 8:08 am to I Love Bama

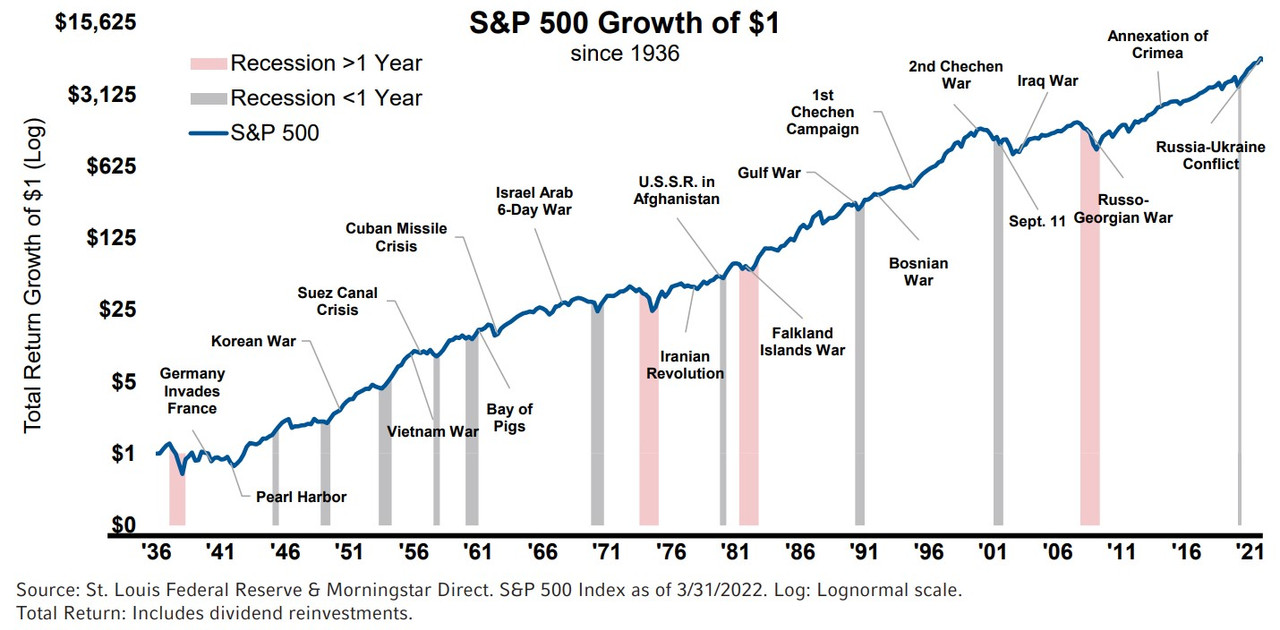

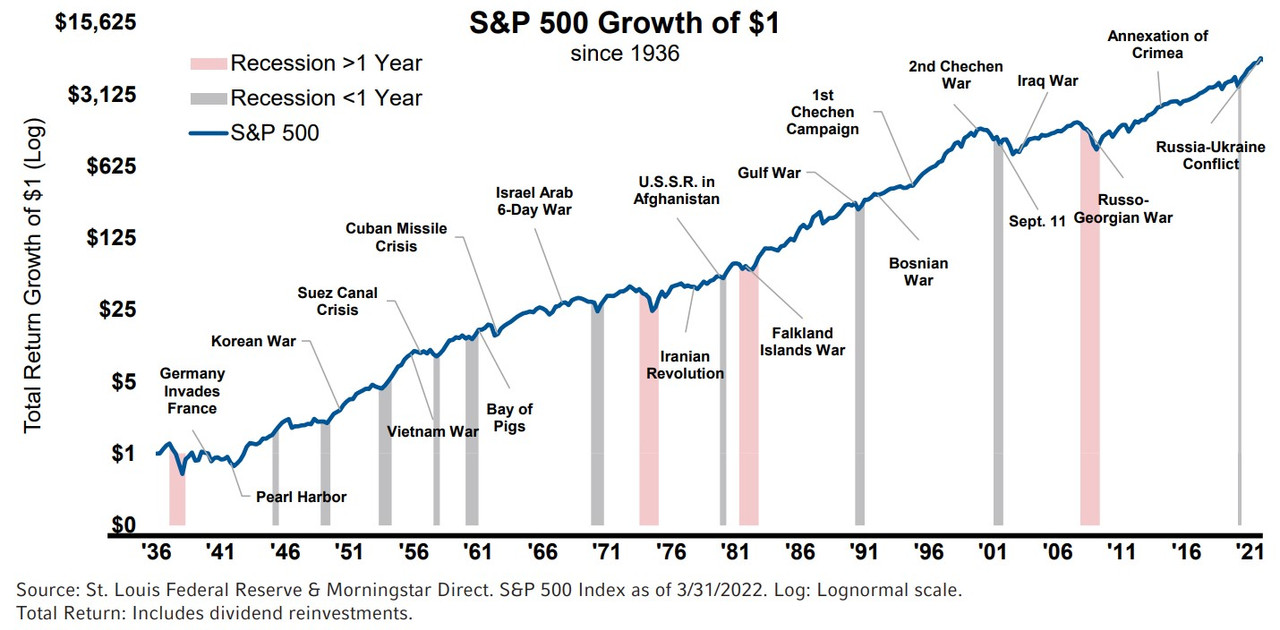

At any given time you can always point to all of the crisis around the globe and choose to be scared.

Or you can just look at the stock market over time and see that it goes up with dips here and there. As long as you're expecting returns over 5-10 years, you'll be fine.

Or you can just look at the stock market over time and see that it goes up with dips here and there. As long as you're expecting returns over 5-10 years, you'll be fine.

Posted on 8/15/22 at 8:15 am to SouthMSReb

Can the Fed create ENOUGH “new money” to keep propping or will the unintended consequences kill everyone’s cost of living?

