- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Will the housing market "crash"?

Posted on 5/19/22 at 7:45 pm

Posted on 5/19/22 at 7:45 pm

If so, how much and when?

If not why?

If not why?

This post was edited on 5/19/22 at 7:48 pm

Posted on 5/19/22 at 7:57 pm to themasterpater

No idea and the definition of crash is variable.

Posted on 5/19/22 at 7:58 pm to themasterpater

I think it will level out and may even pull back a little. I don’t foresee any type of crash coming though. Inventory remains too low.

Posted on 5/19/22 at 8:13 pm to themasterpater

No. We massively underbuilt for 12 years after the last housing crash. Average age of American is right in the sweet spot for first time home buyers or people moving up to family homes. People moving from wealthy areas to cheaper areas has been a driving force. They will continue to keep prices high, as will Blackrock. Unlike last housing crisis people can actually afford the homes they are living in, so that is not going to cause an inventory glut from pressure selling.

Just my thoughts and I may be way off. In fact, I hope I am off for the NW FL condo market. I think supply is going to keep that market hot.

Just my thoughts and I may be way off. In fact, I hope I am off for the NW FL condo market. I think supply is going to keep that market hot.

This post was edited on 5/20/22 at 9:06 am

Posted on 5/20/22 at 8:13 am to PotatoChip

We are headed towards a recession. Inflation is staggering. JP Morgan is predicting $6/gallon gasoline this Summer. The Fed will continue to raise rates in response to inflation. Lot's of people will not qualify for a mortgage on the house they want. The stock market is taking massive hits and people are seeing their retirement accounts dwindle.

House prices will be forced down.

House prices will be forced down.

Posted on 5/20/22 at 8:19 am to greygoose

quote:

House prices will be forced down.

That would be just fine with me - it would lower my insurance and property taxes.

Posted on 5/20/22 at 1:07 pm to themasterpater

i hope so

then i can scoop up stuff real cheap for more cash flow from BUY N HOLDS. put flips on back burner obviously if prices crash.

then i can scoop up stuff real cheap for more cash flow from BUY N HOLDS. put flips on back burner obviously if prices crash.

