- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

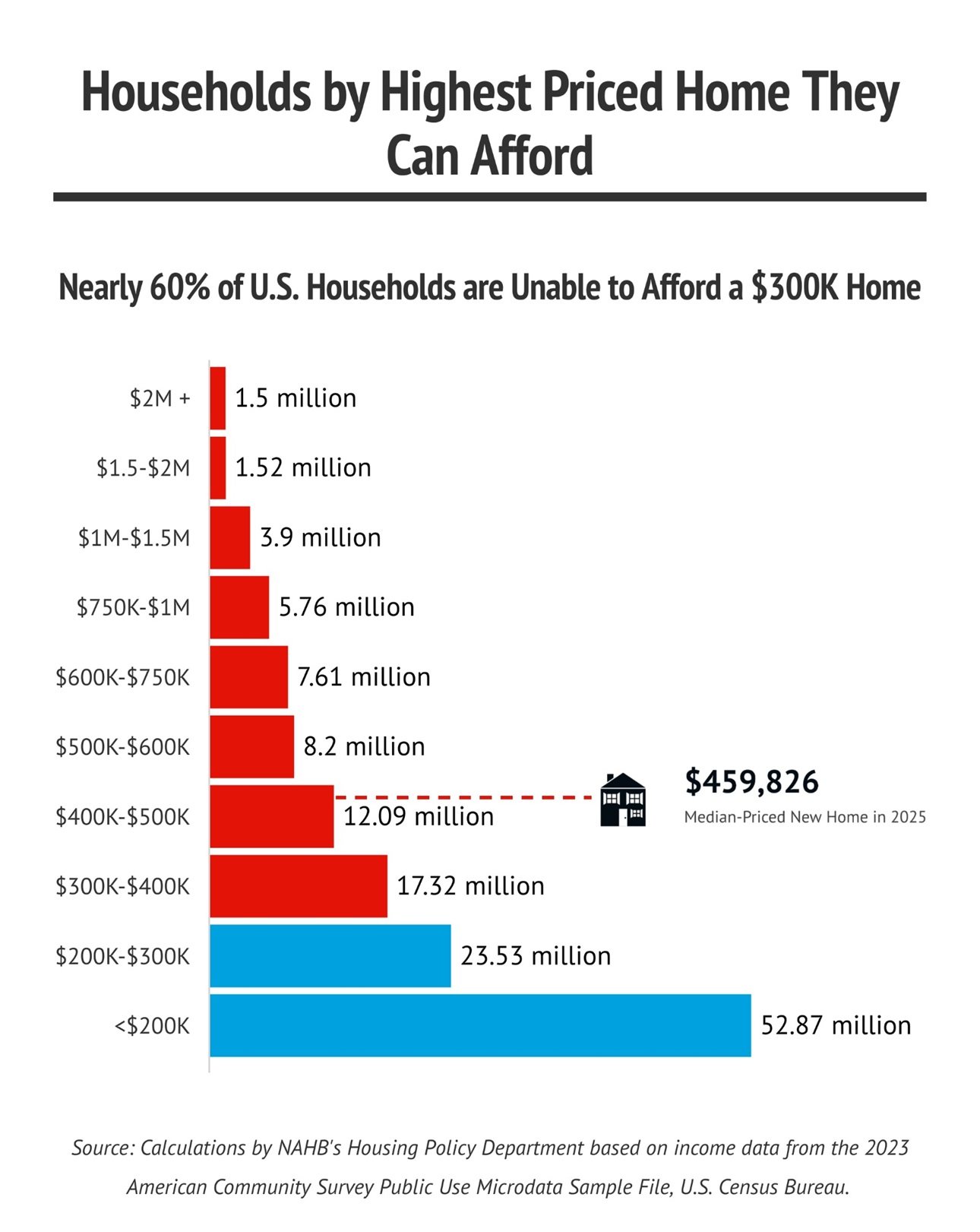

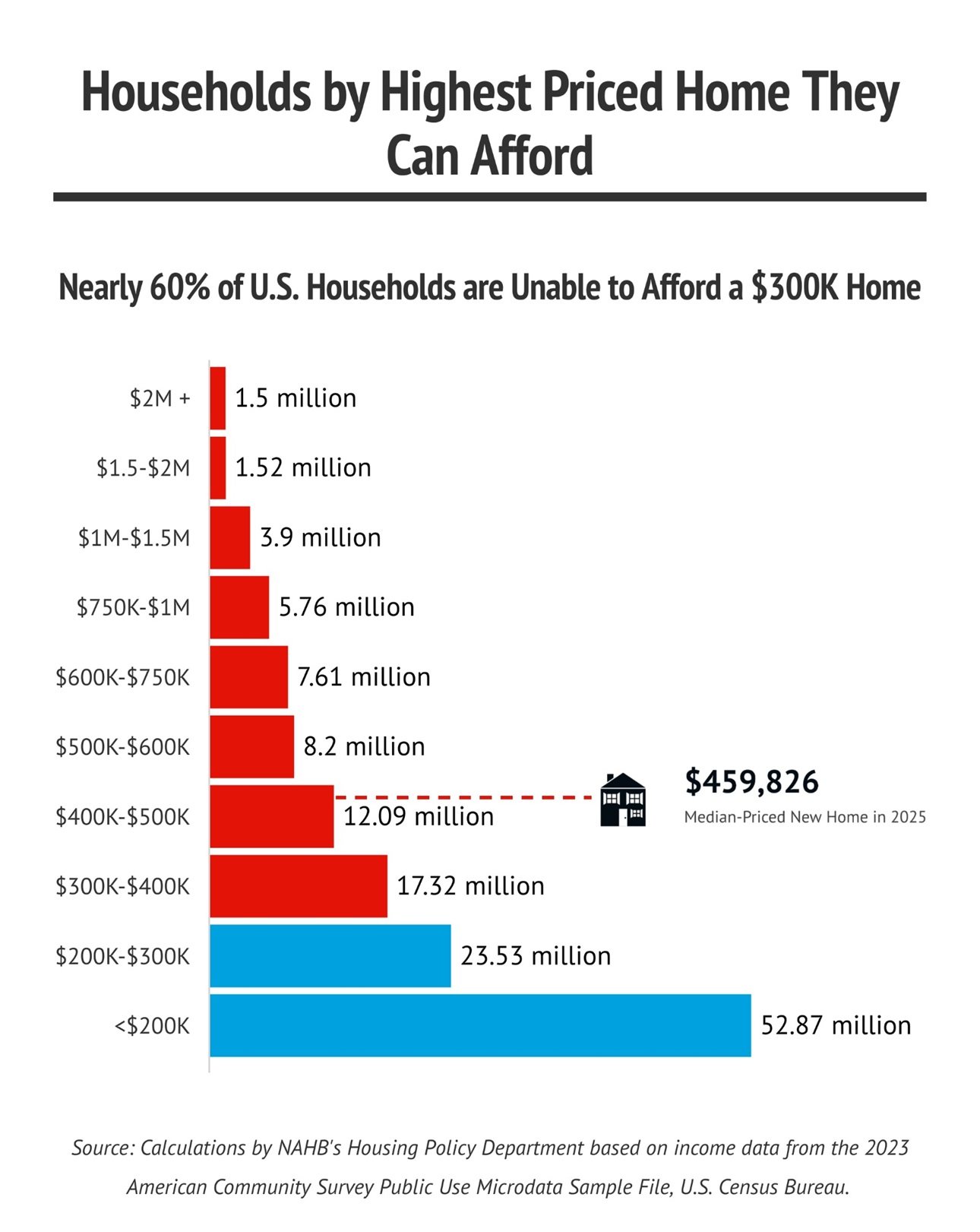

57% of US households can't afford to buy a $300K home today. The median is around $408K

Posted on 5/14/25 at 8:29 am

Posted on 5/14/25 at 8:29 am

Yet some people here keep preaching "muh appreciation is still 4% this year."

None of that matters if you are all fighting for a shrinking group of buyers who can actually afford your house.

I say this as a person who owns more than one property/house with net worth directly tied to the RE market. I can still acknowledge that appreciation due to over speculation has far outpaced wage growth and the fix isn't simply to lower rates. We need values to deflate which will make boomers big mad.

Inventory is an issue and not just because we undebuilt after 2008 happened but because speculators (yes, I see the irony in that considering I have rentals) have taken up a lot of inventory for Airbnb, section 8, etc. We also need to make the double closings used by the "we buy your house for cash" guys illegal. Its not needed and is actually a scam but people fall for it thinking they are going to get cash right away when in reality they still have to wait for the house to sell. Its just another parasite on the housing industry.

