- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: BlackRock suffered $1.6 trillion in losses in 6 months

Posted on 7/23/22 at 2:08 pm to wutangfinancial

Posted on 7/23/22 at 2:08 pm to wutangfinancial

quote:Let's actually get back to your original nonsense claims:

Blackrock and Vanguard have accumulated so much in assets that a simple rebalancing won’t crash the markets. Single stock names will just go straight to $0. The CARES Act bailed them out the conundrum is it also bailed out the taxpayer and there asset values.

quote:wut

Blackrock and Vanguard have accumulated so much in assets that a simple rebalancing won’t crash the markets.

quote:wut

Single stock names will just go straight to $0.

quote:wut

The CARES Act bailed them out the conundrum is it also bailed out the taxpayer and there asset values.

3 sentences - zero sense.

Posted on 7/23/22 at 2:09 pm to wutangfinancial

quote:Literally nothing to back up your nonsense, understood.

wutangfinancial

Posted on 7/23/22 at 3:10 pm to Big Scrub TX

quote:Didn't read, but the number is $1.7T of $10T, IOW -17%.

it doesn't provide the denominator to measure the $1.6T in losses

That's misleading though, because a significant portion of BLK holdings is non-equity fixed income. It is BLK's ESG manipulation of companies that is at issue. So that's the segment performance you'd want to compare with the S&P or DJIA.

Posted on 7/23/22 at 3:12 pm to the_truman_shitshow

They can withstand the losses because they, along with about 3-4 other major investment funds, are the go-to for people who are looking for funds rather than investing in individual companies.

It’s them, Vanguard, and a few others.

It’s them, Vanguard, and a few others.

Posted on 7/23/22 at 3:12 pm to Salviati

quote:yeah, you have to know all that shite dont ya?

Okay. We'll do this the hard way.

1. Did Blackrock lose significantly more money as a percentage of assets than other institutional investors?

2. If Blackrock lost significantly more money as a percentage of assets than other institutional investors, why would Blackrock intentionally lose $1.6 trillion?

get on the right narrative, right Olaf?

Posted on 7/23/22 at 3:14 pm to wutangfinancial

quote:So you're not really saying the bids were for $0, but rather that there were zero bids. Right?

Other shareholders who believed the market price at $0 was below the intrinsic value of the shares

Posted on 7/23/22 at 3:22 pm to teke184

quote:They can withstand the losses because they are dealing to a significant extent with woke government pension accounts, and they balance holdings with fixed income.

They can withstand the losses because ...

Posted on 7/23/22 at 3:30 pm to NC_Tigah

quote:From what I can tell of their holdings, $1.9T of the $10T is in fixed income. And as a reminder, fixed income has been slaughtered in 2022 - the AGG is down like 10% and high yield maybe like 15%, so it's not like it changes it all that much.

That's misleading though, because a significant portion of BLK holdings is non-equity fixed income.

In any event, it looks like about $6.5T is in index and ETFs.

I would guess that an average 60/40 for the 1st half is down ~17-22%, so BlackRock is right in line with that.

quote:I'm not sure that's as coherent as you think it is. Can you clarify what you mean?

It is BLK's ESG manipulation of companies that is at issue. So that's the segment performance you'd want to compare with the S&P or DJIA.

As of the beginning of 2022, they only had ~$500B of ESG to begin with. People are looking for the tail to be wagging the dog that likely just isn't there.

I think this is the fairest thread title a good-faith OP could have made:

BlackRock's $10T AUM down ~16% in Q1 2022 - pretty much in line with overall markets.

For ESG, their US ESG equity fund was down ~22% in the first half - basically, right in line with the S and P 500. BIRIX

Posted on 7/23/22 at 4:18 pm to Big Scrub TX

quote:

BTW, the article is pathetic in that it doesn't provide the denominator to measure the $1.6T in losses against.

Posted on 7/23/22 at 4:45 pm to leeman101

quote:Me, only because I haven't sold anything YTD.

Who has not lost money in the stock market YTD?

My investments are paying their dividends like "Roscoe", and I'm very comfortable with their financials.

Posted on 7/23/22 at 4:51 pm to Big Scrub TX

quote:BLK hemorrhaged outflow money from their ESG holdings over the past months. I don't recall the amount, but it was significant enough that Fink was forced to speak both to the losses, and to his continued überliberal commitment to the ESG premise.

so BlackRock is right in line with that.

