- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: How much money do people need to retire?

Posted on 2/27/24 at 4:03 pm to fareplay

Posted on 2/27/24 at 4:03 pm to fareplay

quote:

Assume liquidated all assets (no car house etc). You’re 65 and likely live till 90.

What would be the minimum $ to retire comfortably?

$5mil to live comfortably, $10mil to live well.

Posted on 2/27/24 at 4:09 pm to fareplay

quote:Why would you assume that?

You’re 65 and likely live till 90

quote:So that means 65% of men who reach age 65 will die before age of 90.

data suggests that a 65-year-old male today, in average health, has a 35% chance of living to 90

This post was edited on 2/27/24 at 4:10 pm

Posted on 2/27/24 at 4:15 pm to HubbaBubba

I’m not 65 I’m trying to put it in context for myself

Posted on 2/27/24 at 4:35 pm to BK Lounge

quote:

In America ? If youre currently under 40 and dont come from SIGNIFICANT family wealth, you will likely never be able to retire before you are 80 years old… Gotta move to a LCOL country and you can retire at 50, or even earlier

What a bullshite post. God, your victim mentality posts are tiring.

No one wants to abandon their families and friends to move to fricking Thailand to live in squalor and bang teenage hookers.

People want to stay here and thrive. And if you have any drive at all you can do it and retire at 60-65 with millions.

Posted on 2/27/24 at 4:51 pm to fareplay

quote:

We still got ~880k left in mortgage but expect paid off in 10 years or so. Max roth max 401 etc etc but still by 50 seems tough

Now you say backdoor Roth. You should have said that initially. This seems like a troll.

This post was edited on 2/27/24 at 4:53 pm

Posted on 2/27/24 at 5:58 pm to Jake88

I watched my Dad retire at 60 with 125k in the bank, and by the time he and my Mom passed 20 years later my sister and I got 100 of it. House paid for, one car paid for, he chewed tobacco , drank his Miller, and fished every day until he died at 69. A simple life doesn't take much money. He had his SS and a small pension 250/mo., paid all the bills and had money left over. So it CAN be done, you just wont be traveling the world or living in 30A.

This post was edited on 2/27/24 at 6:00 pm

Posted on 2/27/24 at 6:13 pm to Legion of Doom

quote:

In before 3.50

That’s actually a good answer this time. $3.5m is about $140k a year. Assuming SS is still around then that would be great yearly income for a retiree

Posted on 2/27/24 at 6:14 pm to PhiTiger1764

quote:

What a bullshite post. God, your victim mentality posts are tiring.

No one wants to abandon their families and friends to move to fricking Thailand to live in squalor and bang teenage hookers.

.

.

.

.

.

