- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: The math for buying a home no longer works, per WSJ

Posted on 12/21/23 at 2:02 pm to Dire Wolf

Posted on 12/21/23 at 2:02 pm to Dire Wolf

quote:

it confirms that wages didn't keep up with housing costs even before the covid housing market boom, which was the point

By a significant margin of 0.27%.

Great point.

Let's do 31 more pages.

Posted on 12/21/23 at 2:03 pm to meansonny

quote:

By a significant margin of 0.27%.

Great point.

Let's do 31 more pages.

your math aint mathin too well

before COVID was a thing, the last 20 year (2000-2020) delta bw average home price increase and average wage increase was 39% ($163,200 to $329,000 and $14.75/hr to $24/hr)

This post was edited on 12/21/23 at 2:04 pm

Posted on 12/21/23 at 2:06 pm to hubertcumberdale

quote:

Average home cost in 2003 = $198,000 Average home cost in 2023 = $431,000

A huge chunk of this is people wanting more and having no clue what they can afford, and builders building it for them.

I just saw a commercial for a home about 60 mins from me that was a new build for 1900 sq ft and $250,000. Nothing immediately around me is being built for under $500k. Those lots don’t cost $250k, it’s land and builders profit for the most part along with more expensive grade materials.

The point is, everyone wants to blame inflation. Nah. Cheaper shite can be built. Its choice, it’s all choice.

