- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Median, real net worth rose 37% from 2019-2022

Posted on 11/2/23 at 11:57 am

Posted on 11/2/23 at 11:57 am

quote:

Americans experienced a record surge in net worth propelled by unprecedented government stimulus during the pandemic, laying the groundwork for economic resilience in 2023.

Inflation-adjusted median net worth jumped 37% to $192,900 from 2019 to 2022, according to the Federal Reserve’s Survey of Consumer Finances out Wednesday. That marked the largest three-year increase in data back to 1989, and it was more than double the next-largest one on record, the Fed said.

LINK

Posted on 11/2/23 at 12:00 pm to Big Scrub TX

What’s that look like excluding home values.

Posted on 11/2/23 at 12:05 pm to lynxcat

quote:Not sure. Stocks are up a lot too. But why exclude home values?

What’s that look like excluding home values.

Posted on 11/2/23 at 12:06 pm to Big Scrub TX

Home values have soared…hypothesis is that most of this “net worth” jump is tied up in illiquid Real Estate.

Posted on 11/2/23 at 12:19 pm to Big Scrub TX

I think that is more likely an indication that the inflation adjustment metric is broken, than that the median American actually got 37% richer in 3 years.

Posted on 11/2/23 at 12:28 pm to Big Scrub TX

quote:

Americans experienced a record surge in net worth propelled by unprecedented government stimulus during the pandemic

The Biden administration on this:

Which then brings us to this:

What that piece is (essentially) proponing is that the government's increasing the net worth of the citizenry through doling out obscene amounts of over-leveraged currency to the masses is the sign of a strong and robust economy.

This post was edited on 11/2/23 at 12:31 pm

Posted on 11/2/23 at 12:58 pm to Bard

quote:

The Biden administration on this:

And Trump

Posted on 11/2/23 at 1:02 pm to Big Scrub TX

This unprecedented government stimulus propelled this country further into debt that it will never be able to repay, shortening the timeline until the absolute bottom falls out of this country's financial system.

Posted on 11/2/23 at 2:09 pm to Teddy Ruxpin

quote:

And Trump

No argument here. The Donald helped bring about a strong economy (built on lower taxes and cheaper energy :thisistheway.gif:) but he was far more spendy than I would have liked (even to the point of making sure his name was on that first round of stimulus checks).

I pointed out Biden because he's the current President (who was also responsible for one of the rounds of checks).

Posted on 11/2/23 at 2:59 pm to lynxcat

quote:... and at 20% down, it's a 'leveraged' investment.

hypothesis is that most of this “net worth” jump is tied up in illiquid Real Estate.

Posted on 11/2/23 at 3:54 pm to Big Scrub TX

quote:

Not sure. Stocks are up a lot too. But why exclude home values?

My income and any raises I’ve had were decimated by inflation.

Posted on 11/2/23 at 4:26 pm to Big Scrub TX

Does this factor in inflation and the debasement of our currency? Because if not, these figures denominated in US dollars mean nothing.

Posted on 11/2/23 at 4:42 pm to SloaneRanger

Yes, it's real net worth, not nominal net worth so it accounts for inflation.

Also, is your username a reference to a style of clothing worn in London in the 1980s?

Also, is your username a reference to a style of clothing worn in London in the 1980s?

Posted on 11/2/23 at 4:53 pm to SloaneRanger

Can’t read the article as it is paywalled. So you’re saying it is all inflation adjusted? Because I certainly have nice nominal gains in my investment accounts for that period, but the massive decrease in the purchasing power of a dollar is such that I’m not sure I’m ahead. Same goes for the value of my real estate.

You look back on what you were paying in 2019 for gas, food, utilities, insurance, etc. and it’s shocking.

You look back on what you were paying in 2019 for gas, food, utilities, insurance, etc. and it’s shocking.

