- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Tax Cuts for the Rich: Defend the position

Posted on 8/1/17 at 9:56 am to volod

Posted on 8/1/17 at 9:56 am to volod

quote:Your chart doesn't demonstrate that. Those are not effective tax rates. Do you understand the difference?

I was mainly just trying to show how previous trends lead up to the common misconceptions about tax rates in relation to job growth.

This post was edited on 8/1/17 at 9:57 am

Posted on 8/1/17 at 9:56 am to volod

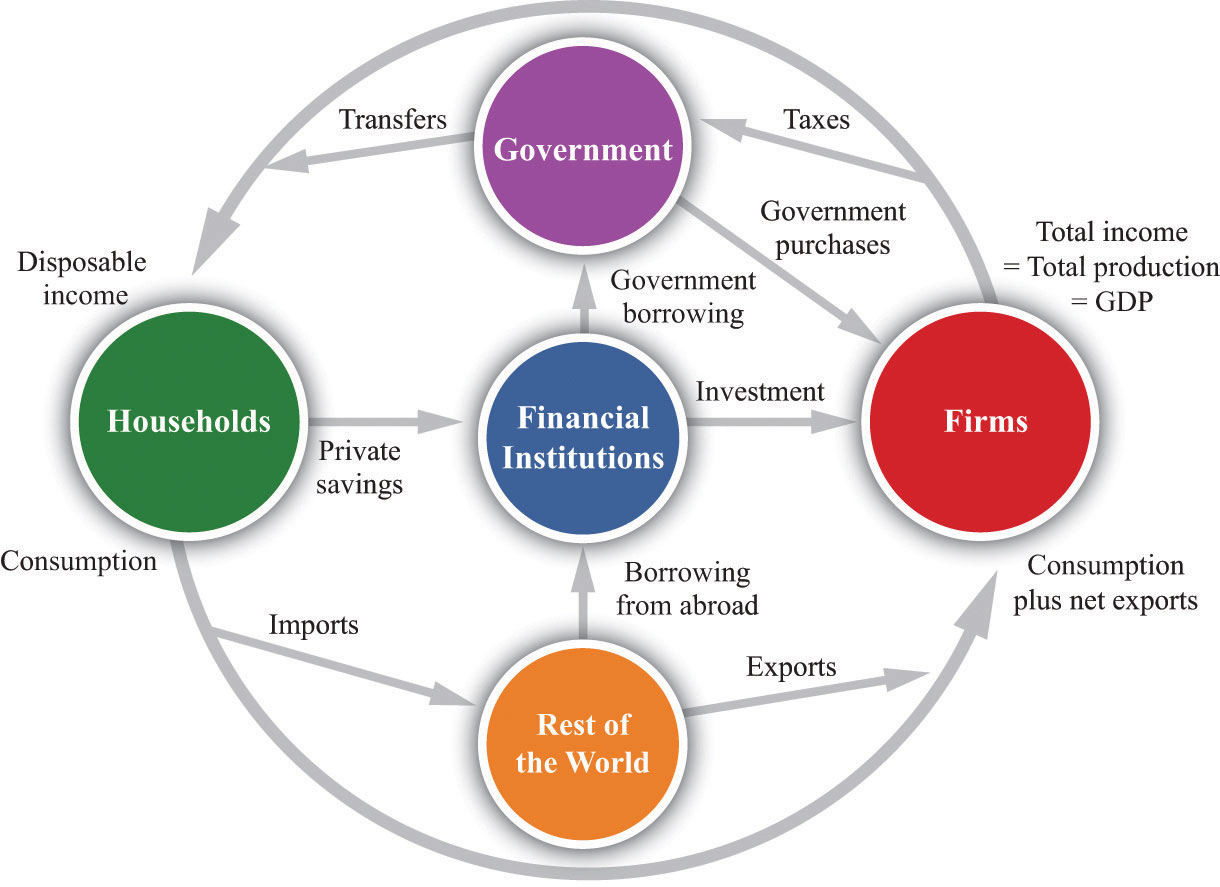

Volod. I want you to ask yourself if all those evil rich people didn't invest their mountains of cash who would hurt first according to this macro economic flow chart.

Posted on 8/1/17 at 9:56 am to Machine

quote:

i'm happy somewhere between Nixon and Eisenhower era taxes

while keeping the same system of deductions?

