- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

GumboPot

| Favorite team: | Georgetown |

| Location: | |

| Biography: | |

| Interests: | |

| Occupation: | |

| Number of Posts: | 139990 |

| Registered on: | 3/3/2009 |

| Online Status: | Online |

Recent Posts

Message

quote::rotflmao:

I'm still hoping the coordinate the timing for the Iranian strike with the moment he finishes his speech so that the Dems rebuttal is drowned out with footage of airstrikes on Tehran.

quote:

He wants everyone done and dusted before that fricking spook VA governor utters a word.

Good point.

re: Who pays the tariffs?

Posted by GumboPot on 2/24/26 at 3:41 pm to Harry Caray

quote:

Know what the top income tax bracket was when "America was great" through the 1950s?

The normal income tax rate was only 1% when they first introduced the income tax constitutionally in 1913.

Then they started boiling the frog and still boiling it.

re: Who pays the tariffs?

Posted by GumboPot on 2/24/26 at 3:35 pm to Taxing Authority

I really wish people would be as disgusted with the income tax as much as they are with with tariffs.

quote::lol:

Trump's SOTU Address Could Approach 3 Hours in Length

Get a lot of kern.

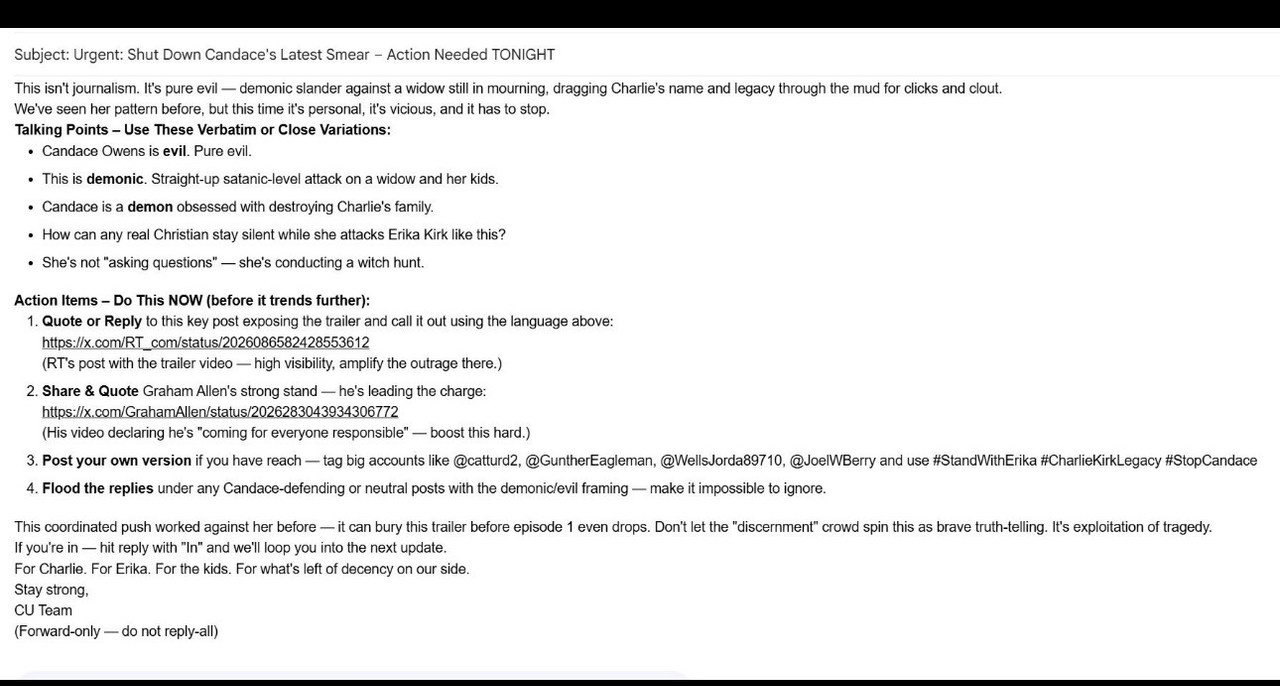

re: Dan Bongino goes ABSOLUTELY HAYWIRE on Candace Owens

Posted by GumboPot on 2/24/26 at 3:08 pm to Bunkie7672

Erika and TPUSA should sue Candace.

quote:

Are we watching a "movie"?

Prolly. :lol:

quote:

lmao. awesome. where did you find that screenshot?

In the replies to the CO tweet.

Here is the talking points memo that went out:

:popcorn:

:popcorn:

Dan apparently doing some marketing for Candace. Now I’m curious what this is all about:

Loading Twitter/X Embed...

If tweet fails to load, click here.Why is Dan so upset?

re: Why is there silence on what is happening in Mexico

Posted by GumboPot on 2/24/26 at 2:16 pm to SouthEasternKaiju

quote::lol:

No standing.

It seemed like there were a dozen threads on the cartel violence in Mexico yesterday.

Good.

This falls under the umbrella of "economy" for most people. The polls say people care about economic issues the most.

Last on the list is foreign policy. People are not only against the war with Iran and it's last on the list of issues that people care about. Foreign policy polls about 1%. People are mostly irritated by military intervention because they see money being spent on foreign nations instead of being spent on ourselves.

This falls under the umbrella of "economy" for most people. The polls say people care about economic issues the most.

Last on the list is foreign policy. People are not only against the war with Iran and it's last on the list of issues that people care about. Foreign policy polls about 1%. People are mostly irritated by military intervention because they see money being spent on foreign nations instead of being spent on ourselves.

I disobeyed Trump on his advice to get vaxxed. It's amazing that so many liberals followed Trump's advice.

quote:

Because you say it, it must be true, right?

Weird reply. He summarized a linked article.

I thought this was polite message board etiquette.

What do we get if we vote for Republicans?

quote:

Just a few blocks away is an incredible "second little Italy" for NYC with amazing food. Now 10 blocks away from that....not so nice...

Most cities are like this. NOLA is well known that one block is the perfect neighborhood, next block is a shite hole then back to the perfect neighborhood.

quote:

Any list of most dangerous college campuses with LSU left out of the top 20 is shite .

I bet the list is about reporting. For example the regular street fights that happen at LSU tailgates near the north gates never get reported but any skirmish at aTm probably gets reported.

re: Trump has sued JP Morgan bank and its CEO, Jamie Dimon, for $5 billion

Posted by GumboPot on 2/24/26 at 7:34 am to SmackoverHawg

quote:

They cannot deny for political or religious reasons

Unless they have friends in the federal government and can use a federal law enforcement agency as cover.

Popular

0

0