- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 9/28/20 at 9:02 pm to 3D

quote:

XOM has been dead money for me for almost 10 years. Even with the dividend, the account goes down every year.

Same here, I don’t bother selling, I’m just praying for a miracle.

Posted on 9/29/20 at 7:38 am to cgrand

quote:

what is the opportunity cost of investing in O&G now rather than waiting for oil prices to recover? Your money sitting idle in XOM and CVX could be used elsewhere on stocks that are gaining now

This is a good point. The sector is not a large part of my portfolio currently but I plan to increase buys of CVX depending on performance. CVX is paying 7% dividend, XOM is closer to 10% currently so I wouldn’t say my money is sitting idle.

CVX is so beaten down it could gain 20% and still be below the 200 ma long term downward trend. A return to the highs in June would be about a 40% gain. The case for owning the stock is the dramatic downturn in US drilling and US oil production and a recovery in the world economy.

It’s not like this hasn’t happened before. The oil business is a boom and bust business, always has been.

Posted on 9/29/20 at 9:38 am to 3D

I just wish someone would buy them out, and clean-out upper management. This has been an underperformer in my portfolio.

This post was edited on 9/29/20 at 9:49 am

Posted on 9/29/20 at 10:50 am to TDFreak

quote:

I just wish someone would buy them out, and clean-out upper management. This has been an underperformer in my portfolio.

You want someone to buy out XOM? They are literally the biggest oil company in the world

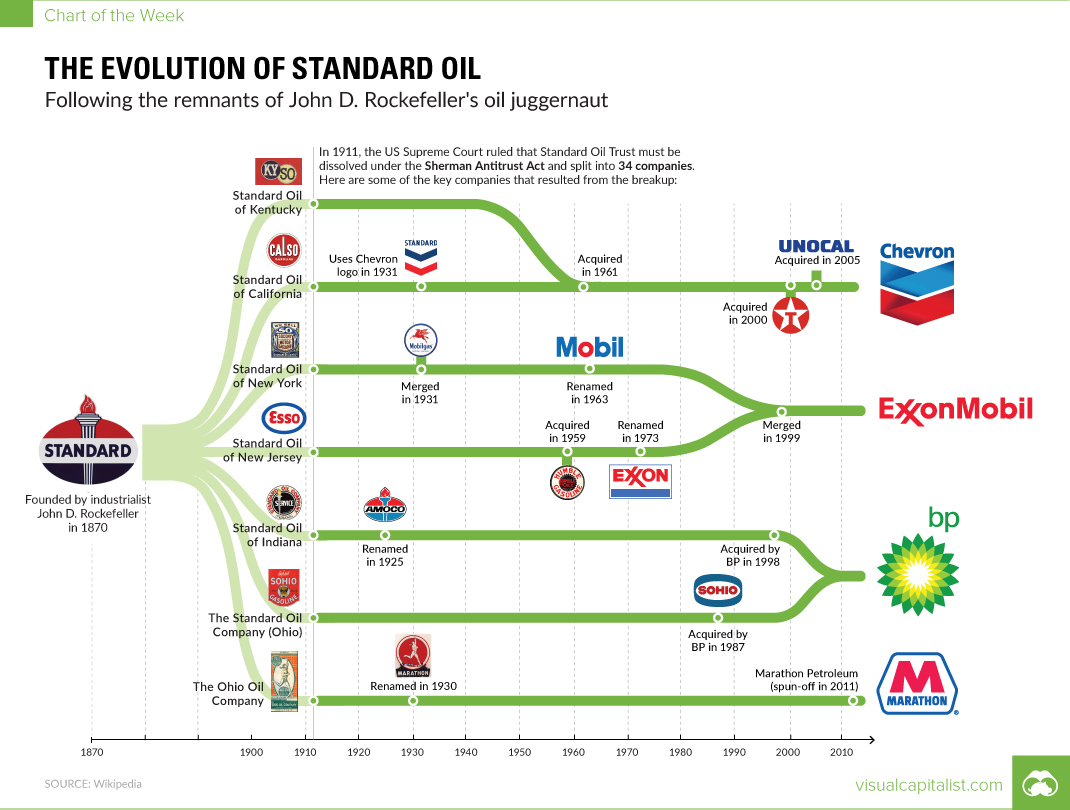

LINK

This post was edited on 9/29/20 at 10:51 am

Posted on 9/29/20 at 12:51 pm to hubertcumberdale

Yeah man! And make Trevor Milton the CEO! I hear he’s available now! He’d fit right in on this clown show!

