- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

The U.S. Housing Boom Is Coming to an End, Starting in Dallas

Posted on 12/1/18 at 1:01 pm

Posted on 12/1/18 at 1:01 pm

Baws this isn’t good news

LINK

LINK

quote:

PLANO, Texas—A half-hour drive straight north from downtown Dallas sits one of the fastest-growing counties in the country. Cotton fields have been replaced with Toyota’s new North American headquarters, a Dallas Cowboys training facility and a sand-colored shopping strip with a Tesla dealership and a three-story food hall. Yet even with the booming growth, Dallas’s once vibrant housing market is sputtering. In the high-end subdivisions in the suburb of Frisco, builders are cutting prices on new homes by up to $150,000. On one street alone, $4 million of new homes sat empty on a visit earlier this month. Some home builders are so desperate to attract interest they are offering agents the chance to win Louis Vuitton handbags or Super Bowl tickets with round-trip airfare, if their clients buy a home. Yet fresh-baked cookies sit uneaten at sparsely attended open houses.

Posted on 12/1/18 at 1:01 pm to RedRifle

Surprised it took this long

Posted on 12/1/18 at 1:02 pm to RedRifle

Really scared of that caravan I see.

Posted on 12/1/18 at 1:03 pm to RedRifle

Wow, they built too many houses in one place, means the entire US housing market is going bust!

Posted on 12/1/18 at 1:03 pm to RedRifle

Younger people realize that getting locked in to a 30 year McMansion to keep up with the Jones isn’t a smart decision.

This post was edited on 12/1/18 at 1:10 pm

Posted on 12/1/18 at 1:04 pm to RedRifle

A buddy that follows these things told me it had to do with insurance rates.

This post was edited on 12/1/18 at 1:07 pm

Posted on 12/1/18 at 1:04 pm to PrivatePublic

Sellers have to realize most buyers buy based on what they can spend monthly. With increasing interest rates that is 10’s of thousands from two years ago.

Posted on 12/1/18 at 1:05 pm to RedRifle

Some of the builders out here really are offering some crazy stuff.

This post was edited on 12/1/18 at 1:16 pm

Posted on 12/1/18 at 1:06 pm to RedRifle

How many homes account for that $4M valuation? 4? 8? 400?

Posted on 12/1/18 at 1:06 pm to RedRifle

quote:

On one street alone, $4 million of new homes sat empty on a visit earlier this month.

10 empty $400,000 homes is the end of a boom

Posted on 12/1/18 at 1:08 pm to RedRifle

I wish someone would tell Nashville so I can afford a normal sized house not in the hood.

Posted on 12/1/18 at 1:08 pm to weadjust

quote:

10 empty $400,000 homes is the end of a boom

Home prices nationwide are probably due for a correction this story not withstanding

Posted on 12/1/18 at 1:12 pm to weadjust

quote:

10 empty $400,000 homes is the end of a boom

You really don't know what a clarifying statement is?

Posted on 12/1/18 at 1:17 pm to RedRifle

Those homes start at 800k-1m. I am not shocked

Posted on 12/1/18 at 1:17 pm to Powerman

quote:

Home prices nationwide are probably due for a correction this story not withstanding

It's coming.

