- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

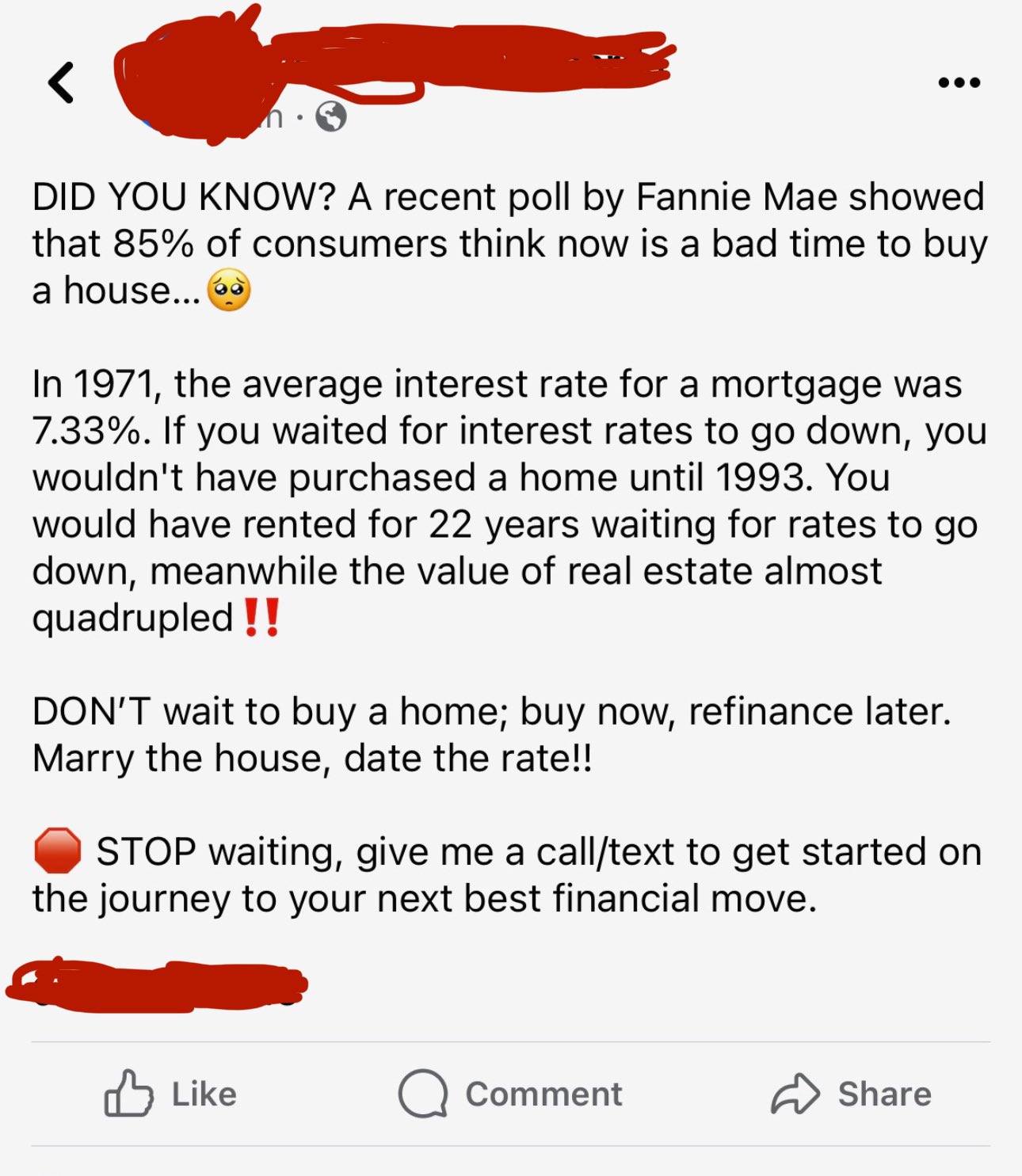

New Realtor talking point: "Marry the house, date the rate"

Posted on 11/13/23 at 10:14 am

Posted on 11/13/23 at 10:14 am

Imagine being a first-time home buyer who doesn't understand the market and you come to trust this person who is an alleged professional in their field for advice

I bet this person doesn't actually understand their local market at all

Notice how she doesn't mention that prices are starting to drop and only sells the hope that prices always go up.