Posted on 9/29/20 at 2:44 pm to Auburn1968

After seeing everything Exxon Mobile has done these past few months I don’t think I’ll ever want to apply for a job there. No long term stability

Posted on 9/29/20 at 3:30 pm to tigersfan1989

That is every company now.

Posted on 9/29/20 at 3:33 pm to GREENHEAD22

Every OG has made steep cuts... most steeper than XOM

Posted on 9/29/20 at 3:34 pm to tigersfan1989

quote:

Exxon Mobile

ExxonMobil

The oil industry and most industries have always been that way. What industry would you rather work in, automotive? steel? airline? banking? paper? anything that is manufacturing? How often do you read headlines on their layoffs?

Incidentally -

“ Prolonged closures at Disney's California-based theme parks and limited attendance at its open parks has forced the company to lay off 28,000 employees across its parks, experiences and consumer products division.”

Historically oil industry jobs and their support related sectors have some of the highest paying salaries. With only a high school diploma you can make 6 figures working in a plant. Yes there is down sizing every 15 years or so (and those are generally salaried positions), but it always comes back. In the late 1980’s and early 1990’s there were lots of small refineries and companies closing shop. By the end of the 1990’s the majors were picking up the gap and expanding. It’s cyclic. Even with more electric vehicles, it will be back.

This post was edited on 9/29/20 at 4:05 pm

Posted on 9/29/20 at 6:19 pm to LSURussian

quote:

XOM's debt-to-equity ratio as of 6/30/20 was 37% and you think that's a "lot" of debt?

I know that for the first 6 months of 2020 XOM spent $18 billion and only generated $6 billion. They used debt to plug that hole. Are oil prices better now than they were in the first 6 months of the year on average? Do you think XOM is doing layoffs, cutting benefits and reducing spending because they think it will get better soon?

XOM won't be filing for bankruptcy but it also isn't worth anywhere close to $40 a share. The financial reports are there for all to see. Considering they aren't making money upstream or downstream they took on a lot of debt.

This post was edited on 9/29/20 at 8:38 pm

Posted on 9/29/20 at 7:41 pm to 8thyearsenior

Pretty sure their chemicals company is making money.

Upstream should be close to break even covering dividends with current oil price.

Still 2 years away from good times again I would guess

Upstream should be close to break even covering dividends with current oil price.

Still 2 years away from good times again I would guess

Posted on 9/29/20 at 11:07 pm to jimjackandjose

quote:

Pretty sure their chemicals company is making money.

Chemicals combined with downstream made around $980 million in the first half of the year.

quote:

Upstream should be close to break even covering dividends with current oil price.

Why do you think that? Average price for the first half of this year was about $37 a barrel, I'd guess it has averaged $39 since.

Posted on 9/30/20 at 8:33 am to jimjackandjose

Gas prices in NYC are cheaper than I've seen in ages, but the heavy traffic is coming back even though de Blasio is trying hard to turn NY into Detroit.

Posted on 9/30/20 at 11:39 am to hubertcumberdale

quote:

They are literally the biggest oil company in the world

Saudi Aramco says hello...

Posted on 9/30/20 at 2:17 pm to 8thyearsenior

I’ve heard their ability to cover dividends is in the 40ish range per barrel.

With the cuts made since first half, my guess is 3Q and 4Q will be close at 40 per barrel oil

With the cuts made since first half, my guess is 3Q and 4Q will be close at 40 per barrel oil

Posted on 9/30/20 at 2:42 pm to abitabrewed4LSU

What’s the thought on Chevron?

Posted on 9/30/20 at 2:55 pm to jimjackandjose

We’ll find out in about a month. They had about $10b in cash on hand to cover expenses and said they wouldn’t borrow any more money. I agree that they likely will be fine at 40-45 in the short term but they’re going to start losing people and production will drop if they don’t spend more. 55 is probably the sweet spot for Exxon with their current suite of assets.

Posted on 9/30/20 at 3:08 pm to C

quote:

55 is probably the sweet spot for Exxon

Any way one of you guys that follow this stuff might can make a prediction on how far down the road before we see $55 oil?

Posted on 9/30/20 at 3:28 pm to notiger1997

Well you have decline curves in production so if you’re not drilling, you’re production is going to deplete. I don’t think it will go up unless consumption reaches pre COVID levels in the next 12 months or we see overall supplies remain negative at year end and into the 1Q next year. Otherwise probably 2021 or 22 before you see it. What wouldn’t surprise me is to see us quickly go from 50 to 70+. That would mean the fracking activity in the US can’t make up the supply difference and Saudi isn’t willing to pump more.

Popular

Back to top

2

2