- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: 100 basis points tomorrow, or not?

Posted on 6/15/22 at 5:26 am to NC_Tigah

Posted on 6/15/22 at 5:26 am to NC_Tigah

So if it’s 75/100, does the market react less favorably than if it’s 50?

Honestly don’t understand… the higher would help fight inflation which is a good thing. Someone explain like I’m 5

Honestly don’t understand… the higher would help fight inflation which is a good thing. Someone explain like I’m 5

Posted on 6/15/22 at 7:04 am to Lsut81

quote:

Honestly don’t understand… the higher would help fight inflation which is a good thing. Someone explain like I’m 5

It won’t help fight energy or food inflation, which is now the big issue as another poster mentioned.

I bet they go with 50bps and site that core cpi has fallen although not as much as they’d like so they’ll continue their path and reassess next month but likely do another 50 with September on the table for 25-50. At that point they’ll say we’ve done all we can do and any further tightening will hurt the consumer too much, they’ll look towards Fiscal policy to help ease energy prices.

Posted on 6/15/22 at 7:08 am to Grinder

50 w/ 75 on the table for following months

Posted on 6/15/22 at 7:21 am to Civildawg

quote:

I don’t understand how raising rates is going to fix anything. I feel like the main reason everything is so high is fuel prices.

Raising rates reduces demand by increases borrowing costs (less loans and home purchases), and by layoffs.

Not sure how much the strengthening the dollar helps versus fuel prices, but that should happen too.

If Saudi starts pumping more oil along with the rate hike, prices will drop fast.