Posted on 5/20/22 at 1:55 pm to themasterpater

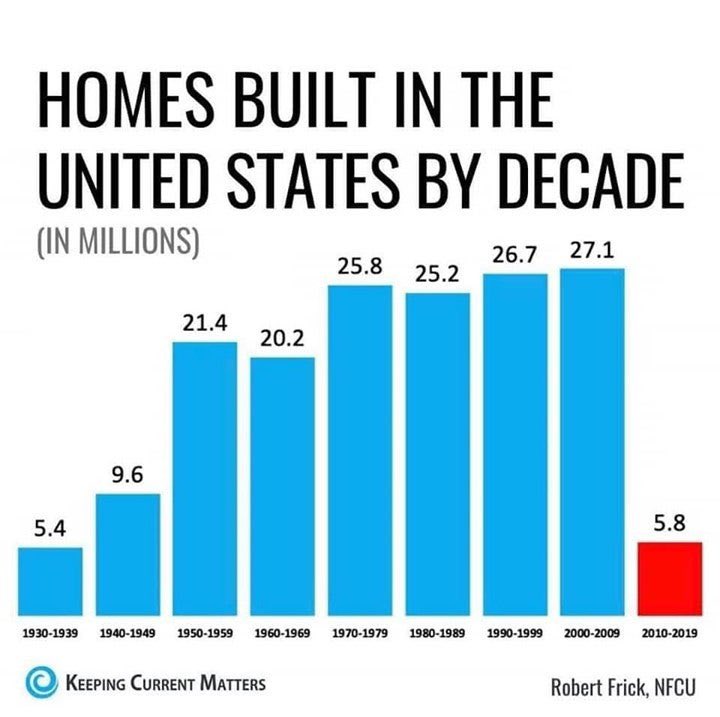

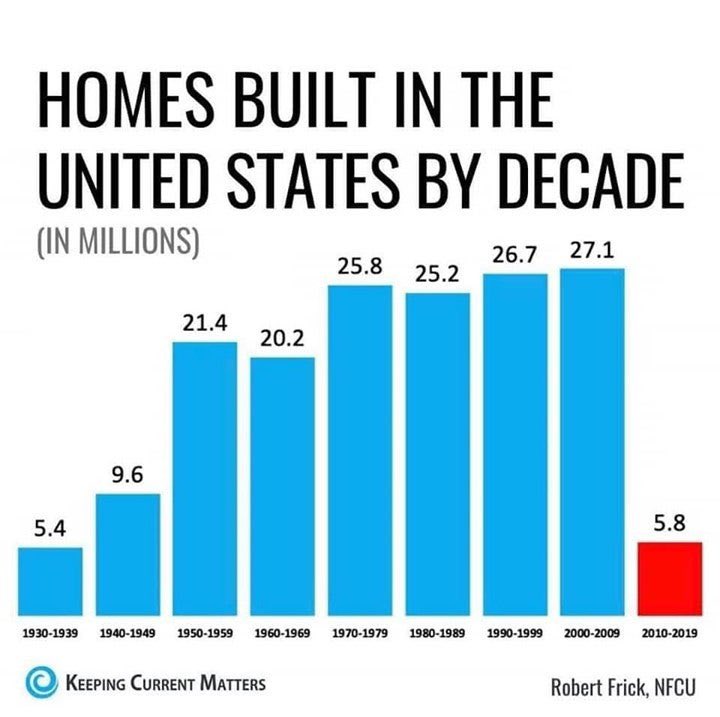

This chart really summarizes why it is unlikely:

Posted on 5/20/22 at 2:08 pm to buckeye_vol

Wow I did not realize that builds were that far behind. Makes me feel a little bit better.

Posted on 5/20/22 at 2:16 pm to buckeye_vol

Posted on 5/20/22 at 2:33 pm to buckeye_vol

Posted on 5/20/22 at 2:37 pm to themasterpater

I think we are already in a correction with more shoes to drop

If the increase in rates doesn’t put the brakes on inflation then some real bad things could happen. We’ve already seen a slowdown in the rate of increase in inflation so the rate increases appear to be working

If the increase in rates doesn’t put the brakes on inflation then some real bad things could happen. We’ve already seen a slowdown in the rate of increase in inflation so the rate increases appear to be working

Posted on 5/20/22 at 2:41 pm to themasterpater

IMO it will not crash.

Up until now we have little supply and extreme demand. That has led to crazy prices(30% increase in value year over year). Now we still have little supply with decreased demand, but still demand which will result in year over year value increases that aren't outrageous.

IMO prices of homes won't stay even or drop unless demand craters (8-10% interest rates) or supply increase.

But supply won't increase from people selling their homes because

A) Rent is also stupid high right now

B) Everyone has a historicly low interest rate

So the only way supply will increase is if more homes are built. But with high material cost and supply chain issues, combined with slowing demand, nobody wants to start ramping up home production. Which will in turn keep demand from falling too far. Thus keeping home prices from crashing.

And as another poster pointed out, the majority of individuals who bought their home can actually afford them due to the changes in mortgage qualification. So in order to cause mass foreclosures we would have to push past a recession and fall into a full blown depression.

Up until now we have little supply and extreme demand. That has led to crazy prices(30% increase in value year over year). Now we still have little supply with decreased demand, but still demand which will result in year over year value increases that aren't outrageous.

IMO prices of homes won't stay even or drop unless demand craters (8-10% interest rates) or supply increase.

But supply won't increase from people selling their homes because

A) Rent is also stupid high right now

B) Everyone has a historicly low interest rate

So the only way supply will increase is if more homes are built. But with high material cost and supply chain issues, combined with slowing demand, nobody wants to start ramping up home production. Which will in turn keep demand from falling too far. Thus keeping home prices from crashing.

And as another poster pointed out, the majority of individuals who bought their home can actually afford them due to the changes in mortgage qualification. So in order to cause mass foreclosures we would have to push past a recession and fall into a full blown depression.

This post was edited on 5/20/22 at 2:45 pm

Posted on 5/20/22 at 2:52 pm to themasterpater

Not a chance it "crashes"

Posted on 5/20/22 at 3:03 pm to Bayou_Tiger_225

There are a couple things that might change values quickly.