Posted on 12/21/23 at 2:10 pm to baldona

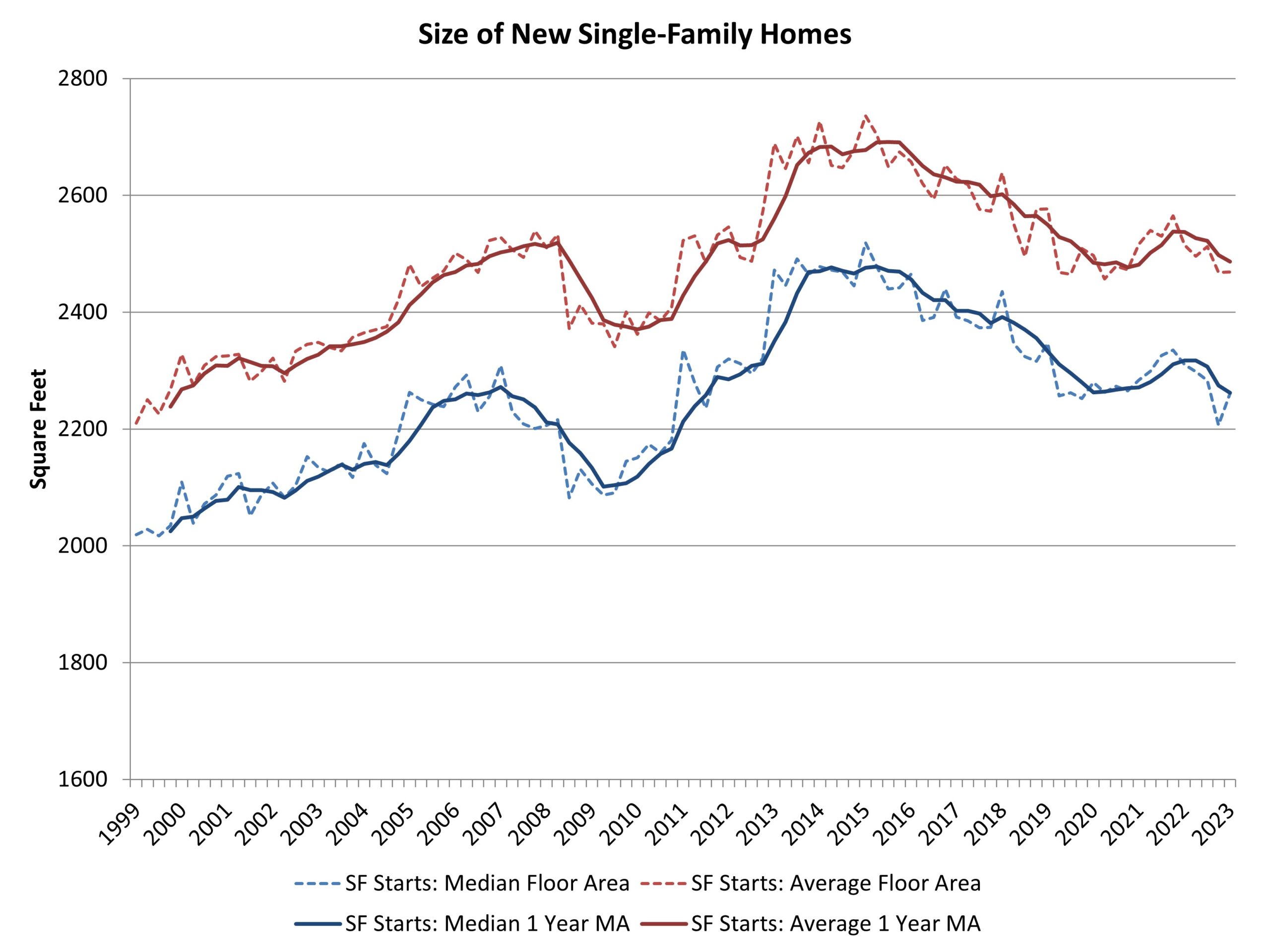

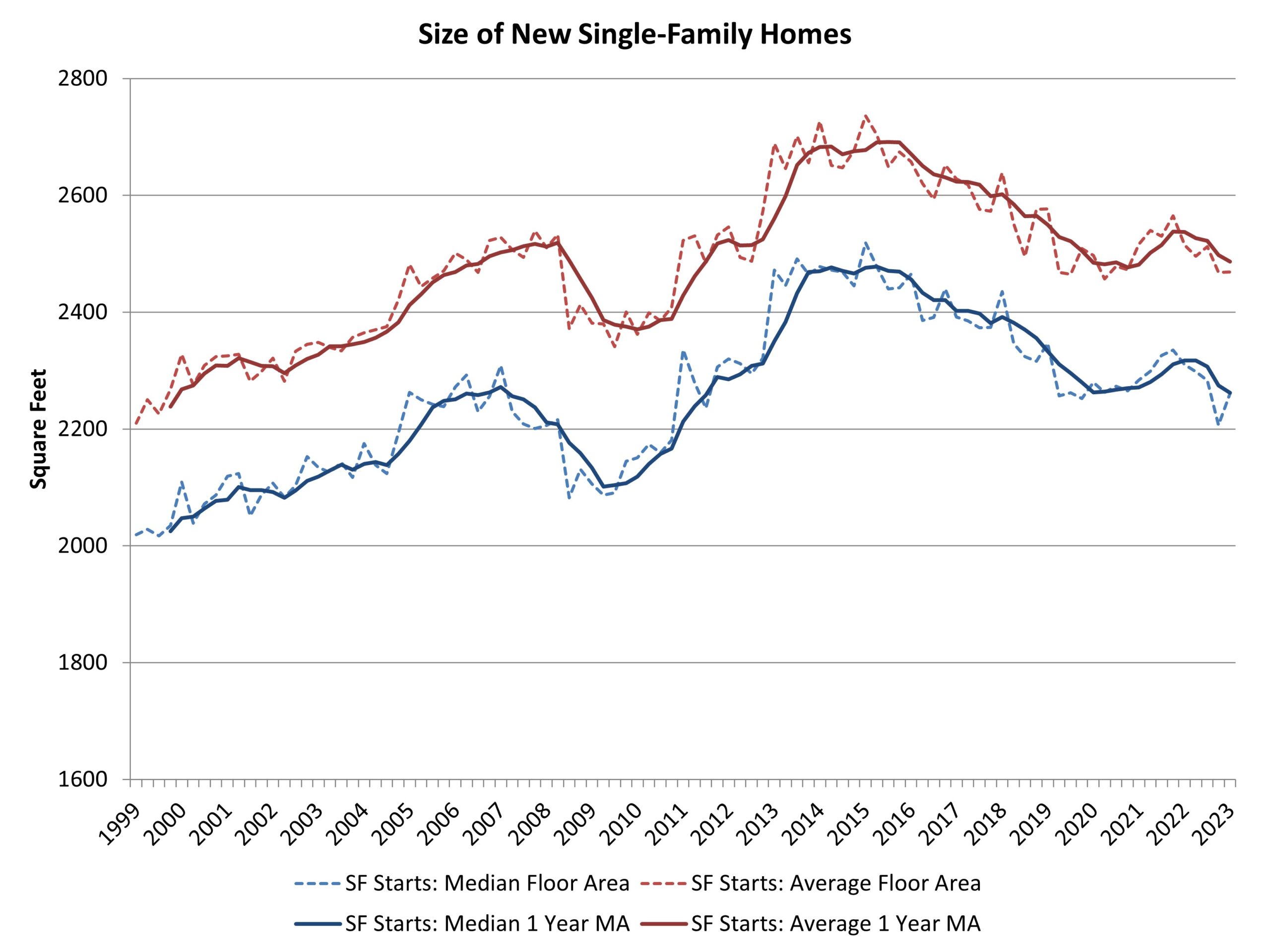

looks like average home sizes have been decreasing over the last ~10 years

Posted on 12/21/23 at 2:13 pm to hubertcumberdale

quote:

quote:

According to SSA.Gov, annual wage growth was 3.27% over 20 years.

According to your chart, annual home appreciation is 3.5%.

We have a 31 page thread because people want 0.23% annual difference to be categorized as "significant" and unlike any burden ever carried by a previous generation.

Thanks for the supporting chart by the way.

Average home cost in 2003 = $198,000

Average home cost in 2023 = $431,000

this is a 118% increase

Average wage in 2003 = $16/hr

Average wage in 2023 = $29/hr

this is a 81% increase

so, no its not 0.27% or whatever random number you keep mentioning, but the delta over the last 20 years bw average new home price and average wages is 36%

There is conflicting data.

But let's use your numbers.

Over the last 20 years, home prices have averaged 4% annual growth.

Wage growth is 3.29%.

The gap is 0.71% per year over the 20 years.

That includes an uncommon 3 year run in home prices at 14% per year (which could falter in the near future depending upon unemployment).

So the argument is that home prices outpaced wages by 0.27% per year over 20 years.

Stretch that average out over 23 years and you are looking at closer to a 0.7% per year gap.

So there are the facts.

I don't know how any first time homebuyers do it (despite the fact that half of the home purchases last year were first time homebuyers).

God bless you all in your struggle. To expect or hope anything better is:

Posted on 12/21/23 at 2:16 pm to meansonny

quote:

Over the last 20 years, home prices have averaged 4% annual growth.

Based on FRED data, Home prices have increased (on average, last 20 years) annually 5.1% where wages have increased annually 3.1% which is a 2% annual delta so 6.4x of your figure of 0.27%

From 2000 - 2020 home prices outpaced wages by 39%

I agree its nuts

This post was edited on 12/21/23 at 2:20 pm

Posted on 12/21/23 at 2:22 pm to hubertcumberdale

quote:

your math aint mathin too well

Everyone has a different data source (i used SSA.gov's annual average income).

But let's use math on your post here.

$163200 to $329,000 is about 3.7% annual growth over 20 years.

$14.75 to $24 is 2.57% annual growth over 20 years.

You have a gap of 1.13% per year.

So your struggle is based on a compounding deficit of 1.13% per year.