I bet this person doesn't actually understand their local market at all

Notice how she doesn't mention that prices are starting to drop and only sells the hope that prices always go up.

This post was edited on 11/13/23 at 10:16 am

Posted on 11/13/23 at 10:16 am to stout

Whats the issue?

We better hope Powell holds strong and doesnt start cutting this year

We better hope Powell holds strong and doesnt start cutting this year

Posted on 11/13/23 at 10:17 am to stout

Now compare the price of house in 1971 versus the price of a house now. Even adjusted for inflation a home costs such a higher percentage of our income it’s astounding.

And rent is so expensive how can anyone save up a down payment for a home?

And rent is so expensive how can anyone save up a down payment for a home?

Posted on 11/13/23 at 10:18 am to stout

I don't think we are in for the housing collapse everyone thinks we are in for

Posted on 11/13/23 at 10:18 am to stout

Using the 22 years of rates not going down example doesn't really help her argument

Posted on 11/13/23 at 10:18 am to stout

Sounds like something a hot realtor with no other options besides selling houses came up with.

Posted on 11/13/23 at 10:19 am to stout

While I don't disagree entirely, that person, assuming a woman, contracdicted themselves in the same post.

You would've also waited 20 years to refinance

You would've also waited 20 years to refinance

Posted on 11/13/23 at 10:19 am to stout

In fairness his / her point about renting for 22 years isn’t bad.

I get what you’re saying, but I don’t think her point is totally invalid either.

I get what you’re saying, but I don’t think her point is totally invalid either.

Posted on 11/13/23 at 10:21 am to stout

I bet you she somehow sells houses though. Just proves that majority of people are just gullible idiots.

Posted on 11/13/23 at 10:21 am to stout

I mean, I have no love lost for realtors.

That being said, they are in sales. They are being paid to sell a product. They are saying what they need to say to sell the product.

Should they take their client's product to a customer and say "look, we're trying to sell this, but honestly it's a bad deal and you really shouldn't buy it"?

That being said, they are in sales. They are being paid to sell a product. They are saying what they need to say to sell the product.

Should they take their client's product to a customer and say "look, we're trying to sell this, but honestly it's a bad deal and you really shouldn't buy it"?

Posted on 11/13/23 at 10:23 am to stout

Talked to the real estate agent the other day and she told me the biggest problem she is having right now is getting people approved with the bank. People are trying to buy and the prices are going down but the bank is being strict with loans.

She said for a 400k home right now you need an income of 200k. I was pretty surprised at that number

She said for a 400k home right now you need an income of 200k. I was pretty surprised at that number

