- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

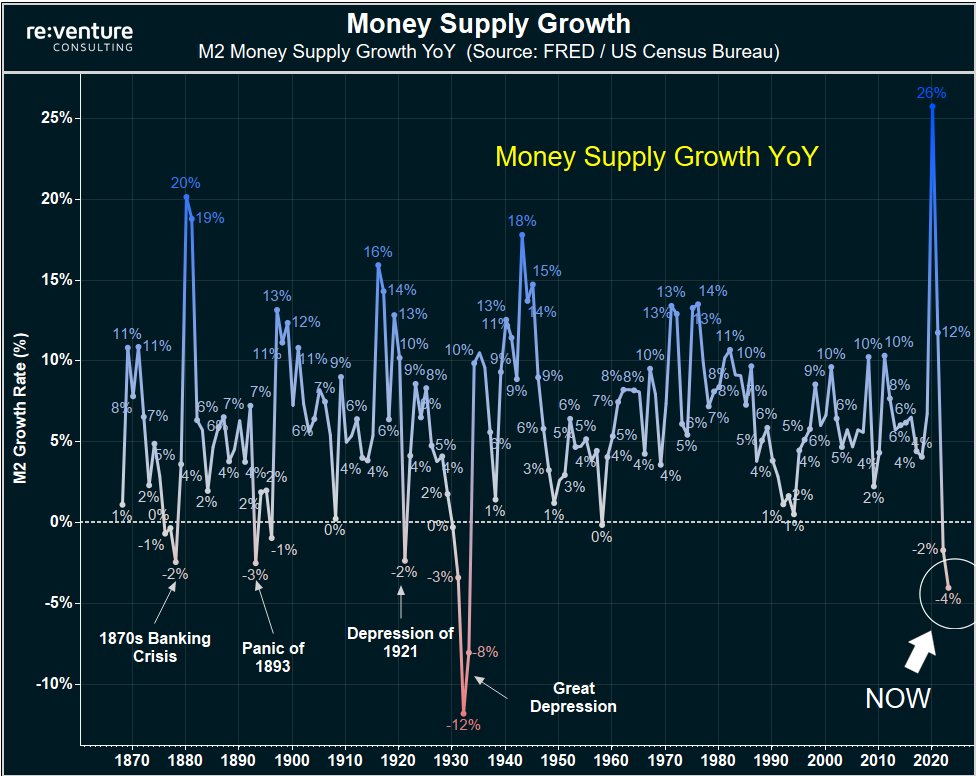

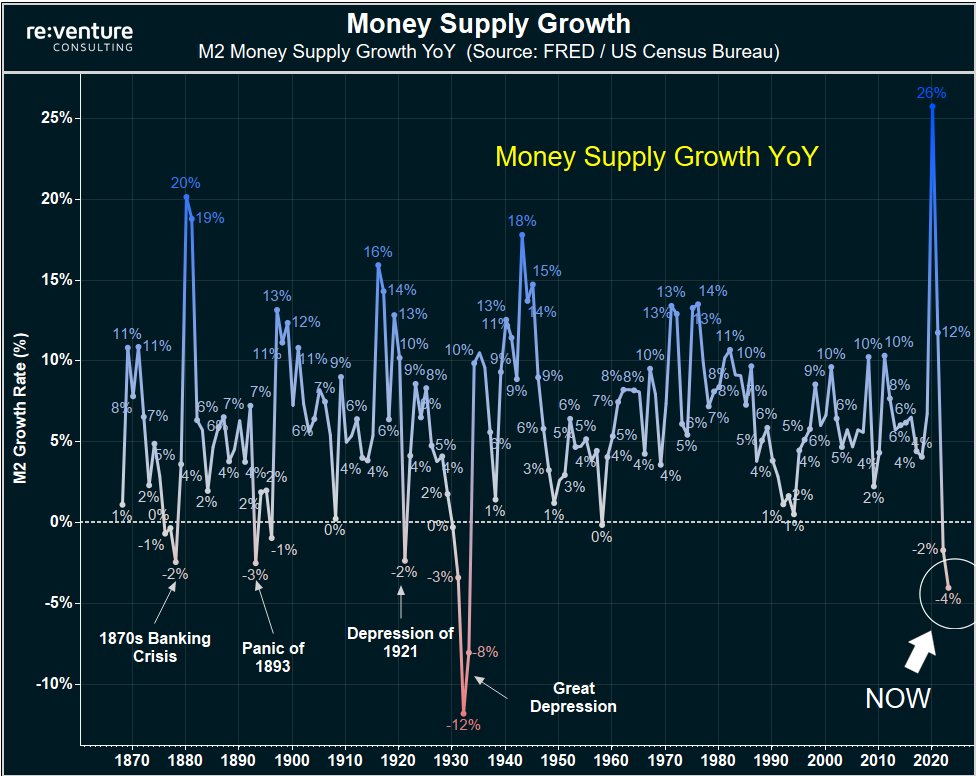

The money supply is shrinking

Posted on 4/27/23 at 8:43 am

Posted on 4/27/23 at 8:43 am

Which was needed to slow inflation but the question is if this is too much too fast. I am asking for those that know more about this stuff than the rest of us. Where do you see this going?

Is Elon wrong here?

quote:

@elonmusk

The data with which the Federal Reserve is making decisions has too much latency

Is Elon wrong here?

This post was edited on 4/27/23 at 8:47 am

Posted on 4/27/23 at 8:44 am to stout

Part of how we got here is that the Fed has been taking dumb actions for years with the hopes of kicking the can down the road.

Problem is that the road eventually hits a dead end.

Problem is that the road eventually hits a dead end.

Posted on 4/27/23 at 8:45 am to stout

Where did it go? This is not my expertise area

Posted on 4/27/23 at 8:47 am to teke184

quote:

Problem is that the road eventually hits a dead end.

I am surprised they have been able to stretch it for this long. I suspected shite to hit the fan months ago.

Posted on 4/27/23 at 8:48 am to DarthRebel

quote:

Where did it go?

Up Hunter’s nose

Posted on 4/27/23 at 8:48 am to stout

quote:

Is Elon wrong

My go to answer is probably no

Posted on 4/27/23 at 8:50 am to DarthRebel

The chart is for year over year growth. I would be more curious to see just a chart of M2 supply over time.

Posted on 4/27/23 at 8:52 am to Lou Pai

quote:

I would be more curious to see just a chart of M2 supply over time.

This?

Posted on 4/27/23 at 8:52 am to stout

quote:

I am surprised they have been able to stretch it for this long. I suspected shite to hit the fan months ago.

US monetary policy doesn’t happen in a vacuum… fortunately (or unfortunately for sentiment on this board), the US is still the safest, most secure place to park your money… until that changes, we will chug along with ups and downs.

