- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Need Horizontal Drilling Investment advice

Posted on 5/7/23 at 5:29 pm

Posted on 5/7/23 at 5:29 pm

Reaching out to All the Investor Gurus on the board.

I have an opportunity to make a substantial investment into several wells in the NYOBRERA Oil Play outside of Denver, Co.

Mainly wanting to see what you guys think of future oil prices in next 1-2 years and beyond, which I know is hard to forecast. I have a long oilfield and international trade background, but have never made a substantial investment like the one I have the opportunity right now.

Quick summary based on material presented to me:

1st oil projected in June/22’

Est. 1,800 bbls per day

75% of sales are from the oil

25% of sales are from Nat Gas From well, Colorado state law they must capture it all

Very old company that has withstood the ups & downs.

Projections based on $200k per unit

$8,093 per month if 1,800 bbls/day

$6,995 per month if 1,550 bbls/day

$5,897 per month if 1,300 bbls/day

$4,220 per month if 950 bbls/day

49% annualized return

12-month 63% est. ROI

18-month 100% break-even, estimated of course

100% tax write-off year 1 on investment via IRS Code “263C”

15% tax reduction on annual revenue

Wells in this play are typically 15-20 year life span Per “EOG, who is the longest tenured oilco. in this play

10% of initial investment returned upon ig & abandonment in 15-20 yrs. Est.

4.5% Colorado state income tax

4th largest play in country

Surrounded by Chevron, Exxon, EOG, Conoco

Land is owned by company, so it’s private and no worries about Federal land shutdowns via DC

4-DIFFERENT WELLS in this deal to eventually produce 7.2M projected bbls

“3 different benches in this play”

Pudwell = Proven & Undeveloped

Est. 7.2M bbls of oil in this well/project

Anticipated to get 4.8M bbls by year 7

Pay is Approx. 7,000’ ft. Deep

255’ thick & able to go up to 3,500’ horizontally

Wells are very close to transport pipelines cutting down on logistical overhead.

They are telling me that they’re estimating oil will be between $90-100 bbl by year-end

I follow oil due to my industry & business, but I’m no guru on the investment side.

I do know that WTI$ has been slipping past serval weeks, and global concerns of recessions etc.

What do you jaws think of this opportunity? It kind of sounds to good to be true, but even if it does half of the projections, it’s still solid. And I’m looking to make a significant investment on this, and looking to get some advice.

If I do not answer quickly, I’ll respond in due time in between some house work.

Anything to ask this group on my end?

Any projections from your end?

Any concerns to look out for?

Thanks in advance

I have an opportunity to make a substantial investment into several wells in the NYOBRERA Oil Play outside of Denver, Co.

Mainly wanting to see what you guys think of future oil prices in next 1-2 years and beyond, which I know is hard to forecast. I have a long oilfield and international trade background, but have never made a substantial investment like the one I have the opportunity right now.

Quick summary based on material presented to me:

1st oil projected in June/22’

Est. 1,800 bbls per day

75% of sales are from the oil

25% of sales are from Nat Gas From well, Colorado state law they must capture it all

Very old company that has withstood the ups & downs.

Projections based on $200k per unit

$8,093 per month if 1,800 bbls/day

$6,995 per month if 1,550 bbls/day

$5,897 per month if 1,300 bbls/day

$4,220 per month if 950 bbls/day

49% annualized return

12-month 63% est. ROI

18-month 100% break-even, estimated of course

100% tax write-off year 1 on investment via IRS Code “263C”

15% tax reduction on annual revenue

Wells in this play are typically 15-20 year life span Per “EOG, who is the longest tenured oilco. in this play

10% of initial investment returned upon ig & abandonment in 15-20 yrs. Est.

4.5% Colorado state income tax

4th largest play in country

Surrounded by Chevron, Exxon, EOG, Conoco

Land is owned by company, so it’s private and no worries about Federal land shutdowns via DC

4-DIFFERENT WELLS in this deal to eventually produce 7.2M projected bbls

“3 different benches in this play”

Pudwell = Proven & Undeveloped

Est. 7.2M bbls of oil in this well/project

Anticipated to get 4.8M bbls by year 7

Pay is Approx. 7,000’ ft. Deep

255’ thick & able to go up to 3,500’ horizontally

Wells are very close to transport pipelines cutting down on logistical overhead.

