- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Long story. My parents and “check washing”.

Posted on 1/12/23 at 9:28 pm

Posted on 1/12/23 at 9:28 pm

My folks are boomers from Louisiana. They have your standard bank account with WFargo. Debit card and still have a checkbook. They write 2 checks only. Ever… One for their senior leaving place and the other to my Aunt. This check is sent to her for lawncare for an old property they now share.

This check for $100 bucks was stolen from a mailbox. Then “washed” and cashed through Bank Of America. The $100 check turned into $7000. It was from my dad to an African/Nigerian name.

My folks notice the cash missing and call. They (Wells Fargo) start an investigation. Then nothing. My folks follow up. Are told they need to hear from Bank of America who cashed the check. If Bank of America do not resolve it the claim “Expires” in 3 months. Bank of America is less than helpful because my folks have no account through them.

What other recourse do I have? Police?

Check was written and mailed in Harris County. Sent to and stolen from Calciseau Parrish. Then fraudulently cashed at a Bank of America branch that we can not find out?

Just trying to help my folks out. At a loss here as to what to do besides call both banks daily until a resolution.

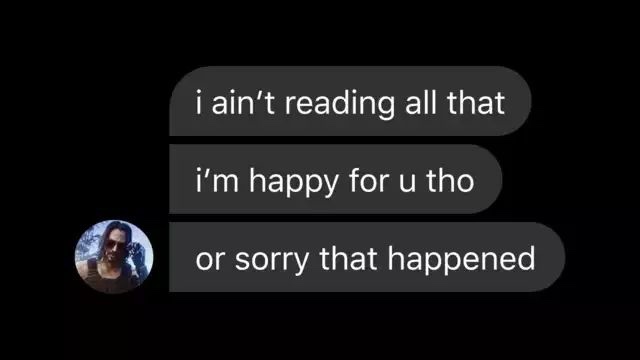

This is already a text wall. I will wait for replies and answer any questions I can.

This check for $100 bucks was stolen from a mailbox. Then “washed” and cashed through Bank Of America. The $100 check turned into $7000. It was from my dad to an African/Nigerian name.

My folks notice the cash missing and call. They (Wells Fargo) start an investigation. Then nothing. My folks follow up. Are told they need to hear from Bank of America who cashed the check. If Bank of America do not resolve it the claim “Expires” in 3 months. Bank of America is less than helpful because my folks have no account through them.

What other recourse do I have? Police?

Check was written and mailed in Harris County. Sent to and stolen from Calciseau Parrish. Then fraudulently cashed at a Bank of America branch that we can not find out?

Just trying to help my folks out. At a loss here as to what to do besides call both banks daily until a resolution.

This is already a text wall. I will wait for replies and answer any questions I can.

Posted on 1/12/23 at 9:31 pm to LSU alum wannabe

I would call sheriffs office in Harris county and Calciseau parish as well as postmasters in both , see where that goes

Posted on 1/12/23 at 9:32 pm to LSU alum wannabe

For that amount you need to contact the police

Good luck

Good luck

Posted on 1/12/23 at 9:34 pm to LSU alum wannabe

Show up at a WF and/or BoA brick and mortar and ask for the manager. Hammer them until you have answers and a plan for how this gets unwound.

This post was edited on 1/12/23 at 9:34 pm

Posted on 1/12/23 at 9:34 pm to LSU alum wannabe

BOA = Bunch of Asshats

Approach this issue like BOA is your enemy, because they are.

Sorry for this happening to your folks.

Approach this issue like BOA is your enemy, because they are.

Sorry for this happening to your folks.

Posted on 1/12/23 at 9:35 pm to LSU alum wannabe

frick BoA for being shitty. You know they have tapes and ID info. You cant just roll in and cash a $7k check without IDs and an account.

Posted on 1/12/23 at 9:37 pm to LSU alum wannabe

quote:

Bank of America is less than helpful

Not surprising

FYI - there are no Bank of America branches in Louisiana

How do you know it was stolen in Calcasieu parish?

This post was edited on 1/12/23 at 9:40 pm

Posted on 1/12/23 at 9:41 pm to LSU alum wannabe

My bank recently emailed me about the hazards of mailing checks.

This must be rampant.

This must be rampant.

Posted on 1/12/23 at 9:45 pm to LSU alum wannabe

Big banks are not your friend.

Stay local, as a local bank would be incredibly more helpful.

Stay local, as a local bank would be incredibly more helpful.

Posted on 1/12/23 at 9:49 pm to LSU alum wannabe

They have 30 days from receipt of the bank statement to challenge the fraudulent activity in LA. I’m admittedly not well versed in banking law and negotiable instruments, but believe in this situation your parents’ bank would be able cancel the transaction if it was timely reported and the bank that cashed the check would bear the risk of loss.

Edit- found the statute in LA - it’s RS 10:3-407. But as others have said, a lawyer would be helpful in this situation. Here’s the text of the statute fwiw.

§3-407. Alteration

(a) "Alteration" means (i) an unauthorized change in an instrument that purports to modify in any respect the obligation of a party, or (ii) an unauthorized addition of words or numbers or other change to an incomplete instrument relating to the obligation of a party.

