- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

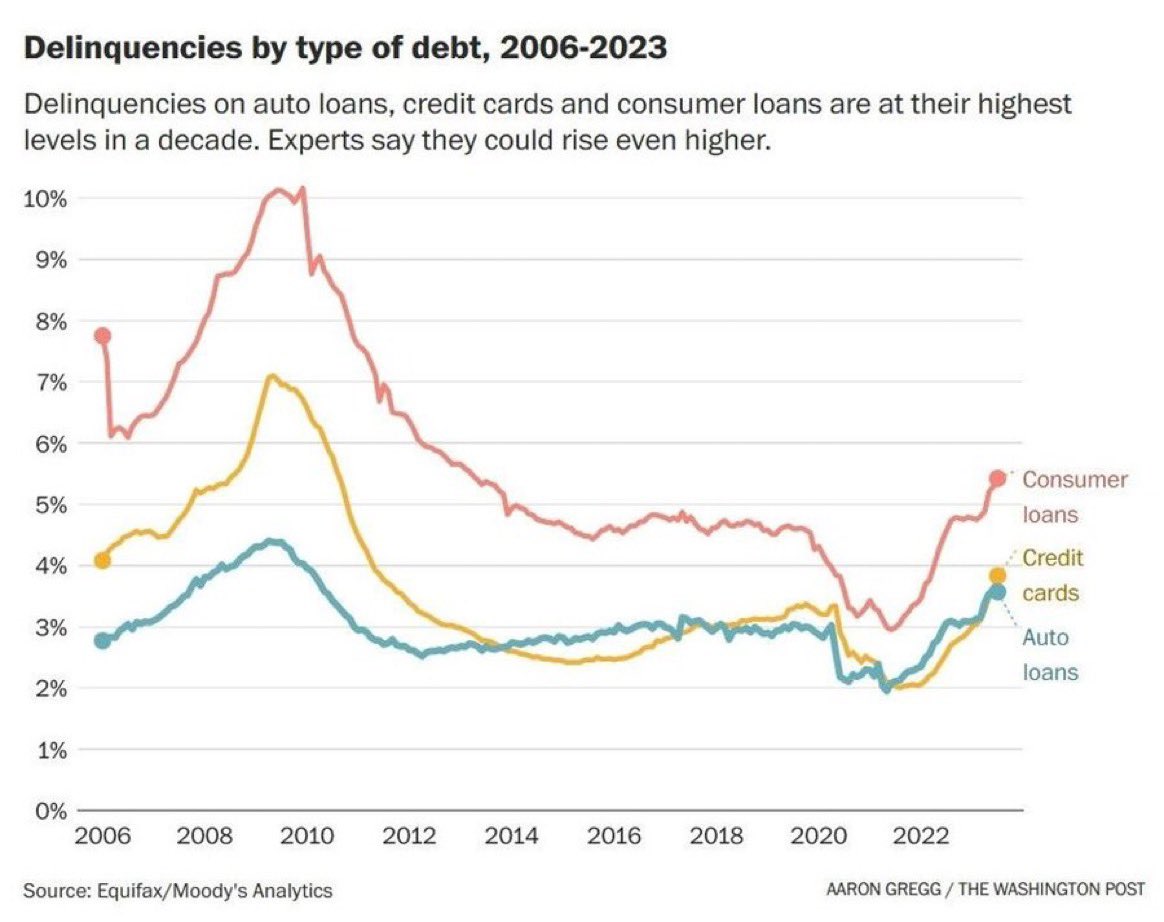

Delinquencies on auto loans are at the highest level in a decade

Posted on 9/15/23 at 8:53 am

Posted on 9/15/23 at 8:53 am

Might be able to get a good deal on some used chromed out truck nuts soon

Posted on 9/15/23 at 8:54 am to stout

I'm ready for the auto market to crash. This shite is stupid.

Posted on 9/15/23 at 8:54 am to stout

How many of those are for Chargers and/or Challengers

This post was edited on 9/15/23 at 8:55 am

Posted on 9/15/23 at 8:54 am to stout

Now do delinquencies on mortgages.

Posted on 9/15/23 at 8:56 am to stout

Is this just a market correction after the forgiveness policy during Covid?

Posted on 9/15/23 at 8:57 am to MrJimBeam

quote:

I'm ready for the auto market to crash. This shite is stupid.

