- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: I’ve gone full Husss - the Fed is engineering a depression

Posted on 7/11/22 at 7:26 am to Upperdecker

Posted on 7/11/22 at 7:26 am to Upperdecker

quote:

The Fed is also convinced that there is too much money being held by the lower and middle class, driving inflation.

Help me understand the reason for believing this.

The Fed believes that lower and middle class, known to not be savers and a population known to be constantly struggling to escape debt, are now holding too much money?

Posted on 7/11/22 at 10:47 am to Willie Stroker

quote:

The Fed believes that lower and middle class, known to not be savers and a population known to be constantly struggling to escape debt, are now holding too much money?

This doesn’t specify class but keep in mind lower and middle classes take up far more of the population than upper class. Also recognize the upper class invest free money while middle and lower just hold it in personal savings, so personal savings increases will skew heavily to those classes

LINK

Fed personal savings rate increased massively with stimulus checks (link)

There’s good evidence that these savings were temporary and have been pumping into the market now that the economy has opened up, driving up inflation. All of these savings will be gone soon of course bc like you said, these classes don’t save money long term. But there’s a lot of evidence that they did have savings considering people are still spending money heavily on “wants” rather than essentials despite the inflationary environment - bc these people can’t see that they’ll run of out money soon

This post was edited on 7/11/22 at 10:51 am

Posted on 7/11/22 at 10:55 am to Upperdecker

The level is irrelevant it's the rates of change you should be looking at.

Posted on 7/11/22 at 11:01 am to NC_Tigah

quote:

Inflation likely has peaked and is already starting to come down.

Hardly.

Food prices will increase by 18%-20% by fall, national average for gas will reach $7./gal by year end, and heating oil/nat gas prices are set to explode as we head into the winter season.

A current shopping cart of traditional staple items at the grocery is roughly $300., and represents about a $75 increase in price since January 2022.

The $300 typical basket is essentially enough product to create 10 days of multi-purpose meals for the average family of four. That same shopping cart will be $500 by late fall.

The level of inbound inflation that is coming Americas way will be historic …. and it will become worse. The current initiatives to restrict access to fertilizers going on in the Netherlands and Sri Lanka? ... coming soon to America and you can bank on it. By the way, the Netherlands is the 2nd largest food producer on the planet behind the USA.

"Transitory" my arse. The Fed is trapped. Fed printing press goes "Brrrrrrr" .....

Posted on 7/11/22 at 11:03 am to cadillacattack

Upperdecker .... what is your plan to ride this out?

Posted on 7/11/22 at 11:11 am to cadillacattack

quote:

Upperdecker .... what is your plan to ride this out?

401k/Roth - keep making normal contributions. I have a long horizon.

Otherwise - trying to bank roll cash for the recovery and preserve my savings. Reduce expenditures where I can and bargain for pay increases. Prep for taking advantage of the recovery. Not investing additional money since I expect it to go down

Edit: but full disclosure I’ve never invested during a recession so there may be better strategies

This post was edited on 7/11/22 at 11:27 am

Posted on 7/11/22 at 11:43 am to Upperdecker

quote:

Otherwise - trying to bank roll cash for the recovery and preserve my savings. Reduce expenditures where I can and bargain for pay increases. Prep for taking advantage of the recovery. Not investing additional money since I expect it to go down

Edit: but full disclosure I’ve never invested during a recession so there may be better strategies

What are your thoughts on real estate?

I mean traditionally that's where you want to be to ride out inflation, but we are clearly overpriced right now.

I can't see how this doesn't ride down 20%+ if the economy locks up, but where the hell else can you hide right now?

I mean is it gold/silver?

Posted on 7/11/22 at 11:49 am to Upperdecker

Let’s piece a little more of the big picture together real quick: shutting down the economy allowed them to offset the inflation monster they were creating and then when things opened up BAM. They (Fed) now need to kill demand because they have absolutely no control over the supply side to keep their facade of credibility. They will continue to kill us through inflation AND deflation so the volatility will continue from here on out.