Posted on 12/21/23 at 2:24 pm to hubertcumberdale

quote:

Based on FRED data, Home prices have increased (on average, last 20 years) annually 5.1%

Everyone is using different data sources and all of them are different. Lol

Nobody is showing their math except me, though.

Posted on 12/21/23 at 3:02 pm to hubertcumberdale

Ultimately all great data points, but to be as accurate as possible, you'd have to separate wage by age, look up average age of a first time homebuyer and track that way. You might also want to look at average cost of a starter home specifically. Comparing averages across all the segements and population will skew numbers upwards is my guess.

Recent data suggests the average first-time buyer is 36 years old (2022 data). For reference in 1973 it was 30 years old and 32 in 2003.

Avg hourly wage for a 36 year old equals $63k/yr in Q3 of 2023. (so right above $30/hr)

sources:

LINK

LINK /

An article from July '23 suggests that the median starter home price in June was $242,000.

Assuming a 20% downpayment, someone would need to save $50k.

With a $63k salary, take home is about 48k (a little less but I'm rounding up). Take home is $4k a month.

Rent: $1,800

Groceries: $500

Water/Gas/Electric Utilities: $300

Student Loans: $300 (using national average)

Gas: $200 (assuming one tank of gas every week)

Car insurance on your beater: $100

Cell Phone: $75

Internet: $50

Renter's insurance: $30

Total expenses w no "fun" stuff. No cable, no streaming, no coffee, no dining out: $3,360. That leaves $600 a month for savings, incidentals, etc.

This does not account for childcare (average first-time parent is 27.6), doctor's visits, or any discretionary spending. This also assumes no pets. Since very few people live a life without any discretionary income, let’s assume you spend a little bit of your surplus on fun stuff so you don’t unalive yourself from depression. You have a surplus of $200/month and you pray nothing goes wrong because that’ll quickly drain what little you can save

For simplicity's sake, let's assume your spouse stays home to help save on childcare but works a part-time job bringing in an additional $400/month and you can put it all into savings - it would take you 10 years to save up for a downpayment assuming homes do not continue to increase in price.

Want to argue that your spouse should work fulltime? Okay let's do it!

Your spouse works full-time and brings in $2800/month, but now you are paying $1600/month in childcare and need a second car. So let's say you get a cheap car note at $300, another $200 in gas and another $100 in insurance, so they are clearing $600 instead of $400. Now it'll take 6.5 years to save up - again - assuming no increase in purchase price, interest rates, etc. This also assumes no other expense increases in that timeframe ( )

)

We aren't saying it isn't possible, it's just freaking hard for the Average Joe. Of course for most OT ballers, we can buy a new house every other year.

Recent data suggests the average first-time buyer is 36 years old (2022 data). For reference in 1973 it was 30 years old and 32 in 2003.

Avg hourly wage for a 36 year old equals $63k/yr in Q3 of 2023. (so right above $30/hr)

sources:

LINK

LINK /

An article from July '23 suggests that the median starter home price in June was $242,000.

Assuming a 20% downpayment, someone would need to save $50k.

With a $63k salary, take home is about 48k (a little less but I'm rounding up). Take home is $4k a month.

Rent: $1,800

Groceries: $500

Water/Gas/Electric Utilities: $300

Student Loans: $300 (using national average)

Gas: $200 (assuming one tank of gas every week)

Car insurance on your beater: $100

Cell Phone: $75

Internet: $50

Renter's insurance: $30

Total expenses w no "fun" stuff. No cable, no streaming, no coffee, no dining out: $3,360. That leaves $600 a month for savings, incidentals, etc.

This does not account for childcare (average first-time parent is 27.6), doctor's visits, or any discretionary spending. This also assumes no pets. Since very few people live a life without any discretionary income, let’s assume you spend a little bit of your surplus on fun stuff so you don’t unalive yourself from depression. You have a surplus of $200/month and you pray nothing goes wrong because that’ll quickly drain what little you can save

For simplicity's sake, let's assume your spouse stays home to help save on childcare but works a part-time job bringing in an additional $400/month and you can put it all into savings - it would take you 10 years to save up for a downpayment assuming homes do not continue to increase in price.

