- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Stock Market Performance 1 Year after Entering Bear Market

Posted on 6/14/22 at 8:51 am

Posted on 6/14/22 at 8:51 am

Hold the line, baws. It will get better.

1957 = +31%

1962 = +26.1%

1966 = +24.6%

1970 = +11.8%

1973 = -26.9%

1982 = +30.4%

1987 = +23.2%

2001 = -1.2%

2002 = +7.4%

2008 = -29.1%

2009 = +47.3%

2020 = +59%

One year performance after entering a bear market. Hopefully this isnt like ’73 or ’08, but short term turbulence is part of the game. Let's keep building wealth, MT!!!

1957 = +31%

1962 = +26.1%

1966 = +24.6%

1970 = +11.8%

1973 = -26.9%

1982 = +30.4%

1987 = +23.2%

2001 = -1.2%

2002 = +7.4%

2008 = -29.1%

2009 = +47.3%

2020 = +59%

One year performance after entering a bear market. Hopefully this isnt like ’73 or ’08, but short term turbulence is part of the game. Let's keep building wealth, MT!!!

Posted on 6/14/22 at 8:58 am to WG_Dawg

quote:

when did we enter this one?

I think officially, last Wednesday.

Posted on 6/14/22 at 9:02 am to anc

I like the positivity, but look around at quite literally everything.

Pain is coming.

Pain is coming.

Posted on 6/14/22 at 9:04 am to anc

If you only invest in a bull market...

Posted on 6/14/22 at 9:11 am to thegreatboudini

I dunno man, people are still buying $7 loaded teas left and right here.

Posted on 6/14/22 at 9:31 am to WG_Dawg

quote:

when did we enter this one?

Yesterday officially at close. S&P 500 officially closed over 20% down from it's previous high (back in Jan). If you base the market on that which most probably would being 500 or so largest publicly traded companies.

Bear market just means market is down at least 20% from a previous high.

Posted on 6/14/22 at 9:35 am to anc

The stock market is a Ponzi scheme that boomers invented to get out of paying you a pension

Posted on 6/14/22 at 9:56 am to el Gaucho

A pension technically meets the definition of a Ponzi scheme though..

Posted on 6/14/22 at 10:36 am to skewbs

It seems like 2001 coming down from irrational exuberance but we'll see.

Posted on 6/14/22 at 12:53 pm to Shepherd88

quote:

people are still buying $7 loaded teas left and right here.

Might seem that way, but if 10% of customers stop buying them, the company will notice. You might not because you won’t really see a difference between 10 and 9 people in a store, but I guarantee the company’s accountants will.

Posted on 6/14/22 at 1:04 pm to Shepherd88

quote:

A pension technically meets the definition of a Ponzi scheme though..

Ironically, pension funds invest heavily in stocks and rely on the historical returns of those stocks to remain solvent.

Posted on 6/14/22 at 1:09 pm to StringedInstruments

quote:

Might seem that way, but if 10% of customers stop buying them, the company will notice. You might not because you won’t really see a difference between 10 and 9 people in a store, but I guarantee the company’s accountants will.

This store here is steadily getting 200-250 customers a day. This is purely a discretionary item as well. The kids at the high school have now made it a status symbol based on the flavors they bring to school. So I’ll let this continue to be my recession indicator and report back with the numbers if they start dropping.

Posted on 6/14/22 at 1:31 pm to Shepherd88

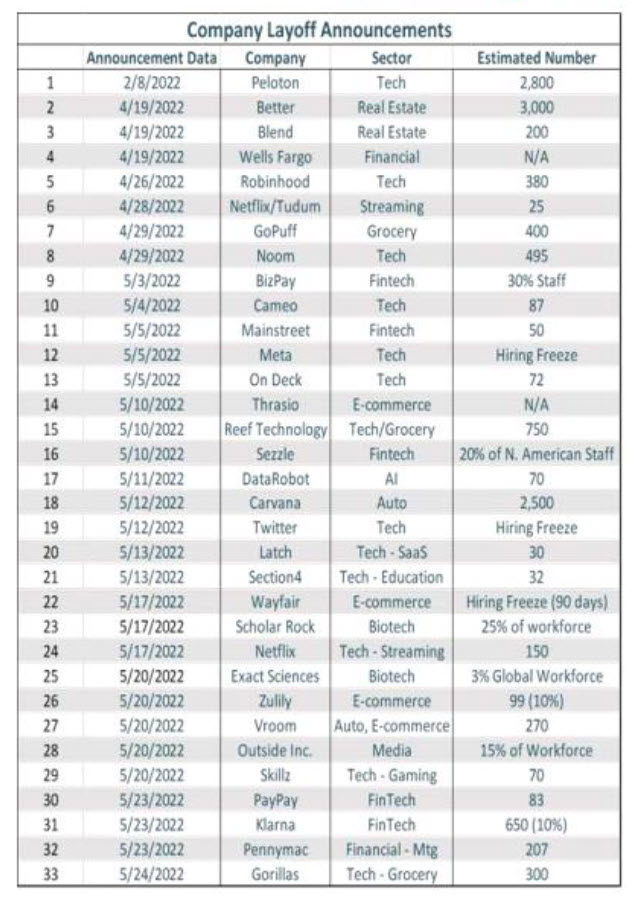

Bear Market always signifies mass layoffs well here is the beginning of the job termination cycle.

Posted on 6/14/22 at 1:48 pm to MrLSU

I can identify like 7 of those companies. I’ve never heard of most of them

Posted on 6/14/22 at 2:07 pm to el Gaucho

F pensions and social security.

I think everyone should be responsible for their own retirement and then taxpayers can stop funding morons who didn’t plan well for the future

I think everyone should be responsible for their own retirement and then taxpayers can stop funding morons who didn’t plan well for the future

Posted on 6/14/22 at 2:08 pm to anc

Biden wasn’t in power then. This is the exception to all previous bear markets because he is an idiot.

Posted on 6/14/22 at 7:18 pm to FlyingTiger1955

quote:

Biden wasn’t in power then. This is the exception to all previous bear markets because he is an idiot.

Between the Covid lockdowns and paying people to stay home and not doing evictions and printing more money in 2 years then in 200. Throw in a major war in Europe, a US administration trying to push green and punish carbon in the middle of a all the down turn…..

This is not like previous bears. Not saying this is a gloom and door scenario, just that “past performance not indicative of future results”.

As always they will be money to be made, but need to weigh the risks and not make rash decisions. Time to be smart and patient for time to make the right move.

Popular

Back to top

7

7