Posted on 8/1/17 at 9:59 am to SlowFlowPro

quote:negative

while keeping the same system of deductions?

i also feel we as voters need to hold our elected officials to a higher standard. no reason we should be wasting as much money as this country does across the board. i don't think most people would have a problem with taxes if they knew their money was actually being spent efficiently, and could see the results in their communities and states

Posted on 8/1/17 at 9:59 am to Eurocat

quote:

Taxes should be raised on the rich.

They already have enough anyway.

It must be sad going through life being bitter and envious that others are more successful than you.

Posted on 8/1/17 at 10:03 am to Machine

quote:

i don't think most people would have a problem with taxes if they knew their money was actually being spent efficiently, and could see the results in their communities and states

Exactly why you won't hear me bitch about my property taxes in the Houston burbs. Our schools, parks, and local development is constant. We see our money spent, and spent well. And we're good with it.

Posted on 8/1/17 at 10:03 am to Eurocat

quote:Abject greed on display.

Taxes should be raised on the rich.

They already have enough anyway.

Posted on 8/1/17 at 10:04 am to MSMHater

quote:

Exactly why you won't hear me bitch about my property taxes in the Houston burbs. Our schools, parks, and local development is constant. We see our money spent, and spent well. And we're good with it.

It's almost like the closer the government is to the people it's governing, the more efficient and effective it is.

Posted on 8/1/17 at 10:05 am to MSMHater

quote:easily the thing that pisses me off the most about living in Louisiana. if i didn't have family and a solid job here, i'd head west

Exactly why you won't hear me bitch about my property taxes in the Houston burbs. Our schools, parks, and local development is constant. We see our money spent, and spent well. And we're good with it.

Posted on 8/1/17 at 10:05 am to Machine

quote:

negative

if your system becomes law, i'm going to for sure invest in cryptocurrencies because wealth in the US will vanish overnight

quote:

i also feel we as voters need to hold our elected officials to a higher standard

i don't disagree but that's just not going to happen

it's kind of why LA is fricked. our underclass has grown too big and keeps growing

quote:

i don't think most people would have a problem with taxes if they knew their money was actually being spent efficiently,

our federal spending is spent on (1) Medicare (2) Medicaid (3) Social Security and (4) Defense and (5) Interest on our debt

non-discretionary spending is 17% of the budget!

Posted on 8/1/17 at 10:06 am to Eurocat

quote:

Taxes should be raised on the rich.

They already have enough anyway

Words of a fricking LOSER.

Posted on 8/1/17 at 10:07 am to SlowFlowPro

I see a great opportunity to decrease our budget by 47%.

Then we can go after the shitshow that is the DoD acquisition process and save some more.

Then we can go after the shitshow that is the DoD acquisition process and save some more.

Posted on 8/1/17 at 10:07 am to SlowFlowPro

quote:all areas that can be slashed, or retooled. well...minus 5

our federal spending is spent on (1) Medicare (2) Medicaid (3) Social Security and (4) Defense and (5) Interest on our debt

Posted on 8/1/17 at 10:08 am to volod

Tax cuts across the board only if there is spending cuts across the board also. We are in debt, we don't get out of debt by racking up more credit. I get the argument for trickle down creates more jobs = more tax base etc, but we have a spending problem. Until that gets under control there is no point cutting income.

Posted on 8/1/17 at 10:09 am to Machine

quote:

all areas that can be slashed, or retooled.

good luck

Posted on 8/1/17 at 10:11 am to volod

Your statement:

From your article:

So you want to lower taxes, but those taxes are mostly being paid by the "rich." So therefore you want to lower taxes on the rich. Congrats on being a Republican!

Also this:

This article disingenuously (I hope it isn't outright ignorance) glosses over that fact the rich people just don't stuff their money in a mattress; they invest it. That investment is the capital to start new businesses, fund innovation and pay for upgrades that make a more productive economy.

That's why he says it doesn't DIRECTLY produce jobs.

quote:

1) I agree that the government takes too much in taxes (both federal and state). The people should have more access to the money they earn.

