- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: What Is There To Be Bullish About?

Posted on 8/18/22 at 12:09 pm to Turf Taint

Posted on 8/18/22 at 12:09 pm to Turf Taint

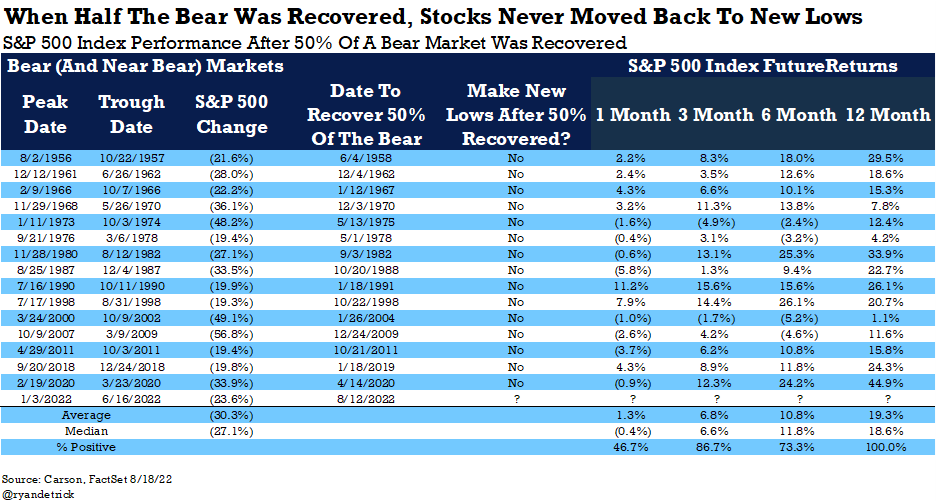

Last week, the S&P 500 recovered half of the bear market losses.

This is a very good sign, as stocks have never moved back to new lows after this happened.

In fact, a year later, higher every time and up 19.3% on average as well.

This is a very good sign, as stocks have never moved back to new lows after this happened.

In fact, a year later, higher every time and up 19.3% on average as well.

Posted on 8/18/22 at 2:45 pm to BeYou

quote:

Last week, the S&P 500 recovered half of the bear market losses.

This is a very good sign, as stocks have never moved back to new lows after this happened.

In fact, a year later, higher every time and up 19.3% on average as well.

The bears will not like this. We have been told the great reset will be like no other.

Posted on 8/18/22 at 2:51 pm to I Love Bama

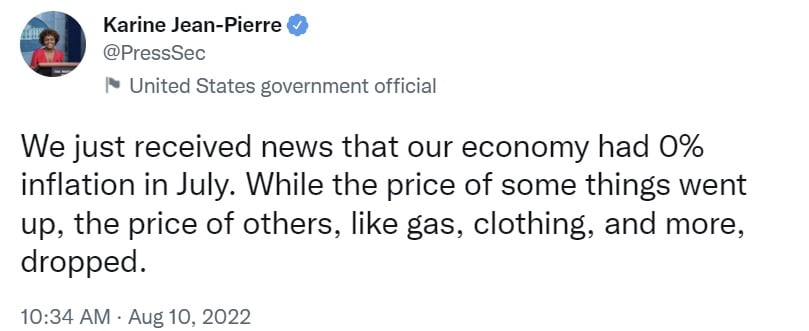

With respect to inflation, it appears to be taming and in many cases, prices are substantially lower

The consumer appears to be resilient

Also, an interesting aspect to inflation is that the price to consumer oftentimes lags which means profit margins grow. This is why some retailers are seeing solid numbers.

This could continue for a while too

The consumer appears to be resilient

Also, an interesting aspect to inflation is that the price to consumer oftentimes lags which means profit margins grow. This is why some retailers are seeing solid numbers.

This could continue for a while too

Posted on 8/18/22 at 3:10 pm to BeYou

quote:

In fact, a year later, higher every time and up 19.3% on average as well.

Isn't it also true that every time the "yield inverts" we are in/start a recession about a year later?

This post was edited on 8/18/22 at 3:10 pm

Posted on 8/18/22 at 3:55 pm to BeYou

quote:

Last week, the S&P 500 recovered half of the bear market losses.

This is a very good sign, as stocks have never moved back to new lows after this happened.

In fact, a year later, higher every time and up 19.3% on average as well.

Posted on 8/18/22 at 4:01 pm to boomtown143

quote:

In fact, a year later, higher every time and up 19.3% on average as well.

quote:

sn't it also true that every time the "yield inverts" we are in/start a recession about a year later?