We also have whole neighborhoods that could benefit from gentrification but gentrification is racist. If you are for Federal dollars to help solve the inentory issue then this is a quicker solution than popping up new developments with postage stamp lots, causing drainage issues with houses made from cardboard by a national builder.

The head of FHFA and HUD are great and have taken steps in the right direction that will help ease speculation fraud and assist with inventory but I hope Trump 2.0 tackles the issue head-on on or we truly will be a nation of renters.

Also,

Foreclosures starts by year has been trending down since the peak of 2009 Q3 when nearly 600K houses went into foreclosure. This has changed recently and we are seeing quarters with rising rates. The CV data is junk and doesn't count but a year ago you could argue rising foreclosures were a rebound from CV. I don't think that is the case now as it seems to be due to a slowing market and lower buyer demand coupled with people who overpaid in 2020-21. In another year we will see more foreclosures since Trump ended the CV forbearance that Biden was abusing to kick the can down the road. It ends in October and a foreclosure start takes about 3 months to reach preforeclosure status.

In before stout RE thread...reeeeeee

None of that matters if you are all fighting for a shrinking group of buyers who can actually afford your house.

I say this as a person who owns more than one property/house with net worth directly tied to the RE market. I can still acknowledge that appreciation due to over speculation has far outpaced wage growth and the fix isn't simply to lower rates. We need values to deflate which will make boomers big mad.

Inventory is an issue and not just because we undebuilt after 2008 happened but because speculators (yes, I see the irony in that considering I have rentals) have taken up a lot of inventory for Airbnb, section 8, etc. We also need to make the double closings used by the "we buy your house for cash" guys illegal. Its not needed and is actually a scam but people fall for it thinking they are going to get cash right away when in reality they still have to wait for the house to sell. Its just another parasite on the housing industry.

We also have whole neighborhoods that could benefit from gentrification but gentrification is racist. If you are for Federal dollars to help solve the inentory issue then this is a quicker solution than popping up new developments with postage stamp lots, causing drainage issues with houses made from cardboard by a national builder.

The head of FHFA and HUD are great and have taken steps in the right direction that will help ease speculation fraud and assist with inventory but I hope Trump 2.0 tackles the issue head-on on or we truly will be a nation of renters.

Also,

Foreclosures starts by year has been trending down since the peak of 2009 Q3 when nearly 600K houses went into foreclosure. This has changed recently and we are seeing quarters with rising rates. The CV data is junk and doesn't count but a year ago you could argue rising foreclosures were a rebound from CV. I don't think that is the case now as it seems to be due to a slowing market and lower buyer demand coupled with people who overpaid in 2020-21. In another year we will see more foreclosures since Trump ended the CV forbearance that Biden was abusing to kick the can down the road. It ends in October and a foreclosure start takes about 3 months to reach preforeclosure status.

Loading Twitter/X Embed...

If tweet fails to load, click here. In before stout RE thread...reeeeeee

This post was edited on 5/14/25 at 8:40 am

Posted on 5/14/25 at 8:32 am to stout

Wages have NOT kept up! Nor have job expectations.

And you wonder why your grandchildren hate you.

Many of you scoff at those who ask for more than 70k for a starting salary.

I'll just go walk in, with a firm handshake, and get a job. The world has changed and y'all suck

And you wonder why your grandchildren hate you.

Many of you scoff at those who ask for more than 70k for a starting salary.

I'll just go walk in, with a firm handshake, and get a job. The world has changed and y'all suck

Posted on 5/14/25 at 8:33 am to stout

In Florida it is somewhat ironic with all of the speculation and Airbnb purchases that you would think there would be competition with hotel prices and yet they are almost priced out of the market

Posted on 5/14/25 at 8:34 am to stout

quote:

buyers who can actually afford your house

Sell your home for 300k instead of 400k. Problem solved.

Posted on 5/14/25 at 8:36 am to stout

We need Jerome to go full Volcker to get prices down.

Posted on 5/14/25 at 8:37 am to TimeOutdoors

quote:

Sell your home for 300k instead of 400k. Problem solved.

I bought a hurricane-damaged home and remodeled it so I have a ton of equity. I could do that if needed. There are many who bought in 2021 that are upside down in towns like Austin, where the market has decreased like 23% since the 2021 peak who can't

Posted on 5/14/25 at 8:38 am to stout

A house shouldn't cost $300,000.00 in the first place.

This post was edited on 5/14/25 at 8:39 am

Posted on 5/14/25 at 8:39 am to stout

Bought two houses, was going to flip but will probably hold as rentals unless a banger becomes available and I need the cash.

