- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Oof, Home Prices Posted Largest Annual Drop in More Than 11 Years in April

Posted on 5/18/23 at 11:01 am

Posted on 5/18/23 at 11:01 am

quote:

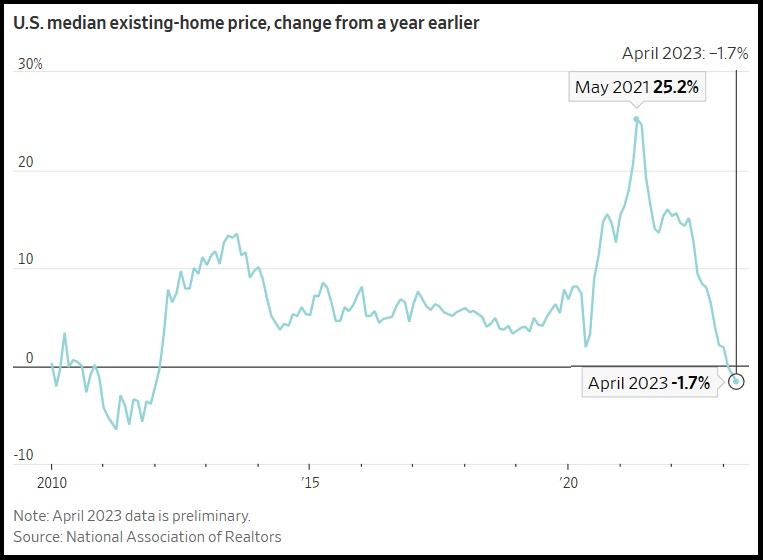

Sales of previously owned homes fell in April from the prior month and prices declined from a year earlier by the most in more than 11 years.

U.S. existing home sales, which make up most of the housing market, fell 3.4% in April from the prior month to a seasonally adjusted annual rate of 4.28 million, the National Association of Realtors said Thursday. April sales fell 23.2% from a year earlier.

The national median existing-home price fell 1.7% in April from a year earlier to $388,800, the biggest year-over-year price decline since January 2012, NAR said. Median prices, which aren’t seasonally adjusted, were down 6% from a record high of $413,800 in June. Home prices have fallen the most in the western half of the U.S., while prices continue to rise from a year earlier in many eastern markets.

Existing-home sales have declined for 14 out of the past 15 months and are down roughly one-third since the start of 2022.

WSJ Archived.

Posted on 5/18/23 at 11:02 am to GumboPot

Doesn’t that mean demand is dropping? Isn’t that a good thing right now?

Posted on 5/18/23 at 11:03 am to GumboPot

Even after the drop they are still way above where they were before the pandemic buying craze.

Posted on 5/18/23 at 11:04 am to sidewalkside

quote:

Even after the drop they are still way above where they were before the pandemic buying craze.

Still seeing houses that are going for double their appraisal value, shite is bananas.

Posted on 5/18/23 at 11:04 am to VermilionTiger

quote:

Doesn’t that mean demand is dropping? Isn’t that a good thing right now?

Interest rates have to play a big role in this.

Posted on 5/18/23 at 11:05 am to GumboPot

Something had to give with the over 6% APR that adds several hundreds of dollars to the mortgage payment, not to mention rising insurance rates.

Posted on 5/18/23 at 11:05 am to GumboPot

Prices are down but you'd still be better off buying last year with the 2% interest rates.

This post was edited on 5/18/23 at 11:06 am

Posted on 5/18/23 at 11:05 am to VermilionTiger

Really depends on where you are in the market. A lot of people were over buying during/after the pandemic. If there arises a situation where they need to move on from that house, they may be stuck if they end up underwater.

Posted on 5/18/23 at 11:05 am to GumboPot

I don't need to sell or buy a house anytime soon.

Thanks, update us again next month.

Thanks, update us again next month.

Posted on 5/18/23 at 11:05 am to GumboPot

Big Scurb TX keeps telling us all a correction in the housing market won't happen

Posted on 5/18/23 at 11:06 am to GumboPot

Just bought a house at the beginning of the month

Posted on 5/18/23 at 11:06 am to sidewalkside

quote:

Even after the drop they are still way above where they were before the pandemic buying craze.

We are headed below "pandemic buying craze":

Posted on 5/18/23 at 11:07 am to GumboPot

We need a housing correction

Posted on 5/18/23 at 11:09 am to bad93ex

I’d be willing to bet that the 1% national average price drop isn’t seen at all in any major city in the south and is much more pronounced in the rust belt and pacific NW where people are leaving.

Posted on 5/18/23 at 11:09 am to GumboPot

Blackrock needed a discount buying homes

Posted on 5/18/23 at 11:10 am to fallguy_1978

quote:

We need a housing correction

We need a *insert cost of fricking anything here* correction

Posted on 5/18/23 at 11:10 am to GumboPot

Call me when we are back to 1985 prices

Posted on 5/18/23 at 11:10 am to Oilfieldbiology

quote:

I’d be willing to bet that the 1% national average price drop isn’t seen at all in any major city in the south and is much more pronounced in the rust belt and pacific NW where people are leaving.

I agree. The WSJ article did not address regional trends.

Posted on 5/18/23 at 11:12 am to theunknownknight

quote:

Call me when we are back to 1985 prices

You mean 40 years ago?

Posted on 5/18/23 at 11:13 am to Oilfieldbiology

Someone please til Baldwin Co, AL this.

Popular

Back to top

21

21