(b) Except as provided in Subsection (c), an alteration fraudulently made discharges a party whose obligation is affected by the alteration unless that party assents or is precluded from asserting the alteration. No other alteration discharges a party, and the instrument may be enforced according to its original terms.

(c) A payor bank or drawee paying a fraudulently altered instrument or a person taking it for value, in good faith and without notice of the alteration, may enforce rights with respect to the instrument (i) according to its original terms, or (ii) in the case of an incomplete instrument altered by unauthorized completion, according to its terms as completed.

Edit- found the statute in LA - it’s RS 10:3-407. But as others have said, a lawyer would be helpful in this situation. Here’s the text of the statute fwiw.

§3-407. Alteration

(a) "Alteration" means (i) an unauthorized change in an instrument that purports to modify in any respect the obligation of a party, or (ii) an unauthorized addition of words or numbers or other change to an incomplete instrument relating to the obligation of a party.

(b) Except as provided in Subsection (c), an alteration fraudulently made discharges a party whose obligation is affected by the alteration unless that party assents or is precluded from asserting the alteration. No other alteration discharges a party, and the instrument may be enforced according to its original terms.

(c) A payor bank or drawee paying a fraudulently altered instrument or a person taking it for value, in good faith and without notice of the alteration, may enforce rights with respect to the instrument (i) according to its original terms, or (ii) in the case of an incomplete instrument altered by unauthorized completion, according to its terms as completed.

This post was edited on 1/12/23 at 10:01 pm

Posted on 1/12/23 at 9:55 pm to LSU alum wannabe

1-get a sheriff or police report. even the smallest of towns have seen this. this won't take long. call them to the house to report elder abuse, mail fraud, felony theft.

2-go to the post office with the report and report the mail fraud.

3-once it is in the USPS' purview things will happen.

4-report all of the above and a brief story on your State AG's website.

5-Use the words "elder abuse" and you are their advocate.

Wells Fargo won't give two craps about the investigative part much past where you are at; but will have to repay the money.

I suspect someone dirty at BOA. But don't let Wells Fargo stalemate the case.

2-go to the post office with the report and report the mail fraud.

3-once it is in the USPS' purview things will happen.

4-report all of the above and a brief story on your State AG's website.

5-Use the words "elder abuse" and you are their advocate.

Wells Fargo won't give two craps about the investigative part much past where you are at; but will have to repay the money.

I suspect someone dirty at BOA. But don't let Wells Fargo stalemate the case.

This post was edited on 1/12/23 at 9:58 pm

Posted on 1/12/23 at 10:00 pm to LSU alum wannabe

quote:

What other recourse do I have? Police?

Yes...

This should have been your first move.

This is a felony forgery. They will contact the bank and the bank will actually listen to them.

Posted on 1/12/23 at 10:16 pm to LSU alum wannabe

Contact your states attorney general office and see if they can help.

Posted on 1/12/23 at 10:21 pm to LSU alum wannabe

File complaints with the Department of Financial institutions in Louisiana and the Texas Dept of Banks. Then duplicate those complaints with the CFPB and FTC. This is about shaking trees to motivate action. Their compliance departments are compelled by law to answer the complaints. The State AGs will not be able to do much but it’s worth filing with them as well.

Posted on 1/12/23 at 10:28 pm to LSU alum wannabe

That sucks. I would think the police is the way to go.

My mom.. 76 years old, writes checks for everything. Does nothing electronic because she doesn't trust it.

One time I was at her house and I mentioned something about my debit card and her husband told me "only poor people use debit cards". We don't really see eye to eye, never have. Mainly because he is a jackass who likes to tell people (when I say people, I mean anyone he talks to) how they should do things and that the way he does it is the right way.

We butted heads right away because I pretty much told him that when he starts to tell me what I should do or how his way is better.. To just stop because I don't fricking care and half the time has no clue what he is talking about so as hard as it is I have to be the diplomatic one and then when I get in my van I yell out all the shite I wanted to say, but according to him. If you use a debit card you are a poor.

My mom.. 76 years old, writes checks for everything. Does nothing electronic because she doesn't trust it.

One time I was at her house and I mentioned something about my debit card and her husband told me "only poor people use debit cards". We don't really see eye to eye, never have. Mainly because he is a jackass who likes to tell people (when I say people, I mean anyone he talks to) how they should do things and that the way he does it is the right way.

We butted heads right away because I pretty much told him that when he starts to tell me what I should do or how his way is better.. To just stop because I don't fricking care and half the time has no clue what he is talking about so as hard as it is I have to be the diplomatic one and then when I get in my van I yell out all the shite I wanted to say, but according to him. If you use a debit card you are a poor.

Posted on 1/12/23 at 10:33 pm to LSU alum wannabe

quote:

The $100 check turned into $7000. It was from my dad to an African/Nigerian name.

I'd be just as concerned how the Nigerian knew a $7k check was going to clear.

Withdraw all but say $500 from the Wells Fargo account until this resolves, then close it.

Wells Fargo is btw, one of the worst rated banks for customer service, on top of being significantly fined for consumer lending fraud some years back.

Posted on 1/13/23 at 4:32 am to LSU alum wannabe

See Charlie I think you got the wrong idea about me, let me tell you what I do...

Popular

Back to top

42

42