- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

June CPI in line with expectations, core CPI comes in cool.

Posted on 7/15/25 at 8:19 am

Posted on 7/15/25 at 8:19 am

Nothing in this data justifies holding off on rate decreases later in the year, at least in my opinion.

Especially when you dig in to the report and see the only reason cpi came in as expected and not below expectations was because of oil spike during Israel-iran conflict

LINK

Powell himself said the June report would be the most informative

Especially when you dig in to the report and see the only reason cpi came in as expected and not below expectations was because of oil spike during Israel-iran conflict

LINK

Powell himself said the June report would be the most informative

Posted on 7/15/25 at 8:27 am to HailHailtoMichigan!

The rates are keeping inflation in check. What reason is there to cut rates with good job reports other than Americans have become used to and addicted to cheap dept since the 2008 crash.

Posted on 7/15/25 at 8:32 am to HailHailtoMichigan!

Why would we lower rates with the economy supposedly humming along and the biggest reason they havent is citing the tariff wars leading to increased inflation and we just jumped from 2.3-2.4% the last 3 months to 2.7% YoY this month?

Thats not an insignificant jump from where we just were.

Thats not an insignificant jump from where we just were.

This post was edited on 7/15/25 at 8:33 am

Posted on 7/15/25 at 8:33 am to The Boat

I get what you’re saying, but all our competitor nations are lowering their rates.

That introduces opportunity cost

That introduces opportunity cost

Posted on 7/15/25 at 8:41 am to HailHailtoMichigan!

A lot of Americans have near 0% interest rate expectations since that’s what they were for most of 2009-2021. I don’t need to borrow and prefer not getting bent over by the banks for once.

Posted on 7/15/25 at 8:44 am to HailHailtoMichigan!

The last time the Fed lower the rate, market rates went up. Isn't that what actually matters?

Posted on 7/15/25 at 8:55 am to HailHailtoMichigan!

quote:

I get what you’re saying, but all our competitor nations are lowering their rates.

They arent fighting tariff wars with the whole world like we are which are inflationary. We just jumped from 2.3-2.4 last 3 months to 2.7 YoY this month now. This is the opposite of clamoring for rate reductions when we know they want the rate to be as close to 2% as possible. This is exactly the reason Powell has stated why he's hesitant to lower rates. Increasing tariffs can introduce more inflation because those just get passed onto the consumer.

This post was edited on 7/15/25 at 8:56 am

Posted on 7/15/25 at 9:09 am to thunderbird1100

I get that to an extent and I am not arguing for rates to be where they were from 2018,19, etc

But when you compare the current rates to where rates were during previous years of 2.6-3.0% inflation, they are way higher than rates during those cycles.

But when you compare the current rates to where rates were during previous years of 2.6-3.0% inflation, they are way higher than rates during those cycles.

Posted on 7/15/25 at 9:12 am to HailHailtoMichigan!

quote:

But when you compare the current rates to where rates were during previous years of 2.6-3.0% inflation, they are way higher than rates during those cycles.

Again, we werent fighting the world with tariffs back then either. When you introduce a lot of unpredictability, its hard to sit back and say "LOWER RATES!"

It's a lot more comfortable to be "wrong" with keeping higher rates and inflation not ultimately ticking up due to the unpredictability with the world economy than lowering rates because 1 guy wants it and then inflation runs rampant as a result.

It's really as simple as stop the tariff war and they probably would lower rates. It's like telling someone keep going closer to the bonfire, you're fine, as you're unpredictably pouring gasoline on it.

This post was edited on 7/15/25 at 9:15 am

Posted on 7/15/25 at 9:34 am to HailHailtoMichigan!

quote:

I get that to an extent and I am not arguing for rates to be where they were from 2018,19, etc

What hilarious is that the fed rate rose above ~0 for the first time in nearly a decade in 2018/2019. You used that as an example of not wanting rates too low, but those years were the highest rates we'd had in a long time up to that point

Posted on 7/15/25 at 10:17 am to HailHailtoMichigan!

quote:What is the U.S. competing with them for relative to overnight bank-to-bank lending interest rates?

but all our competitor nations

Posted on 7/15/25 at 10:17 am to HailHailtoMichigan!

Not "cool", "cooler than expected". They were expecting an increase of 0.2% and we had an increase of 0.1%. Now, any reason to panic? Of course not. Hell, I would say not even really a reason to be concerned. But, this report does seem to bolster Powell's position that maintaining a "wait and see" approach is currently better than either a rate increase or decrease.

Posted on 7/15/25 at 10:19 am to HailHailtoMichigan!

quote:COVID recovery period.

current rates to where rates were during previous years of 2.6-3.0% inflation, they are way higher than rates during those cycles.

