- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Mortgage Delinquencies are Spiking

Posted on 7/20/20 at 10:42 am to Mr Perfect

Posted on 7/20/20 at 10:42 am to Mr Perfect

No one said it wouldn't happen. They said it shouldn't happen.

So congrats on being correct on something everyone knew would happen.

So congrats on being correct on something everyone knew would happen.

Posted on 8/17/20 at 4:28 pm to stout

Here's the updated data as of 8/17/20:

LINK

quote:

Mortgage Delinquencies Jump by Most Ever. 60-Day Delinquencies Hit Highest Level Ever. Record 16% of FHA Mortgages Delinquent. What a Mess

by Wolf Richter • Aug 17, 2020 •

The mortgage delinquency-and-forbearance mess keeps getting messier – in record-setting ways. At the same time, the record-low mortgage rates continue to push certain other segments of the housing industry toward ever greater exuberance.

That contradiction became humorously obvious on the Bloomberg News Economics front page, where side-by-side these two headlines appeared: The overall delinquency rate for mortgages on one-to-four-unit residential properties soared by nearly 4 percentage points (386 basis points) during the second quarter, and by June 30 reached 8.22% (seasonally adjusted), the highest in nine years, according to the Mortgage Bankers Association’s National Delinquency Survey.

This nearly 4-percentage point jump in the overall delinquency rate was the largest in the history of MBA’s survey going back to 1979.

Delinquencies started soaring in April. A month ago, CoreLogic had reported that the percentage of mortgages entering the early stages of delinquencies — from 0 days to 30 days delinquent — had spiked phenomenally in April beyond all prior records.

What we’re seeing now is that many of these mortgages are becoming more seriously delinquent. This shows up in the stages of delinquencies, according to the MBA today. At the end of June: The 30-day delinquency rate fell by 33 basis points to 2.34%

The 60-day delinquency rate rose by 138 basis points to 2.15%, the highest since the survey began in 1979.

The 90-day delinquency rate jumped by 279 basis points to 3.72%, the highest since Q3 2010

The delinquency rate of FHA mortgages jumped by nearly 6 percentage points (596 basis points), the biggest jump in survey history (since 1979), to a delinquency rate of 15.65%, the highest delinquency rate in survey history.

The delinquency rate of VA mortgages jumped by 340 basis points to 8.05%, the highest since Q3 2009.

The delinquency rate of conventional mortgages jumped by 352 basis points, to 6.68%, the highest rate since Q2 2012.

Delinquency rates here include mortgages that were already at least one month delinquent before they entered into a forbearance program. So these mortgages are still delinquent, and the borrower has stopped making payments before entering into forbearance, but the lender has agreed to not pursue its legal rights for the agreed-upon period of forbearance.

Instead of the borrower either catching up, or the mortgage going into foreclosure, the mortgage is put on ice during forbearance. The borrower doesn’t need to make payments. And the lender, after putting the delinquent mortgage into forbearance, may no longer consider the mortgage delinquent, and may therefore still show the mortgages as “performing,” and may still show interest income from it, though no one is making payments.

There are now 4.2 million mortgages in forbearance, according to estimates by the MBA. Meaning 4.2 million homeowners have stopped making payments, in addition to the homeowners that have stopped making payments but are not in forbearance programs.

The delinquency rates here do not include mortgages that have undertaken the final steps: moving into foreclosure. But the current trend for lenders is to move mortgages into forbearance and put them on ice for as long as possible – “extend and pretend” – rather than foreclosing on the property.

This mess playing out in the mortgage market has been largely swept under the rug of widespread, government-supported forbearance programs – to where no one really knows what will happen to those mortgages when these forbearance programs end.

And the exuberance in other parts of the real estate industry, such as with homebuilders, and even with mortgage brokers and mortgage lenders that arrange refi and purchase mortgages, is a contradiction to what is going on with these swept-under-rug delinquencies that will eventually come to a head.

LINK

Posted on 8/17/20 at 9:28 pm to cadillacattack

Well... This seems bad. So why is no one talking about it?

Posted on 8/17/20 at 9:37 pm to cadillacattack

So....what does happen when this “comes to a head” like the article says?

Posted on 8/17/20 at 9:52 pm to cadillacattack

LINK

Wow. Those comments in that link are very interesting to get a view of the bigger picture. Very interesting reading.

Wow. Those comments in that link are very interesting to get a view of the bigger picture. Very interesting reading.

Posted on 8/17/20 at 10:23 pm to PhiTiger1764

quote:

Well... This seems bad. So why is no one talking about it?

Because it's not. The housing industry is fire and will continue to lead us out of this mess

Posted on 8/18/20 at 10:03 am to SDVTiger

it's really weird .... you've got this tremendous backlog of delinquent mortgages that are being artificially held out of the market inventory by government intervention .....

At the same time, there is tremendous Demand ... and housing starts are exploding ...

This reminds me of the the housing market during the Carter administration, except that short-term construction interest rates back then were in the 15% range ....

LINK

At the same time, there is tremendous Demand ... and housing starts are exploding ...