Posted on 11/2/23 at 5:00 pm to Big Scrub TX

The Growing Generational Wealth Gap

quote:

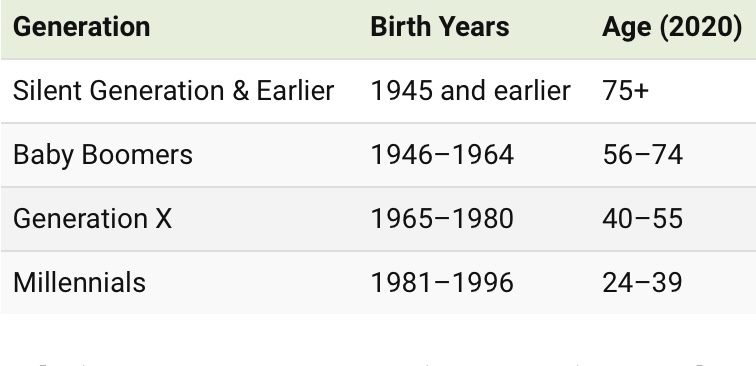

As young generations usher into adulthood, they inevitably begin to accumulate and inherit wealth, a trend that has broadly remained consistent.

But what has changed recently is the rate of accumulation. In the U.S., household wealth has traditionally seen a relatively even distribution across different age groups. However, over the last 30 years, the U.S. Federal Reserve shows that older generations have been amassing wealth at a far greater rate than their younger cohorts.

As the visual above shows, the older have been getting richer, and the younger have been starting further back than ever before .

quote:

By Generation: Baby Boomers Benefit & Millennials Lag

To examine the proportion of wealth each generation holds, it’s important to clearly define each age group. Though personal definitions might differ, the U.S. Federal Reserve uses a clear metric:

Relative to younger generations growing up, the Silent Generation and Greatest Generation before them have seen a decreasing share of household wealth over the last 30 years.

However, the numerical levels have been relatively stable. For these combined generations, total wealth has gone from $16 trillion in 1989 to $19 trillion in 2019, with a peak of $27 trillion in 2007. Considering this cohort has understandably shrunk over time—from an estimated 47 million to 23 million in 2019—their individual shares of wealth have actually increased.

Immediately following are the Baby Boomers, who held more than half of U.S. household wealth towards the end of 2020. At $59 trillion, the generation holds more than ten times the amount held by a comparative number of Millennials.

With $29 trillion held in 2019, Generation X has also been gaining in wealth over the last 30 years. It’s good enough for five times the wealth of Millennials, though at just $440k/person, they’ve fallen far behind Baby Boomers in rate of growth

Finally, trying to catch up to their older cohorts are Millennials, who held the least amount of household wealth ($5 trillion) for the greatest population (73 million) in 2019, an average of just under $69k/person.

For a direct comparison, it took Generation X nine years to climb from their start of 0.4% of household wealth in 1989 to above 5%, while Millennials still haven’t crossed that threshold. But it’s not all doom and gloom for Millennials. Their rate of growth is starting to rise, with the generation’s level of wealth climbing from $3 trillion in 2016 to $5 trillion in 2019.

quote:

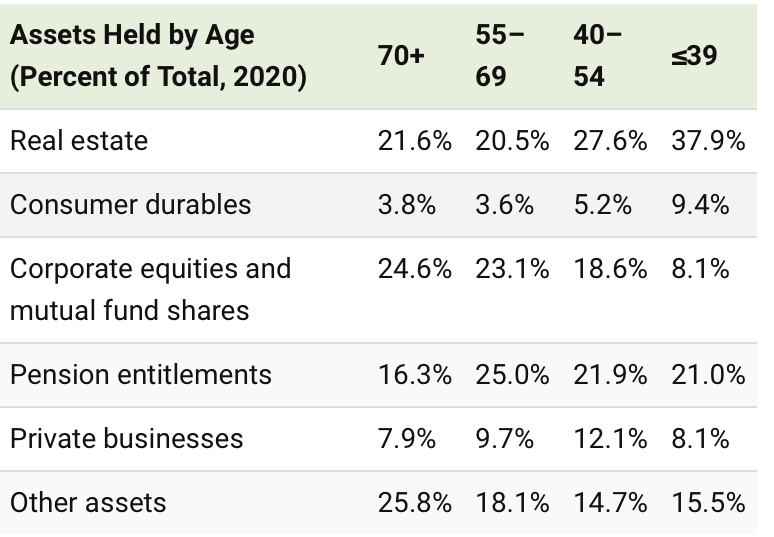

By Age: A Growing Share for 55+

Though the generational picture is stark, the difference in U.S. household wealth by age makes the picture of shifting wealth even clearer.

