- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Winning a Super Bowl in the state of California actually cost Sam Darnold 70k.

Posted on 2/9/26 at 2:07 pm

Posted on 2/9/26 at 2:07 pm

Thanks Gavin.

https://sports.yahoo.com/articles/sam-darnold-pay-hefty-california-061934079.html

https://sports.yahoo.com/articles/sam-darnold-pay-hefty-california-061934079.html

quote:

According to Sportico reporter Kurt Badenhausen, the Golden State's notorious "jock tax" means Darnold will fork over more in taxes than he receives in his Super Bowl winner's bonus.

"California has the highest income tax of any state, and the Super Bowl means 8 'duty days' in CA. Taxes hit your annual comp," Badenhausen posted. "Super Bowl winner bonus from NFL: $178K/player. Sam Darnold's estimated CA taxes: $249K."

Per this terrible math, Darnold receives $178,000 for winning the Super Bowl but owes California an estimated $249,000 in state income tax for his time in the state. It is a $71,000 net loss for helping the Seahawks to win the NFL final.

Posted on 2/9/26 at 2:08 pm to BoomerandSooner

He should just not pay it. frick California.

Posted on 2/9/26 at 2:11 pm to Saint Alfonzo

It really is going to be interesting to see what happens to California as their population continues to shrink.

The people with brains are getting out and most white liberals aren’t having many, if any kids.

The people with brains are getting out and most white liberals aren’t having many, if any kids.

Posted on 2/9/26 at 2:13 pm to BoomerandSooner

Imagine getting drafted by a California or NY team.

Posted on 2/9/26 at 2:16 pm to Saint Alfonzo

Darnold a legal resident of California? If not , he doesn't practice his profession full time as a resident in the State of California. California tried this bs with Airline Pilots that were non residents, merely making legs thru California commercial airports. Federal Court declared it illegal

Posted on 2/9/26 at 2:21 pm to BoomerandSooner

No he won’t. People have no idea how the tax system works.

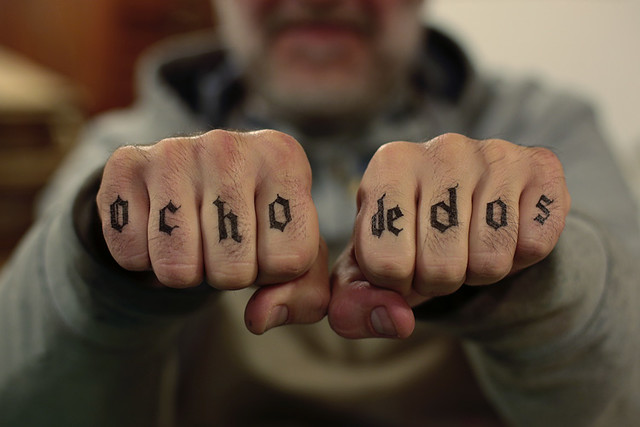

Posted on 2/9/26 at 2:22 pm to OchoDedos

quote:

Darnold a legal resident of California? If not , he doesn't practice his profession full time as a resident in the State of California.

Interesting. What constitutes “full time?”

Is it a percentage of your total hours or something?

Cause if its 100% percent of your time, I’m sure there’s creative ways to work “out of state” on paper (or legitimately) to try and avoid this bullshite

Posted on 2/9/26 at 2:25 pm to The Pickwick

quote:

No he won’t. People have no idea how the tax system works.

More leftist lies. The math is right there in the OP.

Posted on 2/9/26 at 2:26 pm to Laugh More

I was hoping an accountant with some experience with this would chime in on one of the threads, there's been multiple.

There's no way the CPA's don't have good ways of reducing this. I would also think the pro sports would have better ways to handle this.

Its never as simple as 1/20 games in California so 1/20th is taxed. Someone said 8/365 days. But I've never heard of someone being taxed for a "day" of work and he's not working all 8 days really. Not to mention he certainly isn't working all 365 days of the year.

There's no way the CPA's don't have good ways of reducing this. I would also think the pro sports would have better ways to handle this.

Its never as simple as 1/20 games in California so 1/20th is taxed. Someone said 8/365 days. But I've never heard of someone being taxed for a "day" of work and he's not working all 8 days really. Not to mention he certainly isn't working all 365 days of the year.

