- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 9/8/23 at 8:29 am to Cosmo

quote:

Yet prices still arent dropping Realtors are assholes

On my in-office days I pass a handful of houses that have been on the market for a bit. Nice area, most houses are sitting on larger lots. Of the four, three were pulled off and then put back on at a lower price. I think we’re finally hitting the bubble where the cost of the house will have to come down to accommodate the interest rates.

Posted on 9/8/23 at 8:30 am to stout

Listen, I paid 12% on my $25,000 home 50 years ago. You just need to work hard and shut up.

Posted on 9/8/23 at 8:31 am to Weekend Warrior79

quote:

Implying you limit your Debbie downer updates to once a week?

I post the news I see. Don't hate on me if it is not all Sunshine and rainbows out there.

Posted on 9/8/23 at 8:31 am to JasonDBlaha

quote:

Couldn’t imagine being a Gen Z kid who just graduated from college and is working while trying to find a home now

Hate to say it - a lot of them voted for this shite

Posted on 9/8/23 at 8:31 am to TigerV

quote:

Hate to say it - a lot of them voted for this shite

No, a lot of them didn't vote at all

Posted on 9/8/23 at 8:33 am to Cosmo

quote:

Yet prices still arent dropping

Realtors are assholes

Supply has to be very low as well. I can't imagine what would have to happen for me to sell my current house at 2.75% and buy a house at 7%.

Posted on 9/8/23 at 8:34 am to Ingeniero

quote:

I'm glad we bought when it was 2.7%. We ain't moving.

Wife was toying with the idea of wanting a bigger house a few months ago. She started looking around at the price point where we'd be comfortable based on the projected monthly note at our current interest rates (3.25%). She found one she liked, I said that's cute this is how much we "can afford" if we only want to spend XXXX a month with today's current interest rates. She closed her laptop

Posted on 9/8/23 at 8:34 am to Splackavellie

quote:

Commie!!

Clearly communist propaganda

Posted on 9/8/23 at 8:34 am to GetCocky11

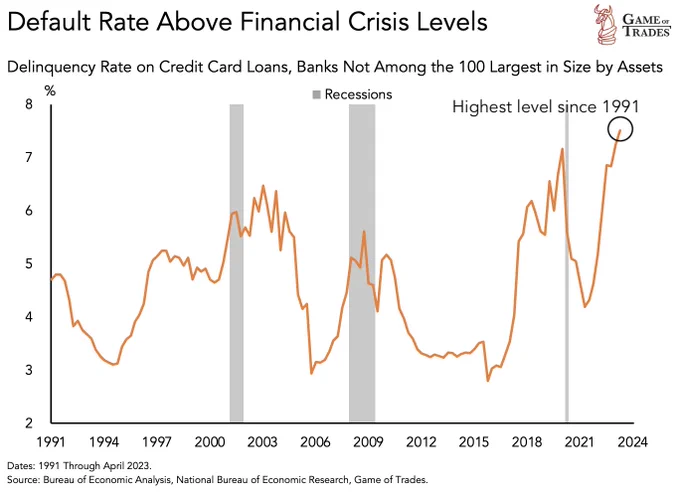

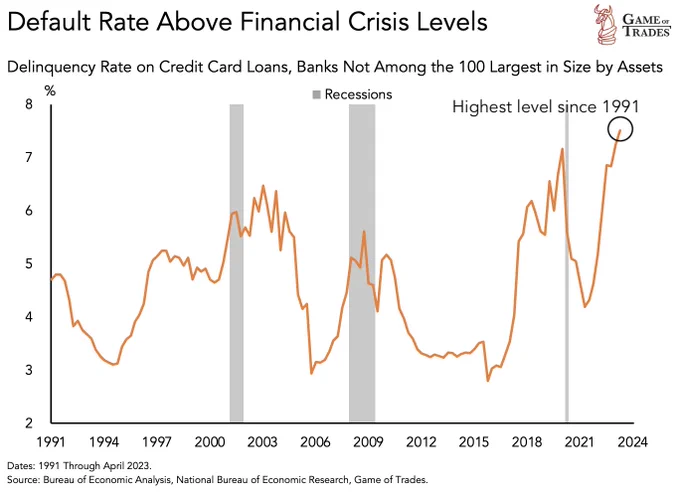

Default rate on credit card loans from small lenders is now higher than:

Dot Com bubble

Financial Crisis

C-19

This is how it usually starts. People stop paying on unsecured debt first, then they miss a car payment or two, then they stop paying the mortgage when they realize they need at least one car to keep a job and they can still live in the house for about a year before they are evicted due to foreclosure.

Dot Com bubble

Financial Crisis

C-19

This is how it usually starts. People stop paying on unsecured debt first, then they miss a car payment or two, then they stop paying the mortgage when they realize they need at least one car to keep a job and they can still live in the house for about a year before they are evicted due to foreclosure.

Posted on 9/8/23 at 8:35 am to stout

quote:

I post the news I see. Don't hate on me if it is not all Sunshine and rainbows out there.

I'm just giving you shite because you said "weekly". The news/rates are the reality that is out there, and I actually find the information you post helpful at understanding what is really happening outside of my personal bubble.

Posted on 9/8/23 at 8:36 am to stout

Need this 2nd round of covid to do its thing like 2020

Posted on 9/8/23 at 8:36 am to Weekend Warrior79

quote:

and I actually find the information you post helpful at understanding what is really happening outside of my personal bubble.

Posted on 9/8/23 at 8:37 am to stout

I watch a few different markets as well and homes are definitely sitting longer now. And prices are starting to drop a little as Bluegrass Belle said.

Posted on 9/8/23 at 8:38 am to stout

Wake me when we hit the Carter Era double digits.

I remember hearing 19% mortgage rates on the Nightly News when Dan Rather was young. (pessimists were forecasting 21%).

I wonder what the rates were in the 40's-50's under the Gold Standard without fiat currency, might look it up one day.

I remember hearing 19% mortgage rates on the Nightly News when Dan Rather was young. (pessimists were forecasting 21%).

I wonder what the rates were in the 40's-50's under the Gold Standard without fiat currency, might look it up one day.

Posted on 9/8/23 at 8:38 am to Weekend Warrior79

Yeah, we ended up in a new hotspot for real estate during Covid. We bought in 2020 and stretched outside our comfort zone for a bigger than necessary house. Looking back, I was a damn genius. One of the best decisions of my life.

Posted on 9/8/23 at 8:39 am to GetCocky11

quote:

Listen, I paid 12% on my $25,000 home 50 years ago. You just need to work hard and shut up.

Here is a stat you might find interesting.

Per Black Knight: It would take some combination of up to a 28% decline in home prices, a more than 4% reduction in 30-year mortgage rates, or up to a 60% growth in median household incomes to bring home affordability back to its 25-year average.

Black Knight and CoreLogic are the two largest data sources on the housing market FYI

Posted on 9/8/23 at 8:41 am to Schmelly

quote:

Dafuq is a zombie house?

Vacant, non-maintained home, with owners who are behind on payments but not yet foreclosed.

Posted on 9/8/23 at 8:42 am to stout

I honestly doubt the government is going to let this bubble pop. It’s almost as if the housing market itself has gotten “too big to fail” and no one is going to want to be the person in charge when it happens.

Back to top

1

1