Posted on 6/15/22 at 7:34 am to Grinder

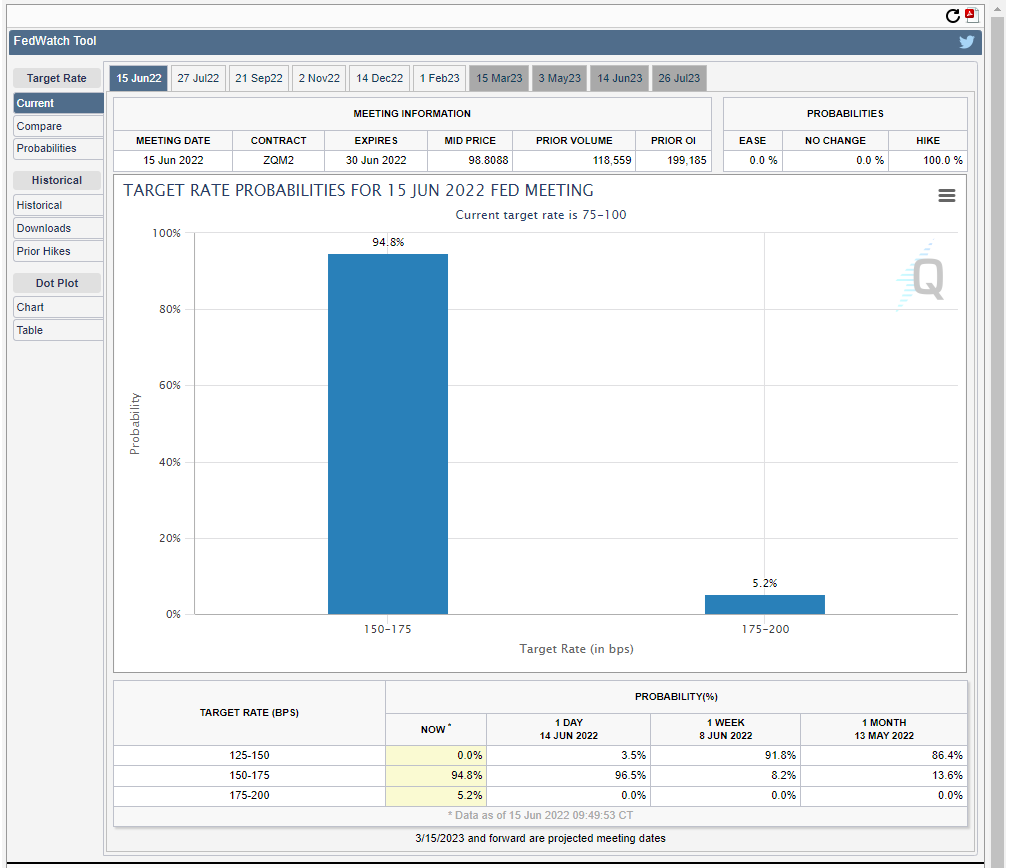

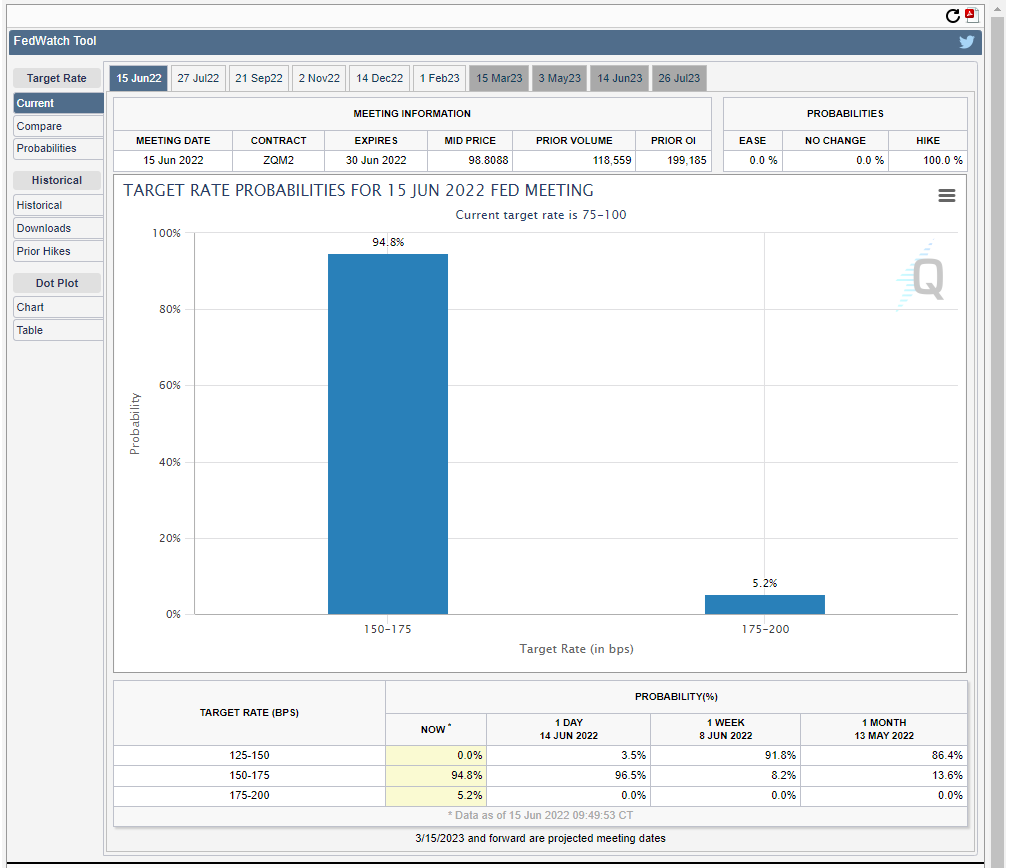

I think the betting odds are like 95% for 75bp with the wild card being 100.

If it is only 50, stocks will tank again.

Market needs to see the FED take charge.

If it is only 50, stocks will tank again.

Market needs to see the FED take charge.

Posted on 6/15/22 at 7:35 am to TDFreak

quote:

If Saudi starts pumping more oil along with the rate hike, prices will drop fast

Nothing is going to drop gas prices fast. The Saudis are not going to increase output nearly fast enough to even dent the supply issue, and even if they magically did bring an additional million bpd tomorrow, that does nothing for the refining bottleneck, which is the bigger bottleneck right now.

Posted on 6/15/22 at 7:39 am to TigerFanatic99

quote:

Nothing is going to drop gas prices fast

The drop in gas prices are going to be just like 2008. Demand is about to fall off a cliff by design. I don't understand the people who are bullish on energy right now. The party is almost over.

Posted on 6/15/22 at 7:56 am to ItzMe1972

Yes I too love when the economy is in the tank just because it might benefit me politically

Posted on 6/15/22 at 9:03 am to Grinder

75 is practically already unheard of. They're not doing 100.

Posted on 6/15/22 at 9:23 am to transcend

I'd be very surprised at 100. I think it will be 75 bps, but wouldn't be surprised at 50 with groundwork for 75 next time.

Posted on 6/15/22 at 9:45 am to Grinder

100 bps is the political move so I suspect it will be 100 instead of 75. 100 might help Democrats in November if they can bottom out now and show a small recovery before the election to help save at least a few blue seats.

This post was edited on 6/15/22 at 10:03 am

Posted on 6/15/22 at 9:56 am to I Love Bama

quote:

If it is only 50, stocks will tank again.

Whatever they do... it's going to be so the elites can take advantage of a very short term (like 1-2 days) stock market pop.

I think that is 50. You think it is 75. Honesty, you may well be right...

Posted on 6/15/22 at 10:02 am to LSUFanHouston

Agree. 50 spikes the market for a few days. That's a fade/rebalance situation depending on if you can short or are long only.

Posted on 6/15/22 at 10:09 am to Grinder

50.

75bps next meeting if inflation doesn’t temper at all.

75bps next meeting if inflation doesn’t temper at all.

Posted on 6/15/22 at 10:25 am to LSUcam7

this.

75 was "off the table" per Powell - and man these institutions make ENORMOUS bond bids/bets pricing that talk in

50 is most likely

75 would actually cause some worry/panic

100 is a nightmare and nofricking way -- the banks are putting this out there because they own The Fed and are helping to distribute talking points

rinse/repeat

75 was "off the table" per Powell - and man these institutions make ENORMOUS bond bids/bets pricing that talk in

50 is most likely

75 would actually cause some worry/panic

100 is a nightmare and nofricking way -- the banks are putting this out there because they own The Fed and are helping to distribute talking points

rinse/repeat

Posted on 6/15/22 at 10:43 am to Shankopotomus

quote:

5 was "off the table" per Powell - and man these institutions make ENORMOUS bond bids/bets pricing that talk in

50 is most likely

75 would actually cause some worry/panic

100 is a nightmare and nofricking way -- the banks are putting this out there because they own The Fed and are helping to distribute talking points

For those of us not familiar, can you give context as to why the response for each of the three possibilities? Why would 75 cause panic and 100 be a nightmare? Is that not what the market wants in order to bring inflation into check and companies able to manage and be more profitable?

Posted on 6/15/22 at 10:47 am to Lsut81

Structure of markets. There are derivative trades that are large enough to cause a liquidation event if positioned in the wrong direction.

Posted on 6/15/22 at 10:51 am to wutangfinancial

quote:

There are derivative trades that are large enough to cause a liquidation event if positioned in the wrong direction.

So basically a 100pt increase would auto-trigger a number of events that would cause a market crash?

Posted on 6/15/22 at 10:58 am to Grinder

I figure they'll surprise everybody and reduce rates back down to .25 because that's the only damn trick they know.

Popular

Back to top

2

2