Posted on 11/13/23 at 10:25 am to stout

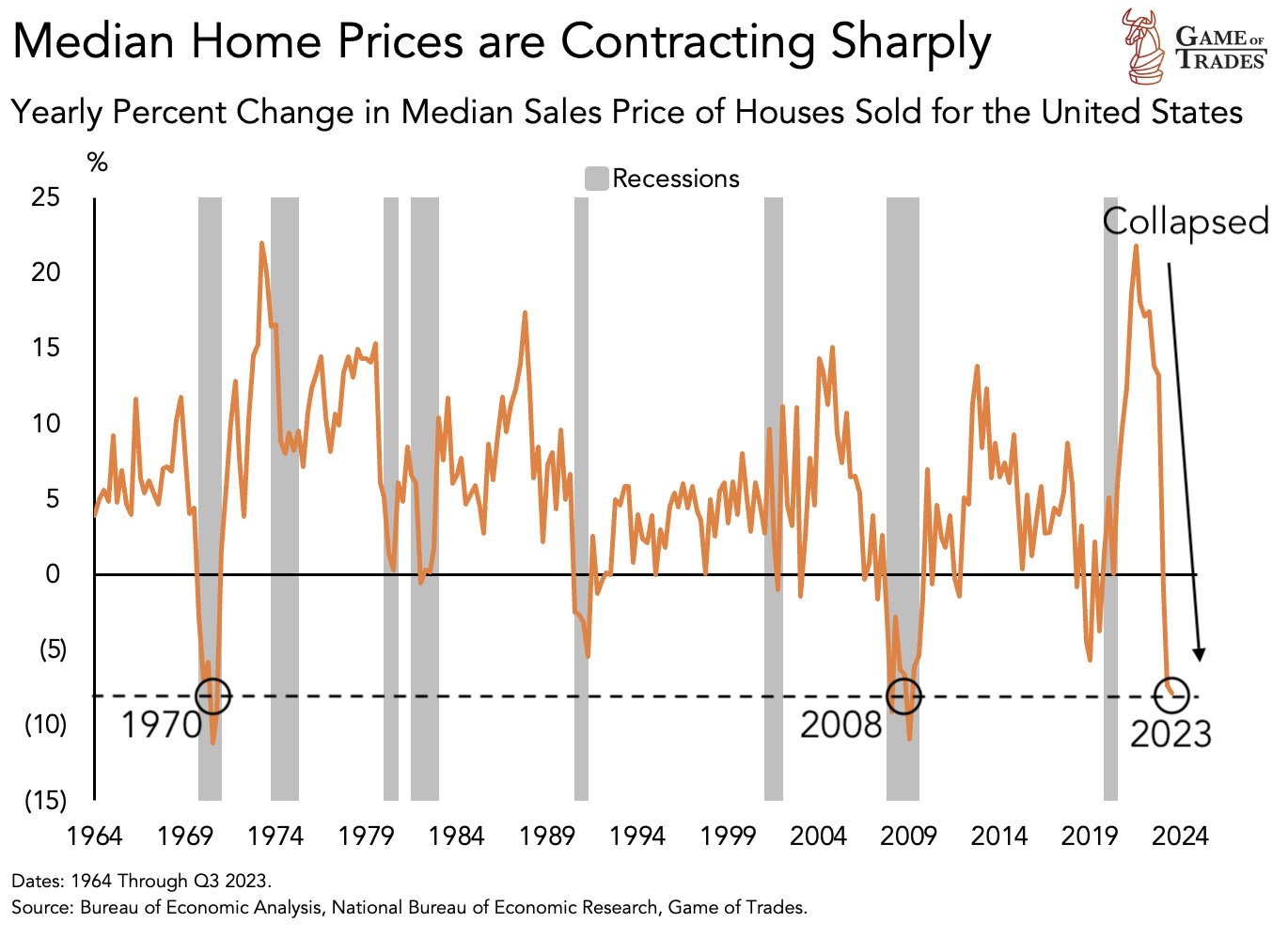

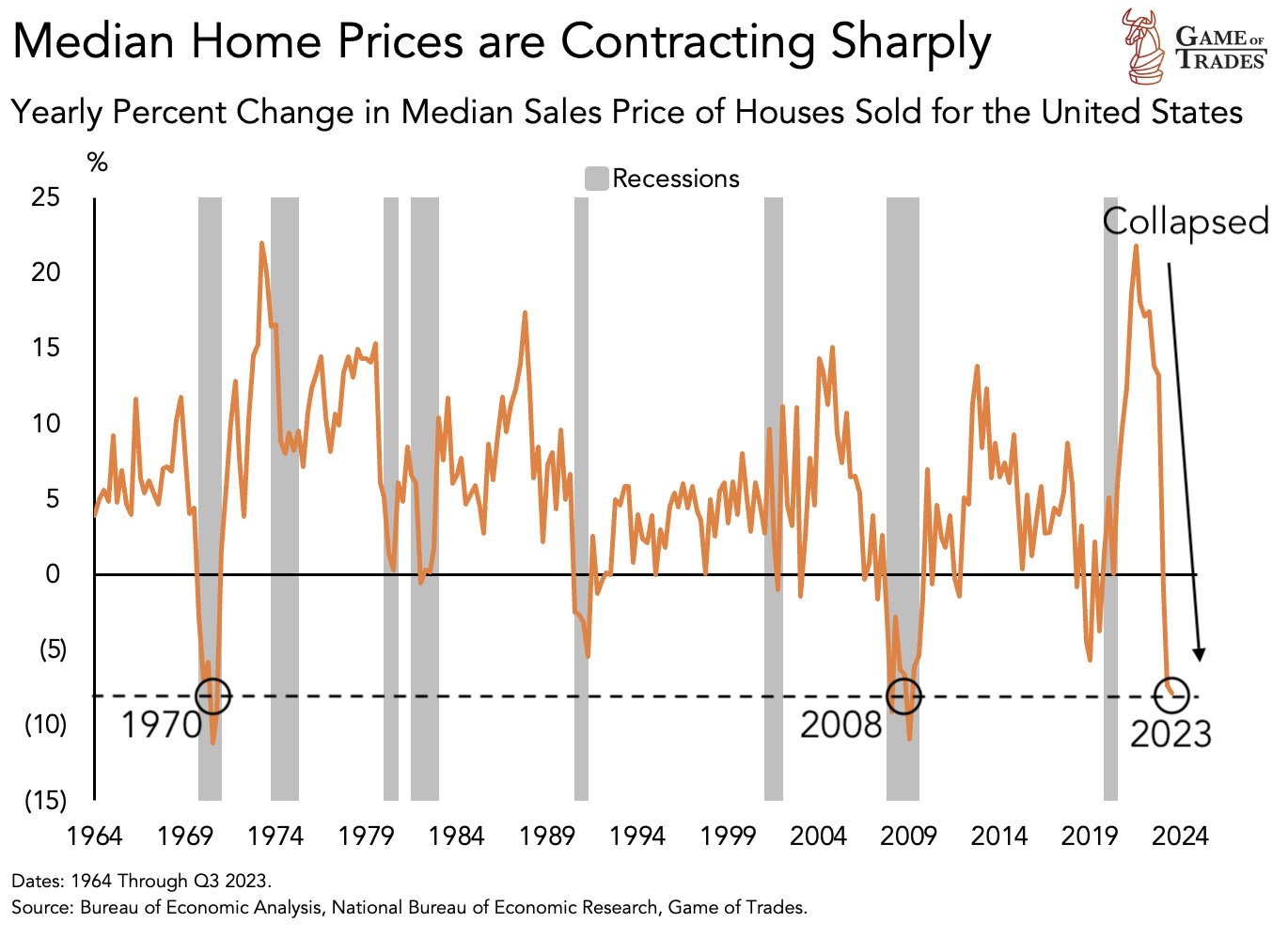

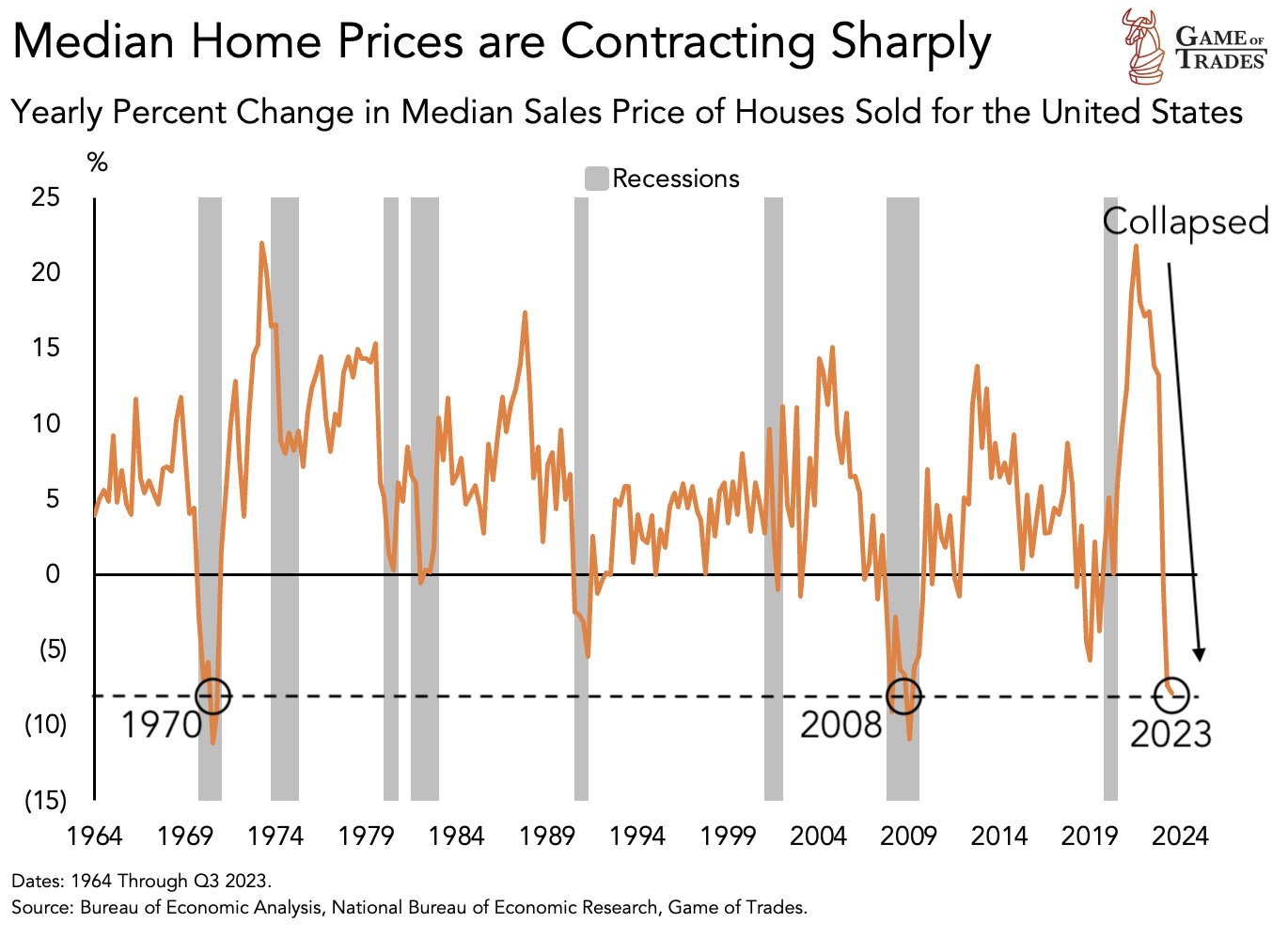

As a reminder, that graph shows year over year change. Reductions in the rate of increase is not a price decrease. With that in mind, prices have never decreased (going below the 0 line) for longer than about a year before shooting up again at any point in the last 75 years. Will history repeat itself? Who knows. But if it does, based on that graph, prices will be skyrocketing again within the next 12 months because we are already at the bottom of the dip.

Posted on 11/13/23 at 10:28 am to stout

marry the house; date the rate; frick the realtor. is better

Posted on 11/13/23 at 10:28 am to stout

I seent it. I think I posted not long ago about a local realtor doing this with almost the exact same script

Posted on 11/13/23 at 10:30 am to stout

i love when people bring up the historical rates back then and then leave out the cost of housing and inflation metric

This post was edited on 11/13/23 at 10:31 am

Posted on 11/13/23 at 10:35 am to stout

Will have to pry my 2.6% rate from my cold dead hands