I think this highlights the fact that no one knows what the hell is going to happen. We have too many mixed signals and too many unknowns. Anyone trying to draw conclusions based on historical data is mistaken because we are experiencing issues that a modern economy has never experienced.

Posted on 8/18/22 at 6:00 pm to boomtown143

quote:

Isn't it also true that every time the "yield inverts" we are in/start a recession about a year later?

Don't feel like looking it up but I feel like the yield inversion you are talking about has happened more than a couple of times since the GFC but we've only just now had our first actual recession since.

Posted on 8/19/22 at 6:57 am to UpstairsComputer

quote:

Wrong

I believe y’all are discussing two different parameters. His is based on closing prices and yours is based on intraday - I think that’s the difference.

This post was edited on 8/19/22 at 6:58 am

Posted on 8/19/22 at 8:09 am to slackster

We get to use words like "never" and "every time" because of wicks?

Happened in 68, 73, 81 and 00 too, fwiw.

Happened in 68, 73, 81 and 00 too, fwiw.

Posted on 8/19/22 at 9:10 am to BeYou

This rally is going to be a huge bull trap

Posted on 8/19/22 at 10:02 am to I Love Bama

Politics has a heavy hand on the economy, business atmosphere and investment confidence these days as well as the supply chain -- especially in energy. Everything Brandon and his leftist puppet masters have done is a strong negative. They are spending nearly 1 trillion on useless or unnecessary crap and calling it "inflation reduction."

That will start ending in November and be effectively hobbled in January.

That will start ending in November and be effectively hobbled in January.

Posted on 8/19/22 at 8:23 pm to Niner

I love this chart! No Lehman Brothers; just the Russo-Georgian War. No Dot Com bubble; it’s the 2nd Chechen War. No COVID; it’s the Russia-Ukraine Conflict.

Did Hillary Clinton and the FBI add the text notes?

Did Hillary Clinton and the FBI add the text notes?

Posted on 8/21/22 at 6:11 am to TDFreak

quote:

Did Hillary Clinton and the FBI add the text notes?

I pulled the chart from material speaking to investors' concern over geopolitical impact on markets. So, yea, wasn't my intention to point out those items - just that the S&P 500 makes money over the long-term.

Posted on 8/21/22 at 7:13 am to I Love Bama

Market going back down this week. Check out the pattern. We had our hard run bear market rally, now time to reverse downwards. A lot of the indicators last week came out suggesting we still have problems, and we have new problems on the horizon. The consumer credit bubble is a massive possibility. China is literally imploding. Energy in general is going into crisis. Russian sanctions are believed to begin having a significant effect soon. And inflation isn’t going away yet - 8.5% inflation isn’t sustainable. If we don’t see it drop below ~7.5%, then market will believe this inflation is still a threat even if it’s not extending itself

Black stone’s CEO took a big stock payout this quarter. That implies he believes market goes further down. Follow the smart money. If we had followed smart money like Bezos and Musk in 2021 when they sold, you’d have sold at the exact top

The next time we get a full MACD reversal from a bottom and RSI reset from the ~35 range, I’ll agree it’s probably the bottom of this recession. But everything about this few weeks rally says bear market rally, not true rally

Black stone’s CEO took a big stock payout this quarter. That implies he believes market goes further down. Follow the smart money. If we had followed smart money like Bezos and Musk in 2021 when they sold, you’d have sold at the exact top

The next time we get a full MACD reversal from a bottom and RSI reset from the ~35 range, I’ll agree it’s probably the bottom of this recession. But everything about this few weeks rally says bear market rally, not true rally

This post was edited on 8/21/22 at 7:23 am

Posted on 8/21/22 at 10:39 am to Upperdecker

quote:

And inflation isn’t going away yet - 8.5% inflation isn’t sustainable. If we don’t see it drop below ~7.5%, then market will believe this inflation is still a threat even if it’s not extending itself

If anything is going to keep inflation that high, it will be energy prices and/or if fuel prices climb back up after they stop raping the SPR (they are still high yet enough consumers seem to have become conditioned to accepting $3-$4 gallon gas nationally as a norm to go back to normal purchasing habits).

Fuel was the other big factor driving inflation to our current levels, the primary being over-liquidity. While the liquidity issue is being addressed, it's pretty much a certainty at this point that energy prices will be far higher than normal for months to come. Fuel (gasoline and diesel) will be interesting to watch as the draw down on the SPR is set to continue into November. This should mean prices remain around $3-$4 nationally for gas into January, but there's so many things which can happen to change that. Still, fuel remaining high will keep inflation from retreating quickly.

