- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Fe_Mike

| Favorite team: | Mississippi St. |

| Location: | |

| Biography: | |

| Interests: | |

| Occupation: | |

| Number of Posts: | 3720 |

| Registered on: | 7/2/2015 |

| Online Status: | Not Online |

Forum

Message

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 1/30/26 at 12:41 pm to PotatoChip

A cliff with no bottom.

I mean there is zero support.

I mean there is zero support.

No idea, but looking like another rough one today.

Freaking Albemarle down 8% premarket. We're down 6%.

Unreal the hit the lithium sector is taking these past 3 days.

Freaking Albemarle down 8% premarket. We're down 6%.

Unreal the hit the lithium sector is taking these past 3 days.

quote:

There's no way today doesn't recover, right?

Well…I was wrong.

Feels like a great opportunity here. There's no way today doesn't recover, right?

This seems like such an overreaction to the change of stance on critical mineral price floors.

This seems like such an overreaction to the change of stance on critical mineral price floors.

Ugh nevermind, stop with the puff pieces.

Lithium getting rocked the last two days.

Lithium getting rocked the last two days.

Keep these puff pieces coming!

I can't wait to see "FP" next to SLI in my portfolio again. Tells me nobody is bearish on this thing right now though. Not a short in sight.

I can't wait to see "FP" next to SLI in my portfolio again. Tells me nobody is bearish on this thing right now though. Not a short in sight.

Pretty damn good day on decent volume considering how awful the rest of the sector was. Most lithium players were down 5%. I'll take it.

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 1/26/26 at 5:16 pm to Elusiveporpi

quote:

I’m bored in this cold weather. Let’s let our imaginations run for a minute. What do you think SLI will run to after FID announcement? Lots of people are saying it’s built in already. I’m thinking it’s not. I’m thinking we hit $7.5 with absolutely nothing to back that up.

I'll be completely honest, I think FID just falls somewhere in the midst of a multi-month uptrend. i.e. if you look back at the 2 year chart in 2027 you won't notice a 'blip' for FID announcement.

I would not be shocked in the slightest if we're red the day FID is announced.

I think a larger than expected offtake agreement could spike us, and even moreso if they announce who that agreement is with (talking a Tesla type deal, in dreamland, not saying that's likely).

I think a US investment could also create a binary spike.

Other than that, I don't see much moving this thing on a binary event.

What I do think is that if FID and offtakes are announced as expected within the next 3 months, and lithium prices are stable or rising, we'll organically run to $8-10 without any shocking (20%+) spikes.

TLDR:

I think it's possible, assuming news comes like most are thinking, to be stabilized in the $9-$11 trading range come Q4 2026.

Same old SLI, but at $5+ as support.

Lithium prices are higher across the board than all of our FEED estimates, and they are growing.

The risk of a negative FID is all but eliminated, and sure, the price reflects that. As I stated, I don't think positive FID news is going to move this too much.

But the growth potential is still massive.

SLI is in a great position to negotiate contracts, which may be why they are taking longer. My guess is everyone (SLI management and the companies they are discussing offtakes with) hit the brakes when lithium prices finally started coming back up a few months ago. If SLI had an attractive value proposition when lithium was $10k/ton in mid '25, it's irresistible right now at $25k/ton and growing.

$15/share within the next 3 years isn't even a hail mary, it's borderline probable. That's 200% return in 3 years if not (much) sooner. Most people consider something a great investment if it can give them that return in 10 years.

There's risk, anything can happen, a 'new' technology (graphene, for example) could finally find its legs and completely slash lithium demand overnight. But right now, this thing looks like as good an investment as a risk tolerant investor could possibly make.

Lithium prices are higher across the board than all of our FEED estimates, and they are growing.

The risk of a negative FID is all but eliminated, and sure, the price reflects that. As I stated, I don't think positive FID news is going to move this too much.

But the growth potential is still massive.

SLI is in a great position to negotiate contracts, which may be why they are taking longer. My guess is everyone (SLI management and the companies they are discussing offtakes with) hit the brakes when lithium prices finally started coming back up a few months ago. If SLI had an attractive value proposition when lithium was $10k/ton in mid '25, it's irresistible right now at $25k/ton and growing.

$15/share within the next 3 years isn't even a hail mary, it's borderline probable. That's 200% return in 3 years if not (much) sooner. Most people consider something a great investment if it can give them that return in 10 years.

There's risk, anything can happen, a 'new' technology (graphene, for example) could finally find its legs and completely slash lithium demand overnight. But right now, this thing looks like as good an investment as a risk tolerant investor could possibly make.