HBR puts it this way:

quote:

The conclusion to be drawn from this evidence seems pretty clear: funds investing in companies that publicly embrace ESG sacrifice financial returns without gaining much, if anything, in terms of actually furthering ESG interests.

HBR

This post was edited on 7/23/22 at 4:52 pm

Posted on 7/23/22 at 5:07 pm to NC_Tigah

100%

This happened in the Treasury market during SE Asia trading in March 2020. If you think the Covid response from Congress was about a virus you have larger mental problems than the guy melting in this thread calling me crazy

Other examples REPO failure in fall 2019, the rebalance I referenced earlier that was sold to useful idiots as the Chinese Deval….etc

Just an observations about supply, demand and momentum in the market. Yo CuckTex why would “we,” the Treasury , buy bond etfs and not actual bonds in a SPV with the Fed instead of the bonds themselves?

This happened in the Treasury market during SE Asia trading in March 2020. If you think the Covid response from Congress was about a virus you have larger mental problems than the guy melting in this thread calling me crazy

Other examples REPO failure in fall 2019, the rebalance I referenced earlier that was sold to useful idiots as the Chinese Deval….etc

Just an observations about supply, demand and momentum in the market. Yo CuckTex why would “we,” the Treasury , buy bond etfs and not actual bonds in a SPV with the Fed instead of the bonds themselves?

Posted on 7/23/22 at 6:21 pm to wutangfinancial

quote:Whoa chief!

If you think the Covid response from Congress was about a virus you have larger mental problem

Hang on!

I'm financially successful, and certainly knowledgeable as far as nonfinancial folks go. But if someone is posting with "financial" in their username, here or on the Money Board, I'm all ears. I'll leave others to hurl invectives. If I'm asking questions on either board, rest assured, it's nothing but clarification or curiousity.

Posted on 7/23/22 at 6:24 pm to NC_Tigah

That was not a shot at you

Posted on 7/23/22 at 6:55 pm to NC_Tigah

quote:Good, I hate that stupid shite. What's more, I can make the very sound argument that the single greatest ESG investment to be made now is in conventional energy - oil and gas. Something like 2 billion humans around the world are still immiserated because they are being denied access to cheap energy like all of us in the west have had for decades.

BLK hemorrhaged outflow money from their ESG holdings over the past months.

If it's human welfare we actually care about, then get them cheap energy! All the better if it's natural gas, which is plenty clean enough.

Check out this Bloomberg piece from earlier this month:

quote:

Europe’s Rush to Buy Africa’s Natural Gas Draws Cries of Hypocrisy

The EU wants to import as much African gas as it can, but doesn’t want to fund projects that would allow the world’s poorest continent to burn more of the fuel at home.

Near the tip of Nigeria’s Bonny Island, an arrowhead speck of land where the Atlantic Ocean meets the Niger Delta, a giant plant last year produced enough liquefied natural gas to heat half the UK for the winter. Most of it was shipped out of the country, with Spain, France and Portugal the biggest buyers.

Just 17 miles away in the town of Bodo, residents still use black-market kerosene and diesel to light wood stoves and power electricity generators. The fuel is manufactured with crude stolen from the foreign energy giants — Shell, Eni and TotalEnergies — that co-own the Bonny Island facility along with the Nigerian government.

“The gas here goes to Bonny and Europe to power homes and industries but we have no benefits from it,” said Pius Dimkpa, chairman of Bodo’s local community development committee. “Nothing comes to us.”

LINK

Absolutely shameful. Cheap energy for me, but not for thee.

Posted on 7/23/22 at 10:12 pm to NC_Tigah

quote:

quote:

Fink does have masters.

Yeah?

Who would you suggest that is?

Who is driving ESG and SRI?

The WEF. Klaus Schwab, Soros, the Rockefellers, Rothschilds, Bilderbergs.

Posted on 7/23/22 at 10:36 pm to the_truman_shitshow

The haven’t “lost” all that money, no? Their position is just reduced at this time.

Posted on 7/24/22 at 12:42 pm to NC_Tigah

Bump for the non-clowns that want to learn something useful:

The date of the Vanguard rebalancing was August 24, 2015. This was sold to the public as the "China Deval" because, media. There was a formulation change on one of their target date strategies from domestic equities into EM fixed income. Johnson & Johnson bid was less than a quarter so the ETF NAVs with JNJ shares all crashed. They have ways to get these settled now limit downs as an example.