They are telling me that they’re estimating oil will be between $90-100 bbl by year-end

I follow oil due to my industry & business, but I’m no guru on the investment side.

I do know that WTI$ has been slipping past serval weeks, and global concerns of recessions etc.

What do you jaws think of this opportunity? It kind of sounds to good to be true, but even if it does half of the projections, it’s still solid. And I’m looking to make a significant investment on this, and looking to get some advice.

If I do not answer quickly, I’ll respond in due time in between some house work.

Anything to ask this group on my end?

Any projections from your end?

Any concerns to look out for?

Thanks in advance

This post was edited on 5/7/23 at 8:12 pm

Posted on 5/7/23 at 5:42 pm to Westbank111

Start Rosy Finch Boys Oil LLC and put me down for $5k

Sorry I don't have intelligent answer

Does harsh winter impact oil- I know yes on gas

Sorry I don't have intelligent answer

Does harsh winter impact oil- I know yes on gas

This post was edited on 5/7/23 at 5:46 pm

Posted on 5/7/23 at 6:46 pm to Westbank111

At what price is that 18 month BE at? I am not familiar with that play but what type of natural decline are you expecting in production?

Posted on 5/7/23 at 7:52 pm to Westbank111

4.8 MM bbls out of 1 well ain’t going to happen. Will it be economic, could be, but it’s not making 4.8 MM bbls.

Not sure what a unit equates to is but if it’s 200k for 1%, that would be pretty expensive.

Not sure what a unit equates to is but if it’s 200k for 1%, that would be pretty expensive.

Posted on 5/7/23 at 8:02 pm to whikyncoke

Sorry, I forgot to put this in my bullet list

It’s actually 4 wells combined in 2 mile laterals / 10,000’ run on this core project.

4 wells w/ estimate of 7.2M bbls total, based on the reports.

Well notes spaced 980’ (pad to

Pad) 8-well pad, but I haven’t really learned what an “8-well pad” technically means.

They are estimating 3.5M bbls in 1st 18-months.

Still getting more info. Haven’t pulled the trigger yet, but 1-unit is $200,000, but I also think they will offer me a 1/4 unit for $50,000 if I want to get my feet wet and be more conservative.

The company is a decades long colleague and friend with one of my family members that is into M&A work & large financing raises for resorts, hotels, B&I, just about anything, but all major/significant deals they are into.

It’s actually 4 wells combined in 2 mile laterals / 10,000’ run on this core project.

4 wells w/ estimate of 7.2M bbls total, based on the reports.

Well notes spaced 980’ (pad to

Pad) 8-well pad, but I haven’t really learned what an “8-well pad” technically means.

They are estimating 3.5M bbls in 1st 18-months.

Still getting more info. Haven’t pulled the trigger yet, but 1-unit is $200,000, but I also think they will offer me a 1/4 unit for $50,000 if I want to get my feet wet and be more conservative.

The company is a decades long colleague and friend with one of my family members that is into M&A work & large financing raises for resorts, hotels, B&I, just about anything, but all major/significant deals they are into.

Posted on 5/7/23 at 8:05 pm to thelawnwranglers

Lol, Rosy Finch wouldn’t even need a drill-bit, he’d just crack open a red bull can over his head and get to digging.

Harsh winters can impact the industry, but I think harsh is moee RE e like the Bakken Shale Play in North Dakota, frozen tundra up there, I been there in the winter. A buddy of mine was doing frack-water hauling & we were there for the 1st winter storm, Minot, N. Dakota is another level of Harsh.

I don’t think it messes with Colorado like that, but I’m no Guru, but these are good questions to ask , thanks!

Harsh winters can impact the industry, but I think harsh is moee RE e like the Bakken Shale Play in North Dakota, frozen tundra up there, I been there in the winter. A buddy of mine was doing frack-water hauling & we were there for the 1st winter storm, Minot, N. Dakota is another level of Harsh.

I don’t think it messes with Colorado like that, but I’m no Guru, but these are good questions to ask , thanks!

Posted on 5/7/23 at 8:09 pm to GREENHEAD22

Correction, I forgot to state that it’s 4-wells

On this project.

And projections are to pump 3.2M bbls in 1st 18-months.

