- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

If you could invest in only 1 stock, what would it be?

Posted on 10/1/25 at 12:21 pm

Posted on 10/1/25 at 12:21 pm

?

Posted on 10/1/25 at 1:45 pm to slinger1317

quote:

VOO

VOO or VTSAX, and why one over the other?

Have a 16 yr old that I want to start investing a portion of his savings. I’m already heavy in VTSAX in my Roth because it’s been there for many years.

This post was edited on 10/1/25 at 1:47 pm

Posted on 10/1/25 at 2:00 pm to meeple

VOO is specific to S&P 500. You can’t auto invest at least from certain platforms. If you like the fund and want it auto invested then do VFIAX, it’s the same. The difference is VFiAX is a mutual fund and VOO is a ETF. You can’t pull funds or buy/sell quickly from a mutual funds vs ETF.

VSTAX is tied to the CRSP total index and is broader. You can auto invest.

Both have similar returns and both are very cheap for expenses.

It is based on your preference. I like the S&P.

VSTAX is tied to the CRSP total index and is broader. You can auto invest.

Both have similar returns and both are very cheap for expenses.

It is based on your preference. I like the S&P.

This post was edited on 10/1/25 at 2:03 pm

Posted on 10/1/25 at 2:21 pm to PSS101

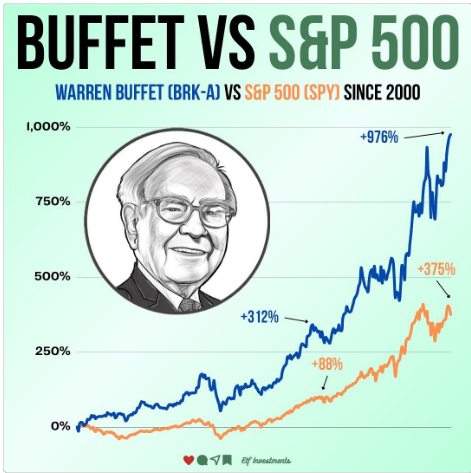

Berkshire Hathaway.

Sitting on $344 Billion in Cash earning over a Billion a month.

Own dozens of businesses outright that they could sell at a premium if they chose to.

They are positioned beautifully for a market that we all know is stretched.

Market goes up they make money.

Market crashes they put their $344 Billion to work.

Sitting on $344 Billion in Cash earning over a Billion a month.

Own dozens of businesses outright that they could sell at a premium if they chose to.

They are positioned beautifully for a market that we all know is stretched.

Market goes up they make money.

Market crashes they put their $344 Billion to work.

Posted on 10/1/25 at 2:26 pm to OH NO

quote:Buying the hottest names like Coca Cola and OXY.

Market crashes they put their $344 Billion to work.

Sure, it's a safe play, but I wouldn't buy it unless I wanted safety.

In fact, it's trailing the S&P this year by a good margin.

BRKB 10.5 %

SP500 14.4%

Posted on 10/1/25 at 2:32 pm to bayoubengals88

quote:

Buying the hottest names like Coca Cola and OXY.

Sure, it's a safe play, but I wouldn't buy it unless I wanted safety.

In fact, it's trailing the S&P this year by a good margin.

BRKB 10.5 %

SP500 14.4%

This year

Berkshire has historically outperformed the S&P by a large Margin.

It sold off big after Buffett announced his retirement.

Prior to that Berkshire was outperforming the market this year.

Loading Twitter/X Embed...

If tweet fails to load, click here.This post was edited on 10/1/25 at 2:33 pm

Posted on 10/1/25 at 2:36 pm to OH NO

What about when Buffett is gone?

Popular

Back to top

23

23