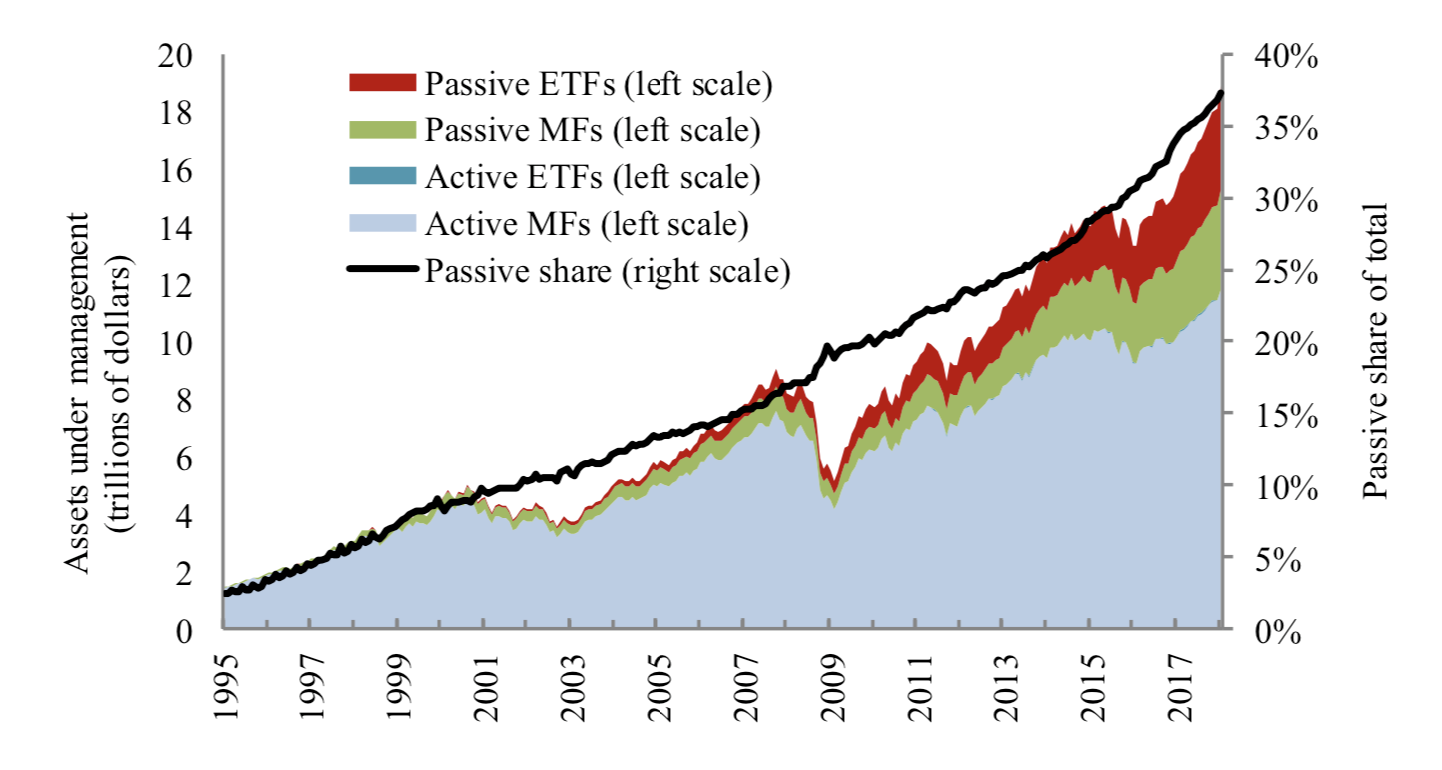

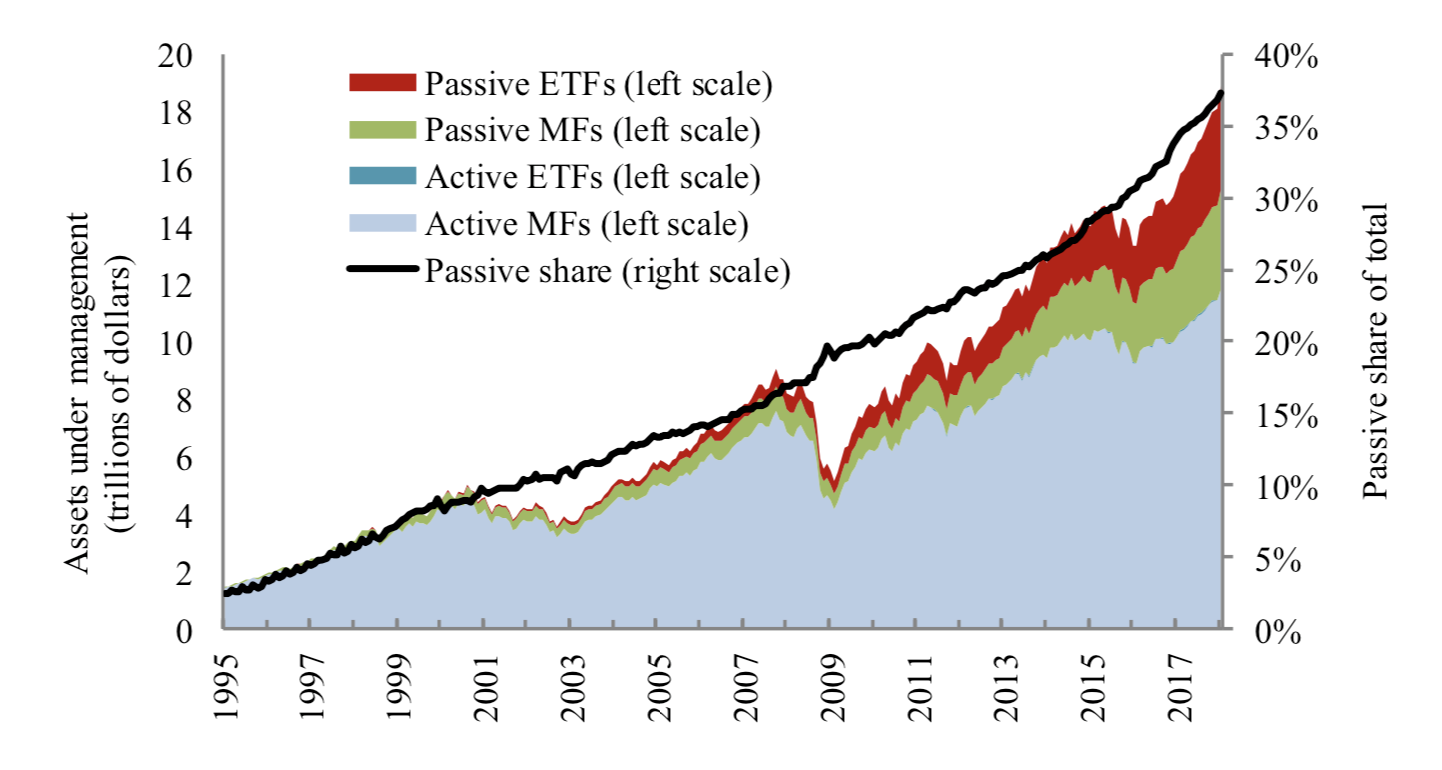

The other dates of note that everybody will remember when there were some net selling of passive strategies: March 2020, Dec 2018, Fall 2008. Our markets are illiquid at higher rates of passive continues to gobble up shares with no regard for price. There is research showing the reflexivity of shares is something like every $1 that goes into a passive product affects single share prices by $4. I'm sure that number get's higher over time. When the buying turns to selling that reflexivity reverses. That is why things get so volatile now and explains why large cap equities don't behave as discounting vehicles for future cashflows.

Once we hit over 50% it can only end with the Federal government having to step in because Vanguard and Blackrock cannot unwind without crashing markets and the entire public and private pension system in the world.

The date of the Vanguard rebalancing was August 24, 2015. This was sold to the public as the "China Deval" because, media. There was a formulation change on one of their target date strategies from domestic equities into EM fixed income. Johnson & Johnson bid was less than a quarter so the ETF NAVs with JNJ shares all crashed. They have ways to get these settled now limit downs as an example.

The other dates of note that everybody will remember when there were some net selling of passive strategies: March 2020, Dec 2018, Fall 2008. Our markets are illiquid at higher rates of passive continues to gobble up shares with no regard for price. There is research showing the reflexivity of shares is something like every $1 that goes into a passive product affects single share prices by $4. I'm sure that number get's higher over time. When the buying turns to selling that reflexivity reverses. That is why things get so volatile now and explains why large cap equities don't behave as discounting vehicles for future cashflows.

Once we hit over 50% it can only end with the Federal government having to step in because Vanguard and Blackrock cannot unwind without crashing markets and the entire public and private pension system in the world.

Posted on 7/24/22 at 12:59 pm to LuckyTiger

And lest we never forget why we do this job . . .

Cocaine and hookers, my friend!

Cocaine and hookers, my friend!

Popular

Back to top

0

0