- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Core inflation rate INCREASED +.2% in the month of August coming in at 2.9% year-over-year

Posted on 9/26/25 at 8:57 am

Posted on 9/26/25 at 8:57 am

quote:CNBC.com

The core personal consumption expenditures price index showed inflation in August at 2.9% on an annual basis after rising 0.2% for the month. Both were in line with estimates.

The personal consumption expenditures price index posted a 0.3% gain for the month, putting the annual headline inflation rate at 2.7%, the Commerce Department reported Friday.

The headline annual inflation rate was a slight increase from the 2.6% in July while the core rate was the same.

So, inflation ticked up in August year-over-year and still well above the Fed's inflation target.

Can somebody please explain why rates need to be cut??

Posted on 9/26/25 at 8:59 am to LSURussian

Isn't that just a little below what they were expecting?

Posted on 9/26/25 at 9:01 am to SmackoverHawg

quote:I think the article I linked says the inflation numbers were "as expected."

Isn't that just a little below what they were expecting?

Posted on 9/26/25 at 9:02 am to LSURussian

Can somebody please explain why rates need to be cut??

Well I guess the argument is that inflation isn’t the only consideration. I don’t know whether they need to be cut or not. But I guarantee you that if a Dem was in office they’d be cut.

ETA: Where do these figures come from? If it’s the UMich figures, then those aren’t worth much anyway.

Well I guess the argument is that inflation isn’t the only consideration. I don’t know whether they need to be cut or not. But I guarantee you that if a Dem was in office they’d be cut.

ETA: Where do these figures come from? If it’s the UMich figures, then those aren’t worth much anyway.

This post was edited on 9/26/25 at 9:26 am

Posted on 9/26/25 at 9:04 am to LSURussian

I'd go for another 25 basis points next month and then see what the numbers show. I agree that rapid deep cuts aren't needed and could be detrimental, but what do I know?

Posted on 9/26/25 at 9:12 am to LSURussian

YOU MEAN we aren't in deflation yet!

Posted on 9/26/25 at 9:14 am to SmackoverHawg

quote:Nope, it was right down the line.

Isn't that just a little below what they were expecting?

Loading Twitter/X Embed...

If tweet fails to load, click here. The key takeaway here though is that inflation still grew even though it was just .1 (both MoM and YoY), meaning we cut rates with sticky/growing inflation.

This post was edited on 9/26/25 at 9:15 am

Posted on 9/26/25 at 9:24 am to LSURussian

quote:

an somebody please explain why rates need to be cut??

Because the job market is in way worse shape than inflation is high

This isn’t difficult

The job market is in shambles right now.

Nobody is hiring

Posted on 9/26/25 at 9:25 am to Bard

I saw an argument from a Wharton economist the other day that based on what he was seeing, higher rates were hurting the supply side and driving inflation. He laid it out pretty good that judicious cuts would help increase supply to the extent that prices would stabilize prices.

Posted on 9/26/25 at 9:34 am to HailHailtoMichigan!

quote:

Because the job market is in way worse shape than inflation is high

This isn’t difficult

The job market is in shambles right now.

Nobody is hiring

Is the job market "in shambles" because rates are too high, or because of some other factor? If some other factor, is it impossible to modify that factor, or could we modify it to the result of a better job market without impacting inflation?

Posted on 9/26/25 at 9:34 am to HailHailtoMichigan!

quote:The board's resident Drama Queen has spoken.

The job market is in shambles right now.

Nobody is hiring

Posted on 9/26/25 at 10:12 am to SloaneRanger

quote:If you click on the CNBC link I posted in my topic's first post it will give you that information.

ETA: Where do these figures come from? If it’s the UMich figures, then those aren’t worth much anyway.

Posted on 9/26/25 at 10:19 am to SmackoverHawg

quote:

I saw an argument from a Wharton economist the other day that based on what he was seeing, higher rates were hurting the supply side and driving inflation. He laid it out pretty good that judicious cuts would help increase supply to the extent that prices would stabilize prices.