They also know that all these bills and credit the Fed lent the U.S. will never be paid because they have run out of tax payers to pay for it and the ones that are left are getting killed by inflation. Truth be known, tax receipts were awful this year but you never hear a word about it.

The global plan is to get rid of a large swath of the global population and steal their wealth and purchasing power before people can rise up. If they can’t get rid of them quick enough they at least need to come for the guns. Interesting we saw all the shootings under Obama, they stopped under Trump and are back again under the corpse in chief, eh? And no, I’m on neither side of the political spectrum but I am a Libertarian. Give me Liberty or give me death.

There’s always a method to their madness. Cutting out carbon is cutting out what we exhale and trees take in that then creates the oxygen we breathe in. Read between the lines: they want us eradicated. The only ones they want left are the ones they can easily control by giving them CBDC directly into their accounts and they are telling you this already with their “equity inclusion” BS.

They also know that all these bills and credit the Fed lent the U.S. will never be paid because they have run out of tax payers to pay for it and the ones that are left are getting killed by inflation. Truth be known, tax receipts were awful this year but you never hear a word about it.

The global plan is to get rid of a large swath of the global population and steal their wealth and purchasing power before people can rise up. If they can’t get rid of them quick enough they at least need to come for the guns. Interesting we saw all the shootings under Obama, they stopped under Trump and are back again under the corpse in chief, eh? And no, I’m on neither side of the political spectrum but I am a Libertarian. Give me Liberty or give me death.

There’s always a method to their madness. Cutting out carbon is cutting out what we exhale and trees take in that then creates the oxygen we breathe in. Read between the lines: they want us eradicated. The only ones they want left are the ones they can easily control by giving them CBDC directly into their accounts and they are telling you this already with their “equity inclusion” BS.

Posted on 7/11/22 at 11:58 am to tide06

quote:

What are your thoughts on real estate?

My OP said I’m of the opinion that a housing crash or slow down is near. Wait for real estate after a crash on the recovery - I’ll be a buyer then as well. If you don’t wait for a crash, you aren’t getting a good deal and you’re taking on risk. Look at housing inventories building rapidly and prices are being adjusted downwards on the market - not enough sales going through yet for these to show up as data, but a lot of examples that people have stopped buying. You can also just use common sense to understand that interest rates at all time low suddenly skyrocketing will cause people to stop buying when other prices are also skyrocketing. If people can’t afford to flip houses anymore, tons of buyers will be leaving the market

quote:

I can't see how this doesn't ride down 20%+ if the economy locks up, but where the hell else can you hide right now? I mean is it gold/silver?

Not sure. Silver is a definite no unless you’re in physical. Silver paper market is manipulated by JPM. Gold maybe, but there’s a lot of theory that it doesn’t work as a market hedge or inflation hedge like it’s supposed to

Posted on 7/11/22 at 12:08 pm to Hussss

quote:

They (Fed) now need to kill demand because they have absolutely no control over the supply side to keep their facade of credibility. They will continue to kill us through inflation AND deflation so the volatility will continue from here on out.

Yep, as postulated in my OP - Fed can’t fight supply side so must kill demand proportionally

quote:

Truth be known, tax receipts were awful this year but you never hear a word about it.

Masked by market doing well last year so tax volume was higher, but the future returns will be lower

quote:

If they can’t get rid of them quick enough they at least need to come for the guns. Interesting we saw all the shootings under Obama, they stopped under Trump and are back again under the corpse in chief, eh?

Possible

quote:

Cutting out carbon is cutting out what we exhale and trees take in that then creates the oxygen we breathe in. Read between the lines: they want us eradicated.

Alright you lost me baw. They’re cutting carbon emissions from industry, not people breathing. Cutting industry emissions gives us room to support more people on Earth

Posted on 7/11/22 at 12:11 pm to cadillacattack

quote:

A current shopping cart of traditional staple items at the grocery is roughly $300., and represents about a $75 increase in price since January 2022.