Posted on 2/9/26 at 2:28 pm to BarnHater

quote:

The math is right there in the OP.

And the OP is not correct. Sure he MAY have to pay it up front but if his tax guy has half a brian he will get it back.

For people to believe this is crazy

This post was edited on 2/9/26 at 2:30 pm

Posted on 2/9/26 at 2:33 pm to BoomerandSooner

Good thing Darnold has enough money to not hire a broke-dick accountant who would tell him he has to pay this.

He doesn't owe a dime to CA in taxes at all. Does anyone here understand how this works? Doesn't seem like it.

He doesn't owe a dime to CA in taxes at all. Does anyone here understand how this works? Doesn't seem like it.

Posted on 2/9/26 at 2:37 pm to BoomerandSooner

this is actually not true, its only on the money made in CA.

"What that means here is that the winning team, their take-home pay will be approximately $86,000. If you're on the losing side, the take-home would be about $49,800,"

"What that means here is that the winning team, their take-home pay will be approximately $86,000. If you're on the losing side, the take-home would be about $49,800,"

Posted on 2/9/26 at 2:38 pm to The Pickwick

quote:

For people to believe this is crazy

Posted on 2/9/26 at 2:38 pm to theballguy

quote:

He doesn't owe a dime to CA in taxes at all. Does anyone here understand how this works? Doesn't seem like it.

He absolutely does, all professional players do

Google the "jock tax"

Posted on 2/9/26 at 2:41 pm to OchoDedos

quote:

Darnold a legal resident of California? If not , he doesn't practice his profession full time as a resident in the State of California. California tried this bs with Airline Pilots that were non residents, merely making legs thru California commercial airports. Federal Court declared it illegal

I don’t think that it works like this. I believe athletes do pay state taxes for each state in which they play games.

Posted on 2/9/26 at 2:43 pm to theballguy

quote:

He doesn't owe a dime to CA in taxes at all. Does anyone here understand how this works? Doesn't seem like it.

I believe that you’re wrong.

Posted on 2/9/26 at 2:43 pm to BoomerandSooner

California currently has the highest top marginal income tax rate in the U.S. at 13.3%. In addition, a 1.3% disability insurance tax (instituted in 2024) applies to all wages, bringing the effective top rate for athletes to approximately 14.6%.

The tax is calculated using the "Duty Day" method:

Ratio: The number of days spent "on duty" in California (practices, games, media days, team meetings) is divided by the total number of duty days in the season.

Application: This percentage is applied to the athlete's entire annual salary, not just the bonus for the specific California game.

Super Bowl LX Impact: Players in the 2026 Super Bowl typically logged at least eight duty days in California. Because the tax applies to a portion of their multi-million dollar season salaries, some players can actually lose money by playing in the game.

The tax is calculated using the "Duty Day" method:

Ratio: The number of days spent "on duty" in California (practices, games, media days, team meetings) is divided by the total number of duty days in the season.

Application: This percentage is applied to the athlete's entire annual salary, not just the bonus for the specific California game.

Super Bowl LX Impact: Players in the 2026 Super Bowl typically logged at least eight duty days in California. Because the tax applies to a portion of their multi-million dollar season salaries, some players can actually lose money by playing in the game.

Posted on 2/9/26 at 2:45 pm to The Pickwick

quote:

And the OP is not correct. Sure he MAY have to pay it up front but if his tax guy has half a brian he will get it back.

The information is correct. What a tax guy does to alleviate the amount is another issue. Not to mention that different accountants might treat this differently with different results.

Posted on 2/9/26 at 2:50 pm to Stidham8

quote:

It really is going to be interesting to see what happens to California as their population continues to shrink.

The people with brains are getting out

That's another problem altogether. They're going to AZ, Boise, FL and TX and they're bringing their unchanged voting habits with them. They're not that "smart" at all when they can't see that how they vote directly led to what they got. And they're spreading to conservative states like the fires of Mordor. Ask them why California is faltering, and they'll tell you "Because of Trump's domestic policies". I've witnessed this time and time again.

Popular

Back to top

10

10