Posted on 12/1/18 at 1:21 pm to RedRifle

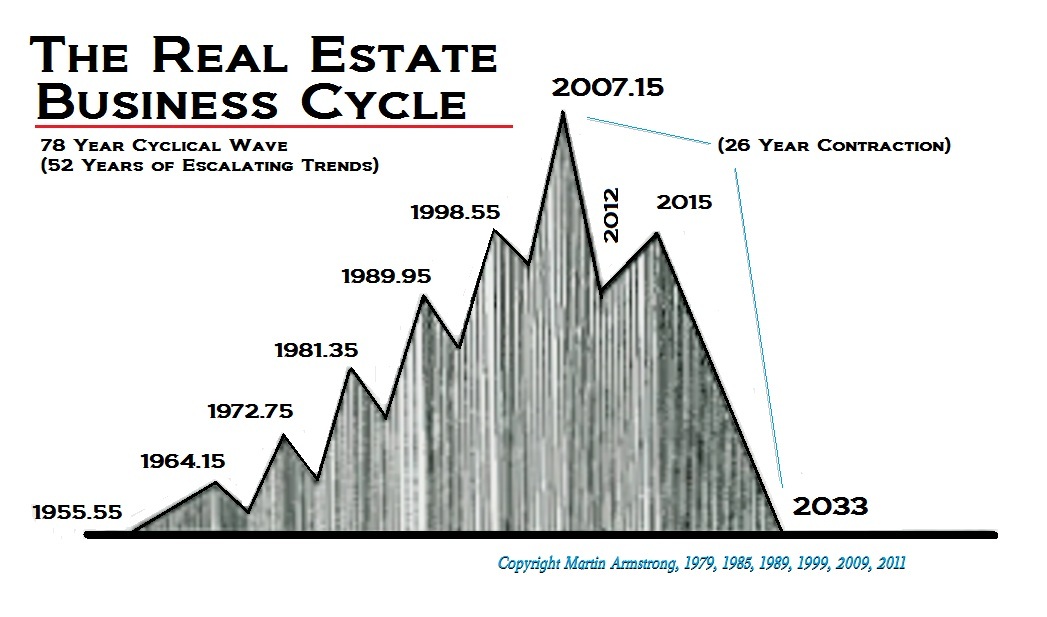

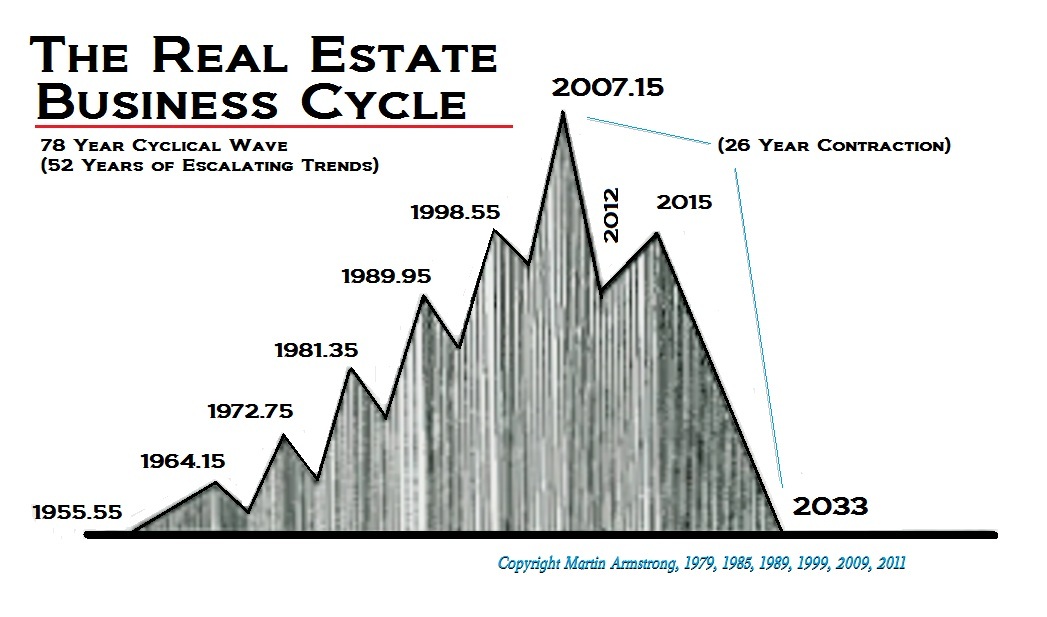

We have 15 years to reach the bottom.

Posted on 12/1/18 at 1:24 pm to TypoKnig

quote:

Younger people realize that getting locked in to a 30 year McMansion to keep up with the Jones isn’t a smart decision.

it’s just younger people.

smart people realize that your home should be your best asset not your worst.

a house leveraged like that for most people is an asset for the bank not the borrower.

a smaller house is a much quicker way to build equity

Posted on 12/1/18 at 1:27 pm to RedRifle

Not really an expert, but I think not much has changed since the real estate crash.

I think they cleaned up the ridiculous mortgage swap practices and whatnot at big investment banks, but mortgage loans are still very easy to come by and interest rates are still ridiculously low.

Once those rates start to rise, and people without a fixed rate start to see mortgage increases, they may second guess that $300,000 house they bought on a middle to low income salary.

I think they cleaned up the ridiculous mortgage swap practices and whatnot at big investment banks, but mortgage loans are still very easy to come by and interest rates are still ridiculously low.

Once those rates start to rise, and people without a fixed rate start to see mortgage increases, they may second guess that $300,000 house they bought on a middle to low income salary.

Posted on 12/1/18 at 1:29 pm to gthog61

I wonder how Austin, Nashville, Denver and other hot US cities are doing real estate wise?

Popular

Back to top

37

37