- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

When are people going to be required to pay mortgages and student loans in forbearance?

Posted on 5/16/21 at 10:23 pm

Posted on 5/16/21 at 10:23 pm

I think once this happens people will get back to working instead of sitting on their arse collecting unemployment.

Posted on 5/16/21 at 10:32 pm to Lickitty Split

Also, they will stop asking $900,000 for a house that should be on the market for $650,000 because they have been able to pretty much live in it for rent free instead of being practical and downsizing like they should because their source of income has decreased for a variety of reasons.

This post was edited on 5/16/21 at 10:35 pm

Posted on 5/16/21 at 10:35 pm to Lickitty Split

Are there people that haven't been paying their mortgage for over a year?

Posted on 5/16/21 at 10:46 pm to John McClane

If I would have known you could do that I wouldn't have sold my house

Posted on 5/16/21 at 11:05 pm to Powerman

Moratorium on foreclosures will end in the next couple of months, and there will be a lot of houses on the market and prices will drop. Be glad you already sold.

Posted on 5/17/21 at 5:52 am to ithad2bme

quote:

Moratorium on foreclosures will end in the next couple of months, and there will be a lot of houses on the market and prices will drop.

No they won’t

Posted on 5/17/21 at 6:19 am to Lickitty Split

I believe all of that comes to an end in August and September, and I think this forces a flattening of the housing market boom.

Posted on 5/17/21 at 7:59 am to ithad2bme

Will they require the balance to be paid up to current or did they just delay payments for the time period?

Posted on 5/17/21 at 8:00 am to Powerman

quote:

Are there people that haven't been paying their mortgage for over a year?

Yes. Same for rent and also car payments.

Posted on 5/17/21 at 8:02 am to 13SaintTiger

quote:

No they won’t

No way to know what will happen. If you ask me there will be some negative impact of a bunch of people suddenly having to pay mortgages, rent, and car payments again after a year of not doing such. To say there will be no change isn't backed by the math.

Posted on 5/17/21 at 9:24 am to WhiskeyThrottle

quote:

Will they require the balance to be paid up to current or did they just delay payments for the time period?

I have read where a lot of banks will allow them to just throw the payments on the back-end. I believe it has been accruing interest the entire time. So, those that think they have been living mortgage free for the last 1 1/2 years, will have a higher balance to pay off with the accrued interest (unless they were at least making interest payments)

Posted on 5/17/21 at 11:24 am to Weekend Warrior79

Interesting.

That formula works when home prices are appreciating at a high rate.

It could have an effect down the road keeping home prices inflated (cant afford to discount a sales price because of a payoff).

These are well educated gambles by the mortgage company. It will be interesting to see if it pays off or backfires.

That formula works when home prices are appreciating at a high rate.

It could have an effect down the road keeping home prices inflated (cant afford to discount a sales price because of a payoff).

These are well educated gambles by the mortgage company. It will be interesting to see if it pays off or backfires.

Posted on 5/17/21 at 11:30 am to Lickitty Split

quote:

student loans in forbearance

quote:

I think once this happens people will get back to working instead of sitting on their arse collecting unemployment.

Why would someone be in a hurry to pay for something that is going to get forgiven?

Posted on 5/17/21 at 12:03 pm to Powerman

"Without assistance, over 10 million people nationwide could find themselves without housing when the Centers for Disease Control and Prevention (CDC) eviction moratorium ends on June 30." They are projecting 500K homeless in Los Angeles