I need to get more info on the Nat Gas as that accounts for 25% of the revenue, good question to ask.

But yes, what is this world gonna look like in 18-months, we may be in Armageddon at that point, will be election 2024, that scares me as well.

This world is brink of a collapse we have never seen, and it will be Global and by design, so these things worry me as well.

BUT, oil & Nat Gas isn’t going anywhere too soon although these idiots in DC are pushing EV, Wind Power.

The only alternatives I like is Solar, the other 2 above create more problems then they are worth IMO

Thanks for the response Greenhead

On this project.

And projections are to pump 3.2M bbls in 1st 18-months.

I need to get more info on the Nat Gas as that accounts for 25% of the revenue, good question to ask.

But yes, what is this world gonna look like in 18-months, we may be in Armageddon at that point, will be election 2024, that scares me as well.

This world is brink of a collapse we have never seen, and it will be Global and by design, so these things worry me as well.

BUT, oil & Nat Gas isn’t going anywhere too soon although these idiots in DC are pushing EV, Wind Power.

The only alternatives I like is Solar, the other 2 above create more problems then they are worth IMO

Thanks for the response Greenhead

Posted on 5/7/23 at 8:21 pm to Westbank111

I think you may have misunderstood my first question. At what average price is the 18 month break even being calculated at? $70WTI?

I am unfamiliar with land but I would check on P&A obligations as well.

That being said I do plan on making a call this week on possible doing the same thing but at much lower buy ins.

Congrats and good luck!

I am unfamiliar with land but I would check on P&A obligations as well.

That being said I do plan on making a call this week on possible doing the same thing but at much lower buy ins.

Congrats and good luck!

Posted on 5/8/23 at 8:12 am to Westbank111

quote:8 different wells that share the same surface facilities.

but I haven’t really learned what an “8-well pad” technically means

Posted on 5/8/23 at 8:34 am to Westbank111

quote:

but I haven’t really learned what an “8-well pad” technically means.