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 1/23/26 at 2:28 pm to SmackoverHawg

Lithium sector is up, but could be a little from this article:

News Nation: Arkansas Lithium Process

It's just a fluff piece, so kinda odd. Literally nothing interesting (to anyone already invested) in the article. Makes me think a marketing campaign might be starting, with actual news soon.

News Nation: Arkansas Lithium Process

It's just a fluff piece, so kinda odd. Literally nothing interesting (to anyone already invested) in the article. Makes me think a marketing campaign might be starting, with actual news soon.

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 1/16/26 at 7:00 am to SmackoverHawg

Looks like we've got a nasty day in the lithium sector on deck.

May be back under $5.

May be back under $5.

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 1/13/26 at 12:29 pm to SECCaptain

quote:

Why is this not essentially indexed to futures for lithium carbonate? Those have almost tripled in 6 months and show no signs of slowing down

I mean....you're aware that SLI has tripled in the last 6 months, yes?

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 1/13/26 at 8:04 am to Elusiveporpi

Yeh I'm not sure I'd put us in the 'delay' category yet.

I'm just ready for a 10% day to get us out of this fight with $5.

I'm just ready for a 10% day to get us out of this fight with $5.

quote:

When it happens, its going to happen very fast and violent.

Temper expectations on the FID announcement.

I believe FID should be largely baked in already. It’s not going to be a big move (at least I wouldn’t think).

Offtake agreements will be a bit more impactful, in my opinion.

Sumbitch hit $5.45 yesterday after hours and it's red in premarket today.

So damn volatile.

So damn volatile.

Can’t believe they didn’t call targeting he hit him weally weally hawd

quote:

his shoulder hit the receiver directly in the helmet. You can't hit a guy in the head, with any part of your body, with forcible contact.

I think it’s pretty clear the receivers helmet hit his shoulder, not the other way around.

Insane that targeting is one way and an offensive player can’t get called for ducking his head into a tackle.

re: Ole Miss 39 @ Georgia 34 Final - ESPN

Posted by Fe_Mike on 1/1/26 at 8:42 pm to TiptonInSC

There is literally no other way for that dude to make that tackle other than just avoiding him and hoping his teammate made the tackle.

Awful. That’s not football.

Awful. That’s not football.

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 12/17/25 at 8:46 am to ThermoDynamicTiger

Basically yes.

They just announced they're going to be amping up their license enforcement and will be revoking the mining licenses of quite a few lithium miners.

China’s Yichun to Revoke 27 Mining Licenses, Including Ones Held by Big Lithium Producers

Also, at the same time this was announced, suppliers over there greatly increased their demand forecasts.

Also, one of their biggest miners is currently (and continuously) struggling to get one of their biggest mines back online.

They just announced they're going to be amping up their license enforcement and will be revoking the mining licenses of quite a few lithium miners.

China’s Yichun to Revoke 27 Mining Licenses, Including Ones Held by Big Lithium Producers

Also, at the same time this was announced, suppliers over there greatly increased their demand forecasts.

Also, one of their biggest miners is currently (and continuously) struggling to get one of their biggest mines back online.

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 12/17/25 at 7:11 am to ColoradoAg03

Chinese government trying to help us get over $5 today.

Thanks China!

Thanks China!

quote:

Back to the Mad Dog 20/20 mixer...

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 12/15/25 at 8:34 am to ThermoDynamicTiger

Wasn't expecting a "SLI up 10%" alert at the open this morning.

Anybody got a bead on anything? Not seeing any news.

Anybody got a bead on anything? Not seeing any news.

Lending interest is sloooowly creeping up. I got 2.3% yesterday, nothing crazy but highest in over a year I think.

Would be awesome to see that get back up to the 10-20% range for a while.

Would be awesome to see that get back up to the 10-20% range for a while.

Touched $5.09 premarket - could be an indication for potential at some point today.

Just more validation in the concept that they've got real access to $1B in funding already, without prepays and offtake agreements official.

Just more validation in the concept that they've got real access to $1B in funding already, without prepays and offtake agreements official.

quote:

I’m 100% a dint believe any bullshite I read guy. But I will say my wife’s tire had the cleanest cut I ever saw on the side wall the other day.

Do a quick google search of "why people's tires get slashed".

The top answers aren't "because someone tried to rob me". Just sayin'.

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 12/4/25 at 2:30 pm to ThermoDynamicTiger

Tear? What? I see nothing.

quote:

so the working theory is some a-hole was trying to get her to get out of her car to look at her tire.

I'm not saying bad guys don't exist, but they don't need you to get back out your car after just getting in before they can grab you.