This reminds me of the the housing market during the Carter administration, except that short-term construction interest rates back then were in the 15% range ....

quote:

US Housing Starts, Permits Explode Higher In July With Builder Sentiment At Record

by Tyler Durden Tue, 08/18/2020 - 08:40

After screaming higher in May and June (after a 3-month collapse), Housing Starts' rebound was expected to slow drastically in July (while Building Permits were expected to re-accelerate after a disappointing slowdown in June.

However, the analysts could not have been more wrong as both starts and permits exploded higher in July (up 22.6% vs +5% exp, and 18.8% vs +5.4% exp respectively)...

This is the biggest MoM rise in permits since June 2008 (that didn't end well) and biggest MoM rise in starts since Oct 2016...

LINK

Posted on 8/18/20 at 10:13 am to cadillacattack

We are the in process for looking for a new house due to interest rates and getting tired of our neighborhood. houses in my area are overpriced and lasting a day on the market. It’s unlike anything I’ve ever seen. We will go look at a house and say wow this house needs a lot of work I can’t believe they are asking that much and a day or two later it will be sold. We are going to have to wait this out until inventory catches up with demand or just build ourselves

Posted on 8/18/20 at 10:27 am to Civildawg

Meanwhile, San Fransisco has a glut as residents flee the market ....

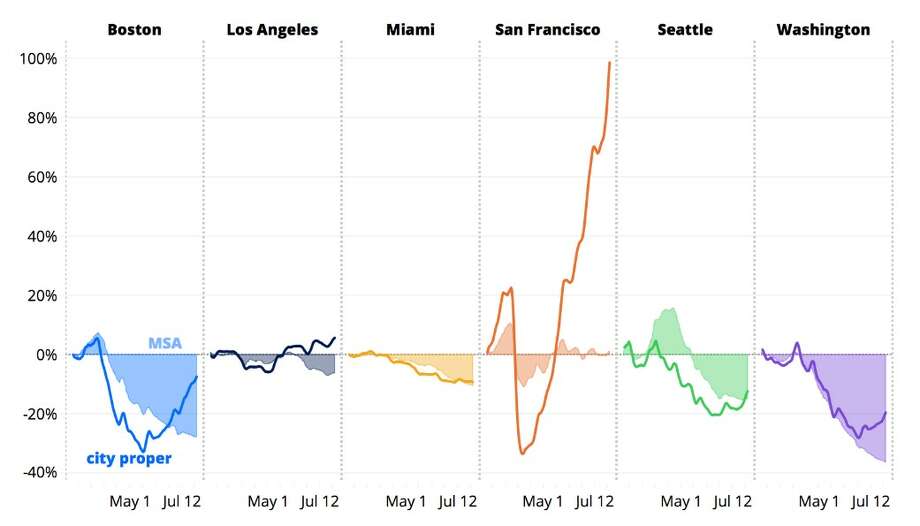

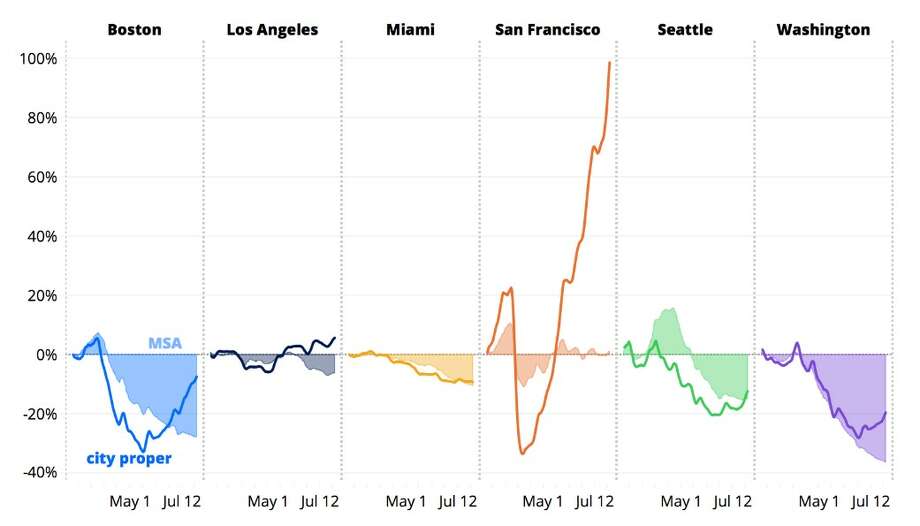

Real estate inventory change from February to July 2020, in metro area and city proper.

Real estate inventory change from February to July 2020, in metro area and city proper.

Posted on 8/18/20 at 11:16 am to cadillacattack

hey friend do you have data on new orleans

Posted on 8/18/20 at 12:33 pm to Civildawg

quote:News flash, building is even more $

We are going to have to wait this out until inventory catches up with demand or just build ourselves

Posted on 8/28/20 at 1:57 pm to achenator

Lafayette, LA comes it at #17, Baton Rouge comes in at #26 .... more:

8/28/20 Update:

more, with charts, mash here:

LINK

8/28/20 Update:

quote:

Subprime Mortgages Fall Massively Delinquent. Taxpayers on Hook. Housing Market Splits in Two

by Wolf Richter • Aug 27, 2020

On one side: land rush by a few hundred thousand home buyers. On the other: millions of homeowners with delinquent mortgages. Here are the metros by FHA delinquency rate. Two exceed 27%.

