- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

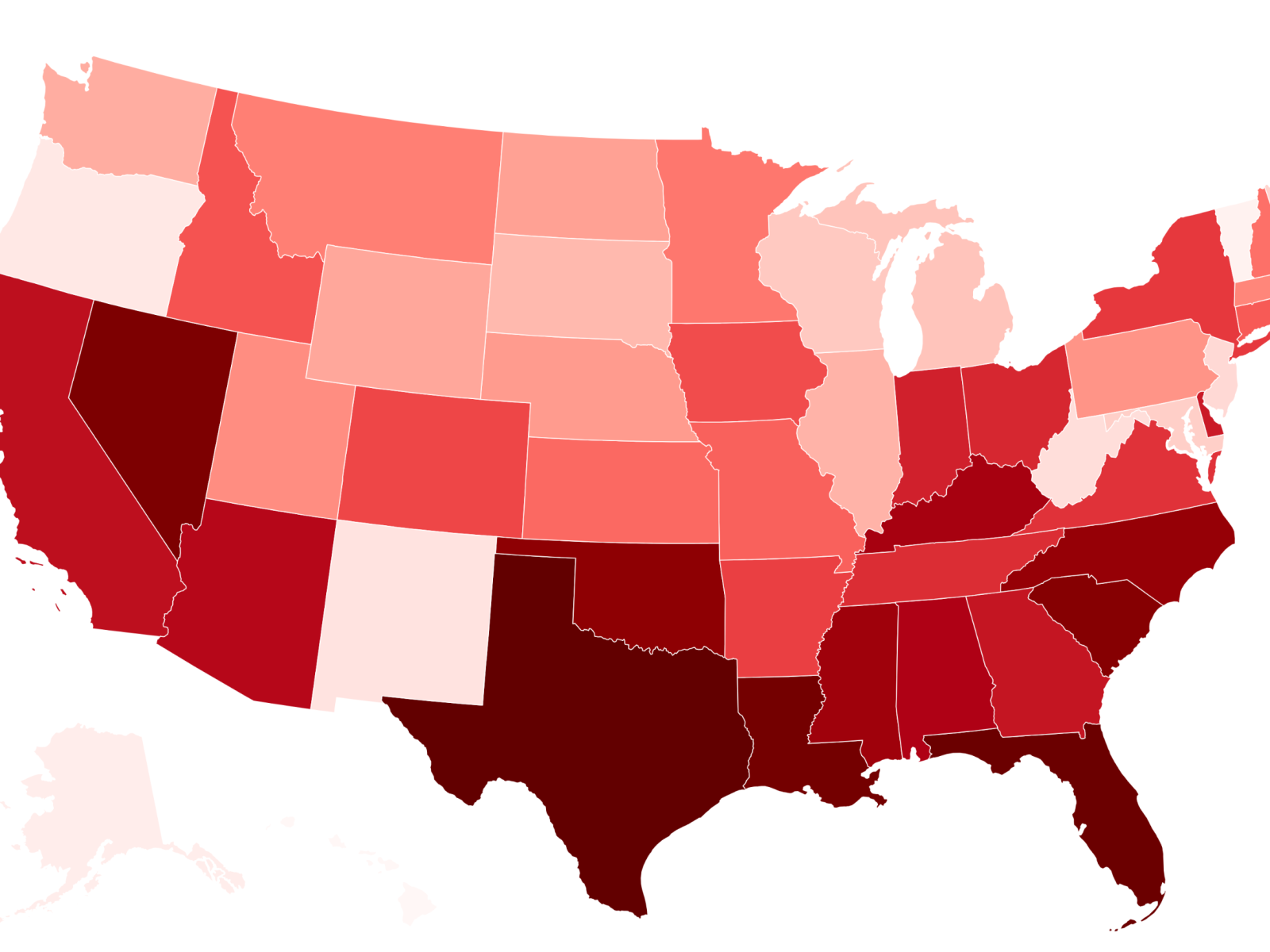

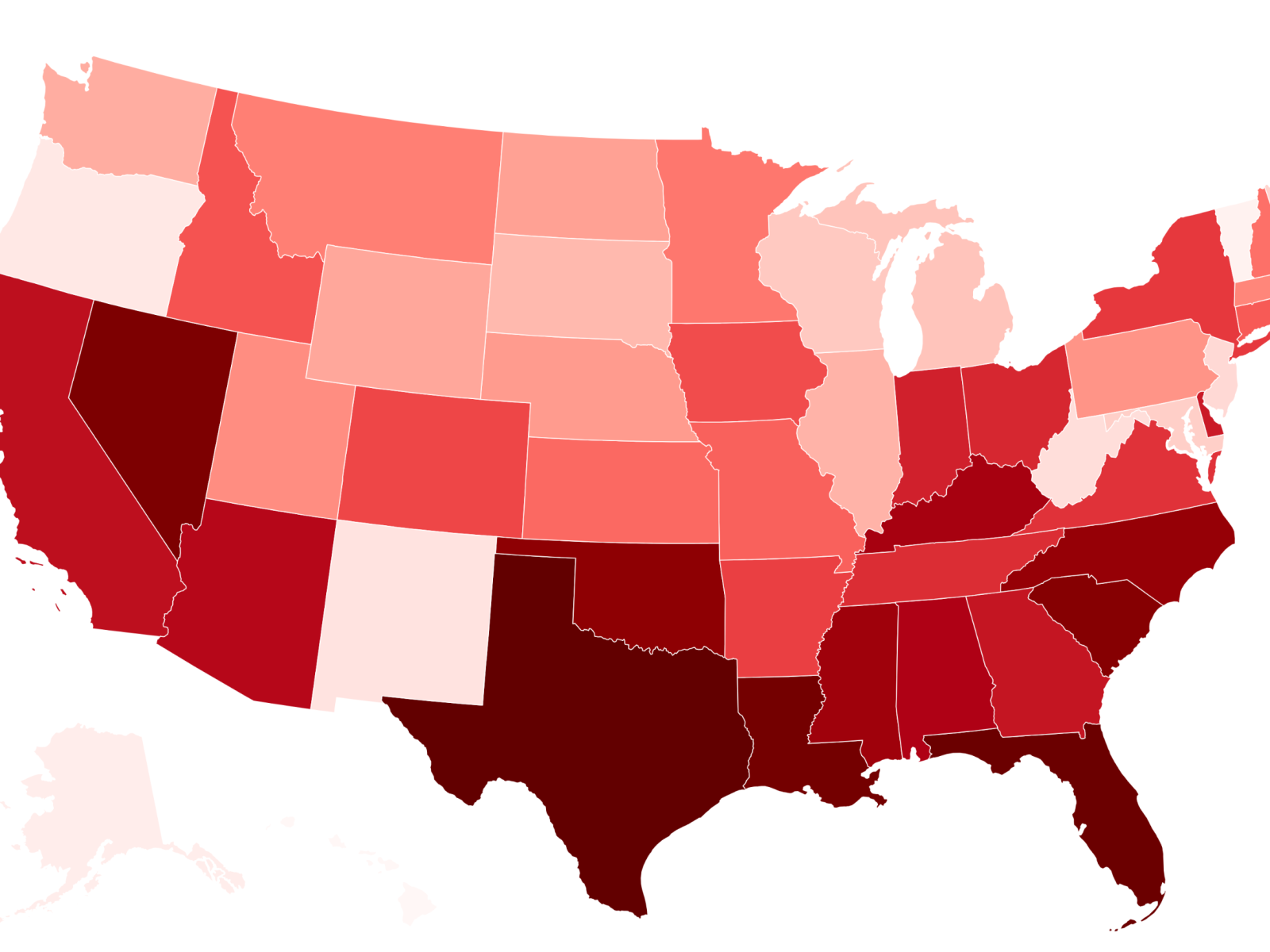

Texas #1 financially distressed US state, followed by Florida, and Louisiana

Posted on 8/21/25 at 11:23 am

Posted on 8/21/25 at 11:23 am

quote:

“Around 11.8% of Louisianians also have a credit account in forbearance or with deferred payments, the highest share in the country,” according to WalletHub.

https://wallethub.com/edu/states-with-the-most-people-in-financial-distress/130790

quote:

With prices rising on everything from groceries to rent amid a backdrop of economic uncertainty, many Americans are struggling to pay the bills.

They’re even turning to credit to pay for essentials. A recent LendingTree survey found that one-quarter (25%) of buy-now-pay-later users have used these loans to buy groceries.

quote:

But some states are struggling more than others. Florida is now one of the most financially stressed states in the country, second only to another Southern state, according to a new report by WalletHub, which defines financial distress as having credit in forbearance or deferring payments due to financial difficulty.

“When you combine data about people delaying payments with other metrics like bankruptcy filings and credit score changes, it paints a good picture of the overall economic trends of a state,” WalletHub analyst Chip Lupo said about the findings.

Here are the five states struggling the most and why people there are having such a tough time.

The top 5 financially distressed states

Texas is the most financially distressed state in the country, followed by Florida, Louisiana, Nevada and South Carolina. The states that are best off? That honor goes to Hawaii, followed by Vermont, Alaska, Oregon and New Mexico.

quote:

To determine their ranking, WalletHub compared all 50 states across nine key metrics in six categories, calculating an overall score by weighting the average across all metrics. For example, the ‘credit score’ category is determined by two key metrics: the average credit score as of March earned double weight, while the change in credit score from March 2024 to March 2025 earned full weight.

quote:

Once all the numbers were crunched, Texas came out on top — and, in this case, No. 1 means the most distressed or worst off — even though the state has a larger GDP than most countries (ranking ninth on the world stage). And it still has one of the top 10 economies in the U.S.

Texans search Google for ‘debt’ and ‘loans’ at a high rate, “which shows that many people are desperate to borrow, despite already owing money,” says the WalletHub report. They also ranked sixth in the change in number of bankruptcy filings from March 2024 to March 2025, with non-business bankruptcy filings increasing more than 22% in the past year.

