- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Whats the next event that could send the markets back down to the 3500 level or lower??

Posted on 11/23/22 at 6:01 pm

Posted on 11/23/22 at 6:01 pm

Will it be the next CPI inflation reading?if it starts up again? also saw a possible rail strike brewing. Could that flip the market south again? Dont see anything pushing the S&P under 3k even with Tech companies starting their layoffs and inflation still high.

This post was edited on 11/23/22 at 6:02 pm

Posted on 11/23/22 at 7:12 pm to FLObserver

If cpi accelerates, that would be a huge anchor. I dont expect that to happen though, I think it might surprise to downside just because the math of the yoy comp getting easier and the mom basically stopping months ago.

The fed starting to be like "dont worry we are going slow down" publicly, repeatedly also seems to indicate they think it's going to fall off more rapidly than maybe most people think.

It's a weird market, basically trading off the fed at the moment and how economic calender reports effect their actions. As long as geo political world stays the same or gets better, I dont see that stopping until March or so imo, after all 1q earnings get digested in feb. As the fed goes.

The fed starting to be like "dont worry we are going slow down" publicly, repeatedly also seems to indicate they think it's going to fall off more rapidly than maybe most people think.

It's a weird market, basically trading off the fed at the moment and how economic calender reports effect their actions. As long as geo political world stays the same or gets better, I dont see that stopping until March or so imo, after all 1q earnings get digested in feb. As the fed goes.

This post was edited on 11/24/22 at 12:13 pm

Posted on 11/23/22 at 7:23 pm to FLObserver

Russian chemical / nuclear weapon(s).

Posted on 11/23/22 at 9:35 pm to FLObserver

quote:

Whats the next event that could send the markets back down to the 3500 level or lower??

The next panDEMick

Posted on 11/24/22 at 6:55 am to FLObserver

2023 S&P 500 forward earnings continually revised lower due to recession.

BofA now has 2023 S&P 500 earnings at $200. Assign a 16-18 multiple and that gets you to a 3200 - 3600 S&P 500.

Expect more lower earnings revisions throughtout December 2022-January 2023.

BofA now has 2023 S&P 500 earnings at $200. Assign a 16-18 multiple and that gets you to a 3200 - 3600 S&P 500.

Expect more lower earnings revisions throughtout December 2022-January 2023.

Posted on 11/24/22 at 10:20 am to j1897

quote:

The recession.

Yes, but only if it’s deeper or broader than what’s already expected. That would lead to what Frogtown mentioned in the post above.

This post was edited on 11/24/22 at 10:21 am

Posted on 11/24/22 at 10:34 am to FLObserver

I believe Powell talks on the 30th. If he reiterates the market is smoking crack, that could be the catalyst.

Posted on 11/24/22 at 11:33 am to frogtown

quote:

2023 S&P 500 forward earnings continually revised lower

Yep. Any index rally is going to be capped. It's not doomsday or anything, but there's not much upside for investors to be bullish about. Best case is sideways chop.

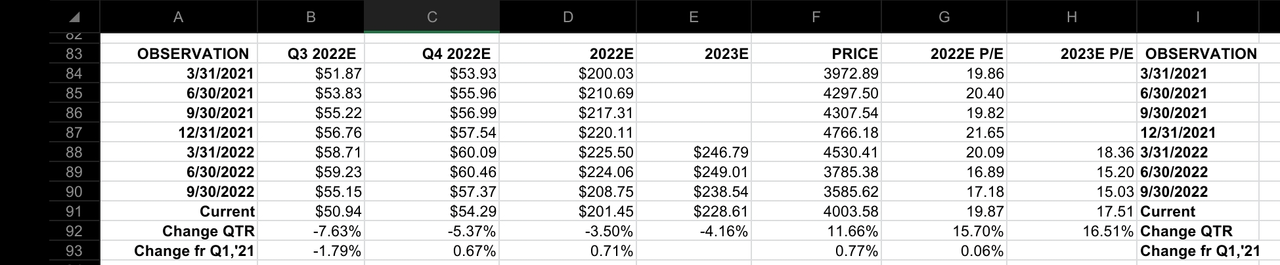

This is current S&P earnings data.

Posted on 11/24/22 at 11:38 am to UpstairsComputer

quote:

he reiterates the market is smoking crack, that could be the catalyst.

The market is smoking crack and they killed my boy, VIX.

Posted on 11/24/22 at 12:53 pm to UpstairsComputer

quote:

If he reiterates the market is smoking crack, that could be the catalyst.

Not a chance at this point I believe. Last couple of week's they are out verbally signaling that bond market is priced appropriately. If they didn't think that, they would be quiet, regardless of what they plan on doing in December. The verbal queues are specifically to guide the markets while their actual actions are to guide the economy. Every single word from a board member is carefully curated and planned.

