- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Tax Cuts for the Rich: Defend the position

Posted on 8/1/17 at 9:27 am

Posted on 8/1/17 at 9:27 am

So now that the Republicans are moving away from the ACA and onto the tax reforms, I want understand why you all support tax cuts.

for TLDR

1) I agree that the government takes too much in taxes (both federal and state). The people should have more access to the money they earn.

2) What is "the Rich" as defined by DEM and GOP media. I always assumed they were talking about 300K to beyond millionaire status. If I am wrong, please provide a more appropriate salary range for my understanding.

At what range do people "not pay taxes at all' (ie get tax returns on their W-2) . Why do most people get taxed if the money is just going to be returned to them?

If I am right, then the question becomes, why do you support tax cuts for only a very small sector of American society. If it does not really benefit the "working class", why should the average worker bother?

3) Your position of "they will create more jobs" does not answer the question 'what types of jobs will be created and what qualifications will they require'

For example, if the goal is get more factories workers at $4/hr with no benefits, obviously you are going have difficulty finding workers in 1st world countries.

I feel that many GOP are being disingenuous about the realities of working conditions in various countries and corporate tax avoidance. This is not about 'fairness' as much it is checks and balances between the worker and their employer. I am not pro-Union, but I am pro-Employee Protection

Tax Cuts for the Rich Dont Directly create Jobs

High Tax Rates on Rich Dont Hurt Overall Economy

for TLDR

1) I agree that the government takes too much in taxes (both federal and state). The people should have more access to the money they earn.

2) What is "the Rich" as defined by DEM and GOP media. I always assumed they were talking about 300K to beyond millionaire status. If I am wrong, please provide a more appropriate salary range for my understanding.

At what range do people "not pay taxes at all' (ie get tax returns on their W-2) . Why do most people get taxed if the money is just going to be returned to them?

If I am right, then the question becomes, why do you support tax cuts for only a very small sector of American society. If it does not really benefit the "working class", why should the average worker bother?

3) Your position of "they will create more jobs" does not answer the question 'what types of jobs will be created and what qualifications will they require'

For example, if the goal is get more factories workers at $4/hr with no benefits, obviously you are going have difficulty finding workers in 1st world countries.

I feel that many GOP are being disingenuous about the realities of working conditions in various countries and corporate tax avoidance. This is not about 'fairness' as much it is checks and balances between the worker and their employer. I am not pro-Union, but I am pro-Employee Protection

Tax Cuts for the Rich Dont Directly create Jobs

quote:

So, you'd think that if you cut the taxes on poor and low-wage people, they'd have more money, which they'd spend, and it would stimulate the economy. That's true - except for one thing, which is the germ of the lie that rich people use to get everybody to think that tax cuts for rich people help economies.

And here's that lie. While it would be true that if you cut income taxes on the poor and low-end working people so they had more money in their pockets it would stimulate the economy, it's impossible. Why is it impossible? Because, as Rush Limbaugh and Mitt Romney point out as often as possible, the bottom 47 percent of American workers make so little money that they don't pay any income taxes. So there's nothing to cut. When Republicans talk about tax cuts, they're not talking about tax cuts for working people.

But what about cutting taxes on rich people? Wouldn't that give them more money to spend - or even invest - which would stimulate economic growth? That's the core, of course, of the tax religion of Limbaugh (who has a reported $400 million contract) and Romney (who was reported to have paid no taxes for years on hundreds of millions in income). Cut rich people's taxes, they say, and the good times will roll!

The thing that makes this a lie is that rich people behave differently from poor and working class people. When they get extra money from tax cuts, they don't spend it. After all, they already have pretty much everything they may want or need.

Instead, as we learned about Mitt Romney in 2012, they open bank accounts in the Cayman Islands and Switzerland and stash that money for future generations. Or, they'll buy an American company, like Sensata, and move it to China where they can get cheaper labor and pollute all they want. Or, since they got the money relatively easily and don't worry so much about losing it - after all, their basic needs are already covered - they gamble with it. They call it "investing in real estate and the market," but it's really just gambling.

None of this, of course, translates into America jobs.

High Tax Rates on Rich Dont Hurt Overall Economy

This post was edited on 8/1/17 at 9:31 am

Posted on 8/1/17 at 9:29 am to volod

Taxes should be raised on the rich.

They already have enough anyway.

They already have enough anyway.

Posted on 8/1/17 at 9:30 am to volod

What, in your opinion, is an acceptable tax rate for "the rich?" What is, in your opinion, "their fair share?"

Posted on 8/1/17 at 9:31 am to volod

quote:

Tax Cuts for the Rich: Defend the position

1. we shouldn't punish people for being more economically viable

2. we shouldn't discriminate in our tax policy based on SES. it should be an evenly-applied law to all persons

now discussing your article

quote:

It hurts directly, as hundreds of billions of dollars no longer flow into the economy and stimulate growth.

so that money isn't a part of he economy if a different group of people posses it?

Posted on 8/1/17 at 9:31 am to volod

Tax cuts around the board. Its just simple: they'll have more money to invest in their own business, invest in making more jobs for their business.

