- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: After doing my neighbor's taxes, who's on fixed income

Posted on 5/21/20 at 7:14 am to Friedbrie

Posted on 5/21/20 at 7:14 am to Friedbrie

I understand what you are saying. Been retired 11 years now. Worked my arse off all my life and saved up a nice nest egg. Kicker is, we live on a set income and yet we still have to pay out the arse in taxes every year.  I still haven't filed my taxes yet knowing I will have to pay out the arse.

I still haven't filed my taxes yet knowing I will have to pay out the arse.

Posted on 5/21/20 at 7:23 am to tigerinthebueche

quote:

allows the victor to spread hegemony.

Too bad we haven't really won a war since WWII.

Posted on 5/21/20 at 7:26 am to The Spleen

quote:

Too bad we haven't really won a war since WWII.

Which is what happens when politicians care more about scoring political points back home than actually winning a war.

Civilian control of the military is by far more preferable than what preceded this concept, but it does have some major drawbacks. The above is one.

Posted on 5/21/20 at 7:56 am to The Spleen

quote:

Too bad we haven't really won a war since WWII.

Yeah but we’ve bombed the shite out of some places and people who needed it. And we’ve greased a ton of hadjis that needed to die, so it evens out. We may not have “won” in the strict sense, but we killed a bunch more of them than they did of us.

Posted on 5/21/20 at 8:01 am to jnethe1

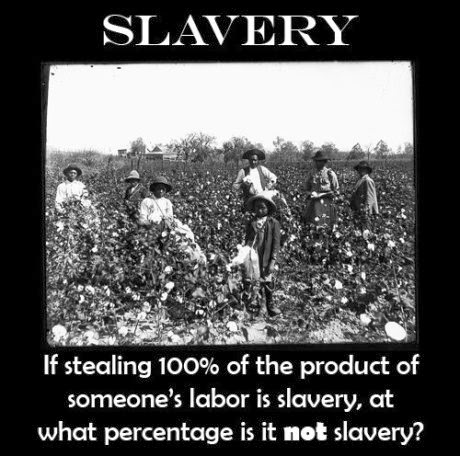

Social security is a Ponzi scheme the government forces us to participate in. Plain and simple.

Posted on 5/21/20 at 8:11 am to Friedbrie

quote:

$70,000. Owes almost $8,000 to fed and state. Man, when you consider sales tax and every other tax under the sun on top of that, including inflation, its pretty infuriating how the saver gets screwed.

So in your opinion he shouldn’t pay taxes on his income? Income from money he deferred taxes on while he was working?

Posted on 5/21/20 at 8:14 am to Friedbrie

quote:

$70,000. Owes almost $8,000 to fed and state.

This doesn’t seem unreasonable.

Posted on 5/21/20 at 8:19 am to yellowfin

quote:

So in your opinion he shouldn’t pay taxes on his income? Income from money he deferred taxes on while he was working?

Problem here, SS income is tax free or suppose to be, but one gets hit on SS if your income is high in taxes. Sucks I have to pay taxes on my SS just because I took the time to save for my retirement. It comes back to were I have to give back about 20% of my SS in taxes every year which is over 30K.

Posted on 5/21/20 at 8:20 am to Friedbrie

quote:

$70,000. Owes almost $8,000 to fed and state. Man, when you consider sales tax and every other tax under the sun on top of that, including inflation, its pretty infuriating how the saver gets screwed.

So he made over 80K, has a total income tax % of less than 10%, didn't withhold a dime of it towards income taxes, and we're supposed to feel sorry for him?

And this is coming from someone who thinks income tax is bullshite

Posted on 5/21/20 at 8:21 am to Friedbrie

quote:

After doing my neighbor's taxes, who's on fixed income

Hope your accounting/tax skills are better than English.

Posted on 5/21/20 at 8:22 am to yellowfin

quote:

So in your opinion he shouldn’t pay taxes on his income?

No one should pay income taxes. Ever.

Posted on 5/21/20 at 8:27 am to Aubie Spr96

My point is, one pays taxes on money that go towards SS before retirement. Then has to pay taxes again on that money once retired if their income is high.

That is the catch 22 on saving for retirement.

That is the catch 22 on saving for retirement.

This post was edited on 5/21/20 at 8:30 am

Posted on 5/21/20 at 8:29 am to Thib-a-doe Tiger

quote:

So he made over 80K, has a total income tax % of less than 10%, didn't withhold a dime of it towards income taxes, and we're supposed to feel sorry for him?

And this is coming from someone who thinks income tax is bullshite

Between a pension, social security, and an IRA, total income was $70,000 not $80,000. Roughly $3,000 was already withheld during the year. $8,000 is what is owed and doesn't include what was already withheld. And yes, I think income tax is bullshite.

Posted on 5/21/20 at 8:29 am to fishfighter

quote:

Problem here, SS income is tax free or suppose to be, but one gets hit on SS if your income is high in taxes. Sucks I have to pay taxes on my SS just because I took the time to save for my retirement. It comes back to were I have to give back about 20% of my SS in taxes every year which is over 30K

Yeah, taxing SS if you're entirely retired it stupid. I get taxing it for those that start drawing it while still working, but makes no sense to tax it if your only other income is from pensions, IRA's, or other retirement accounts.

This post was edited on 5/21/20 at 8:32 am

Posted on 5/21/20 at 8:31 am to fishfighter

quote:

My point is, one pays taxes on money that go towards SS before retirement. Then has to pay taxes again on that money once retired if their income is high. ?

That is the catch 22 on saving for retirement.

Couldn't agree with you more.

Posted on 5/21/20 at 8:33 am to JohnnyKilroy

quote:

I'll never argue that paying into SS is better than just putting it into index funds, but the above appears to be completely false.

Ok, then check the math. There is no link, I simply sat down one day and looked at my grandfather’s situation, then I looked at my own. Instead of just saying it appears, why not do the math?

Posted on 5/21/20 at 8:34 am to The Spleen

quote:

Yeah, taxing SS if you're entirely retired it stupid. I get taxing it for those that start drawing it while still working,

People had paid taxes on that tax already. As my post above.

Posted on 5/21/20 at 8:40 am to AUCE05

quote:

If that passes you off, go look how much they spend on war.

Lol, where would that money go? Oh yeah, more transfer payments.

Posted on 5/21/20 at 8:50 am to Friedbrie

Just wait until assisted living becomes socialized. Grandpa will be paying $8K/mo for the same room old Ms Jones will be paying $500 for because he has the money to burn. They are already asking for financials before you gain admission to these places. Leftist will no doubt start the trend followed by the gubment. Just wait.

Popular

Back to top

0

0