Posted on 8/15/22 at 8:15 am to I Love Bama

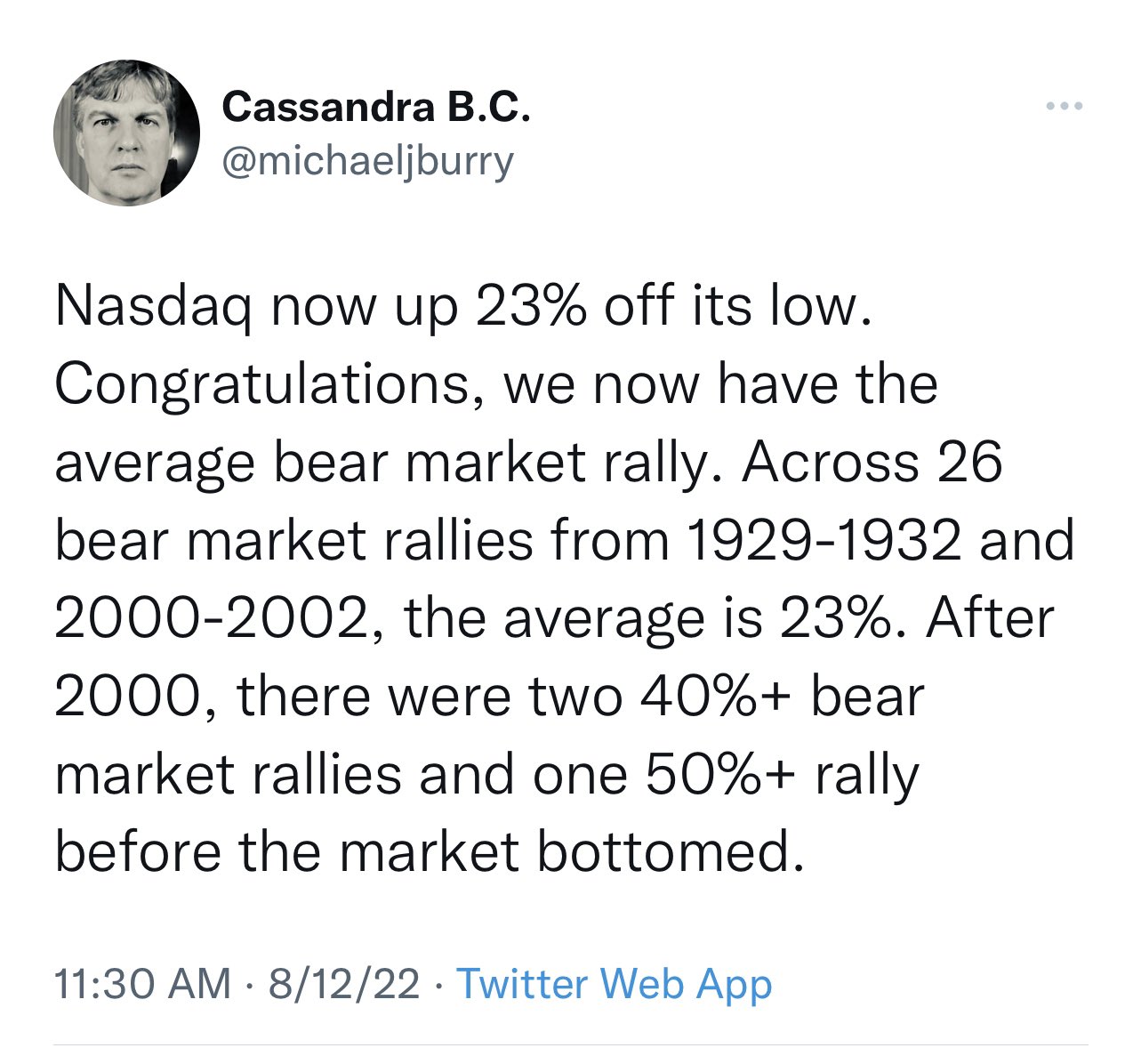

It’s a classic bear market rally. They always sucker in a fair bit of new, dumb money.

Posted on 8/15/22 at 8:21 am to Decisions

quote:

It’s a classic bear market rally. They always sucker in a fair bit of new, dumb money.

I mean it's so obvious... Lol. Please tell us more.

Posted on 8/15/22 at 8:24 am to I Love Bama

Because I'm a long-term investor:

Posted on 8/15/22 at 8:31 am to Niner

6-8 figure boomer cash outs

1-5k Robinhood acct. “new money.”

I wonder which of these will create the trend…..

/sarc

1-5k Robinhood acct. “new money.”

I wonder which of these will create the trend…..

/sarc

Posted on 8/15/22 at 8:31 am to I Love Bama

The market expects about another 1% interest rate increase and then the fed to start cutting in the second half of ‘23. I think this expectation, along with the stock market rally over the last 4 weeks, implies the market is pricing in a very mild recession and a smooth landing on inflation. This is plausible, but I don’t think it’s likely. I think there’s a better chance the fed raises another 2-3% and keeps them there through most of ‘23, and the market will have to adjust down once it realizes this if this is in fact where we are heading.

Posted on 8/15/22 at 8:48 am to UltimaParadox

quote:

Please tell us more.

Everything you listed plus a new bull market in commodities across the board plus continued supply chain issues while manufacturing is relocated from China is going to be a major drag on company earnings and efficiencies for the foreseeable future.

Also:

Do with that what you will.

Posted on 8/15/22 at 8:57 am to Niner

quote:

Because I'm a long-term investor:

You're actually not an investor. You're a systematic momentum trader given what your chart implies. "Stocks go up" so buy is not an investment. Hopefully you insure yourself with that much long exposure.

Posted on 8/15/22 at 9:09 am to I Love Bama

4. We live in a banana republic except the chicks are fat instead of starving

Popular

Back to top

32

32