Posted on 4/27/23 at 8:53 am to DarthRebel

Quantitative tightening, bonds mostly.

Posted on 4/27/23 at 8:56 am to stout

quote:

I am surprised they have been able to stretch it for this long. I suspected shite to hit the fan months ago.

The Federal Reserve is akin to the Climate Change folks. They are intervening into a system so complex that there is no possible way for them to understand it or control it.

Posted on 4/27/23 at 8:57 am to DarthRebel

quote:

Where did it go? This is not my expertise area

That's a complex question but to help you have a basic understanding, in economic systems with lending elements there is something called a money multiplier. A simple example will help to illustrate it.

DarthRebel is in a two person economic system and has $10.

He puts the $10 in the bank. The bank is required to actually hold in reserve 30% of the deposit in this example, $3

The bank lends out to your evil twin $7. The total amount of the money supply is now $17. You have $10 on the books with the bank, your evil twin has $7. The money supply was multiplied by the lending action.

That's a very, very basic illustration of how the money supply grows and is calculated. To shrink it, you can increase the reserve amount, raise the cost of lending, or do several other systemic actions that will lower the money multiplier, the acutal money supply, or both.

In this case, the decrease is likely tied to many, many variables, but the tightening is designed to head off inflation. The easiest action to see is the raising of the fed funds rate over the past few years. Hope that helps just a bit.

Posted on 4/27/23 at 8:59 am to stout

Uhh yeah he's spot on. The OER takes like 2 years for prices to flow through CPI it's absurd. All of the other components take a full year.

