- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

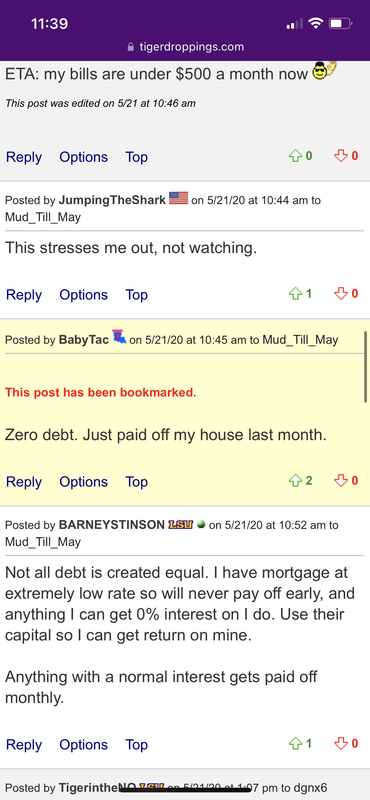

Posted on 9/8/22 at 11:24 am to BabyTac

i only owe about 6k on a car with a trade in value of about 20k

BUT

i don't own anything (well, not myself)

BUT

i don't own anything (well, not myself)

Posted on 9/8/22 at 11:29 am to BabyTac

Depends if Biden is real or not on forgiveness

Posted on 9/8/22 at 11:33 am to BabyTac

quote:How many homes have you paid off in the last 14-15 months?

BabyTac

Posted on 9/8/22 at 11:37 am to BabyTac

A lot, but other than my mortgage (2.9%) and my truck note (0.0%) the debt makes me more money than it costs. I use to think living debt free was the answer, but I learned from self-made millionaires that debt can be good if its used properly.

This post was edited on 9/8/22 at 11:38 am

Posted on 9/8/22 at 11:38 am to BabyTac

I now have a mortgage, but it's less than 20% of the home value, so I'm not too worried about it.

That's it. I keep no other debt.

That's it. I keep no other debt.

Posted on 9/8/22 at 11:38 am to BabyTac

How many brag about paying off your house threads do you need ? This is at least the second one.

Ahh I see you paid your other house off in 2020. Baller.

Edit: Dude has paid his house off 3 times since 2020

Ahh I see you paid your other house off in 2020. Baller.

Edit: Dude has paid his house off 3 times since 2020

This post was edited on 9/8/22 at 11:44 am

Posted on 9/8/22 at 11:45 am to BabyTac

A whole metric frickload.

I made my own way and wasn't given anything and im young, so it doesn't bother me much. It's mostly "good" debt, if there is such a thing.

I made my own way and wasn't given anything and im young, so it doesn't bother me much. It's mostly "good" debt, if there is such a thing.

Posted on 9/8/22 at 11:45 am to BabyTac

I have a mortgage, one car payment (wife's car is paid off), no credit card debt, combined student loans b/t both of us of ~$3000 remaining, and a small HELOC we took out to do some renovations recently. We could pay off the HELOC but doesn't make a ton of sense with only needing to pay ~50$ in interest a month and it just being tied to the equity of our home that has increased in value by about 60% since we bought it. I'd rather have more money available to invest elsewhere for a higher rate of return.

This post was edited on 9/8/22 at 11:49 am

Posted on 9/8/22 at 11:46 am to BabyTac

The house that we are making double payments on

Posted on 9/8/22 at 11:46 am to BabyTac

Between Mortgage, Student Loans, and a Car note

Like 340k

Like 340k

Posted on 9/8/22 at 11:48 am to BabyTac

Just my mortgage and a few more car payments.

Posted on 9/8/22 at 11:49 am to BabyTac

Use CCs for everything and auto-pay in full monthly

(we follow a budget and are pretty disciplined) - zero CC debt beyond the interest-free period.

Have a mortgage and $ of same amount invested - to work positive spread (interest earned on invested $ > mortgage interest)

Zero other debt.

I like Dave Ramsey except for using others' money for things where you can be disciplined and actually earn money on debt (vs. pay through the nose for debt).

(we follow a budget and are pretty disciplined) - zero CC debt beyond the interest-free period.

Have a mortgage and $ of same amount invested - to work positive spread (interest earned on invested $ > mortgage interest)

Zero other debt.

I like Dave Ramsey except for using others' money for things where you can be disciplined and actually earn money on debt (vs. pay through the nose for debt).

Posted on 9/8/22 at 11:50 am to BabyTac

I'm sure this thread will be filled with the truth.

Owe around $15k on some property in Florida and $10k on some property overseas. Both have zero interest so there hasn't been a rush to pay either off.

Owe around $15k on some property in Florida and $10k on some property overseas. Both have zero interest so there hasn't been a rush to pay either off.

Posted on 9/8/22 at 11:53 am to BabyTac

Since the 10k forgiven

My Student Loans -- $12k

Car Note -- $13k

We use CCs for the miles/rewards, but pay off every month.

Moving in march. Currently in the process of buying a house. Loan should be 100-125k. Many fine starter homes in the midwest in this range. Hope to make double mortgage payments each month, will still be MUCH lower than our current rent.

My Student Loans -- $12k

Car Note -- $13k

We use CCs for the miles/rewards, but pay off every month.

Moving in march. Currently in the process of buying a house. Loan should be 100-125k. Many fine starter homes in the midwest in this range. Hope to make double mortgage payments each month, will still be MUCH lower than our current rent.

Posted on 9/8/22 at 11:54 am to BabyTac

Just my mortgage, therefore I'm considered an "enemy" of the American left.

Popular

Back to top

0

0