You don't need a crazy explanation

You don't need a crazy explanation

Posted on 8/1/17 at 9:32 am to volod

quote:Then you just defended tax cuts for "the rich".

1) I agree that the government takes too much in taxes (both federal and state). The people should have more access to the money they earn.

"The rich" are paying almost all of the taxes. The current contribution to federal revenues by the "middle" class is very, very small.

This post was edited on 8/1/17 at 9:33 am

Posted on 8/1/17 at 9:33 am to SlowFlowPro

quote:

so that money isn't a part of he economy if a different group of people posses it?

This is the crux of the issue.

What can the government do with that money that the people who earned it can't?

Do rich people not stimulate the economy?

Posted on 8/1/17 at 9:33 am to Eurocat

Typical european argument here. Pray tell, what is your big government definition of when someone has "enough" of their own money?

Posted on 8/1/17 at 9:33 am to Bunyan

Or spend it on yachts and villas in Switzerland and Caviar from Siberia. There is absolutely no guarantee the money will stay in the USA.

Posted on 8/1/17 at 9:34 am to volod

quote:

Tax Cuts for the Rich: Defend the position

quote:

2) What is "the Rich" as defined by DEM and GOP media. I always assumed they were talking about 300K to beyond millionaire status. If I am wrong, please provide a more appropriate salary range for my understanding.

I wouldn't put $300K as 'rich' in San Fran, NYC, or several other main cities, especially with kids. You're upper middle class in most areas of the country with that. I wouldn't define 'Rich' as anything under $.5-$1M. If you're taking out your own trash, you aren't rich.

No. I don't care about tax cuts for the rich. They're more capable than I am at lobbying governmental officials for their money.

quote:

At what range do people "not pay taxes at all' (ie get tax returns on their W-2) . Why do most people get taxed if the money is just going to be returned to them?

Around 50th percentile.

quote:

If I am right, then the question becomes, why do you support tax cuts for only a very small sector of American society. If it does not really benefit the "working class", why should the average worker bother?

No one cares about the uneducated white males.

quote:

3) You position of "they will create more jobs" does not answer the question 'what types of jobs will be created and what qualifications will they require'

Just don't care.

Posted on 8/1/17 at 9:34 am to volod

Do a little digging into the economic history of this country. The greatest economic boom happened almost immediately following the Reagan tax cuts. So much so that they, in many economists opinion, carried all the way over into the Clinton years.

Tax cuts = economic growth

It's also been proven that lowering taxes not only stimulates the economy, but actually INCREASES government revenue. Increased expendable income = increased spending power = higher business revenues (and taxes) = lower unemployment = more people paying in the system.

This is why conservatives believe in tax cuts.

Tax cuts = economic growth

It's also been proven that lowering taxes not only stimulates the economy, but actually INCREASES government revenue. Increased expendable income = increased spending power = higher business revenues (and taxes) = lower unemployment = more people paying in the system.

This is why conservatives believe in tax cuts.

Posted on 8/1/17 at 9:34 am to ILeaveAtHalftime

Anything over 299k.

Posted on 8/1/17 at 9:34 am to Eurocat

So your argument rests on some subjective definition of when Eurocat thinks that a person has too much of their own money?

ETA: so anyone making 300k automatically has too much and should give the rest to the government? I truly hope you do not vote on this continent. I'll leave the wealth redistribution to homogenous Baltic countries

ETA: so anyone making 300k automatically has too much and should give the rest to the government? I truly hope you do not vote on this continent. I'll leave the wealth redistribution to homogenous Baltic countries

This post was edited on 8/1/17 at 9:37 am

Posted on 8/1/17 at 9:35 am to BrookhavenBengal

quote:

What, in your opinion, is an acceptable tax rate for "the rich?" What is, in your opinion, "their fair share?"

I believe in a progressive tax rate.

Posted on 8/1/17 at 9:36 am to volod

Making one group pay more of the revenue to fund this country than others. Defend that position.

Posted on 8/1/17 at 9:36 am to volod

I believe in a flat tax where no one gets a return.

Posted on 8/1/17 at 9:39 am to volod

quote:

for TLDR

I dont think that means what you think it means.

How about this for the short answer. Taxation is theft for starters. Secondly, singling out the wealthy is discriminatory which I though the regressives were against. Thirdly, if we're going to steal from citizens, then a flat tax should be used to do it. Social programs should be left up to states rights and let those states incur higher costs of living. If I dont give a shite about welfare but want good schools, I can then move my arse to a state who has that set up, or stay where I am and support it. No need to redirect the entire country for the few misfits who "feel something new each day"