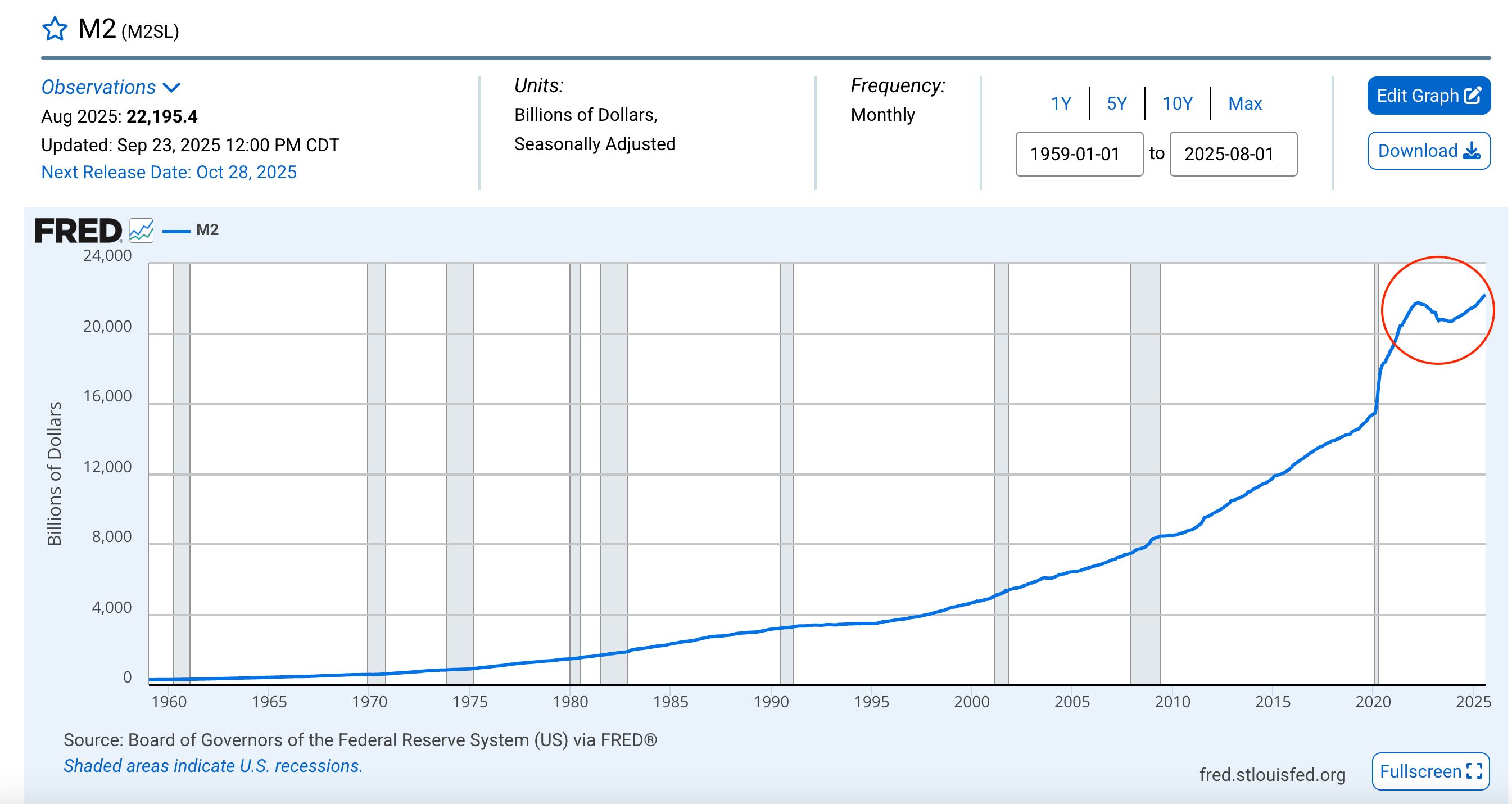

I get that, but that ignores the continued strong expansion of the money supply.

Inflation is a function of too much money chasing too few goods. Cutting rates helps on the supply end, but it's not going to outweigh the constant creation of extra money. As such, at best it's a placebo that allows the inflationary can to be kicked down the road.

Posted on 9/26/25 at 10:24 am to Bard

quote:"Cutting rates" means the Fed is intentionally increasing the money supply.

Cutting rates helps on the supply end, but it's not going to outweigh the constant creation of extra money.

Posted on 9/26/25 at 10:34 am to LSURussian

quote:

Can somebody please explain why rates need to be cut??

The rates really do not have much to do with it now.

Posted on 9/26/25 at 10:39 am to SmackoverHawg

quote:

Wharton economist the other day that based on what he was seeing, higher rates were hurting the supply side and driving inflation. He laid it out pretty good that judicious cuts would help increase supply to the extent that prices would stabilize prices.

This is 100% fact.

Most people are trying to wrap their minds around the new economy. This is not what they grew up on anymore.

Posted on 9/26/25 at 10:44 am to HailHailtoMichigan!

quote:

Because the job market is in way worse shape than inflation is high

This would be the rationale.

quote:

The job market is in shambles right now.

This is not accurate.

quote:

Nobody is hiring

Unemployment is steady. Hiring is only one side of the equation. There aren't broad layoffs either.

Posted on 9/26/25 at 11:40 am to LSURussian

quote:they dont, current rates are fine, you already know why there is a clamor to lower them and its not based in economic analysis

Can somebody please explain why rates need to be cut??

Posted on 9/26/25 at 12:13 pm to cgrand

quote:

and its not based in economic analysis

BS

Popular

Back to top

9

9