- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

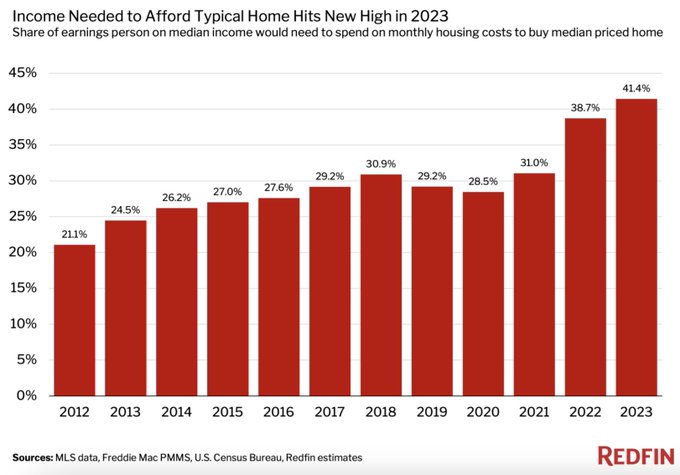

The math for buying a home no longer works, per WSJ

Posted on 12/20/23 at 9:04 am

Posted on 12/20/23 at 9:04 am

unusual whales

unusual whales tweets:

quote:

For this year, an individual earning the median income in the U.S. — $78,642 — would have needed to allocate over 40% of their income to monthly housing costs when purchasing a median-priced home, valued at around $400,000, as per Redfin's findings. This represents the highest percentage in Redfin's records dating back to 2012, indicating an almost 3% increase from the previous year.

unusual whales tweets:

quote:

At current rates, the average household could spend more than 60% of its monthly income on mortgage payments, assuming a 10% down payment, per Creditnews.

quote:

51% of Americans make a median annual salary of $75,000.

They can afford a home that costs about $256,000, per the National Association of Realtors.

Thhe median home price in the United States is $431,000, according to Federal Reserve Economic Data.

Posted on 12/20/23 at 9:05 am to GreatLakesTiger24

Biden made it illegal for millenials to own houses

Posted on 12/20/23 at 9:08 am to GreatLakesTiger24

Clearly the math hasn't worked for a while, this didn't just happen.

Don't buy houses you can't afford and that are over priced, and this current income to cost ratio wouldn't exist.

Don't buy houses you can't afford and that are over priced, and this current income to cost ratio wouldn't exist.

Posted on 12/20/23 at 9:09 am to GreatLakesTiger24

Banks qualified borrowers on a standard of 33% income to house monthly payment. Nowadays, they should raise that standard to at least 45% to help borrowers qualify.

Posted on 12/20/23 at 9:10 am to Palomitz

Yes because just like health care, home ownership is a right.

Posted on 12/20/23 at 9:11 am to el Gaucho

quote:

Biden made it illegal for millenials to own houses

Ya boy is a young millennial that owns a house. I’m like a king amongst the proletariat

Posted on 12/20/23 at 9:11 am to Steadyhands

quote:Exactly, the market would be forced to correct itself.

Don't buy houses you can't afford and that are over priced, and this current income to cost ratio wouldn't exist.

Also, I’ve been saying for years that there are an assload of affordable houses, they’re just in neighborhoods where people don’t want to live. Addressing this issue would bring housing prices down also.

Posted on 12/20/23 at 9:13 am to GreatLakesTiger24

quote:

The income needed to afford a typical home in the US hits a record 41.4% in 2023.

This is up from 21.1% in 2012 and 28.5% in 2020, according to Redfin.

On a POST-TAX basis, homebuyers are spending nearly 60% of their income on home payments.

A homebuyer would need to make at least $110,000 per year to spend 30% or less of their income on home payments.