From your article:

quote:

While it would be true that if you cut income taxes on the poor and low-end working people so they had more money in their pockets it would stimulate the economy, it's impossible. Why is it impossible? Because, as Rush Limbaugh and Mitt Romney point out as often as possible, the bottom 47 percent of American workers make so little money that they don't pay any income taxes. So there's nothing to cut. When Republicans talk about tax cuts, they're not talking about tax cuts for working people.

So you want to lower taxes, but those taxes are mostly being paid by the "rich." So therefore you want to lower taxes on the rich. Congrats on being a Republican!

Also this:

quote:

The thing that makes this a lie is that rich people behave differently from poor and working class people. When they get extra money from tax cuts, they don't spend it. After all, they already have pretty much everything they may want or need.

Instead, as we learned about Mitt Romney in 2012, they open bank accounts in the Cayman Islands and Switzerland and stash that money for future generations.

This article disingenuously (I hope it isn't outright ignorance) glosses over that fact the rich people just don't stuff their money in a mattress; they invest it. That investment is the capital to start new businesses, fund innovation and pay for upgrades that make a more productive economy.

That's why he says it doesn't DIRECTLY produce jobs.

Posted on 8/1/17 at 10:11 am to SlowFlowPro

quote:

good luck

Posted on 8/1/17 at 10:13 am to SlowFlowPro

quote:If one need examples of this, just look at where capital is plentiful.

if your system becomes law, i'm going to for sure invest in cryptocurrencies because wealth in the US will vanish overnight

It's instructive to see that nations with heinous taxation are the same ones resorting to QE and flirting with negative interest rates in an attempt to "stimulate" their economies into life by forcing (the little capital left) into the economy.

Posted on 8/1/17 at 10:17 am to volod

It a relative argument.

1) everyone has a different definition of rich. IS it $250k year, $100k a year, $1M year....

2) because of "progressive" tax brackets, the rich are already paying a larger percentage. If for the sake of numbers everyone paid a 10% flat tax, then the rich would still be paying more. (10% of $100k is $10k and 10% of $1M is $100k)

But since we have a bracket system, the rates go from 10% to i think 35%

So any attempt to lower % on any bracket will appear to give the rich a larger dollar cut in taxes, because they are saving that percentage on a larger sum of money.

3) The theory behind tax cuts creating jobs is that business/entrepreneurs a) need capitol for expansion and growth and b) its all about risk versus reward. Lower taxes lowers give a greater reward to offset the risks being taken. Also, it can extend profitability in businesses that are borderline profitable.

Main issue i have is the philosophy that takes cuts are gifts back to people/businesses. When in fact the money is already the persons/businesses. They earned the money. a tax break is the government just taking less.

Also, this country does not have a revenue issue we have a spending issue. If we raised taxes on everyone (neglecting diminishing returns) and balanced the budget this year, next year we would have a deficit. Spending is growing faster the GPD. Spending must be fixed or we will never balance a budget.

1) everyone has a different definition of rich. IS it $250k year, $100k a year, $1M year....

2) because of "progressive" tax brackets, the rich are already paying a larger percentage. If for the sake of numbers everyone paid a 10% flat tax, then the rich would still be paying more. (10% of $100k is $10k and 10% of $1M is $100k)

But since we have a bracket system, the rates go from 10% to i think 35%

So any attempt to lower % on any bracket will appear to give the rich a larger dollar cut in taxes, because they are saving that percentage on a larger sum of money.

3) The theory behind tax cuts creating jobs is that business/entrepreneurs a) need capitol for expansion and growth and b) its all about risk versus reward. Lower taxes lowers give a greater reward to offset the risks being taken. Also, it can extend profitability in businesses that are borderline profitable.

Main issue i have is the philosophy that takes cuts are gifts back to people/businesses. When in fact the money is already the persons/businesses. They earned the money. a tax break is the government just taking less.

Also, this country does not have a revenue issue we have a spending issue. If we raised taxes on everyone (neglecting diminishing returns) and balanced the budget this year, next year we would have a deficit. Spending is growing faster the GPD. Spending must be fixed or we will never balance a budget.

Posted on 8/1/17 at 10:17 am to MSMHater

Yep, same here on Long Island. Tons of taxes and I have great schools and a public pool (virtually free) and golf course (very minimal fees) within walking distance. And the cops come in about three minutes and so does the ambulance if some trouble happens. I have no problem paying taxes.

Popular

Back to top

1

1