- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

What’s the outlook on the housing market?

Posted on 11/25/22 at 8:49 am

Posted on 11/25/22 at 8:49 am

We screwed up and didn’t pull the trigger on moving back when rates were low. Now we’ve added a baby to the equation and it’s time to get something bigger. Do we need to suck it up and wait a year or so for the price of homes to off-set the rates? Or is this market here to stay for a bit?

Posted on 11/25/22 at 8:51 am to GeauxTime9

Prices coming down. Availability and rates going up.

Posted on 11/25/22 at 9:13 am to GeauxTime9

Massive foreclosures incoming!! Keep saving your money and then strike in 2 years!

Posted on 11/25/22 at 9:48 am to GeauxTime9

This is the peak of the bubble.

High rates and high prices. Prices will catch up soon.

High rates and high prices. Prices will catch up soon.

Posted on 11/25/22 at 12:33 pm to GeauxTime9

I believe the housing market is highly localized. We are seeing houses sit on the market for longer but prices haven’t come down yet. The buyer pool shrank dramatically and immediately with the rate changes.

Posted on 11/25/22 at 1:06 pm to lynxcat

quote:

I believe the housing market is highly localized

this is of course always true

but

7% rates as compared to 3% in just a year is going to put pricing pressure on sellers OTHER than those few who are still willing to swoop in with cash

spring 2023 will tell us a lot (for instance - how much in y/y terms and as % of total sellers lower their prices and how much does that bring buyers off the sidelines?)

it's a weird time right now - calm before the storm IMO

Posted on 11/25/22 at 1:12 pm to GeauxTime9

Prices have been dropping in BR for a few months now.. but I do think a year from now could be a better time to buy.

Posted on 11/25/22 at 1:48 pm to GeauxTime9

Rapidly fading. Give it a few months, maybe a year, to sink in. Sellers who are serious will be pulling the trigger by then for sure.

If you wanted to be proactive, though, just cold call the owners of houses you like and make low ball offers. All they can do is say no.

Posted on 11/25/22 at 3:03 pm to Shankopotomus

Dallas area isn’t seeing the prices fall off yet but we are finally out of a 20+ competitive bid environment for a house 5 days on the market. We went on multiple years of selling above ask so houses selling at list and sitting on the market for 45-60 days is healthy to see.

Posted on 11/25/22 at 4:27 pm to Decisions

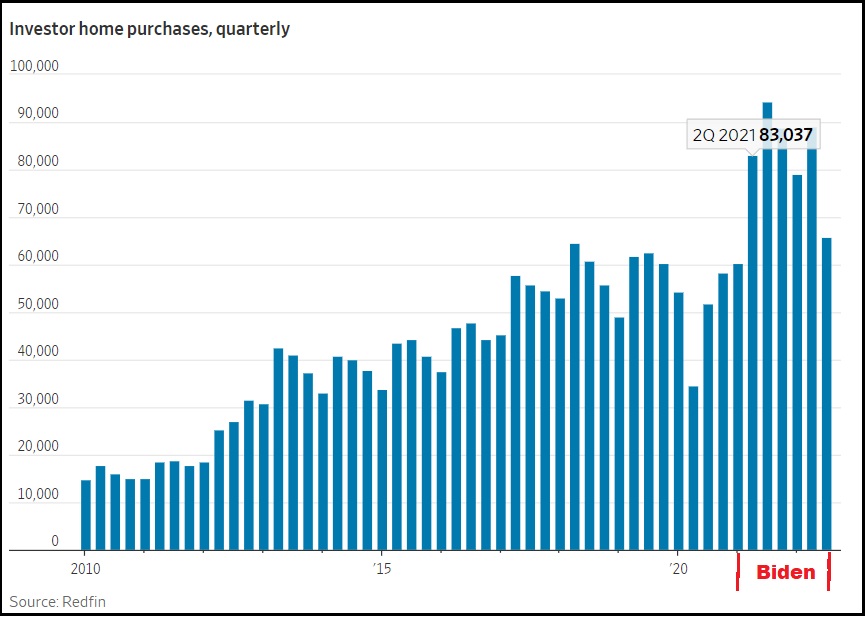

Not being critical but the chart is apparently current date (Nov 2022) and does not depict 2022 recession - makes the chart suspect if they are politicizing facts and data.