Posted on 7/15/25 at 10:27 am to HailHailtoMichigan!

quote:

when you compare the current rates to where rates were during previous years of 2.6-3.0% inflation, they are way higher than rates during those cycles.

Well that’s simply untrue.

In the late 90s we saw inflation under 2% with FFR over 5%

Posted on 7/15/25 at 10:57 am to HailHailtoMichigan!

quote:

But when you compare the current rates to where rates were during previous years of 2.6-3.0% inflation, they are way higher than rates during those cycles.

And our debt-to-GDP ratio was lower, FAR lower depending on what time period(s) you are talking about.

Our economy is addicted to not just federal spending, but federal deficit spending. That's also keeping inflation from being tamed as it's an introduction of over a trillion in new dollars into the economy each year. This has the result of needing higher rates for longer periods, at least until deficit spending begins getting seriously curtailed.

Posted on 7/15/25 at 11:17 am to castorinho

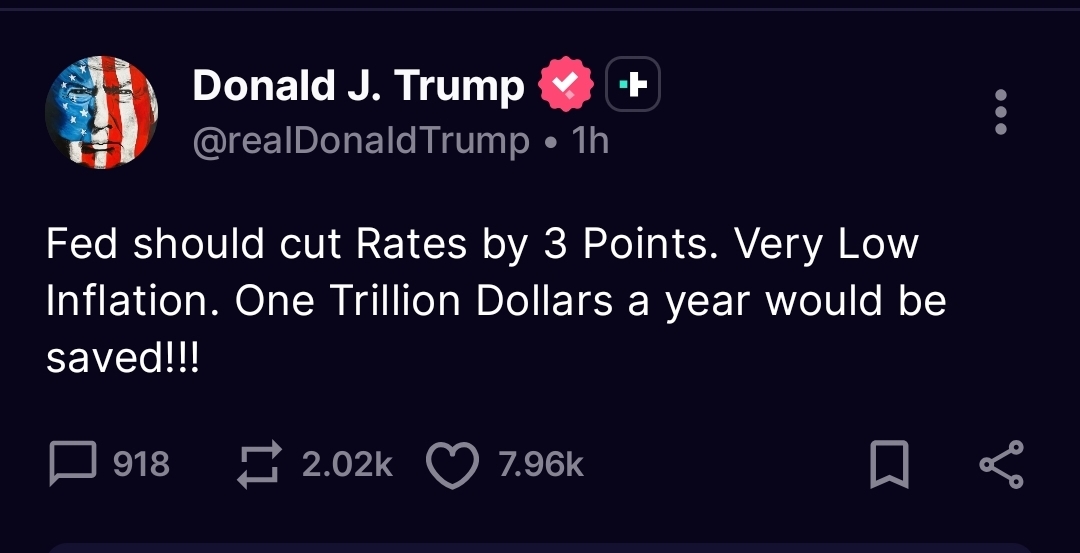

lol, is that a recent post by him? Three points would be a disaster for all the progress we've made on inflation. I agree that a little cut would be beneficial, but don't use a chainsaw when a scalpel is needed.

Posted on 7/15/25 at 11:50 am to BottomlandBrew

I was watching CNBC this morning and they had an ex fed governor claiming the fed should cut 3 points. Seems like he is lobbying for the next chairman job. Trump probably was told about it and posted.

Posted on 7/15/25 at 1:00 pm to BottomlandBrew

quote:

lol, is that a recent post by him? Three points would be a disaster for all the progress we've made on inflation. I agree that a little cut would be beneficial, but don't use a chainsaw when a scalpel is needed.

Looks like it was a Truth Social post from today at 9:08am:

LINK

This post was edited on 7/15/25 at 1:01 pm

Posted on 7/15/25 at 1:49 pm to thunderbird1100

quote:Well, I'm not so concerned about interest rates vis-a-is tariffs and inflation.

They aren't fighting tariff wars with the whole world like we are which are inflationary.

M2 grew from $20.86 trillion in 2023 to $21.3 trillion by October 2024 and $21.56 trillion by January 2025, reflecting a 3.9% YoY growth rate from Jan 24 to Jan 25.

That follows a historic 27% surge in 2020–2021 (COVID-era quantitative easing) and a rare slight contraction (-4.6% in 2023) due to Fed tightening and deposit outflows.

One need look not further than those number to understand why we had historic levels of inflation - which have since moderated.

With money supply growing again at an almost 4% clip, it's no wonder we are seeing inflation on the rise. Without such monetary expansion, tariffs would have no impact on CPI or any other inflation measure.

M2 growth should mirror GDP growth whenever possible, but instead it is used as a lever by the Fed', disrupting market signals and causing all kinds of mal-investment in the process.

Better the Fed focus on stable money and get out of the rate setting business, rates are just prices for time adjusted money, and we already know price controls don't work. Markets can set interest rates just fine.

Popular

Back to top

6

6