Posted on 8/1/17 at 9:39 am to volod

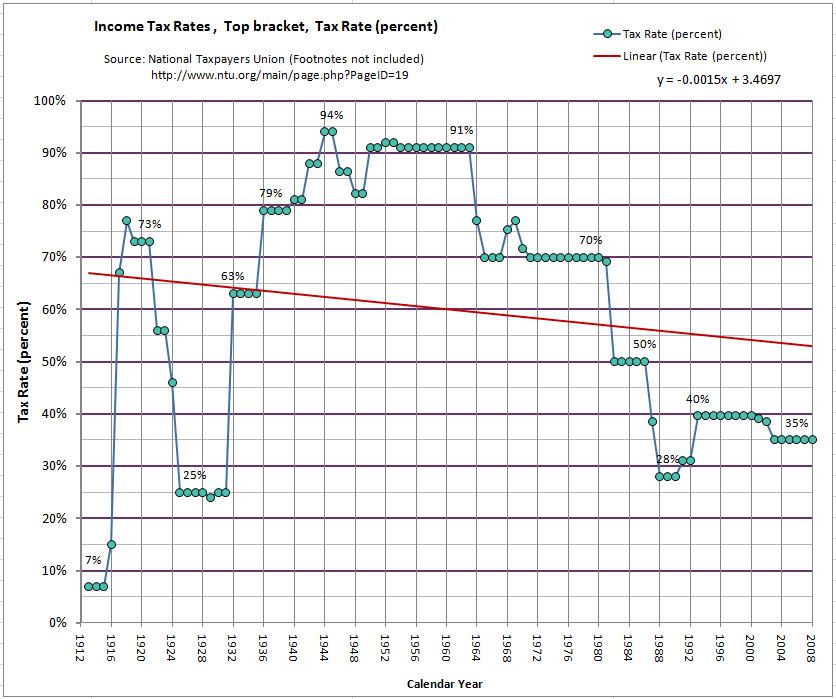

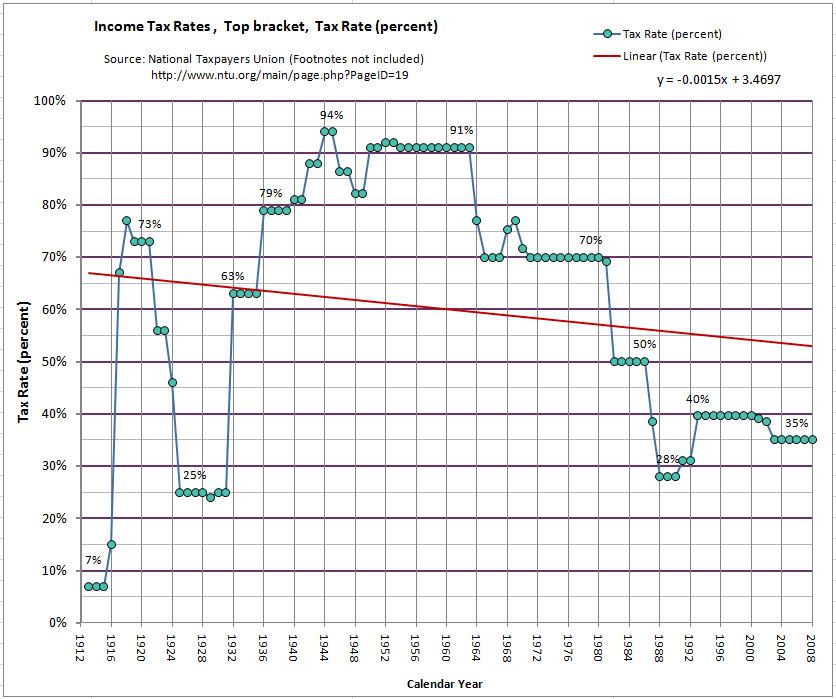

Except there are no numbers on the vertical axis of your graph. The question remains

Posted on 8/1/17 at 9:39 am to SidewalkDawg

quote:

Do rich people not stimulate the economy?

Keynesians love to look at consumer spending at the be all, end all indicator of economic activity

this view means you want more poor people to have money b/c they spend the shite out of it and continue that consumer society

rich people certainly do "stimulate" the economy, but in more indirect and long-term ways that creates gaps in terms of wealth

rich people invest that money, which IS crucial to economic development (RnD + capital expansion requires investment). the problem for left-leaning people is that these investments concentrate the return of that money with "the rich" (rich people invest, big corporations get the money, and rich people get richer when it's successful)

the problem with this view is 2-fold. (1) investment contains risk and that's why the returns on successful investment are bigger. there is no guarantee of a return like there is with a governmental redistribution (when we know that poor people WILL spend that money). (2) successful investment creates jobs, but they're often not the type of jobs that will transform lower SES people. they may go from the underclass to lower-middle class, but since it doesn't transform the lower/underclass to the upper-middle, it's not seen as a victory. they see a safe, consistent redistribution that keeps the lower/underclass somewhat secure (and churning that money) as, at the worst, equal to those same people having menial jobs (Again, why they criticize the wage level at the bottom)

Posted on 8/1/17 at 9:39 am to volod

quote:And by he way.. posting that tax chart makes you look like an idiot.

Volod

No one paid those rates. The deductions and shelters that existed made it really easy to make income non-taxable. Back-in-the day people used to deduct clothes as a work expense.

I've said this before I'd gladly take a doubling of my top tax rate to 78% if you gave me he deductions and shelters of 1979. I'd probably not pay anything.

And you're only looking at one (the top) tax bracket. The lower brackets all paid more as well. One needed a far higher income to reach that top bracket than they do today.

Popular

Back to top

49

49