Inflation is about to start meaningfully falling, whether the reason is good or bad won't matter for a few more months imo, it's just all about fed slowing until next driver which will be earnings in late Jan, thru Feb. Companies guided down last earnings cycle, if they then miss; and the fed is paused.... look out below unless fed actually pivots which would also be a interesting signal this quick.

2023 is gonna be interesting. But I got to give fed credit, they got what they wanted by front loading and jawboning as hawkish as possible, knowing they couldn't actually raise rates to 5 to 6% They are about 30% thru threading the impossible needle.

This post was edited on 11/24/22 at 12:59 pm

Posted on 11/27/22 at 1:10 am to FLObserver

The imminent recession (probably already started), the Fed’s decision to finally increase rates (necessary, but horrible timing), and whatever war they end up starting.

Posted on 11/27/22 at 8:11 pm to FLObserver

The dumbass, panicky Chinese shutting down the second largest economy in the World to fight a cold virus.

Posted on 11/28/22 at 2:20 pm to PinevilleTiger

The China real estate bubble exploding on top of the recession in the West.

Posted on 11/30/22 at 7:56 am to cwill

GDP numbers demolish any hopes of a Fed pivot. Any bullish investor right now still has a recession to look forward to and stocks are too expensive.

Good time to start a sell off.

Good time to start a sell off.

Posted on 11/30/22 at 3:31 pm to JimMorrison

quote:

Good time to start a sell off.

Big selloff today . For Sure

Posted on 11/30/22 at 3:37 pm to JimMorrison

Bump.

Powell predictably backed off the hawkishness a little without really changing the final target.

Bond market calling his bluff and jumping way ahead of what he actually said.

Markets bouncing.

Dec CPI is going to completely control the market until 1Q earnings in late Jan early feb, which should be terrible.

If it falls down into the 6 range imo, the market will go on a tear until earnings sober them up; specifically services will be the critical part in Dec, it's really the only part of CPI that hasn't shown signs it's about to roll over in MOM. (And if history is any indication, companies will come out in late Dec and early Jan and prewarn on earnings because that's becoming the move to minimize downside so be careful for that.)

Powell is playing this kind of brilliantly. CPI comes in light, he can go dove and say I was prepared to go further but data is guiding us. If CPI comes in higher than expected, he basically just stays on the same course and says "I was telling you guys ALL ALONG". And they managed to not break anything.

If CPI doesn't move, than we are in for a big down leg, but there's really no reason to expect that; just look at MOM numbers which are consistently not changing for months now. It's just simple math after that to get the YOY headline number.

I bought some shortdated TLT calls this morning just to flip for a few % points, seemed obvious to me, should have gone in heavier. I guess he would have said market is smoking crack if I had though. First time I've made money on the TLT trade.

Future gets alot more obscure after 1Q earnings. Mike wilson said yesterday he expects 3000-3300 on SP and he basically started the rally in October by calling a technical bounce. I don't really know what to expect from stocks after Jan, but I'm rather certain 10 yr+ yields have peaked.

Powell predictably backed off the hawkishness a little without really changing the final target.

Bond market calling his bluff and jumping way ahead of what he actually said.

Markets bouncing.

Dec CPI is going to completely control the market until 1Q earnings in late Jan early feb, which should be terrible.

If it falls down into the 6 range imo, the market will go on a tear until earnings sober them up; specifically services will be the critical part in Dec, it's really the only part of CPI that hasn't shown signs it's about to roll over in MOM. (And if history is any indication, companies will come out in late Dec and early Jan and prewarn on earnings because that's becoming the move to minimize downside so be careful for that.)

Powell is playing this kind of brilliantly. CPI comes in light, he can go dove and say I was prepared to go further but data is guiding us. If CPI comes in higher than expected, he basically just stays on the same course and says "I was telling you guys ALL ALONG". And they managed to not break anything.

If CPI doesn't move, than we are in for a big down leg, but there's really no reason to expect that; just look at MOM numbers which are consistently not changing for months now. It's just simple math after that to get the YOY headline number.

I bought some shortdated TLT calls this morning just to flip for a few % points, seemed obvious to me, should have gone in heavier. I guess he would have said market is smoking crack if I had though. First time I've made money on the TLT trade.

Future gets alot more obscure after 1Q earnings. Mike wilson said yesterday he expects 3000-3300 on SP and he basically started the rally in October by calling a technical bounce. I don't really know what to expect from stocks after Jan, but I'm rather certain 10 yr+ yields have peaked.

This post was edited on 12/1/22 at 12:02 am

Posted on 11/30/22 at 5:44 pm to Pendulum

quote:

I'm rather certain 10 yr+ yields have peaked.

Beginning to look that way. I was looking at locking in higher rates on a few 2 yr. T-notes around March. May not get the yields that I was expecting by then.

Back to top

13

13