Posted on 5/14/25 at 8:39 am to aubiecat

quote:

A house shouldn't cost $300,000.00 in the first place.

Market decides prices, not stinky commies.

Posted on 5/14/25 at 8:40 am to stout

So what's the solution?

If Powell reduces interest rates, prices will go back up.

If you increase wages, then inflation goes up.

I think it will slowly work itself out. I have seen houses sit more in our area, and there are finally price reductions. But we still have a ton of houses selling for 850k+ and we live in the suburbs of Atlanta. Anything listed under 450 is gone in a day or 2.

We aren't going to have another crash, but I see a house that sold for 375k last year listed for 679k, which is absurd.

If Powell reduces interest rates, prices will go back up.

If you increase wages, then inflation goes up.

I think it will slowly work itself out. I have seen houses sit more in our area, and there are finally price reductions. But we still have a ton of houses selling for 850k+ and we live in the suburbs of Atlanta. Anything listed under 450 is gone in a day or 2.

We aren't going to have another crash, but I see a house that sold for 375k last year listed for 679k, which is absurd.

Posted on 5/14/25 at 8:41 am to swamptiger99

quote:No one is shocked by the desire to have a high starting salary. The issue is with the unrealistic expectations.

Many of you scoff at those who ask for more than 70k for a starting salary.

Companies generally aren’t going to pay someone more than they are worth just because the real estate market is tough for those starting their careers.

Posted on 5/14/25 at 8:42 am to Boss

quote:

So what's the solution?

Deflation

There are ways to achieve this.

Stop the bailout madness that Liz Warren's CFPB has lobbied for that makes lenders try to keep people out of foreclosure. I am in the foreclosure industry and most people in foreclosure are due to divorce of buying too much other shite aka keeping up with the Jonses.

Encourage gentrification

etc

Posted on 5/14/25 at 8:43 am to stout

Pay your house off once you get rid of your consumer debt. You can sell it for whatever you need to and have plenty of money. Create your own economy, then none of this sht matters.

Posted on 5/14/25 at 8:43 am to stout

All these fancy charts are nice and stuff but it ignores that many young people today who can't afford a $300k or $400k home are getting significant down payment help from Boomer parents etc. that enable them to get these homes otherwise we would have a glut of homes on the market and we don't.

There is going to be a huge transfer of wealth when Boomer parents and aunt and uncles start dying off en masse and its going to enable people who ordinarily wouldn't be able to 'afford' a home to pay cash for one or move into their Boomer parent or aunt/uncles paid off home or sell it which will create more inventory and will drive down prices a little bit. These days aren't far away.

There is going to be a huge transfer of wealth when Boomer parents and aunt and uncles start dying off en masse and its going to enable people who ordinarily wouldn't be able to 'afford' a home to pay cash for one or move into their Boomer parent or aunt/uncles paid off home or sell it which will create more inventory and will drive down prices a little bit. These days aren't far away.

Posted on 5/14/25 at 8:49 am to ronricks

quote:

when Boomer parents and aunt and uncles start dying off en masse

Is there a generation on this earth that people wish death upon more than those that were born right after WW2?

Posted on 5/14/25 at 9:06 am to ronricks

Boomers have kids in their 50s.

Are you saying people in their 50s are being handed cash for down payments as a general rule?

Are you saying people in their 50s are being handed cash for down payments as a general rule?

Posted on 5/14/25 at 9:18 am to stout

Hopefully when all the Boomers die off that’ll shake loose a lot of inventory and capital.

Posted on 5/14/25 at 9:25 am to roadGator

quote:

Boomers have kids in their 50s.

Are you saying people in their 50s are being handed cash for down payments as a general rule?

Yeah these idiots have no idea how old boomers actually are and anyone who is older than them is a boomer by default

Posted on 5/14/25 at 9:28 am to Azkiger

quote:

Market decides prices, not stinky commies.

Current prices are more a reflection of inflation than market forces.

Posted on 5/14/25 at 9:29 am to stout

quote:

57% of US households can't afford to buy a $300K home today. The median is around $408Kby

Um

Do you seriously not see the problem with the statistic above? The highest homeownership rates have ever been is in the mid-60 percentage points. That means a substantial percentage of the population can't afford a home at all. That means the median home price is the middle price of what people who can afford homes are paying.

Popular

Back to top

24

24