The $300 typical basket is essentially enough product to create 10 days of multi-purpose meals for the average family of four. That same shopping cart will be $500 by late fall.

To put this in a different perspective, if Inflation were to somehow drop 50% by the end of the year that would mean we would still be looking at ~4%-~5%.

And let's be honest, if we were still gauging Inflation today by the same standards as 1979 we would have been looking at double-digit inflation for at least the last 2-3 months. While the bean counters can manipulate the data to attempt to show things as being not nearly that bad, the consumer feels the truth of it every time they buy something.

Posted on 7/11/22 at 12:27 pm to Upperdecker

quote:

Cutting industry emissions gives us room to support more people on Earth

Nope.

EVERYTHING they do is about CONTROL.

Problem - Reaction - Solution

If they are SO worried about the air, then why in the world are chemtrails being sprayed in the skies globally? For the longest time they denied it and now they just call it “geoengineering.” Wonder what in the hell is in that stuff…….

Always a method to their lies, deceit and deflections. Always.

Posted on 7/11/22 at 12:32 pm to tide06

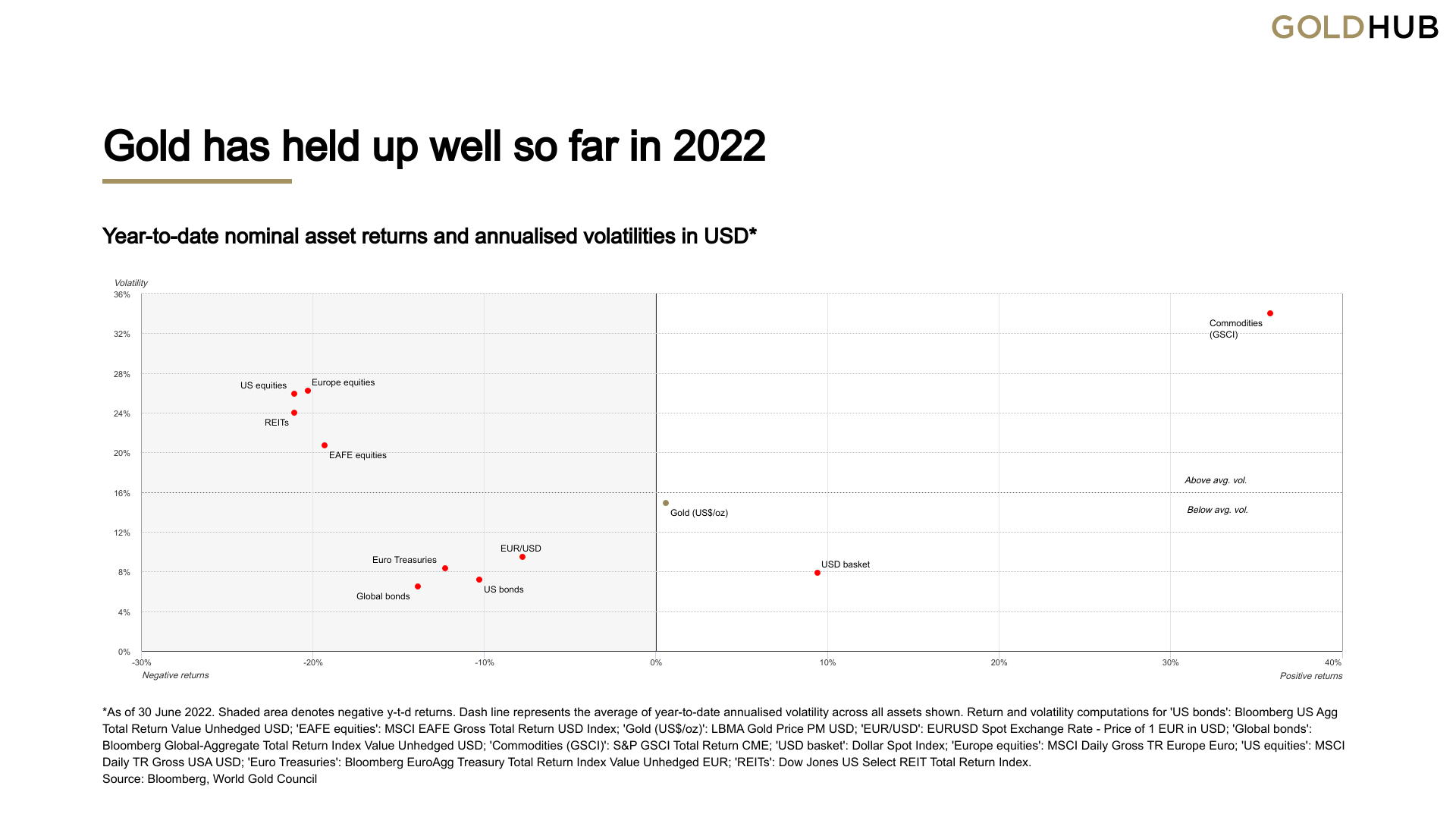

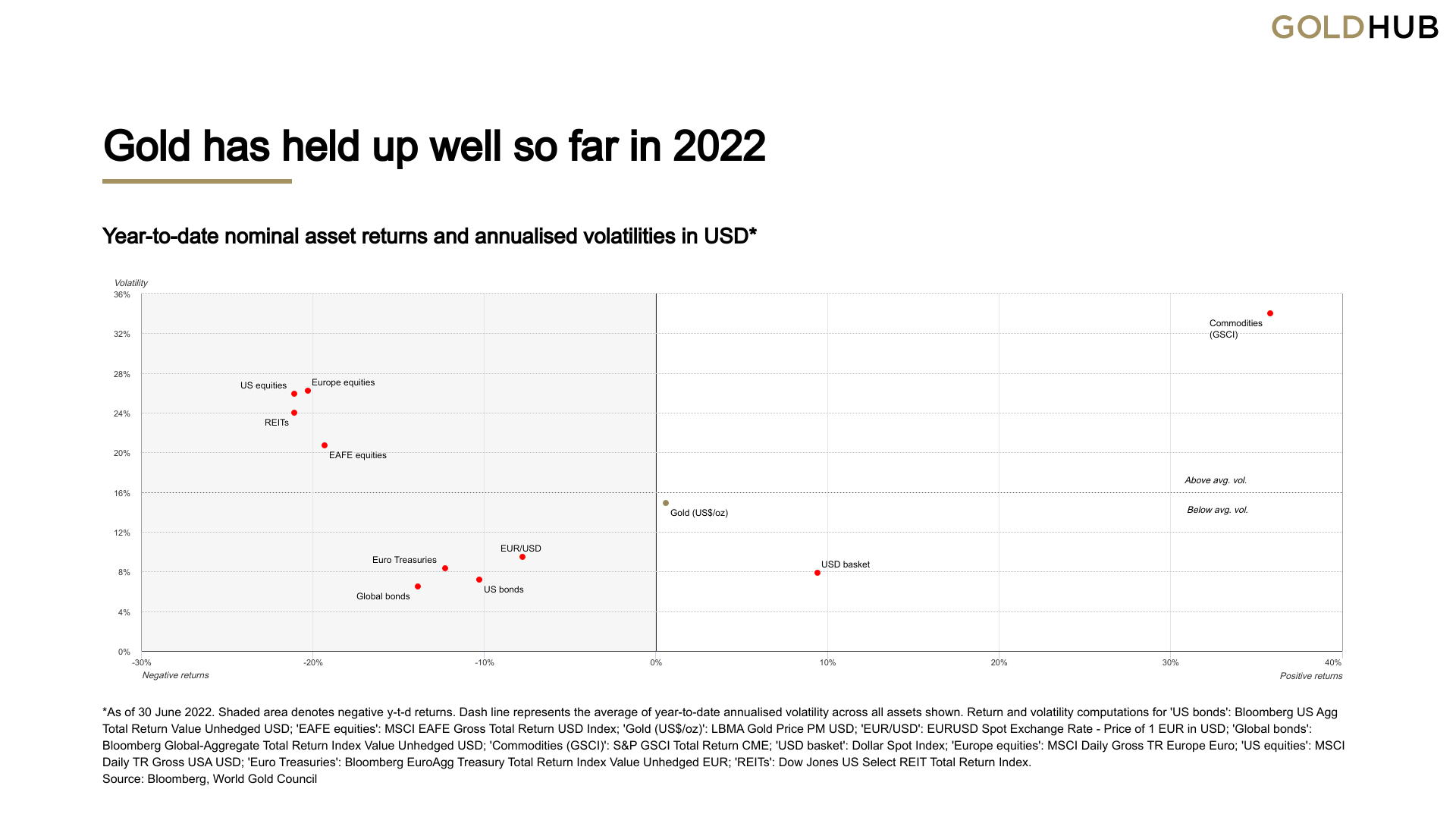