Let it all burn down. Cant wrap my head around seeing all the temp tags on trucks riding around. 50k plus has to be unsustainable.

Posted on 9/15/23 at 8:57 am to stout

I keep seeing all of these threads and it all looks bad, but then I go outside and everything seems to be getting more expensive and everyone seems to be having a good time and I have no idea what any of this means for me or anyone else.

Am I alone in these thoughts/observations?

I assume I just live in a bubble of mostly financially secure people. Or they are all just really good at hiding it, if they are struggling.

Am I alone in these thoughts/observations?

I assume I just live in a bubble of mostly financially secure people. Or they are all just really good at hiding it, if they are struggling.

Posted on 9/15/23 at 8:57 am to stout

Good. frick these auto manufacturers who are intentionally keeping stock low to keep prices high. You look at car lots online and all the damn cars say “in transit”, many still don’t have vehicles on the lot. They are charging way too much and I’m ready for prices to come back to reality.

Posted on 9/15/23 at 8:58 am to stout

do people even get turned down for loans these days

Posted on 9/15/23 at 8:59 am to stout

I hope The Big Short II movie is going to be as good as the original.

Posted on 9/15/23 at 8:59 am to Topwater Trout

No, they pretty much hand them out to anyone, come and get your 84 month loans dummies! If you can’t afford the note on that we can get you a 96! Yep, they really have 96 month vehicle loans.

This post was edited on 9/15/23 at 9:01 am

Posted on 9/15/23 at 9:00 am to Shexter

quote:

Now do delinquencies on mortgages.

Its coming. Credit cards and auto loans always are the first to go. Mortgages will be next. Same pattern in 2007 but for different reasons and before anyone says anything I am not saying 2007-08 will happen again.

More Than 30 U.S. Metros Post Increase in YoY Delinquency Rates

quote:

CoreLogic has released its monthly Loan Performance Insights Report for June 2023 showing that an estimated 2.6% of all mortgages in the U.S. were in some stage of delinquency—defined as 30 days or more past due, including those in foreclosure—representing a 0.3 percentage point decrease compared with 2.9% in June 2022 and unchanged from May 2023.

CoreLogic examined all stages of delinquency and found that in June 2023, the U.S. delinquency and transition rates and their year-over-year changes, were as follows:

Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.2% in June 2022

Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in June 2022.

Serious Delinquency (90 days or more past due, including loans in foreclosure): 1%, down from 1.3% in June 2022 and a high of 4.3% in August 2020.

Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from June 2022.

Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, down from 0.7% in June 2022.

MS and LA leading the way yet again

Posted on 9/15/23 at 9:00 am to Salmon

Friend,

You are not alone in your observations. The world outside these sometimes leaden walls is a beautiful place with far less hatred than some would lead you to believe exists.

How are your home renovations going? We pray daily that your home will be complete for the Advent.

Yours,

TulaneLSU

You are not alone in your observations. The world outside these sometimes leaden walls is a beautiful place with far less hatred than some would lead you to believe exists.

How are your home renovations going? We pray daily that your home will be complete for the Advent.

Yours,

TulaneLSU

Posted on 9/15/23 at 9:01 am to Salmon

quote:

Or they are all just really good at hiding it, if they are struggling.

I think there is truth to this. Many in denial while living on credit cards.

Posted on 9/15/23 at 9:02 am to Salmon

quote:

Am I alone in these thoughts/observations?

No. I honestly figured we would have hit the wall months ago. I have no idea how things are still trucking along.

Posted on 9/15/23 at 9:02 am to stout

My 2 favorite threads:

Tyga Woods Random Instagram Hashtags

Stout's Who is Delinquent on What

Tyga Woods Random Instagram Hashtags

Stout's Who is Delinquent on What

Posted on 9/15/23 at 9:03 am to SelaTiger

quote:

Yep, they really have 96 month vehicle loans.

96-month loan on a high dollar item with only a 36-month warranty. Doesn't make much sense to me.

Posted on 9/15/23 at 9:03 am to Salmon

quote:

I keep seeing all of these threads and it all looks bad, but then I go outside and everything seems to be getting more expensive and everyone seems to be having a good time and I have no idea what any of this means for me or anyone else. Am I alone in these thoughts/observations?

No same here.

quote:

I assume I just live in a bubble of mostly financially secure people. Or they are all just really good at hiding it, if they are struggling.

Probably a bit of both. Trucks, boats, you name it.

Popular

Back to top

22

22