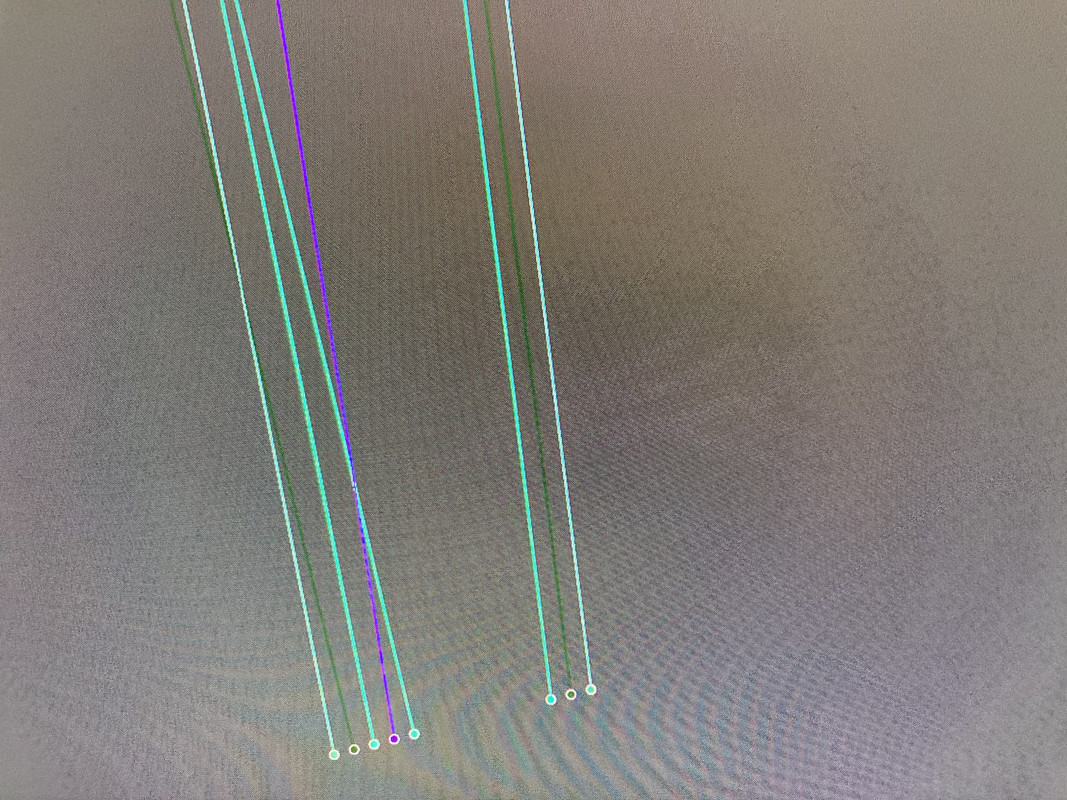

This, for example, is a 5 well pad (left) and a 3 well pad (right). Wells spaced 30' apart and pad to pad is 200-300' depending on where you pull.

Posted on 5/8/23 at 9:00 am to Westbank111

Ok so I'll ramble a bit to unload some info for you.

Assuming this is in the Wattenberg, Weld County, and targeting more than 50% in the Nio. Keep in mind, while it says Nio Oil Play, this region is very gassy.

Because of its proximity to the Rockies, it is really challenging to stay in a particular zone for an entire lateral. The Nio has the most oil by far. Wells will land in the Nio, Ft Hays, and dip down to the Codell almost every single time it's drilled because of how it's fractured and faulted. Getting into those deeper formations will make the well even more gassey. Point is, your 75/25 estimate I think is >P10. It's more like 60/40 when it shakes out, IMO.

4wells producing 1.8MM in their lifetime in this region is also >P10. These wells don't hold pressure like that and water production is usually big here.

I agree on the midstream access. It's top notch up there.

You mentioned 255' of pay. Which is fine, but again its not the beautiful clean 255' sandstone reservoir. This is a cracked up rock at the base of a savage mountain range. It's 255' of rock that contains some hydrocarbons.

Also Colorado has largely figured out winter logistics. They don't get impacted too much operationally in cold.

Overall all of the projections, IMO, are painting a pretty P10 picture, and this is in Colorado. You say it's private land and all, but that state has been fricking the industry for a decade now. I anticipate them to start attacking water production soon and forcing more spend on it.

I'm not one to tell you this is a bad deal, but the only too good to be true left in onshore unconventionals lie in West Texas. Every other play is deteriorating for one reason or another.

Assuming this is in the Wattenberg, Weld County, and targeting more than 50% in the Nio. Keep in mind, while it says Nio Oil Play, this region is very gassy.

Because of its proximity to the Rockies, it is really challenging to stay in a particular zone for an entire lateral. The Nio has the most oil by far. Wells will land in the Nio, Ft Hays, and dip down to the Codell almost every single time it's drilled because of how it's fractured and faulted. Getting into those deeper formations will make the well even more gassey. Point is, your 75/25 estimate I think is >P10. It's more like 60/40 when it shakes out, IMO.

4wells producing 1.8MM in their lifetime in this region is also >P10. These wells don't hold pressure like that and water production is usually big here.

I agree on the midstream access. It's top notch up there.

You mentioned 255' of pay. Which is fine, but again its not the beautiful clean 255' sandstone reservoir. This is a cracked up rock at the base of a savage mountain range. It's 255' of rock that contains some hydrocarbons.

Also Colorado has largely figured out winter logistics. They don't get impacted too much operationally in cold.

Overall all of the projections, IMO, are painting a pretty P10 picture, and this is in Colorado. You say it's private land and all, but that state has been fricking the industry for a decade now. I anticipate them to start attacking water production soon and forcing more spend on it.

I'm not one to tell you this is a bad deal, but the only too good to be true left in onshore unconventionals lie in West Texas. Every other play is deteriorating for one reason or another.

This post was edited on 5/8/23 at 9:13 am

Posted on 5/9/23 at 12:20 am to thegreatboudini

Many thanks Boudini, great intel buddy.

Those are some very good details I can dig into further with these guys and see what their answers are.

You sound like your very educated and experienced in fracking, I know a little, but looking to learn more.

Those are some very good details I can dig into further with these guys and see what their answers are.

You sound like your very educated and experienced in fracking, I know a little, but looking to learn more.

Posted on 5/9/23 at 6:29 am to Westbank111

quote:

Mainly wanting to see what you guys think of future oil prices in next 1-2 years and beyond

I know nothing about drilling but was going to post on this as well.

