- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: 'Contagion' It's what the media is calling the possible coming collapse of Banks

Posted on 3/11/23 at 12:31 pm to billjamin

Posted on 3/11/23 at 12:31 pm to billjamin

quote:

Only fearporn wishcasters and people who lack understanding of why SVB failed are talking about this

quote:

Jim Cramer last month on Silicon Valley Bank: "Fears not justified" "Stock is still cheap" at $320 "Oversold position" Considered stock price at "artificially low levels"

Posted on 3/11/23 at 12:54 pm to UncleFestersLegs

quote:

Jim Cramer last month on Silicon Valley Bank: "Fears not justified" "Stock is still cheap" at $320 "Oversold position" Considered stock price at "artificially low levels"

Posted on 3/11/23 at 12:59 pm to SlowFlowPro

Inverse Cramer ETF must be feasting

Posted on 3/11/23 at 1:00 pm to UncleFestersLegs

quote:

Jim Cramer last month on Silicon Valley Bank:

Someone needs to go full George Kostanza on him and create a fund that trades the opposite of whatever Cramer recommends on his show.

Posted on 3/11/23 at 1:06 pm to Reubaltaich

quote:

This is starting to feel like 2008-2009 again.

This is going to be way worse than 2008-2009. This will

Go beyond the depression. They have gained full control over us and we did nothing to stop it.

Posted on 3/11/23 at 1:07 pm to Jjdoc

quote:and?

'Contagion' It's what the media is calling the possible coming collapse of Banks

Posted on 3/11/23 at 1:34 pm to Reubaltaich

quote:

This is starting to feel like 2008-2009 again.

This is nothing like 2008.

2008 was fueled by massive amounts of loans granted to people who would not be able to repay them. Stated income loans 580 credit scores were getting cash out refi’s and new home financing. That shite was packaged into more shite and sold and sold and sold.

Silicon Valley was full of customers with much better cash flow options. Their underlying performance was not an issue.

Management made bad decision on investments two years ago but that was survivable until everyone freaked the frick out and pulled their money.

Posted on 3/11/23 at 1:38 pm to Meauxjeaux

quote:

This is nothing like 2008.

Well Tucker Carlson had a person on last night that stated this:

, “what we are facing right now is really serious and we are on the brink of a 2008-style financial crisis and I’m not trying to be hyperbolic.”

Posted on 3/11/23 at 1:48 pm to Jjdoc

The news was also talking about balloons like they were aliens for a week.

Their business is getting you to click on their shitty articles, not reporting facts.

Their business is getting you to click on their shitty articles, not reporting facts.

Posted on 3/11/23 at 1:51 pm to LSUnation78

quote:

Their business is getting you to click on their shitty articles, not reporting facts.

While this is true, it does not mean that banks are not collapsing.

The news also went after the banking issues in 2007. They were right. Now they were BSing they way through on what happened and what got us there.

Posted on 3/11/23 at 1:53 pm to SingleMalt1973

quote:

The 5th grade explanation is basically their loans massively out weighed their deposit accounts. Despite advances in technology and wokeness the laws of economics that have been around for centuries trump all.

And this would be about the total opposite of what happened.

Posted on 3/11/23 at 1:56 pm to Jjdoc

Banks tied to crypto, SPACs and with poor gap management might have problems.

Posted on 3/11/23 at 2:24 pm to LSUnation78

quote:

Their business is getting you to click on their shitty articles, not reporting facts.

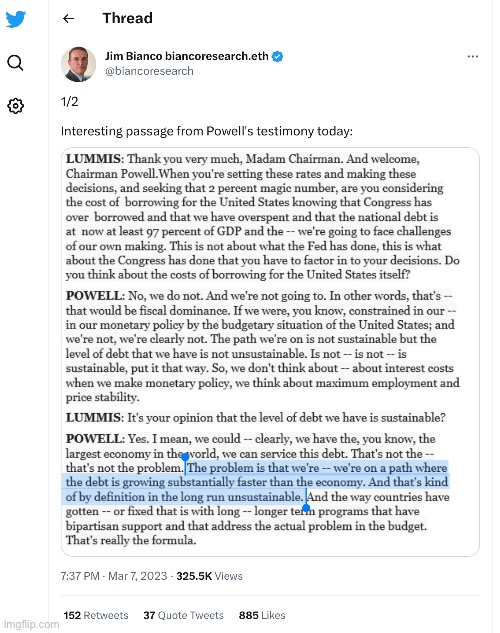

And lost in the incessant chatter this week was the testimony by Fed Chairman Jerome Powell before the Senate Banking Committee:

“The problem is that we're -- we're on a path where the debt is growing substantially faster than the economy. And that's kind of by definition in the long run unsustainable.”

Yet rather than address this looming crisis, Congress continues to spend like there is no tomorrow and is indeed pouring ever more billions of dollars into a rat hole in the hinterlands of Eastern Europe to maintain the hegemony of the U.S. dollar.

The irony here is the de-dollarization of the global economy is imminent unless these unsustainable levels of debt are brought under control.

Yet the kleptocrats in Washington D.C. seem perfectly willing to tripwire WWIII under the delusion that they can maintain the status quo through perpetual Empire.

https://twitter.com/biancoresearch/status/1633280738366746624?

This post was edited on 3/11/23 at 2:33 pm

Posted on 3/11/23 at 3:13 pm to Toomer Deplorable

Math eventually wins, despite demmunists shitty “needs” for irresponsible debt

Posted on 3/11/23 at 3:18 pm to Jjdoc

quote:

noun

1.Disease transmission by direct or indirect contact.

2.A disease that is or may be transmitted by direct or indirect contact; a contagious disease.

3.The direct cause, such as a bacterium or virus, of a communicable disease.

Keeping the covid fear up front and center in the public vernacular.

Never mind that domino effect would be far more appropriate.

Posted on 3/11/23 at 3:24 pm to Jjdoc

Im not worried about Chase, WF, etc

Posted on 3/11/23 at 3:32 pm to Jjdoc

quote:

Silicon Valley Bank failure raises fear of

broader financial contagion

Keep an eye out Monday morning. I wonder how many other banks out there have similar exposure, upside down on treasuries and share similar risk in terms of depositors pulling their money for a better return now that word is out.

I can see some small to medium banks catching the contagion but the large banks (Wells, Chase, even Capital One) should be fine. Their portfolios are much more diversified and they are required to carry "sufficient" cash reserves.

Posted on 3/11/23 at 3:34 pm to billjamin

quote:

They’re uniquely exposed because of their model (PE and VC) then made a colossally bad decision to go big on treasury bonds.

IDK why you are getting down voted here. This is true and just a matter of fact.

Posted on 3/11/23 at 3:51 pm to SingleMalt1973

quote:

The 5th grade explanation is basically their loans massively out weighed their deposit accounts. Despite advances in technology and wokeness the laws of economics that have been around for centuries trump all.

Yeah except that's not what occured here.

Posted on 3/11/23 at 4:00 pm to Jjdoc

quote:

it does not mean that banks are not collapsing

The last FDIC insured bank to fail in the US, before SVB, was two weeks before Potato got "elected".

We went almost 2.5 years without a FDIC insured bank failure in this country. Despite the end of COVID, last year's stock market issues, and inflation / rate hikes.

These days, banks generally fail when it appears their loan portfolio can no longer support their deposit base. See First NBC.

This is not what happened here. This bank had a smaller percentage of loans than normal, and had a larger percentage of their assets in government bonds at low interest rates, and the interest rate hikes have caused these bonds to have massive write downs.

The bank holding co financials came out they looked poor, they said they need to quickly raise some capital to improve their balance sheet, some of their major customers (correctly) freaked out, and here we are.

Are there possibly some banks out there that are specialized like they were that may have the same issues? I'm sure there are.

But the vast, vast majority of the banks in this country do not have a significant portion of their asset base in low rate, long term government securities.

The media likes to fear porn. Of all people, Jjdoc, I thought you didn't trust the media.

Popular

Back to top

2

2