- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: S&P 500 - only 7 red years out of 40.

Posted on 11/10/25 at 3:25 pm to cgrand

Posted on 11/10/25 at 3:25 pm to cgrand

quote:

day trading leveraged ETF's

3x ETFs are definitely too dangerous for normies, but holding 2x ETFs long term is absolutely viable. The amount of drop that would cause liquidation would have to come from nothing short of a nuclear attack, or another such calamity, in which case money would be irrelevant.

I have held SSO exclusively since 2015. I am 30 and have around $470k despite never making much money. And before you say “yea but what if the AI bubble pops and drops the S&P by a gorillion percent?!” the oldest 2x funds are mutual funds that have been around since 1998. They survived, and are still up around 1,800% since inception, far above regular S&P returns.

Posted on 11/10/25 at 3:28 pm to RoyalWe

why would i assume day trading on leveraged etf's? because thats what they are used for most often. you buying and holding 2x and 3x index funds that reset exposure every day? explain to me how that has made you money long term

Posted on 11/10/25 at 3:31 pm to cgrand

I trade quarterly like clockwork. Value cost averaging. Never look at it until the end of the quarter. My CAGR is 24% for the portfolio but 37% with the leveraged ETFs. That’s over the last 8 years. How do I make money? Buy low and sell high.

Posted on 11/10/25 at 3:40 pm to cgrand

quote:

explain to me how that has made you money long term

Dude… just buy and hold lol. This isn’t difficult to understand. Yea there have been times that I wanted to jump off a bridge like in April, but it always comes around. Don’t be a bear, bears are degenerates.

Posted on 11/10/25 at 4:12 pm to DB_tiger

youre talking to the guy who held every position thru the 2008 and 2022 crashes and stayed fully in equities in new investments during that time. i am a buy and hold disciple. leveraged ETFs are not intended as a long hold position. i hope you do well.

in the spirit of the OP i suspect we all can agree that for the vast majority of people (myself included) buying and holding the SP500 is the best decision to make

in the spirit of the OP i suspect we all can agree that for the vast majority of people (myself included) buying and holding the SP500 is the best decision to make

Posted on 11/10/25 at 5:31 pm to cgrand

quote:You must be listening to "experts."

leveraged ETFs are not intended as a long hold position.

Posted on 11/10/25 at 5:37 pm to cgrand

quote:I'm just glad it seems as if people finally have stopped thinking about the Dow.

buying and holding the SP500 is the best decision to make

Posted on 11/10/25 at 6:02 pm to DarthRebel

My parents are nearing 70 and started throwing money in index funds right around 1985 when 401ks became widely available.

My dad says his 401k has averaged over 11% in those 40 years.

Sure there's no guarantee that continues but it's still your best odds of beating inflation and building wealth over the long term.

My dad says his 401k has averaged over 11% in those 40 years.

Sure there's no guarantee that continues but it's still your best odds of beating inflation and building wealth over the long term.

Posted on 11/10/25 at 8:55 pm to SM1010

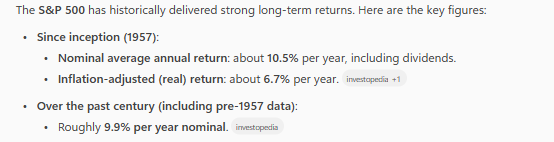

The S&P 500 has grown by approximately 6,972% overall since 1986, or an average of about 11.36% per year, not accounting for inflation. If adjusted for inflation, the cumulative return is about 2,292%, or 8.35% annually.

Seems to good to be this simple. Wish I would have started much sooner

Seems to good to be this simple. Wish I would have started much sooner

Posted on 11/11/25 at 5:52 am to DarthRebel

Good case study of how people have anxieties and emotions that influence their actions. It contributes to that bullwhip effect of the market as a whole. And that fear that led them to sell causes them to miss out on major rebounds.

Posted on 11/11/25 at 10:39 am to ks_nola

quote:

Seems to good to be this simple. Wish I would have started much sooner

My pension boomer parents never taught me this, as they did not have to worry about it. I ended up being in my 30s when I really grasped this concept.

I am drilling this into my teenagers heads, the importance of investing and forgetting about it.

I may have pushed one too far, as he got in trouble the other day in school for not doing his test prep and was tracking stock patterns in class

Posted on 11/11/25 at 11:36 am to ks_nola

quote:It's also quite possible that forward returns will be much lower than that.

The S&P 500 has grown by approximately 6,972% overall since 1986, or an average of about 11.36% per year, not accounting for inflation. If adjusted for inflation, the cumulative return is about 2,292%, or 8.35% annually.

Seems to good to be this simple. Wish I would have started much sooner

Posted on 11/11/25 at 12:35 pm to Big Scrub TX

quote:theres the cutting edge analysis the TD money board is famous for

It's also quite possible that forward returns will be much lower than that.

Posted on 11/11/25 at 1:54 pm to Big Scrub TX

quote:

It's also quite possible that forward returns will be much lower than that.

There is no way to argue that you will be wrong, as the future is not written. All we can ever do, is learn from the past

Posted on 11/11/25 at 3:20 pm to cgrand

quote:Sometimes things really are different. You can't just project the past indefinitely into the future. For one, we know population growth isn't there as an engine like it used to be. Possibly offsetting that is the rise of AI. etc.

theres the cutting edge analysis the TD money board is famous for

But by no means should people casually assume that US equities are going to print the same numbers they have printed in the past.

Posted on 11/11/25 at 4:13 pm to Big Scrub TX

quote:

Sometimes things really are different. You can't just project the past indefinitely into the future. For one, we know population growth isn't there as an engine like it used to be. Possibly offsetting that is the rise of AI. etc.

But by no means should people casually assume that US equities are going to print the same numbers they have printed in the past.

OK, then offer something up. Should we just say frick it and burn this shite to the ground

How does one even invest if you cannot use history as a guide?

Posted on 11/11/25 at 5:56 pm to DarthRebel

quote:No?

Should we just say frick it and burn this shite to the ground

quote:I think you need to be mindful of sizing. Generic recommendations are the "60/40" portfolio, which I think is wrong for a number of reasons. But let's say it was your guidepost - I would certainly not be at 60% equities with valuations like these.

How does one even invest if you cannot use history as a guide?

I don't view that as "market timing" - it's purely valuation based. I wouldn't buy hardly ANY business - public or private - at these prices.

By the same token, a lot of fixed income ("bonds") is expensive now too. I would tilt that exposure heavily in the direction of MBS and away from corporate.

It's fine to use history as a guide, but just realize it can be fools gold. If you had done the same thing with the Nikkei in 1989 (looking at the past 30 years of spectacular performance and then choosing to lean in) it would have been quite painful.

Posted on 11/14/25 at 6:48 am to UltimaParadox

quote:

I have been told by many on this board that investing in broad index funds such as those that track the S&P500 is for old people, and has poor returns.

The way overwhelmingly majority of this board disagrees with this. Most on here realize broad market, low cost investments are key to long term successful investing.

Then there is WkiTiger who laughs at us all from his islands in Greece, the Caribbean and in the Pacific.

Posted on 11/14/25 at 7:19 am to DarthRebel

Now do inflation-adjusted

Posted on 11/14/25 at 8:04 am to OccamsStubble

quote:

Now do inflation-adjusted

I'm 45 and have been maxing all my retirement accounts in various S&P funds since 2005. I'm retiring in 5 to 7 years maybe earlier depending on how my next few annual bonuses go. The greatest gift to investors is the S&P 500 and people who don't use it are god damn fools.

Popular

Back to top

0

0