Posted on 5/17/21 at 12:04 pm to TigerintheNO

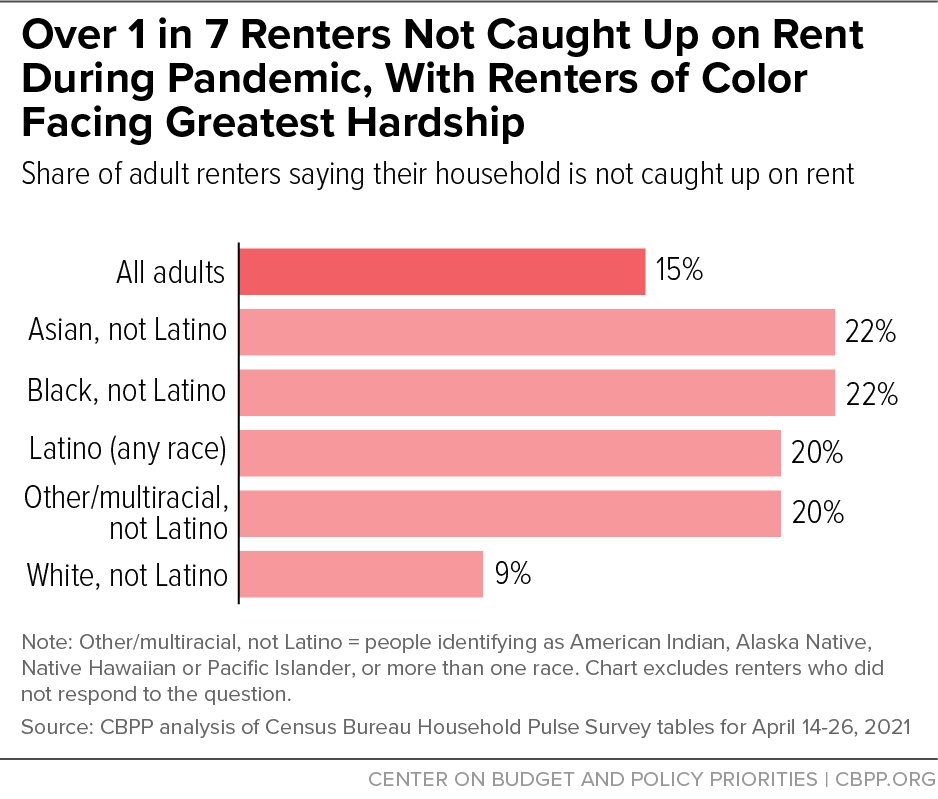

This post was edited on 12/18/21 at 10:38 am

Posted on 5/17/21 at 12:22 pm to TigerintheNO

quote:

According to 2019 Census data, 58% of Black American households are rented. Fifty-three percent 53% of Hispanic households are rented. Less than 31% of white households are rented.

LINK

"people of color" rent more often then whites

Posted on 5/17/21 at 1:04 pm to 13SaintTiger

quote:

No they won’t

It won't be across the board, but baring another stimulus to pay up all the loans that should be headed for foreclosure (entirely possible), there is going to be a huge inventory of foreclosure homes that hit the market. with a surge in supply, what is it that you think keeps prices from dropping? Do you think banks sit on properties and trickle out foreclosures to keep prices higher?

Most of that inventory is in the <$350K price range, so obviously it will affect houses in that range more than homes that are more expensive.

Posted on 5/17/21 at 1:11 pm to Weekend Warrior79

quote:

I have read where a lot of banks will allow them to just throw the payments on the back-end. I believe it has been accruing interest the entire time. So, those that think they have been living mortgage free for the last 1 1/2 years, will have a higher balance to pay off with the accrued interest (unless they were at least making interest payments)

This happens all the time. Dont think you get extra payments to pay it off either. Due to the mortgages being setup the way they are when that last payment comes due you owe the last payment plus all the interest that is accrued during that time frame. If you have a $1,000/mo payment and you accrue $7500 in interest during your deferment your last payment will be $8,500 and due in full. For people that can take out a loan to pay that off it is fine but for people that cant it ends up in foreclosure.

Posted on 5/17/21 at 1:12 pm to ithad2bme

Pricing will stabilize, but probably not drop... there are a lot of other factors driving home pricing (interest rates, cost for new builds, work from home orders).

Popular

Back to top

5

5