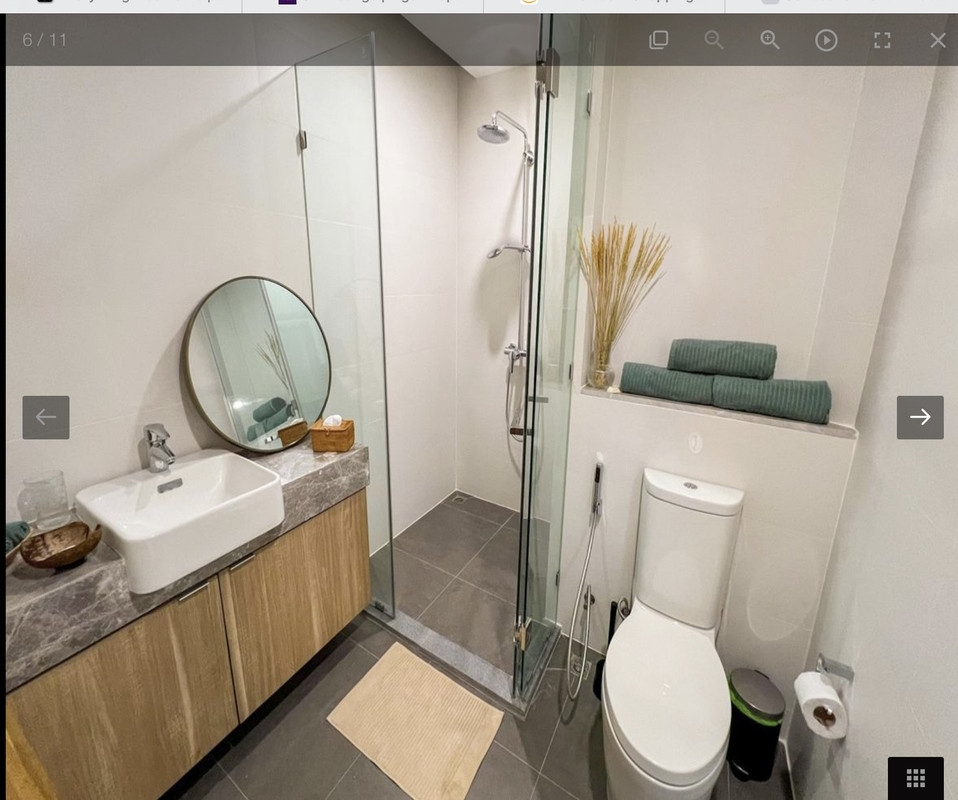

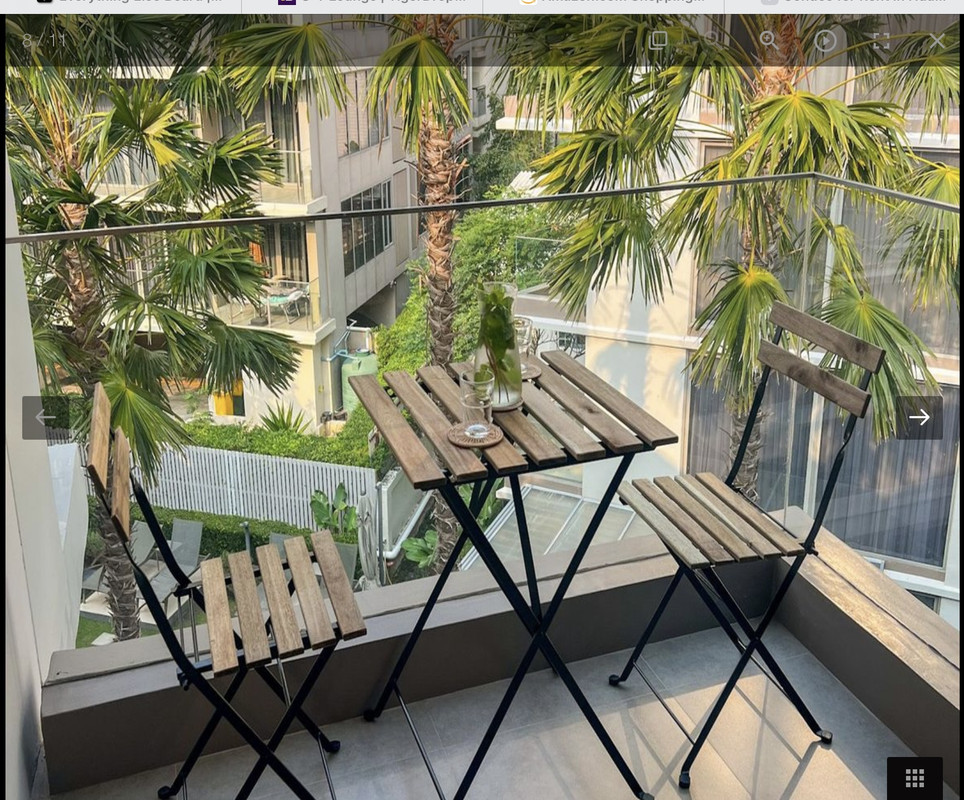

This place is almost identical to the condo where i lived in Hua Hin, Thailand for two years.. to live in this “squalor”, i paid a grant total of $650 USD per month.. im sure it isn’t as nice as ur palatial estate , it’s a small Asian condo, so feel free to pick it apart.. but it’s a lot cheaper than my mortgage , plus who the hell cares, i spent most of my time on the beach which was a short walk away .. im not posting this as a flex or a humblebrag, i simply like to point out ignorance where i find it- and i find plenty of it with you.. btw i have never in my life banged a hooker, much less a teenage one- no matter how many times you say it, it just ain’t the reality .. Hey, if you think America is such an awesome place to live in 2024- then thank god we all like different things .