Posted on 11/25/22 at 6:27 pm to roadkill

Not being critical but some people can’t read charts

Posted on 11/25/22 at 11:51 pm to GeauxTime9

We’re still several years away from adequate inventory levels. Existing Home prices may not exponentially increase like they have the last 3 years, but should rather stabilize, and still increase, albeit at a lower rate.

Posted on 11/26/22 at 1:32 am to GeauxTime9

As a buyer, winter is generally a better time for you. Inventory is coming up so selection is going to be better.

Builder’s are discounting prices and offering incentives. Sellers are having to drop prices because of competition from more inventory. Now through February should be good, but don’t wait past another rate hike by the Fed.

Builder’s are discounting prices and offering incentives. Sellers are having to drop prices because of competition from more inventory. Now through February should be good, but don’t wait past another rate hike by the Fed.

Posted on 11/26/22 at 1:48 am to GeauxTime9

I messed up to. We are looking to move, house is getting to small. Passed on a house next to her brother and close to her mom. Prices were going up and it was right before it got real crazy. I thought the price was a little to high and it wasn't where we really wanted to be. It would of been a nice upgrade though. 9 months after that the same houses were 100k more. I was like WTF. Kinda stuck now. Still looking for the right piece of land to build on. That won't really drop in price much.

Posted on 11/26/22 at 5:34 am to GeauxTime9

I've got a new born and balancing our next move, too.

3 factors I'm looking at in Texas.

Rates

Home prices

Buyer competition/inventory

I think Q423 - Q124 will be the time to make a move.

3 factors I'm looking at in Texas.

Rates

Home prices

Buyer competition/inventory

I think Q423 - Q124 will be the time to make a move.

Posted on 11/26/22 at 7:53 am to Displaced

quote:

Prices coming down

Not everywhere. Who is selling there house with a 3% rate for a more expensive home at a 6%?

quote:

Availability and rates going up.

Rates have dropped big and there is still a massive inventory issue which will be worse when rates are back below 5%

Posted on 11/26/22 at 8:07 am to GeauxTime9

At this point houses are actually less affordable (because of interest rates) than they were in the first half of 2022 when prices peaked.

The median housejold income and costs of ownership are just mismatched with the percentage of total income a buyer has to devote to mortgage etc almost 40% of total take home.

The median housejold income and costs of ownership are just mismatched with the percentage of total income a buyer has to devote to mortgage etc almost 40% of total take home.

Posted on 11/26/22 at 10:07 pm to Cobra Tate

quote:

Not everywhere. Who is selling there house with a 3% rate for a more expensive home at a 6%?

Whoops! We accidentally did. Albeit, we got locked in at 5.375%.

Posted on 11/27/22 at 8:08 am to GeauxTime9

I think higher rates are going to be here for a while. By that I mean several years and possibly for the foreseeable future.

At the end of the day; the Fed knows what ultimately fueled this bubble and inflation was very low interest rates and effectively free money for a decade plus.

It’s about reshaping America’s relationship with money. Let’s not forget that home loan rates only 30 years ago were often as high as 14%. That’s double todays 7% 30yr. I think we loosen up rates with time; but, we may even see another increase in the short term. Eventually settling back to 4.5-6% in 24’ or beyond.

The other part people don’t seem to talk about is the number of homes selling for cash. In my part of the world (Tampa) almost 60% of home sales are straight cash. All these people claiming a crash is impending are overlooking the fact that in many cases there is no mortgage to become distressed.

So, in your situation I’m still thinking about buying. I agree with others that there will be some better home price bargains next year. As for the rates; lock it in. From a historical perspective they aren’t that high even now; and if they do fall you can always ReFi.

At the end of the day; the Fed knows what ultimately fueled this bubble and inflation was very low interest rates and effectively free money for a decade plus.

It’s about reshaping America’s relationship with money. Let’s not forget that home loan rates only 30 years ago were often as high as 14%. That’s double todays 7% 30yr. I think we loosen up rates with time; but, we may even see another increase in the short term. Eventually settling back to 4.5-6% in 24’ or beyond.

The other part people don’t seem to talk about is the number of homes selling for cash. In my part of the world (Tampa) almost 60% of home sales are straight cash. All these people claiming a crash is impending are overlooking the fact that in many cases there is no mortgage to become distressed.

So, in your situation I’m still thinking about buying. I agree with others that there will be some better home price bargains next year. As for the rates; lock it in. From a historical perspective they aren’t that high even now; and if they do fall you can always ReFi.

Popular

Back to top

12

12