Some guy wants to...kidnap your wife? Rob your wife? Ask your wife on a date? Alas, she needs to be out of her car for him to get her!

Better slash her tire while she is in the store....which she got to by getting out of her car....so that after she walks back to the car....out of her car....and finally gets in her car where he can't get her (dangit!) she gets a low pressure light and gets back out the car, where she just was when walking back to her car...and now that he's tricked her into getting out of her car, the bad guy can get her!

Looking good.

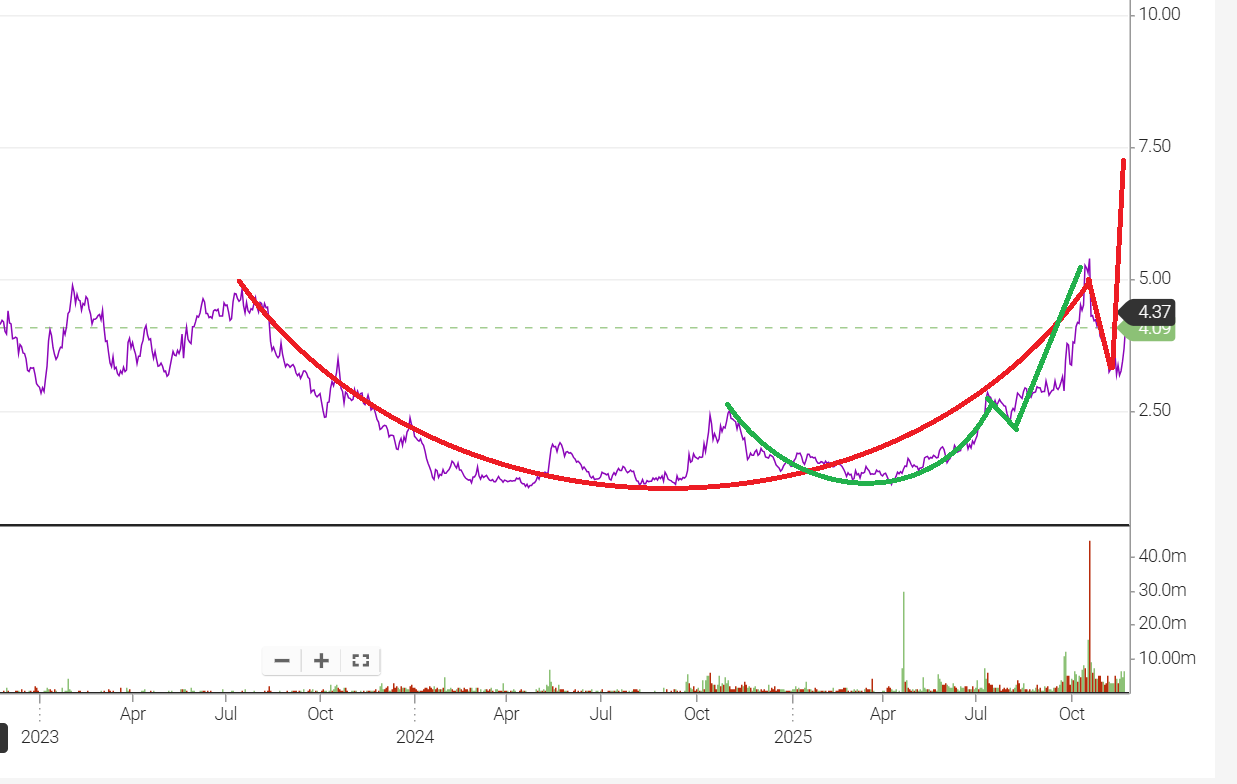

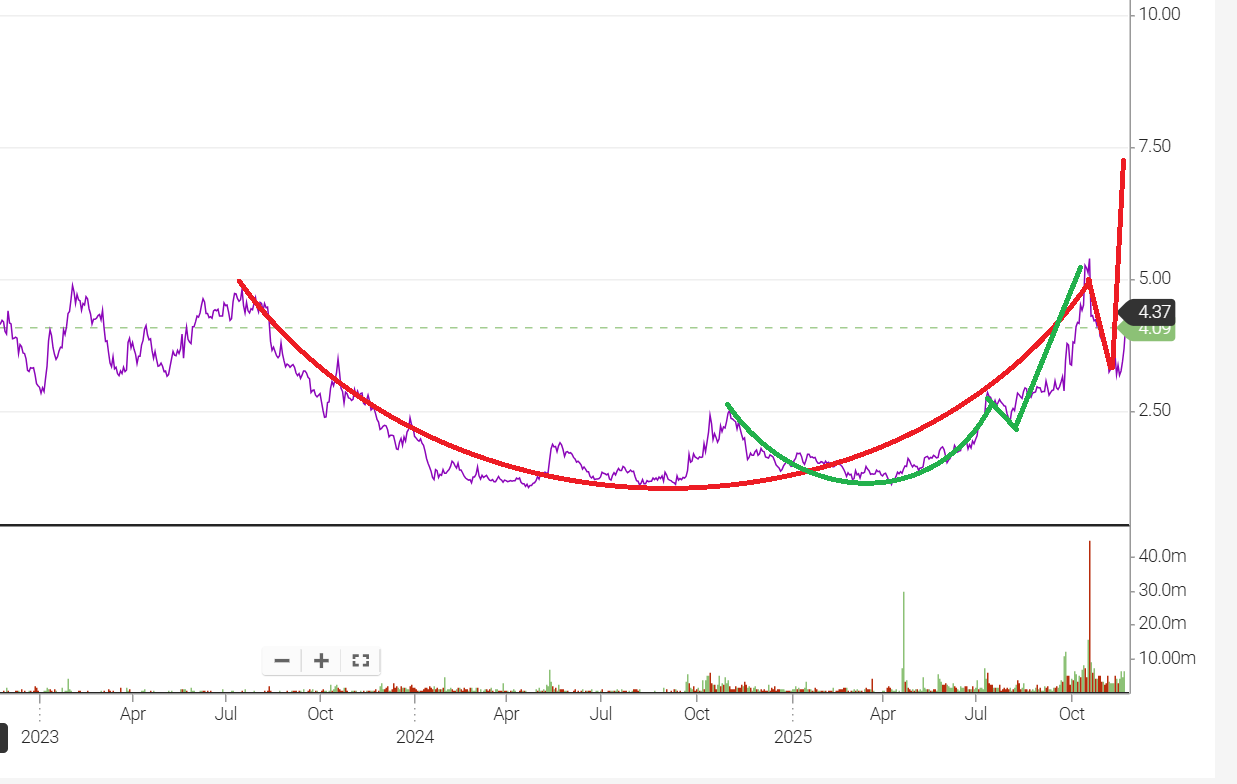

Just gonna drop this here, you can pick it up if ya want, feel free to put it right back down. It's technical gypsy horoscope nonsense.

We had the ~52 week cup and handle complete recently. Shown by the green traced line in the picture. We're now working on a 100+ week cup and handle, shown by the red traced line. Target $7.50? That seems like too much to me but the stars and tea leaves like it. This supports Thermo's theory with even more fact based totally legit science

Just gonna drop this here, you can pick it up if ya want, feel free to put it right back down. It's technical gypsy horoscope nonsense.

We had the ~52 week cup and handle complete recently. Shown by the green traced line in the picture. We're now working on a 100+ week cup and handle, shown by the red traced line. Target $7.50? That seems like too much to me but the stars and tea leaves like it. This supports Thermo's theory with even more fact based totally legit science