On the one hand, the govt is all in on green energy and restricting the output of the industry and the Saudis are aligning against us to some degree. I don’t see how this doesn’t result in higher prices.

But at the same time, higher rates all point to some type of economic recession…which would impact oil to the negative. Also energy companies usually carry a lot of debt which will need to be rolled over at higher rates eventually. I don’t think we’ll see anything like we did during COVID but could see the price dropping if we have an economic shock.

The KISS principal is telling me to ignore the noise and focus on the fact that the entire world depends on oil and gas production and will for a long time. I’m invested in a number of oil and gas royalty and production companies which have done pretty well but wonder about the next 1-2 years.

Posted on 5/9/23 at 2:30 pm to Westbank111

I'm a geologist by trade and spent a few years frac side, with a considerable amount of time in Weld County.

I've personally never made big investments in deals like this outside of ones I've been personally involved in, but I do understand the economics and risks.

Let me known if you want to take this off TD and I can help you more.

I've personally never made big investments in deals like this outside of ones I've been personally involved in, but I do understand the economics and risks.

Let me known if you want to take this off TD and I can help you more.

Posted on 5/9/23 at 5:15 pm to Westbank111

Might lose it all, might not.

I think you'd have to have a ton of money or a very high risk tolerance to buy into this. Everything you've stated is marketing BS - $100 oil at year end, 4 wells, 3,500' of pay, 3 benches, big name offset producers!

Why didn't those big 4 lease up this land? Why is this company outsourcing their risk? Wells decline over time...it's not $8k/mo for 20 years...how quickly does the production run off? 10%, 20%, 50% per year? Is that $8k revenue or net after costs? Does it account for working interest or revenue interests? What prices for oil and gas does it assume?

So much more to ask about the operator itself, offset well performance, geology, etc.

I would rather purchase producing assets as an individual. I don't think you have the knowledge to sink $200k, unless you would otherwise wipe your arse with it.

I think you'd have to have a ton of money or a very high risk tolerance to buy into this. Everything you've stated is marketing BS - $100 oil at year end, 4 wells, 3,500' of pay, 3 benches, big name offset producers!

Why didn't those big 4 lease up this land? Why is this company outsourcing their risk? Wells decline over time...it's not $8k/mo for 20 years...how quickly does the production run off? 10%, 20%, 50% per year? Is that $8k revenue or net after costs? Does it account for working interest or revenue interests? What prices for oil and gas does it assume?

So much more to ask about the operator itself, offset well performance, geology, etc.

I would rather purchase producing assets as an individual. I don't think you have the knowledge to sink $200k, unless you would otherwise wipe your arse with it.

Posted on 5/9/23 at 8:31 pm to Westbank111

quote:

I have an opportunity to make a substantial investment into several wells in the NYOBRERA Oil Play outside of Denver, Co.

I don't know anything about you, but my question to you if you aren't a HNWI or have substantial connections. Why do you think you are being offered this investment? How many other qualified people have passed on this investment before you?

Posted on 5/9/23 at 9:14 pm to barry

Well to his defense even a good prospect is only 40% chance of success. That is conventional well, not sure the % on shale.

Unless you are a big timer and get an in on a LLOG well. You take that bet.

Unless you are a big timer and get an in on a LLOG well. You take that bet.

Posted on 5/24/23 at 7:47 pm to barry

Sorry for delay, this is a very good friend of mine that is good friends & a business colleague of the founding family of the company. They do offerings to family friends/investors etc. and generally do not do public offerings. Or at least that is my understanding of how it works.

Posted on 5/25/23 at 8:45 am to Westbank111

quote:

They do offerings to family friends/investors etc. and generally do not do public offerings. Or at least that is my understanding of how it works.

make no mistake, they are offloading risk. if you are not directly close with the owners, it's likely several others passed before it got to you. not saying anything about the deal one way or another, but that is absolutely the way it has played out.

Posted on 5/25/23 at 10:58 am to lsujro

quote:Agree. The only way to get a possible "deal" on such an investment is if you are actually taking the whole thing down and sourced it yourself off-market.

make no mistake, they are offloading risk. if you are not directly close with the owners, it's likely several others passed before it got to you. not saying anything about the deal one way or another, but that is absolutely the way it has played out.

Popular

Back to top

8

8