The Federal Housing Administration (FHA) prides itself in insuring subprime mortgages with, as it says, “low down payments,” “low closing costs,” and “easy credit qualifying” – all true. Of its active portfolio of 8 million mortgages that it insures, 17% were delinquent in July, the highest rate in FHA history.

In many metros, the delinquency rates of FHA mortgages are above 20%; and in two metros, the delinquency rates exceed 27%.

The delinquency rates include mortgages that were delinquent and then entered a forbearance agreement with the lender, where the lender agreed to not pursue its rights due to nonpayment of the mortgage.

During the term of forbearance – six months, under the CARES Act, extendable by another six months – the borrower isn’t making payments, but the missed interest and principal payments are added to the mortgage balance and will need to be paid somehow.

A FICO credit score below 620 is considered “subprime.” The FHA insures mortgages of borrowers with credit scores well below that. If the borrower has a credit score of at least 580, the FHA will accept down payments of only 3.5%. If the FICO score is below 580, no problem, but then down payment is 10%.

Many of the people whose mortgages the FHA insures have lost their jobs or had had their hours or work reduced. In terms of the lenders, the good thing is that they don’t carry the risk. The FHA and thereby the taxpayer carry the risk.

In terms of the taxpayer, the good thing is that home prices have risen in many markets in recent years, and are rising there right now, and that many fallen-behind homeowners can sell their home and pay off the defaulted mortgage with the proceeds from the sale, and maybe have a little cash left over. And if the home goes into foreclosure because the proceeds wouldn’t have been enough to pay off the mortgage, the losses would be relatively small.

The widespread home price declines that occurred during the subprime crisis of Housing Bust have not happened yet. And that’s why at the moment no one is panicking about these sky-high delinquency rates.

But when millions of homeowners cannot make the mortgage payments and have to put these millions of homes on the market – forced sellers – they trigger a sudden surge of supply of homes for sale, and the entire supply-and-demand equation, and thereby the pricing environment, are going to change.

During the last Housing Bust, this phase happened, but it didn’t happen up front. Home prices started falling for other reasons, and then forced sellers and then their lenders tried to sell their homes, which put enormous downward pressure on prices. This time around, the housing market has split in two:

On one side of the population, there is some sort of land rush going on at the moment, with people trying to buy everything in sight. On the other side are people who’re delinquent on their mortgages. But the numbers are skewed: There are on average 460,000 people buying a home every month. But there are now millions of people behind on their mortgages, including 1.4 million whose mortgages are insured by the FHA.

American Enterprise Institute’s Housing Center, which collected the delinquency data from FHA Neighborhood Watch, sees the eventual impact of the FHA delinquencies in this way: It would be expected that these delinquency percentages will increase over time. At some point, a significant percentage of the then delinquent loans would be expected to be placed on the market by owners under distressed conditions or become foreclosures, and then enter the market.

It is at that point we would expect buyer’s markets to develop in zip codes with heavy exposure to FHA and other high-risk lending combined with high levels of delinquency. So there is a boom on one side of the housing market, and there is already a bust forming on the other side of the housing market. FHA mortgages are far from the only delinquent mortgages, and Fannie Mae, Freddie Mac, the VA, Ginnie Mae, and others are also experiencing surging delinquency rates — just not to this extent.

So the FHA delinquencies are just a segment of the show. The table below shows the 167 Metropolitan Statistical Areas (MSA) and their FHA loans, in order of the delinquency rate of those FHA loans (4th column). It also shows the number (not dollars) of active FHA mortgages in that MSA (3rd column) and the share of FHA mortgages in that market as a percent of total mortgages (by number of mortgages, not dollars). In some markets, FHA mortgages have a share of over 20%, and in other markets a share in the low single digits. The problems will be larger where the FHA share is higher. You can use your browser’s search box to find your MSA. If your smartphone clips the 5th column, hold your device in landscape position.

more, with charts, mash here:

LINK

Posted on 8/28/20 at 4:02 pm to cadillacattack

I will also bet that vehicle repo is way way up as well.....along with Ch. 13 dismissals

Posted on 8/28/20 at 4:17 pm to cadillacattack

One thing I never understood. Why not let people refinance to a lower rate and/or longer term and waive the income requirements etc. They are already on the hook with the original mortgage and now can't afford the payment.

Isn't getting less interest better than a foreclosure?

This is why if I can choose which type of bonds to buy I avoid mortgage backed securities.

Isn't getting less interest better than a foreclosure?

This is why if I can choose which type of bonds to buy I avoid mortgage backed securities.

Posted on 8/28/20 at 5:32 pm to gpburdell

That’s a great question and being in the mortgage business it’s one that is being discussed

Posted on 8/28/20 at 5:51 pm to ellesssuuu

what is the return to the lender on a typical foreclosure?

compared to the outstanding principal?

compared to the outstanding principal?

Popular

Back to top

1

1