Posted on 11/13/23 at 10:40 am to stout

I was talking to a buddy about this yesterday. My issue right now isnt the rates as much as the stupid over evaluation of home prices. Houses that shouldnt be going for more than 150 tops are being listed for 220/230. Paying 7.1 on something that artificially inflated seems like a bad investment to me.

Posted on 11/13/23 at 10:44 am to stout

Just missing the grey recession line now.....

Posted on 11/13/23 at 10:45 am to stout

You guys all act like real life isn't continuing to happen all around us. People get married, people die, people get divorced. The "buying frenzy" from 2022 is over but the housing market is still strong because of short supply. And before you say it, yes, this is highly dependent on location. Some markets are starting to slow down while other really haven't and probably really won't.

The biggest problem facing the overall market is that you've got a lot of houses out there that are financed at some really really attractive rates. I'm personally at 2.65% and will stay on the sidelines for a long time due to this fact. This creates problems for people trying to enter the market because you have a much smaller portion of the the potential pool willing to sell. This creates higher prices and in turn puts more pressure on the market.

It's a vicious cycle. We got addicted to really low rates + the covid money printers going brrrrrrr. Both of those put us in this tough market.

I do agree that as rates start to trickle back down the intensity of the market will start to heat back up and we'll start all of this conversation over again.

The biggest problem facing the overall market is that you've got a lot of houses out there that are financed at some really really attractive rates. I'm personally at 2.65% and will stay on the sidelines for a long time due to this fact. This creates problems for people trying to enter the market because you have a much smaller portion of the the potential pool willing to sell. This creates higher prices and in turn puts more pressure on the market.

It's a vicious cycle. We got addicted to really low rates + the covid money printers going brrrrrrr. Both of those put us in this tough market.

I do agree that as rates start to trickle back down the intensity of the market will start to heat back up and we'll start all of this conversation over again.

Popular

Back to top

38

38