Posted on 2/27/24 at 6:24 pm to stogie5150

quote:

I watched my Dad retire at 60 with 125k in the bank, and by the time he and my Mom passed 20 years later my sister and I got 100 of it. House paid for, one car paid for, he chewed tobacco , drank his Miller, and fished every day until he died at 69. A simple life doesn't take much money. He had his SS and a small pension 250/mo., paid all the bills and had money left over. So it CAN be done, you just wont be traveling the world or living in 30A.

You inherited money because he died 9 years into retirement. Your whole premise is off. What would’ve happened if he lived to 80?

Posted on 2/27/24 at 7:30 pm to fareplay

Posted on 2/27/24 at 7:38 pm to fareplay

A lot more than anyone can imagine.

Add up your monthly expenses. Say you have no house note, no monthly vehicle note, kids are long gone out your home...

Say you can live a decent lifestyle on 3,000k per month. That's 36,000 per year. for 25 years that nearly a million dollars.

But guess what, ole father time starts taking a toll on the body(and it does). Medical bills start to pile up. You might and that's a huge might, have Medicare to cover some or most of the cost. You are on the hook for large medical bills, and prescription drugs, and care...

And the list goes on and on.

Its kinda depressing to think of it but that the reality everyone is going to face.

IMO, you will need at least 2 million, if not more.

Add up your monthly expenses. Say you have no house note, no monthly vehicle note, kids are long gone out your home...

Say you can live a decent lifestyle on 3,000k per month. That's 36,000 per year. for 25 years that nearly a million dollars.

But guess what, ole father time starts taking a toll on the body(and it does). Medical bills start to pile up. You might and that's a huge might, have Medicare to cover some or most of the cost. You are on the hook for large medical bills, and prescription drugs, and care...

And the list goes on and on.

Its kinda depressing to think of it but that the reality everyone is going to face.

quote:

What would be the minimum $ to retire comfortably?

IMO, you will need at least 2 million, if not more.

Posted on 2/27/24 at 8:16 pm to fareplay

Here are Fidelity's age-based milestones you can use to track your progress:

By age 30: 1x your income

By age 40: 3x your income

By age 50: 6x your income

By age 60: 8x your income

By age 30: 1x your income

By age 40: 3x your income

By age 50: 6x your income

By age 60: 8x your income

Posted on 2/27/24 at 8:19 pm to BK Lounge

Stop posting your squalor posts bro. Everyone knows the only way to retire is in Baton Rouge dodging gunshots and people trying to kill you because you're white.

Posted on 2/27/24 at 8:58 pm to Jake88

I think we’re on target, we have a pretty good income

Posted on 2/27/24 at 9:06 pm to SquatchDawg

quote:

still have two kids to put through college

They can do that themselves

Posted on 2/27/24 at 9:22 pm to fareplay

Depends where you retire to.

You can live off of less than $1k a month in some countries.

No way I stay in the US, I plan to retire at 55 to Mexico.

13 more years and I'm done with work.

Assuming my market holdings don't crash. Lol

You can live off of less than $1k a month in some countries.

No way I stay in the US, I plan to retire at 55 to Mexico.

13 more years and I'm done with work.

Assuming my market holdings don't crash. Lol

Posted on 2/27/24 at 9:31 pm to Napoleon

quote:

No way I stay in the US, I plan to retire at 55 to Mexico.

I'm buying a Speed Queen dealership and movie in next to you.

Posted on 2/27/24 at 9:39 pm to fareplay

Depends on pension, health care, debt, lifestyle, COL and many other factors. I'd say you want about the same amount of take home in retirement as take home while you are working.

$1mil in your 401k produces $40k of income/year.

$1mil in your 401k produces $40k of income/year.

Posted on 2/27/24 at 9:41 pm to greenbean

quote:

$1mil in your 401k produces $40k of income/year.

Well then 99% of the OT will be pulling in $400k a year.

Posted on 2/27/24 at 10:56 pm to Dragula

I’m retiring end of year. $927,000 in CD’s making $3,000/mo risk free interest. $2200/mo SS. Zero debt. I hate traveling and I don’t have some pussy wanting to go on vacation every other month. I’ll do some track days at Barbers and get a dog. I’ll be $70,000 liquid end of year and in 2 months past that have access to over $1 million. I’ll never touch the principle. I might even do a reverse mortgage.

Popular

Back to top

1

1