Precious metals do serve as a hedge .... against fiat currency manipulation. Best to own physical, but it's a bit late for physical as the current premiums are very high. As many authors have noted, the flow out of crypto and into gold occurred in Q1. Gold spot has pulled back (currently $1,741/oz), typical for it's seasonal pattern. I believe it will crack north of $2,000 within 8-9 months.

Thus far is has performed well, with a very manageable level of volatility:

Thus far is has performed well, with a very manageable level of volatility:

Posted on 7/11/22 at 12:38 pm to cadillacattack

Been buying GDXJ and GDX throughout the day. I love swinging these during every Op Ex week.

Posted on 7/11/22 at 2:31 pm to Hussss

I wish they’d just let us get nuked or go to Ukraine than a recession

Posted on 7/11/22 at 2:36 pm to Bard

To add to your point -

If it doesn’t adjust they’ll either manipulate the CPI stats even further to garner their goals OR adjust their annual inflation “target” to show they are meeting their goals.

Otherwise it’ll continue down the demand destruction path as that’s all “The Fed” can really do about inflation. They cannot do shite about supply whatsoever

If it doesn’t adjust they’ll either manipulate the CPI stats even further to garner their goals OR adjust their annual inflation “target” to show they are meeting their goals.

Otherwise it’ll continue down the demand destruction path as that’s all “The Fed” can really do about inflation. They cannot do shite about supply whatsoever

Posted on 7/11/22 at 2:38 pm to Hussss

quote:

then why in the world are chemtrails being sprayed in the skies globally?

Y’all had to trigger the crazy guy didn’t y’all?

Posted on 7/11/22 at 3:50 pm to cadillacattack

quote:

Food prices will increase by 18%-20% by fall, national average for gas will reach $7./gal by year end, and heating oil/nat gas prices are set to explode as we head into the winter season.

A current shopping cart of traditional staple items at the grocery is roughly $300., and represents about a $75 increase in price since January 2022.

The $300 typical basket is essentially enough product to create 10 days of multi-purpose meals for the average family of four. That same shopping cart will be $500 by late fall.

Posted on 7/11/22 at 3:54 pm to MusclesofBrussels

https://twitter.com/unusual_whales/status/1546591773396332544?s=20&t=UPB3Fsk4Dk4TVLOWQur7iQ

quote:

BREAKING: White House spokeswoman Jean-Pierre: I expect new CPI data to be highly elevated.

(Uh oh).

Posted on 7/11/22 at 4:05 pm to boomtown143

That just came out? Woof, time for the market to go

Popular

Back to top

1

1