Posted on 12/20/23 at 9:13 am to GreatLakesTiger24

First time home buyers should be buying below their income levels. That allows them to build up equity and stay within an appropriate % of their income. Once they build up equity, buying housing appropriate to their income level becomes more attainable, and eventually may be able to buy above their income level

Also using a median basis for income and comparing it to a median basis for home ownership doesn’t make sense. That assumes everyone should be able to buy a home - which is false, tons of people have to rent or choose to rent. That also assumes that people can only buy one home, also false. Tons of people in upper income brackets buy multiple houses. It’s just a poor and lazy comparison by some blogger

Also using a median basis for income and comparing it to a median basis for home ownership doesn’t make sense. That assumes everyone should be able to buy a home - which is false, tons of people have to rent or choose to rent. That also assumes that people can only buy one home, also false. Tons of people in upper income brackets buy multiple houses. It’s just a poor and lazy comparison by some blogger

This post was edited on 12/20/23 at 9:15 am

Posted on 12/20/23 at 9:13 am to Bullfrog

quote:That's a dumb thing to say. Of course, home ownership isn't a right. But the opportunity is being placed out of the reach of many, many, many people who just 10-15 years ago would have been able to buy. Don't be ridiculous

Yes because just like health care, home ownership is a right.

Posted on 12/20/23 at 9:14 am to GreatLakesTiger24

"Quit fricking whining all the time and make something of yourself. If you want to buy a house, work harder and gain more valuable skills. You only have yourself to blame if your life isn't going the way you want it to"

"This country is going down the toilet thanks to dems. Last one out hit the lights because we ain't coming back. Things were so much better and easier back in the day."

"This country is going down the toilet thanks to dems. Last one out hit the lights because we ain't coming back. Things were so much better and easier back in the day."

Posted on 12/20/23 at 9:14 am to Steadyhands

quote:

Don't buy houses you can't afford

Agreed

quote:

that are over priced

I mean that's all houses anywhere remotely nice to live right now. I bought 6 months ago because I was sick and tired of waiting for a crash that isn't going to happen. Maybe my house will dip 10% of it's worth at some point, but I was sick of renting and not having roots anywhere.

Posted on 12/20/23 at 9:15 am to Steadyhands

quote:

Don't buy houses you can't afford and that are over priced, and this current income to cost ratio wouldn't exist.

Seems like you're missing the point of this thread.

The average hope price is 400+k

Median income *now* isn't able to support buying at the average house price

Has nothing to do with buying outside your means brah.

Posted on 12/20/23 at 9:15 am to PikesPeak

You can buy a house with only 10% down???

Posted on 12/20/23 at 9:15 am to Steadyhands

quote:A big issue is foreign entities and corporations buying these overpriced houses as investment properties. Drive around any neighborhood in the Austin area and you'll see multiple single-family homes with For Rent signs.

Don't buy houses you can't afford and that are over priced, and this current income to cost ratio wouldn't exist.

This post was edited on 12/20/23 at 9:28 am

Posted on 12/20/23 at 9:15 am to alajones

quote:

Also, I’ve been saying for years that there are an assload of affordable houses, they’re just in neighborhoods where people don’t want to live. Addressing this issue would bring housing prices down also.

I have said this a lot and got shredded on here. Those houses also need some sweat equity usually and all I hear is how first-time home buyers aren't capable or don't want to deal with that.

A lot of the issue is people want shiny and new. I get it but you have to start somewhere.

"Zombie houses" could solve a lot of the inventory issues.

This post was edited on 12/20/23 at 9:17 am

Posted on 12/20/23 at 9:16 am to Lake08

quote:

You can buy a house with only 10% down???

uhh yea? Did you think you couldn't? Who told you that?

Posted on 12/20/23 at 9:16 am to GreatLakesTiger24

A large proportion of families now have duel incomes. It seems statistics are slanted to ignore. Although one may argue that an increasing number of households require at least 2 incomes just to stay above water.

Posted on 12/20/23 at 9:17 am to Lake08

quote:

You can buy a house with only 10% down???

You can get a conventional mortgage with only 3% down.

Posted on 12/20/23 at 9:17 am to Lake08

quote:

You can buy a house with only 10% down???

You shouldn’t, but you can. Some people only put down 3 or 5% even. Which jacks up their mortgage costs on a monthly basis so high with straight principal plus PMI that it takes them a long time to actually build equity

Popular

Back to top

44

44