Want to argue that your spouse should work fulltime? Okay let's do it!

Your spouse works full-time and brings in $2800/month, but now you are paying $1600/month in childcare and need a second car. So let's say you get a cheap car note at $300, another $200 in gas and another $100 in insurance, so they are clearing $600 instead of $400. Now it'll take 6.5 years to save up - again - assuming no increase in purchase price, interest rates, etc. This also assumes no other expense increases in that timeframe (

We aren't saying it isn't possible, it's just freaking hard for the Average Joe. Of course for most OT ballers, we can buy a new house every other year.

This post was edited on 12/21/23 at 8:06 pm

Posted on 12/21/23 at 4:04 pm to meansonny

quote:

Based on FRED data, Home prices have increased (on average, last 20 years) annually 5.1%

Everyone is using different data sources and all of them are different. Lol

Nobody is showing their math except me, though.

its really quite simple

New home 2020 = $329,000

New home 2000 = $163,200

FRED

($329,000 - $163,200) / $163,200 = +102%

102% / 20 years = 5.1% annual growth

This post was edited on 12/21/23 at 4:15 pm

Posted on 12/21/23 at 9:20 pm to madamsquirrel

“Our employees keep getting run over at work!”

Posted on 12/21/23 at 9:24 pm to alexahet

quote:

Assuming a 20% downpayment, someone would need to save $50k.

FHA - 3.5% down

Posted on 12/21/23 at 9:29 pm to GreatLakesTiger24

I bought my house at 2.50% interest and I was curious about how much that was worth. So I took the difference in what I'd pay monthly under current market rates (7% I think), subtracted my actual payment from that, and treated that as a cash flow, for which I calculated the present value.

It worked out to a little over $100,000. You can't really include "favorably priced debt" on a personal balance sheet, I guess, but it is a little crazy that lucky timing can translate into something with that high of a present value.

It worked out to a little over $100,000. You can't really include "favorably priced debt" on a personal balance sheet, I guess, but it is a little crazy that lucky timing can translate into something with that high of a present value.

Posted on 12/22/23 at 9:14 am to Dawgfanman

Sure but does that then make the mortgage payment unattainable with the higher loan plus PMI? I haven’t had my coffee so I’m not about to do the math right now.

I can also tell you that in some markets, doing an FHA puts you at a disadvantage

I can also tell you that in some markets, doing an FHA puts you at a disadvantage

Posted on 1/14/24 at 1:10 pm to GreatLakesTiger24

Long thread, so maybe this has been covered, but...

Are the median priced homes being bought by medium income households? I'd guess not. Most of the lower income singles/families are renting. So I'd expect home sales are to people above the median income.

I think we'd need to some history of the medium household income of those who bought median priced homes in each year.

Are the median priced homes being bought by medium income households? I'd guess not. Most of the lower income singles/families are renting. So I'd expect home sales are to people above the median income.

I think we'd need to some history of the medium household income of those who bought median priced homes in each year.

Posted on 1/14/24 at 1:15 pm to hubertcumberdale

quote:

its really quite simple

New home 2020 = $329,000

New home 2000 = $163,200

FRED

($329,000 - $163,200) / $163,200 = +102%

102% / 20 years = 5.1% annual growth

No, 5.1% annual growth is... +170%.

For +102%, it's just ~ 3.6%

1.036^20 = ˜ 2.03 (103%)

Posted on 1/14/24 at 1:55 pm to alajones

quote:

Also, I’ve been saying for years that there are an assload of affordable houses, they’re just in neighborhoods where people don’t want to live. Addressing this issue would bring housing prices down also.

Let me guess, you own a home in a safe neighborhood? Everyone who says this always puts it off on others. You want to put your family in a non safe area?

Popular

Back to top

1

1