I've said before and I'll say it again, I don't see a path forward for inflation to be below 5% before 2023. As long as we have continued high inflation, reports of "strong sales" and businesses "making profits" are largely smoke and mirrors as inflation's hit on currency valuation is outpacing the increase in physical dollars businesses are bringing in. Many seem to be happily blinded by looking at nominal numbers.

This post was edited on 8/21/22 at 10:41 am

Posted on 8/21/22 at 10:58 am to Bard

I have said this before if Oil goes back over 100 in the next few weeks and stays there then the rest of the year into 2023 could be rough for the market. Inflation is still pushing prices higher on pretty much everything.

Every week i still see food prices increasing. The consumer has been resilient for the most part so far but not sure how much longer that will last especially if fuel goes back over 4 plus a gallon for gas. Sept could be a rough ride.

Every week i still see food prices increasing. The consumer has been resilient for the most part so far but not sure how much longer that will last especially if fuel goes back over 4 plus a gallon for gas. Sept could be a rough ride.

Posted on 8/21/22 at 11:24 am to FLObserver

quote:

Every week i still see food prices increasing.

This is another silent issue people aren't really discussing to any depth beyond your quote. One of my cornerstone philosophies of life is "hunger is a powerful motivator", it's part of why Roman poet Juvenal coined the phrase "panem et circenses" (bread and circuses). The wider context on this is that he was saying that as long as government can keep people fed and entertained, most of the citizenry will be willing to ignore government failings.

Here's a dirty little secret: even though CPI has shown a drop for July, Food has risen every single month since May 2021. Every. Single. Month. Food increase for July was 10.9%, up .5 from June (YoY). This is faaaaar outpacing wage growth. The longer this goes on, the more it's going to impact other retail sales (clothes, electronics, etc).

So what happens when we still have free circuses for the masses but bread starts becoming too expensive?

This post was edited on 8/21/22 at 12:11 pm

Posted on 8/21/22 at 12:59 pm to I Love Bama

This is a good discussion on both sides of the equation...

having been in the market for many years, the dreaded boomer, I just have a feeling that the condtions are ripe for a Black Swan event...the people ??? running this country have given rise to my sentiment on this matter.

having been in the market for many years, the dreaded boomer, I just have a feeling that the condtions are ripe for a Black Swan event...the people ??? running this country have given rise to my sentiment on this matter.

Posted on 8/21/22 at 5:05 pm to SalE

quote:

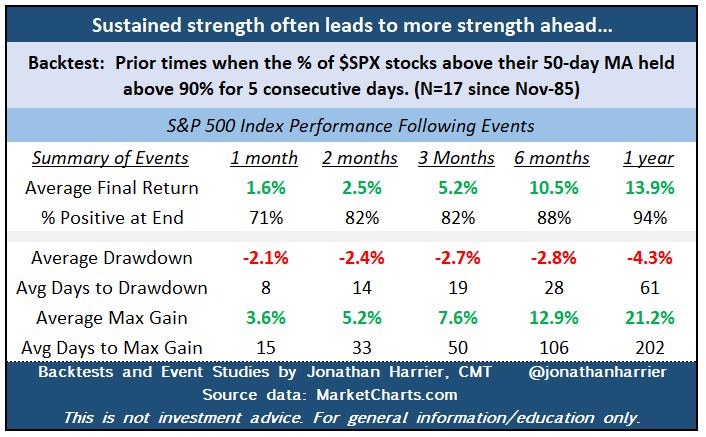

Through 8/18, more than 90% of $SPX stocks were above their respective 50-day MA, for the 5th consecutive day. That kind of sustained strength is significant, usually leading to more ahead. Fairly low average drawdowns.

quote:

The single failure 1 year out was after the Feb-20 '87 event, which had a max drawdown of -21.6% out 200 days (Black Friday crash). Prior to that, $SPX had gained a max of 18% on day 129. At the end of the 1 year lookout period, $SPX was -8.4%.

Most of the max drawdowns were quite early after the event. 4 of the 17 experienced their lowest point within a week. 3 more had their low in the second week.

Only 2 of the 17 prior events happened when $SPX was below the 200-ma, like now...

3/4/1988

5/7/2009

Special attention should be given to the GFC period, which really spans from 2008 through 2010 (European Debt Crisis). We have nothing close to that situation with an economy running at full employment, money freely moving.

Tweet

This post was edited on 8/21/22 at 5:06 pm

Popular

Back to top

3

3