The problem is they will use whatever metric conforms to their narrative so the data driven mantra is complete B.S. in the first place. They're aren't a data driven institution.

The problem is they will use whatever metric conforms to their narrative so the data driven mantra is complete B.S. in the first place. They're aren't a data driven institution.

Posted on 4/27/23 at 8:59 am to Lou Pai

quote:

The chart is for year over year growth. I would be more curious to see just a chart of M2 supply over time.

LP, I thought I read a couple years back that the Fed no longer (at least publicly) tracks the money supply data. Did they reverse course on this, did I misunderstand what was being communicated, or is the money supply just being tracked by non-Fed entities using the best data available (or something else)?

Posted on 4/27/23 at 9:01 am to therick711

quote:

That's a complex question but to help you have a basic understanding, in economic systems with lending elements there is something called a money multiplier. A simple example will help to illustrate it.

DarthRebel is in a two person economic system and has $10.

He puts the $10 in the bank. The bank is required to actually hold in reserve 30% of the deposit in this example, $3

The bank lends out to your evil twin $7. The total amount of the money supply is now $17. You have $10 on the books with the bank, your evil twin has $7. The money supply was multiplied by the lending action.

That's a very, very basic illustration of how the money supply grows and is calculated. To shrink it, you can increase the reserve amount, raise the cost of lending, or do several other systemic actions that will lower the money multiplier, the acutal money supply, or both.

In this case, the decrease is likely tied to many, many variables, but the tightening is designed to head off inflation. The easiest action to see is the raising of the fed funds rate over the past few years. Hope that helps just a bit.

I majored in econ, for a generic simplified explanation, this is well done!

Posted on 4/27/23 at 9:04 am to mwade91383

I appreciate that. It would be hard for me to give a real good explanation of it in the time I'm willing to put into it that would be helpful.

Now I'm just waiting for Darth to come back and say "Thanks, but, actually, I'm Bill Poole. I was just trolling."

Now I'm just waiting for Darth to come back and say "Thanks, but, actually, I'm Bill Poole. I was just trolling."

Posted on 4/27/23 at 9:05 am to Lou Pai

quote:

The chart is for year over year growth.

Growth rate is the key issue. When M2 growth rate goes negative liquidity becomes a major issue.

Historically the way out is war. War allows politicians to sell the concept of more spending which leads to more Federal Reserve money printing (bond buying). War has traditionally been politically palpable reason to spend more (albeit the pandemic was unprecedented).

Ed Dowd explains it:

Ed Dowd Explains How M2 Went Negative In 2022 For The 5th Time Ever And What That Means.

Ed Dowd: "Were in a crisis, and the crisis is now starting to manifest in bank failures."

On a side note, it's the reason the Pentagon and the DC Uniparty are very happy Tucker is gone. Tucker was a massive critic of the Ukraine war and was a major impediment to politicians like Lindsay Graham selling war. Permanent Washington, including the bankers, need Ukraine war as a precursor to WWIII (which will likely include continued fighting with Russia in Ukraine, conflict with China via Taiwan, conflict in the ME with Syria and now conflict in Sudan).

Posted on 4/27/23 at 9:09 am to therick711

Money is also created when the Federal Reserve buys treasuries.

Posted on 4/27/23 at 9:34 am to DarthRebel

quote:

Where did it go? This is not my expertise area

Here is oversimplified example (and how I believe it works...anyone feel free to correct me).

Congress appropriates a $4T budget.

Tax revenue is $3T.

Congress via the Treasury Department needs to raise $1T.

Treasury Department sells $1T worth of bonds.

To maintain interest rate goals set by the Federal Reserve the Treasury Department can only sell $0.5T worth of bonds on the open market not including the Federal Reserve.

The Federal Reserve steps in and purchases the $0.5T in bonds via 21 Primary Dealers (banks that work for the Federal Reserve). $0.5T is printed and the bonds are put on the FR's balance sheet. LINK

The bonds mature and the Treasury pays the par value of the bond plus interest. This is when money is removed. The interest minus expense is returned back to the Treasury. By law the FR cannot earn interest on the bonds they purchase.

Popular

Back to top

9

9