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 11/18/25 at 4:31 pm to GREENHEAD22

quote:

XOM buy SLI at $30/share?

Unfortunately that dream is gone. Equinor owning 49% of (almost) everything pretty much nips that in the bud.

I think we have a strong chance that Equinor buys it out for a 100% premium sometime after SW Arkansas comes online and has contracts. And that price may well be close to $30 anyway. Just, not right now.

re: Diving deeper on Standard Lithium?

Posted by Fe_Mike on 11/18/25 at 4:26 pm to SmackoverHawg

quote:

I guess cause I already knew these things. Thought all that had been public knowledge for a bit. Maybe I just assumed everyone knew they weren't going to have to dilute anymore to get financing.

Tetra will start building in Lewisville AR before SLI, but that doesn't mean anything. As far as I can tell it'll be their first attempt at a demo/test site. When we start, it'll be the big build. Exxon don't have a reliable means of extraction. They're still looking.

Yeh I think this is where I was at on it too.

The press is good, though. I reckon that's how you "get in early" on a company. The DD has to lead you to conclusions/knowns before the Street at large finds out about it. That's why we all think this company is "undervalued".

Man I hope my other spec play binary hits or dies before SLI takes off. I'd love to add another 30-50k shares under $6. I am actively looking to get overleveraged in this company before 2027.

re: is it legal

Posted by Fe_Mike on 11/18/25 at 10:03 am to tigerdup07

Is it legal to change your date of birth on your ID so you can buy booze at 18 even though the drinking age is 21?

Popular

1

1