Until 2001, the shares of household wealth held by different age groups were relatively stable. People aged 40-54 and 55-69 held around 35% each of household wealth, retirees aged 70+ hovered around 20%, and younger people aged under 40 held around 10%.

Since that time, however, the shift in wealth to older generations is clear. The 70+ age group has seen their share of wealth increase to 26%, while the share held by ages 55-69 has grown from 35% to almost half.

But not all ages are seeing an increasing slice of wealth. The 40-54 age group saw its share drop sharply from 36% to 22% between 2001 and 2016 before starting to recover towards the end of the decade, while the youngest cohort now hover around just 5%.

Breaking down that wealth by components is even more eye-opening. The 39 and under age group holds 37.9% of their assets in real estate, the largest share amongst any age group (and concentrated in the hands of fewer people) while older age groups have their wealth spread out across real estate, equities, and pensions.

But the difference is as much in assets as it is in opportunity. In 1989, Baby Boomers and Generation X under 40 accounted for 13% of household wealth, compared to just 5.9% for Millennials and Generation Z under 40 in 2020.

quote:

Will the Tide Turn for Generation Z?

As new and accumulated wealth has been built up in older generations, it’s a matter of time before the pendulum starts to swing the other way.

The Millennials age group are expected to inherit $68 trillion by 2030 from Baby Boomer parents. Of course, that payout isn’t going to be even across the board, with wealthier families retaining the bulk of wealth and the majority of Millennials laden with debt.

And with Generation Z (born 1997-2012) starting to come of age, the uneven playing field is making it hard to begin accumulating wealth in the first place.

Since it is in the best interest of societies to have wealthy generations that can drive economic growth, potential solutions are being examined all over the political sphere. They include different taxation schemes, changing estate laws, and potentially cancelling student debt.

Posted on 11/3/23 at 4:28 am to Big Scrub TX

quote:It's puzzling the Fed would juxtapose median and mean numbers throughout its report. But they do. Bloomberg took that data and ran with it, creating their own colorful, eyecatching graphic (above).

When looking at the average gains rather than medians, the net worth levels were much higher. Overall, the average family was worth more than $1 million in 2022.

Regarding the source of the 37% HH increases, here's a table (stripped of means) from The Fed's Survey of Consumer Finances Report breaking out specific sources of gain.

Posted on 11/3/23 at 6:29 am to NC_Tigah

quote:

But they do. Bloomberg took that data and ran with it, creating their own colorful, eyecatching graphic (above).

Looking at that chart, I question if the 55-75+ age groups each fell into the average range of ~$89k-$184k when they were under 35. (Assume an adjustment for normal inflation).

My assumption is they were higher than that by the time they hit the next age bracket.

Also, the second chart seems to indicate that values on some items (vehicles, property, nonresidential property) have risen but the number of people holding have dropped. Would that mean that real net worth has risen but is concentrated in smaller amounts of people? Thus exposing a growing wealth disparity especially among younger people?

Seems disingenuous and honestly dangerous to prop up the economy as doing well if that’s the case.

This post was edited on 11/3/23 at 6:30 am

Posted on 11/3/23 at 8:11 am to NC_Tigah

I find this data very interesting.

It seems like people have increased their fixed income exposure when most fixed income asset managers did terrible in 2019-2022.

Higher yields and I suppose the value of your FI investments doesn't matter if you're holding to maturity.

It seems like people have increased their fixed income exposure when most fixed income asset managers did terrible in 2019-2022.

Higher yields and I suppose the value of your FI investments doesn't matter if you're holding to maturity.

This post was edited on 11/3/23 at 8:16 am

Posted on 11/3/23 at 8:25 am to CAPEX

Paper wealth, capital misallocation, and GDP propped up by epic fiscal deficits. It will surely turn out well because this time is different.

Posted on 11/3/23 at 9:22 am to Big Scrub TX

Well my home value went up exactly 36.58%, so I guess I nailed it.

I certainly do not feel a 37% jump personally.

I certainly do not feel a 37% jump personally.

Back to top

9

9