One, if the stock market craters a lot of the boomers who own second or third houses may sell to maintain their approximate standards of living. A lot of boomers seem to have actually bought properties since the 2020 stimulus money (when you would normally expect people in their age group to be downsizing)

Two, if there's any investor panic the effect of a group of properties being sold all at once will put abnormal downward pressure on home prices. Zillow found a willing buyer for a large chunk of properties recently. A fair chunk of the investors who bought into funds which have been buying properties are not big fish - and retail investors are kinda predictable when it comes to panic selling when their investments start to take on water.

As a percentage of total income property costs are historically elevated. I don't know how or when that corrects but I think driving those prices down is a significant goal of the Powell fed hikes.

One, if the stock market craters a lot of the boomers who own second or third houses may sell to maintain their approximate standards of living. A lot of boomers seem to have actually bought properties since the 2020 stimulus money (when you would normally expect people in their age group to be downsizing)

Two, if there's any investor panic the effect of a group of properties being sold all at once will put abnormal downward pressure on home prices. Zillow found a willing buyer for a large chunk of properties recently. A fair chunk of the investors who bought into funds which have been buying properties are not big fish - and retail investors are kinda predictable when it comes to panic selling when their investments start to take on water.

As a percentage of total income property costs are historically elevated. I don't know how or when that corrects but I think driving those prices down is a significant goal of the Powell fed hikes.

Posted on 5/20/22 at 3:13 pm to Bayou_Tiger_225

Refinances are over for the foreseeable future obviously. New home purchases (in south Louisiana) as recorded in our parishes are down dramatically, by as much as 50% in April and rising to 70% year to year so far in May. People are not closing on homes here right now.

This is set against rising home prices, increased demographic demand for homes, rising interest rates, full employment, historic inflation, a major correction in the stock market, a recession, political instability, a printing press that goes brrrrr, a potential expanding war in Europe, etc.

This one has it all. It's weirder than usual. So when I look at it I think the only thing that can "crash" the market is prolonged stagflation and until Unemployment becomes high, I just don't see a housing crash. In short, until we have a high unemployment event, I don't see a crash. I see a crazy slowdown and a lot less movement and things staying sideways.

This is set against rising home prices, increased demographic demand for homes, rising interest rates, full employment, historic inflation, a major correction in the stock market, a recession, political instability, a printing press that goes brrrrr, a potential expanding war in Europe, etc.

This one has it all. It's weirder than usual. So when I look at it I think the only thing that can "crash" the market is prolonged stagflation and until Unemployment becomes high, I just don't see a housing crash. In short, until we have a high unemployment event, I don't see a crash. I see a crazy slowdown and a lot less movement and things staying sideways.

Posted on 5/20/22 at 3:15 pm to Diffusedsmoke

quote:I guess I just assumed the chief economist at the Navy Federal Credit Union would have accurate data.

That chart summarizes why people should check their sources.

That said, the 2010 data are relatively close, and there were about as many homes built in the 4 years leading up to the crash as there were than the decade that followed.

So we’re still critically short in housing.

Posted on 5/20/22 at 5:16 pm to themasterpater

I don’t think a crash, but a correction. Our affiliated real estate products have bloomed since 2018 with eye popping growth. The business has slowed since about January so I think a correction is probable

Posted on 5/20/22 at 7:32 pm to themasterpater

Nope there is a serious lack of supply across the United States and with interest rates continuing to rise the supply will only continue to tighten even more because people aren't going to be moving out of their houses because if they sell the house they move into won't be as nice due to the higher interest rates.

You also have to account for the 500k people a month moving into the US which is moving a lot of properties into the rental market.

If there is a soft spot it will be in the 2nd home and AirBNB/VRBO space as people will not be traveling as much the higher these gas prices go up.

You also have to account for the 500k people a month moving into the US which is moving a lot of properties into the rental market.

If there is a soft spot it will be in the 2nd home and AirBNB/VRBO space as people will not be traveling as much the higher these gas prices go up.

Popular

Back to top

27

27