This post was edited on 8/21/25 at 12:11 pm

Posted on 8/21/25 at 11:26 am to Shexter

quote:the Dallas thirty-thousand-ionaire has been a thing for a long time

Texans search Google for ‘debt’ and ‘loans’ at a high rate, “which shows that many people are desperate to borrow, despite already owing money,” says the WalletHub report. They also ranked sixth in the change in number of bankruptcy filings from March 2024 to March 2025, with non-business bankruptcy filings increasing more than 22% in the past year.

Posted on 8/21/25 at 11:26 am to Shexter

Totally worth the financial hit to have a Denali Unlimited

Posted on 8/21/25 at 11:27 am to Shexter

This fails the basic sniff test. Hawaii is insanely expensive, and locals are having massive issues attempting to purchase housing and paying rent.

Posted on 8/21/25 at 11:27 am to Shexter

quote:

one-quarter (25%) of buy-now-pay-later users have used these loans to buy groceries.

Posted on 8/21/25 at 11:30 am to wileyjones

Holy shite that's real. On what planet is paying a credit company over time for Door Dashes not nuked from the solar system.

Posted on 8/21/25 at 11:33 am to Jcorye1

quote:

Holy shite that's real. On what planet is paying a credit company over time for Door Dashes not nuked from the solar system.

Hey buddy! Don't tell me you haven't always wanted to finance an Outback steak and bloomin onion

Posted on 8/21/25 at 11:34 am to Shexter

I am in one of those states.

I am looking out over a parking lot. Worst car in lot is mine, a mid sized Japanese brand. More Land Rovers, Mercedes, BMWs than can count and even 1 Ferrari. Mostly made up of late 20 to early 40 yo’s. Lots loving the beautiful people life or so it appears.

Inflation is real. I paid for a single Subway meal deal for $17 this week. Cooked own lunch ever since.

Statistically speaking, and I strongly suspect this to be true here, I have more wealth than 95% of these folks. Maybe more.

Many of same folks are at Ruth’s Chris for dinner.

Inflation is real for all and can see distress in that for many for sure. However, I also see chit load of self induced distress, too. Flashy shiny people taxing themselves.

I am looking out over a parking lot. Worst car in lot is mine, a mid sized Japanese brand. More Land Rovers, Mercedes, BMWs than can count and even 1 Ferrari. Mostly made up of late 20 to early 40 yo’s. Lots loving the beautiful people life or so it appears.

Inflation is real. I paid for a single Subway meal deal for $17 this week. Cooked own lunch ever since.

Statistically speaking, and I strongly suspect this to be true here, I have more wealth than 95% of these folks. Maybe more.

Many of same folks are at Ruth’s Chris for dinner.

Inflation is real for all and can see distress in that for many for sure. However, I also see chit load of self induced distress, too. Flashy shiny people taxing themselves.

This post was edited on 8/21/25 at 11:35 am

Posted on 8/21/25 at 11:35 am to Jcorye1

quote:

This fails the basic sniff test. Hawaii is insanely expensive, and locals are having massive issues attempting to purchase housing and paying rent.

It’s Marxist propaganda readily consumed by the progressive masses. Wishcasting.

Posted on 8/21/25 at 11:36 am to Shexter

quote:

The states that are best off? That honor goes to Hawaii, followed by Vermont, Alaska, Oregon and New Mexico.

Posted on 8/21/25 at 11:45 am to SuperSaint

quote:

the Dallas thirty-thousand-ionaire has been a thing for a long time

Every time I’m about to be out of debt I go and get myself into double or triple the debt.

I just can’t make good financial decisions

I’m way worse than my wife.

Posted on 8/21/25 at 11:47 am to Jcorye1

quote:

On what planet is paying a credit company over time for Door Dashes not nuked from the solar system.

I think Klarna is having problem now because of too many defunct accounts and they just released big losses in their annual report.

Posted on 8/21/25 at 11:51 am to Shexter

I wonder how this map would compare to an average demographics or voter turnout map.

Posted on 8/21/25 at 11:56 am to SuperSaint

What’s the inflation adjusted version of this as 30k is nothing now

Posted on 8/21/25 at 11:57 am to Artificial Ignorance

quote:

I am in one of those states.

I’m going to guess it’s not Louisiana.

Posted on 8/21/25 at 11:58 am to forkedintheroad

quote:

I wonder how this map would compare to an average demographics or voter turnout map.

Posted on 8/21/25 at 12:04 pm to Shexter

i would have thought california would have been number 1 with how high the cost of living is

Posted on 8/21/25 at 12:08 pm to Shexter

It kind of bothers me how your headline didn't say "Texas 1st most financially distressed US state, followed by Florida, and Louisiana"

Posted on 8/21/25 at 12:08 pm to Shexter

Interest on debt is racist to undocumented hard workers and minorites. They weren't raised with the privilege of understanding finance.

Posted on 8/21/25 at 12:22 pm to Oilfieldbiology

quote:

The states that are best off? That honor goes to Hawaii, followed by Vermont, Alaska, Oregon and New Mexico.

This is the part of the article where the magic happens. What does the “best off” group have in common? The last remnant of the country where there any groups that still pursue subsistence lifestyles.

From each according to his ability, to each according to his need.

Back to top

28

28